- PE 150

- Posts

- Trump’s Tariff Gamble: Inflation Risks Linger Beneath Consumer Optimism

Trump’s Tariff Gamble: Inflation Risks Linger Beneath Consumer Optimism

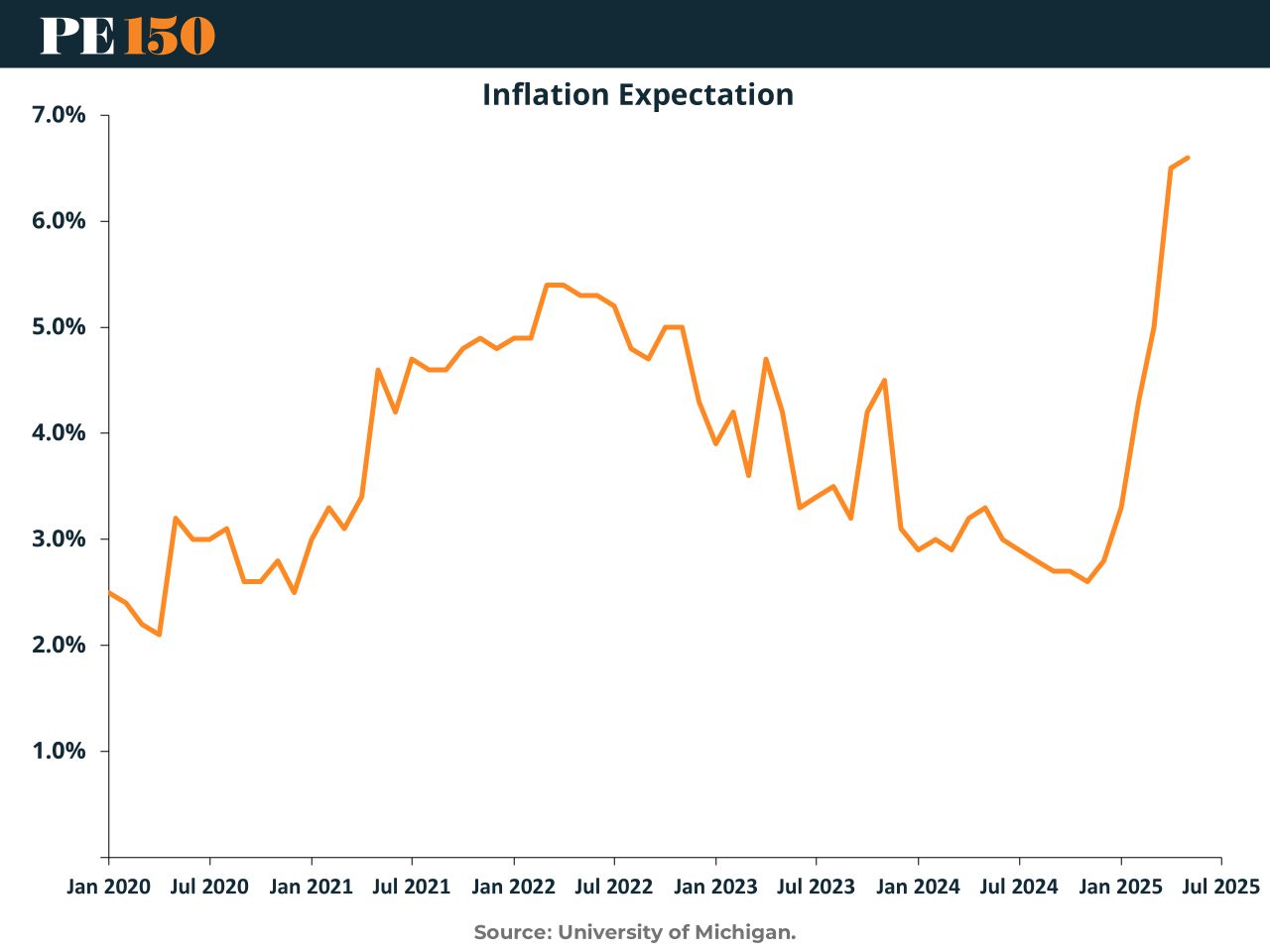

Consumer inflation expectations are cooling—but the tariff storm may just be warming up.

According to the latest New York Fed survey, American households expect inflation to slow over the next year, with median expectations for one-year-ahead inflation dropping to 3.0%, back near pre-2018 trade war levels.

Markets took this as a positive signal. But the macro picture is far more fragile than it looks.

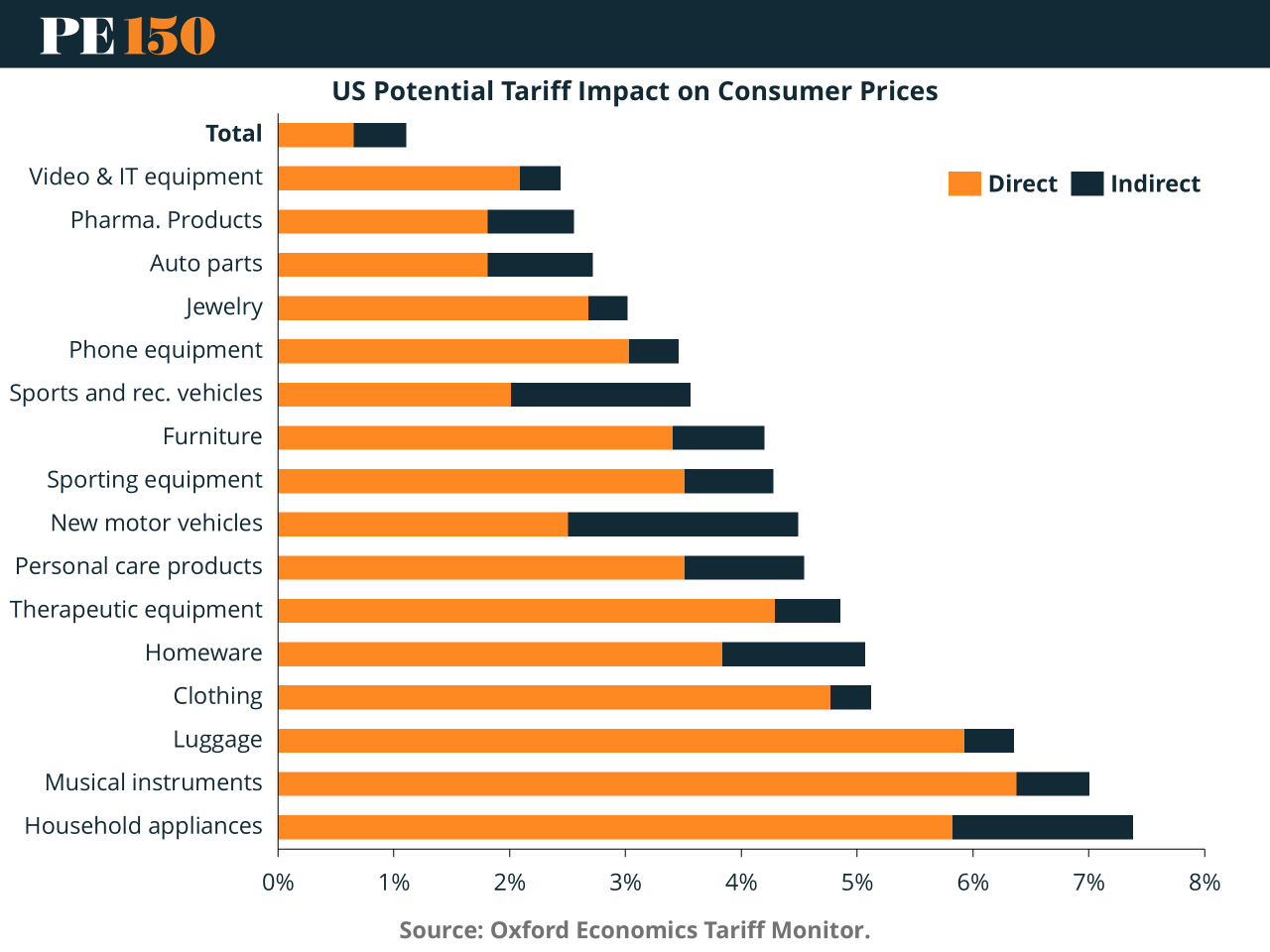

Despite this consumer calm, Donald Trump has doubled down on aggressive tariff threats. His proposed 10% universal import tax and possible 60% levy on Chinese goods would sharply reverse disinflationary progress, adding significant cost pressure across supply chains. According to Oxford Economics, the 2018–2019 tariff waves increased consumer prices by up to 1.5 percentage points in key categories like apparel and electronics.

And while some firms absorbed cost spikes in the first round of tariffs, those buffers are now thinner. According to Oxford Economics, the margin compression post-2018 suggests that a new round of tariffs would likely pass through faster and harder to end consumers.

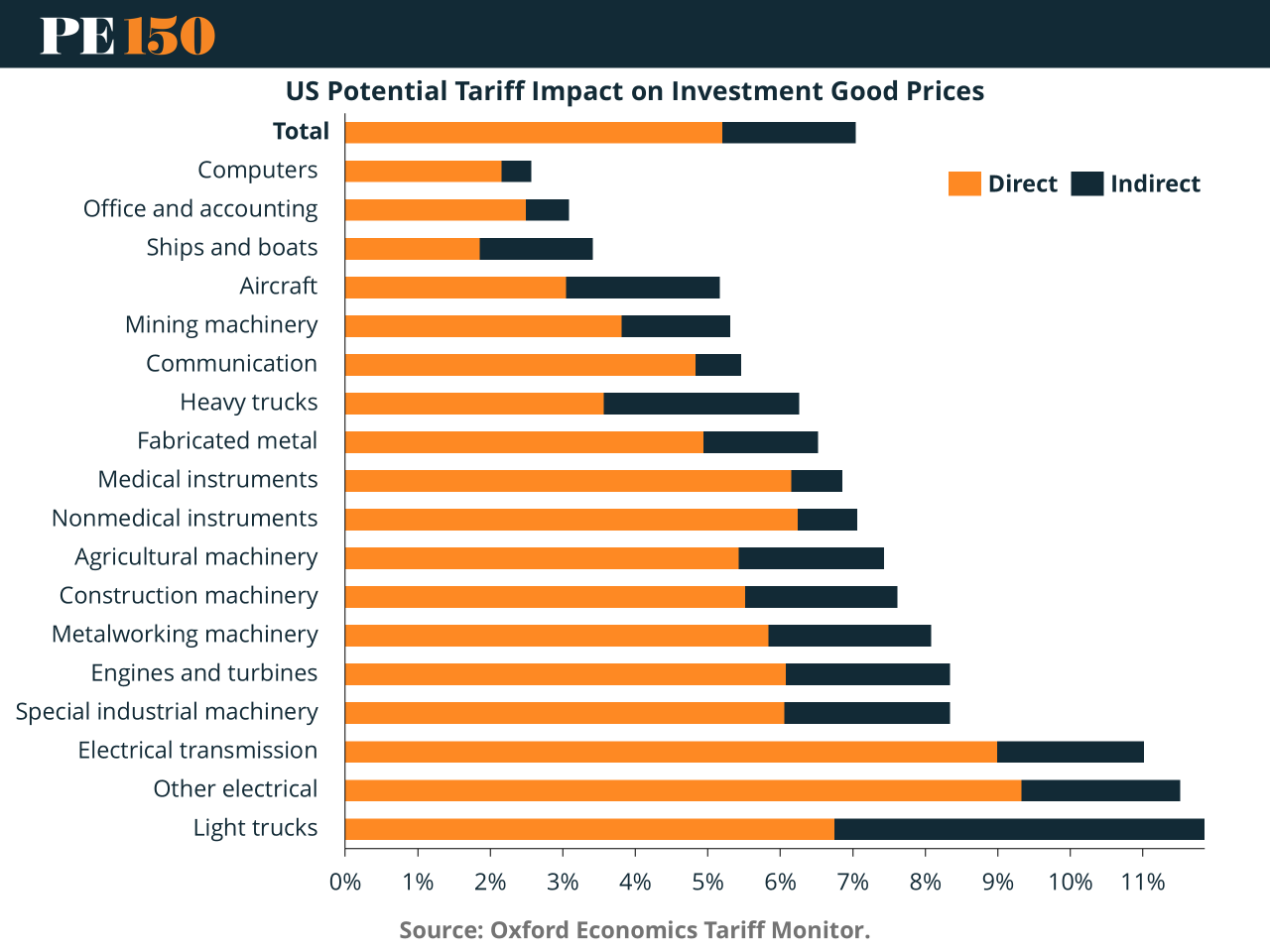

For investors, the implication is clear: Tariffs aren’t just a trade policy—they’re a stealth inflation engine. Unlike demand-driven inflation, trade-induced price hikes are regressive, sticky, and harder to offset via monetary policy. A rate cut won’t lower the cost of a container rerouted away from Shanghai.

Moreover, the tariffs could rekindle the U.S.-China trade war, with spillover risks for supply chains, capex plans, and cross-border M&A—especially in manufacturing and consumer goods.

Meanwhile, long-term inflation expectations remain anchored—for now. The Fed’s credibility buys time, but not immunity. If tariffs trigger another cost shock, the central bank may face a painful tradeoff between cutting rates and defending price stability.

Bottom line: Investors betting on a soft landing should keep one eye on the policy risk dashboard. Consumer sentiment may look calm, but the return of tariff threats could rewire inflation dynamics faster than the bond market is pricing. Trump may be campaigning on economic strength—but his trade playbook could throw a wrench into the recovery.

Sources & References

CNBC. (2025). Inflation expectations drift back down to pre-tariff levels, New York Fed survey shows. https://www.cnbc.com/2025/07/08/inflation-expectations-drift-back-down-to-pre-tariff-levels-new-york-fed-survey-shows.html

CNN. (2025). Inflation is tame. Markets are at record highs. But economists warn Trump is still playing with fire on tariffs. https://edition.cnn.com/2025/07/08/business/trump-tariffs-market-inflation-jobs

NBC. (2025). Trump readies blanket tariffs as he brushes off inflation worries. https://www.nbcnews.com/politics/donald-trump/trump-tariffs-inflation-hasbro-ukraine-patriot-missiles-nato-russia-rcna218125

Oxford Economics. https://www.oxfordeconomics.com/

Surveys of Consumers, University of Michigan, University of Michigan: Inflation Expectation© [MICH], retrieved from FRED, Federal Reserve Bank of St. Louis https://fred.stlouisfed.org/series/MICH/, June 30, 2025.