- PE 150

- Posts

- Why LP's Are Zeroing In on BTC & ETH (900M Users Can’t Be Wrong)

Why LP's Are Zeroing In on BTC & ETH (900M Users Can’t Be Wrong)

Explosive user growth and rising institutional stakes are transforming crypto from volatile side bet to indispensable portfolio allocation.

Good morning, ! This week we’re diving into Asia-Pacific’s split-track PE landscape, why sponsor-backed loans are weathering downturns better than ever, Sycamore’s $10B Walgreens playbook, and the tokenization tailwinds making crypto a serious asset class for allocators.

Join 50+ private markets advertisers who reach our 450,000+ investors and executives: Start Here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

Crypto's Network Effect: From Hype to Portfolio Core

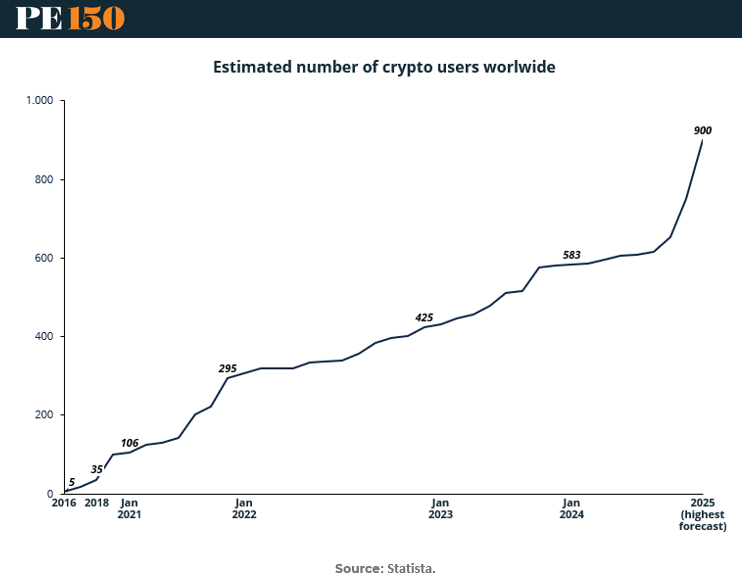

The crypto story isn’t just about price volatility—it’s about user velocity. Since 2016, global crypto adoption has soared from 5 million users to over 583 million, with projections pointing to 900 million by end-2025. That’s a 180x increase in less than a decade—mirroring adoption curves seen in early internet and mobile markets.

This exponential growth is more than just anecdotal; it’s structural. As user numbers climb, so does ecosystem resilience, liquidity, and institutional interest. According to Henley & Partners, 172,000+ individuals now hold over $1M in crypto, with 325 centi-millionaires and 28 billionaires also in. Capital isn’t just flowing in—it’s concentrating, particularly in Bitcoin and Ethereum.

Why it matters for LPs: network effects compound. Every new user doesn't just add marginal value—they strengthen infrastructure and reduce the asymmetry of risk. Hedge funds are paying attention too: 91% now allocate to Bitcoin and Ethereum, up from 67% in 2021.

For HNW portfolios, this isn’t a speculative detour—it’s a parallel financial architecture in motion. And as tokenization of real estate and private markets accelerates, the opportunity cost of staying sidelined is growing louder.

TREND OF THE WEEK

Eastward (Re)Balance

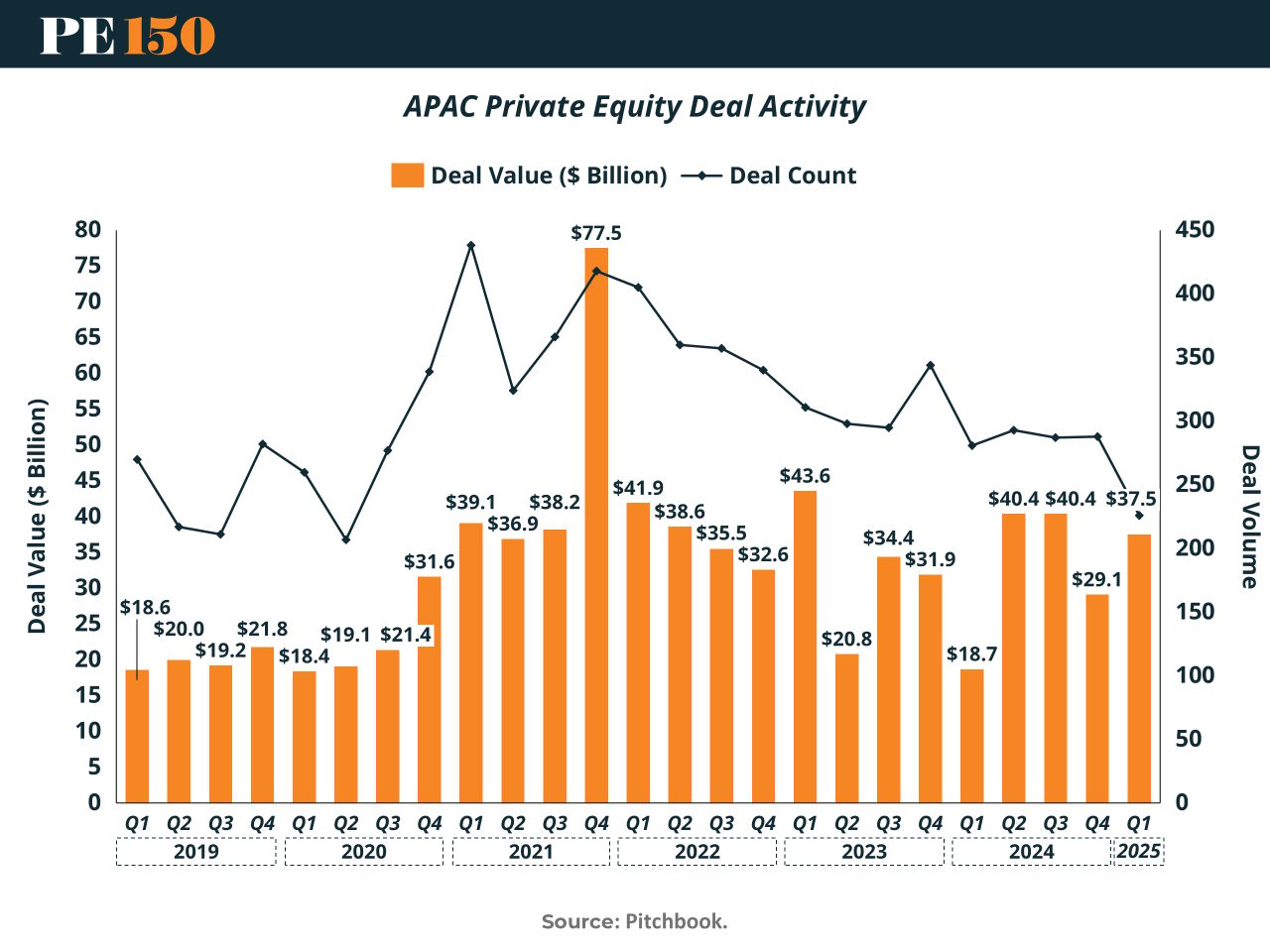

Asia-Pacific’s PE scene in Q1 2025 is giving off strong “choose your fighter” vibes. Japan: surging. China: limping. India and Southeast Asia: picking up the scraps. The $37.5B total deal value masks what’s really happening: capital is gravitating toward governance, liquidity, and deal certainty. Japan’s TSE reforms and debt-friendly environment are baiting global sponsors into scaling up. China, on the other hand, remains caught in its own regulatory maze. (More)

The Private Markets Intelligence Summit of the Year

📍 October 15, 2025 | Well& by Durst, NYC

PE150 is proud to announce it’s exclusive joint venture with CapLink Group!

In it’s first major event partnership, we cordially invite PE150 readers to join 300+ private markets leaders—GPs, LPs, operating partners, and advisors—for a single day of insights, strategy, and dealmaking at the New York Private Capital Summit.

This isn’t another networking event. It’s where strategy meets substance:

→ Keynotes from HarbourVest’s CEO, Bloomberg, Australian Super

→ Deep-dives on secondaries, direct lending, GenAI, and ESG

→ Practical panels on fund formation, human capital, and tax strategy

→ A spotlight on emerging liquidity tools and NAV-based financing

With over 50 senior speakers from firms like Apollo, KKR, Carlyle, Neuberger Berman, and Warburg Pincus, the Summit is designed for decision-makers driving the next decade of private capital.

Reserve your seat before it sells out: First Release Access

LIQUIDITY CORNER

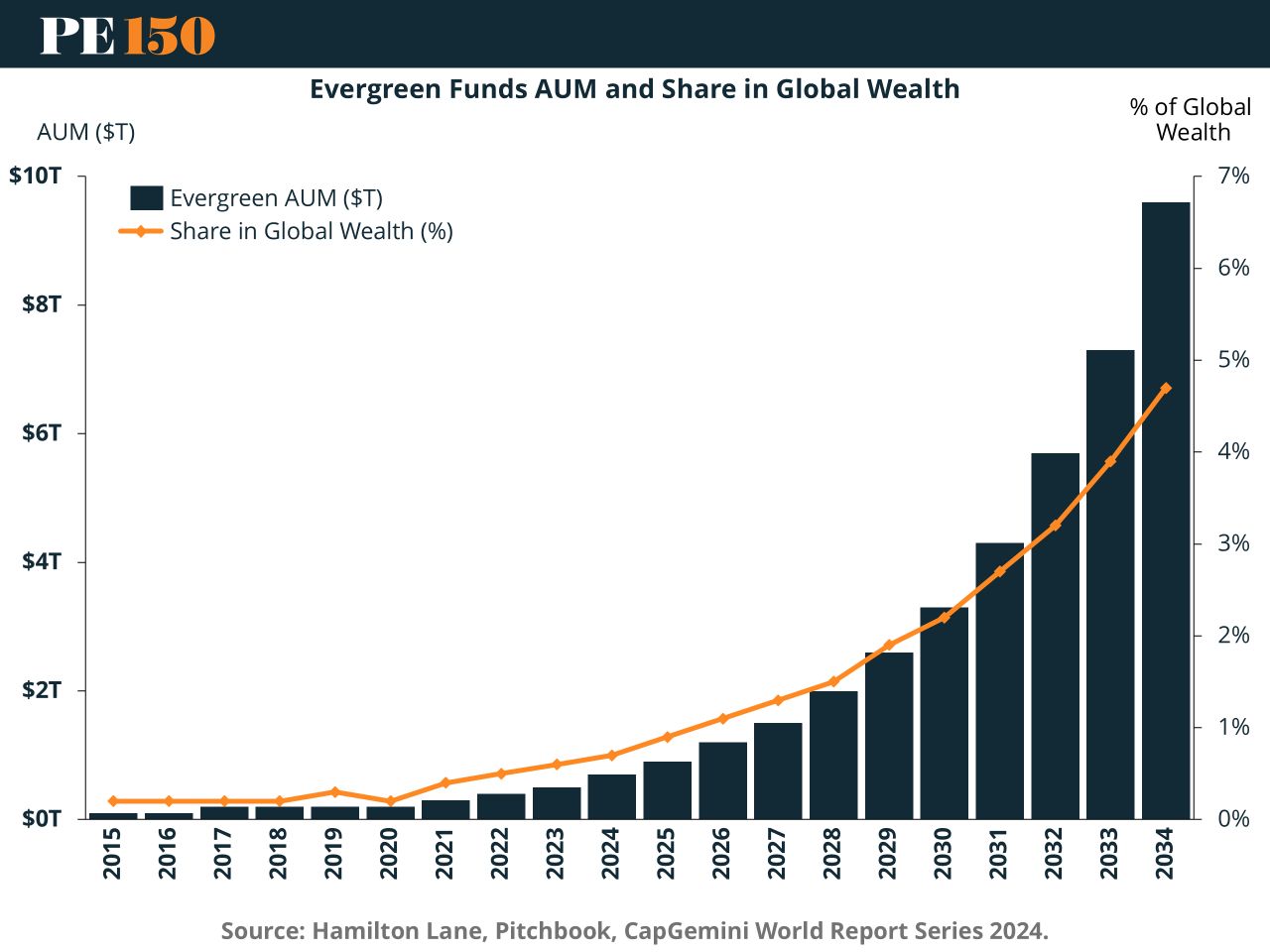

Evergreen, Not Ever-Solved

As GPs stretch holding periods, the buzzword is “evergreen”—but that doesn't mean LPs are buying it. Liquidity mismatches persist, with traditional exits stalled and secondaries unable to meet rising demand. PE’s new toolkit includes semi-liquid funds, continuation vehicles, and NAV financing, yet each carries trade-offs. Valuation friction is now deal-breaker material. Add Asia’s flirtation with tokenized private markets and you’ve got a full-on liquidity lab experiment. But the big question lingers: Can structure solve what exits used to? (More)

DEAL OF THE WEEK

Sycamore to Take Walgreens Private in $10B Buyout

Walgreens shareholders have approved a $10 billion buyout by Sycamore Partners, taking the 123-year-old pharmacy chain private after nearly a century on public markets. The deal offers $11.45 per share, with up to $3 more contingent on future monetization of Walgreens' Village MD stake.

The move comes amid a brutal retail pharmacy reset. Between reimbursement pressure, thinning margins, and a shift away from traditional drugstore models, national chains are in retreat. Walgreens plans to shutter over 1,000 locations by 2027, adding to a broader wave of store closures across the industry.

Taking the company private gives Walgreens cover to execute a turnaround—without the quarterly scrutiny of public markets. For Sycamore, known for distressed and retail-heavy plays, it’s a textbook platform bet: decaying but cash-generative, asset-rich, and ripe for cost rationalization.

Why it matters: This is the biggest U.S. retail privatization in years and signals private equity’s growing role in transforming legacy consumer brands. LPs should watch closely: as public markets turn their back on low-growth incumbents, PE may find long-term value—if it can stomach short-term pain. (More)

From a $120M Acquisition to a $1.3T Market

The wealthiest companies target the biggest markets. For example, NVIDIA skyrocketed ~200% higher last year with the $214B AI market’s tailwind. That’s why investors like Maveron backed Pacaso.

Created by a founder who sold his last venture for $120M, Pacaso’s digital marketplace offers easy purchase, ownership, and enjoyment of luxury vacation homes. And their target market is worth a whopping $1.3T.

No wonder Pacaso has earned $110M+ in gross profits to date, including 41% YoY growth last year alone. Now, with new homes planned in Milan, Rome, and Florence, they’re really hitting their stride. They even reserved the Nasdaq ticker PCSO.

And you can join well-known firms like Greycroft today. Lock in your Pacaso investment now for $2.90/share.

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public.Listing on the Nasdaq is subject to approvals.

PRIVATE CREDIT

Sponsored Loans Prove Safer, Again

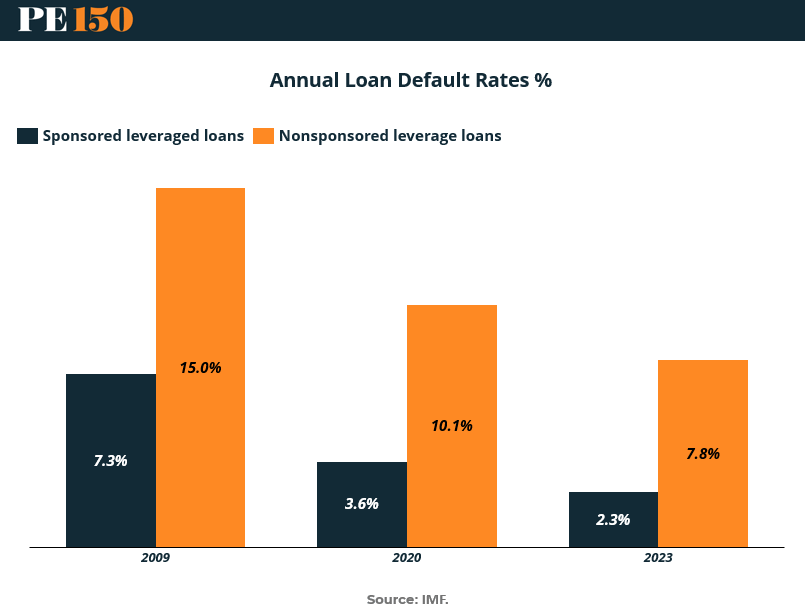

A new IMF dataset confirms what many in private credit already suspected: sponsored leveraged loans continue to default at materially lower rates than their non-sponsored peers.

In the 2009 crisis, default rates for non-sponsored loans hit 15.0%, more than double the 7.3% for sponsored deals. The pattern held in the COVID shock of 2020 (10.1% vs. 3.6%) and again in 2023 (7.8% vs. 2.3%), underscoring the resilience of sponsor-backed borrowers.

What drives the divergence? Sponsors provide more than just capital—they bring governance, board-level oversight, and access to liquidity lifelines. In downturns, that backing matters. It also means sponsored loans tend to benefit from tighter documentation and better alignment between lenders and equity owners.

Why it matters: In a market where spreads are tightening and credit risks are rising, these numbers are a stark reminder that not all leveraged loans are created equal. For direct lenders and BDCs, favoring sponsor-backed borrowers may offer better downside protection—and stronger relative performance when cycles turn. (More)

MICROSURVEY

Where have you seen the most measurable efficiency gains from AI so far? Select the area where the impact has been most noticeable in your day-to-day operations: |

MACROVIEW

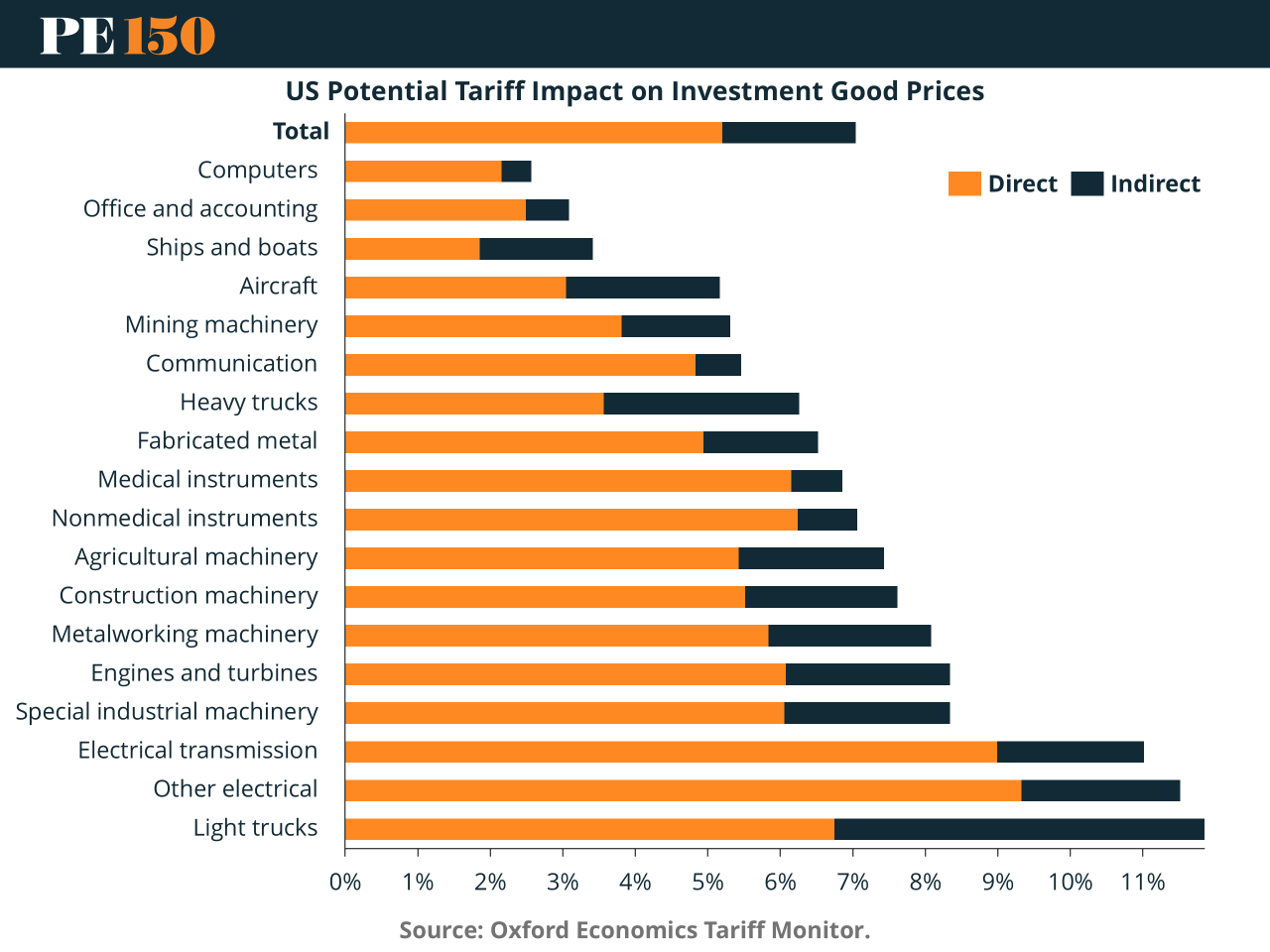

Inflation’s Trojan Horse: Tariffs

Consumer optimism on inflation might be misplaced. The NY Fed says expectations for one-year-ahead inflation have cooled to 3%, echoing pre-trade war calm. But Donald Trump is cueing up another tariff offensive—10% universal import tax, and a 60% hit on Chinese goods. Oxford Economics estimates the last trade spat lifted consumer prices by up to 1.5 percentage points. This time, corporate buffers are thinner. That means quicker pass-through to consumers. For investors? Tariffs are a stealth inflation engine—sticky, regressive, and Fed-proof. Rate cuts can’t fix container detours. Add spillover risks to supply chains, capex, and cross-border M&A, and suddenly, the "soft landing" looks less certain. (More)

TOGETHER WITH 4AM MEDIA

Seniors Everywhere Are Switching to This $99 Hearing Aid

Oricle Hearing gives you crystal-clear sound, wireless charging, and all-day battery life for under $100. No doctor visits, no crazy prices—just amazing hearing at an unbeatable deal.

Discover how these affordable hearing aids are changing the lives of people everyday.

THIS WEEK IN HISTORY

The Day the Subprime Cracked

July 10, 2008: IndyMac Bank folds under the weight of Alt-A mortgages and vanishing liquidity, marking one of the largest U.S. bank failures ever. What started as aggressive lending to lightly-documented borrowers ended with a classic bank run and a front-row seat to systemic fragility. IndyMac wasn’t just another name on the casualty list—it was a red flag. The cracks in the system were showing, and Lehman was only two months away. (More)

INTERESTING ARTICLES

"The only place where success comes before work is in the dictionary."

Vidal Sassoon