- PE 150

- Posts

- Liquidity in Private Equity: Evergreen Solutions for a Dry Spell

Liquidity in Private Equity: Evergreen Solutions for a Dry Spell

Private equity’s liquidity challenge is evolving into a structural feature of the market.

As traditional exits stall—IPO windows remain narrow, and M&A is sluggish—firms are turning to continuation funds, semi-liquid structures, and evergreen funds to meet liquidity demands. Secondary market volume surged from $25B in 2012 to $112B in 2023, yet still falls short of meeting the liquidity needs of a $5.3T AUM industry. The gap is clear: while dry powder in secondaries sits at $171B, investor pressure for distributions, employee liquidity, and strategic flexibility is only growing.

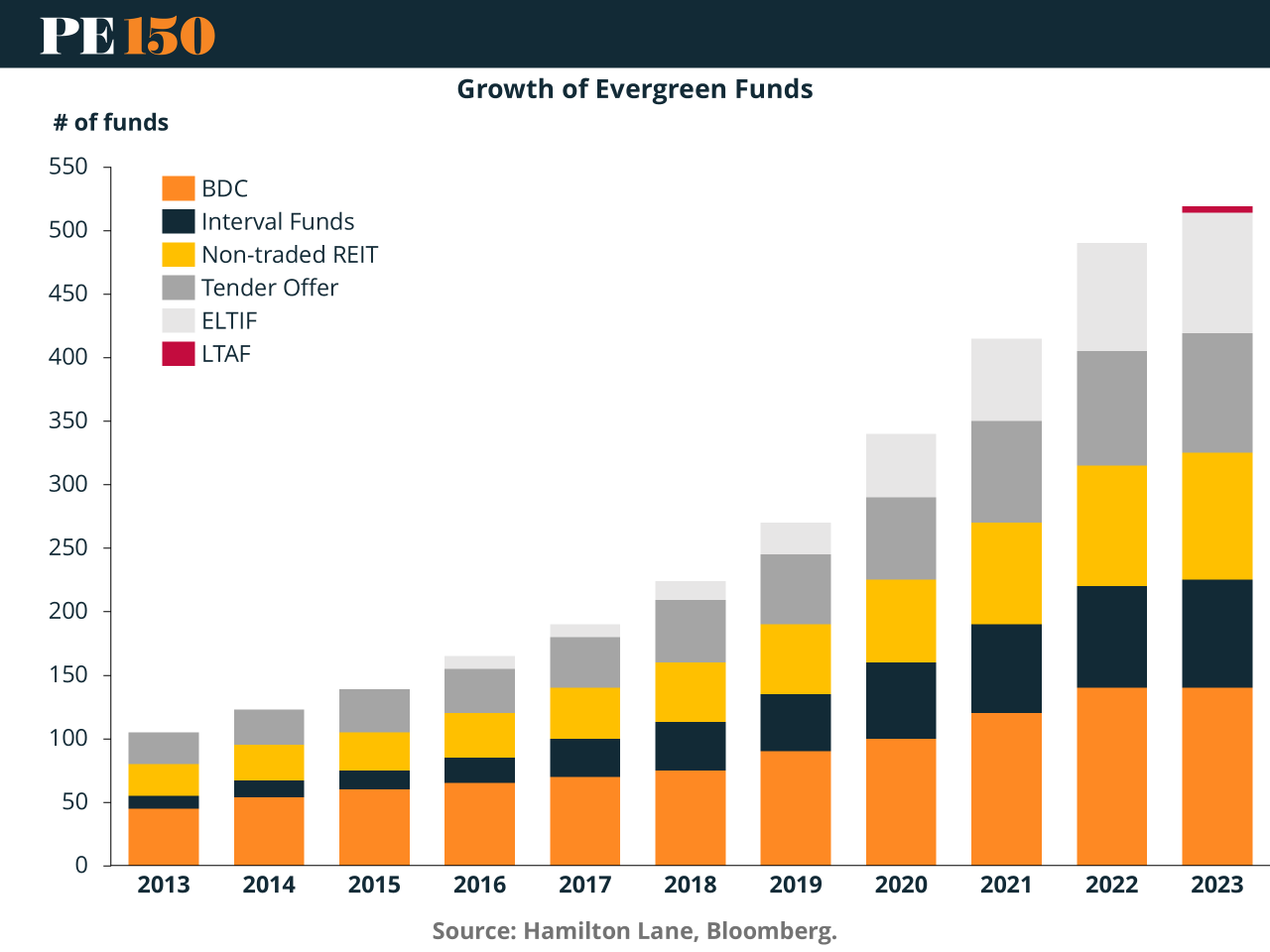

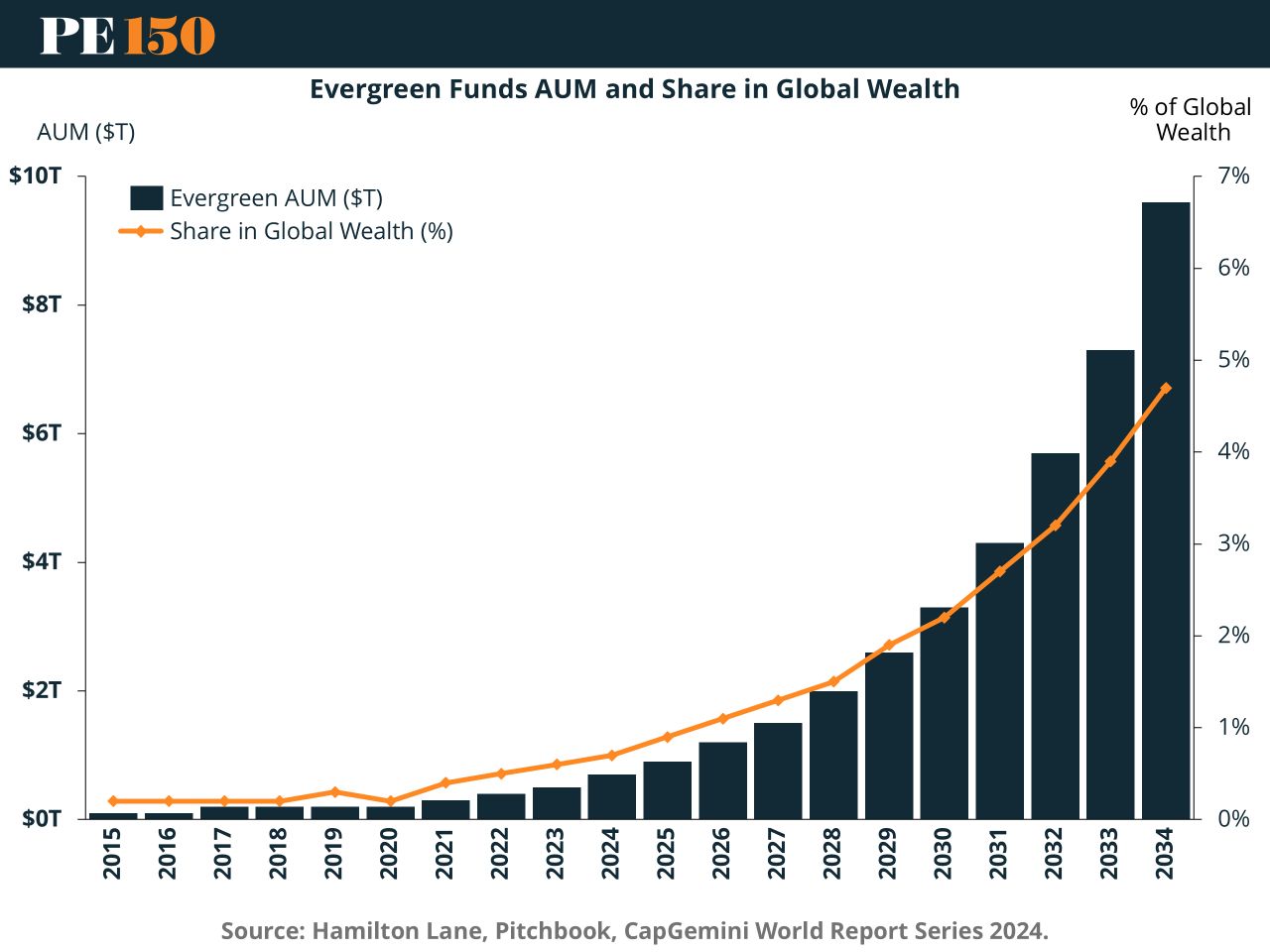

Evergreen and semi-liquid funds are increasingly positioned as the answer. These vehicles, often open-ended with periodic liquidity windows, allow GPs to hold high-performing assets longer without the artificial constraint of a fixed fund life. Hamilton Lane projects a “profound” evolution in GP-LP alignment via these vehicles, as evergreen funds aim to balance long-horizon investing with the growing demand for optionality.

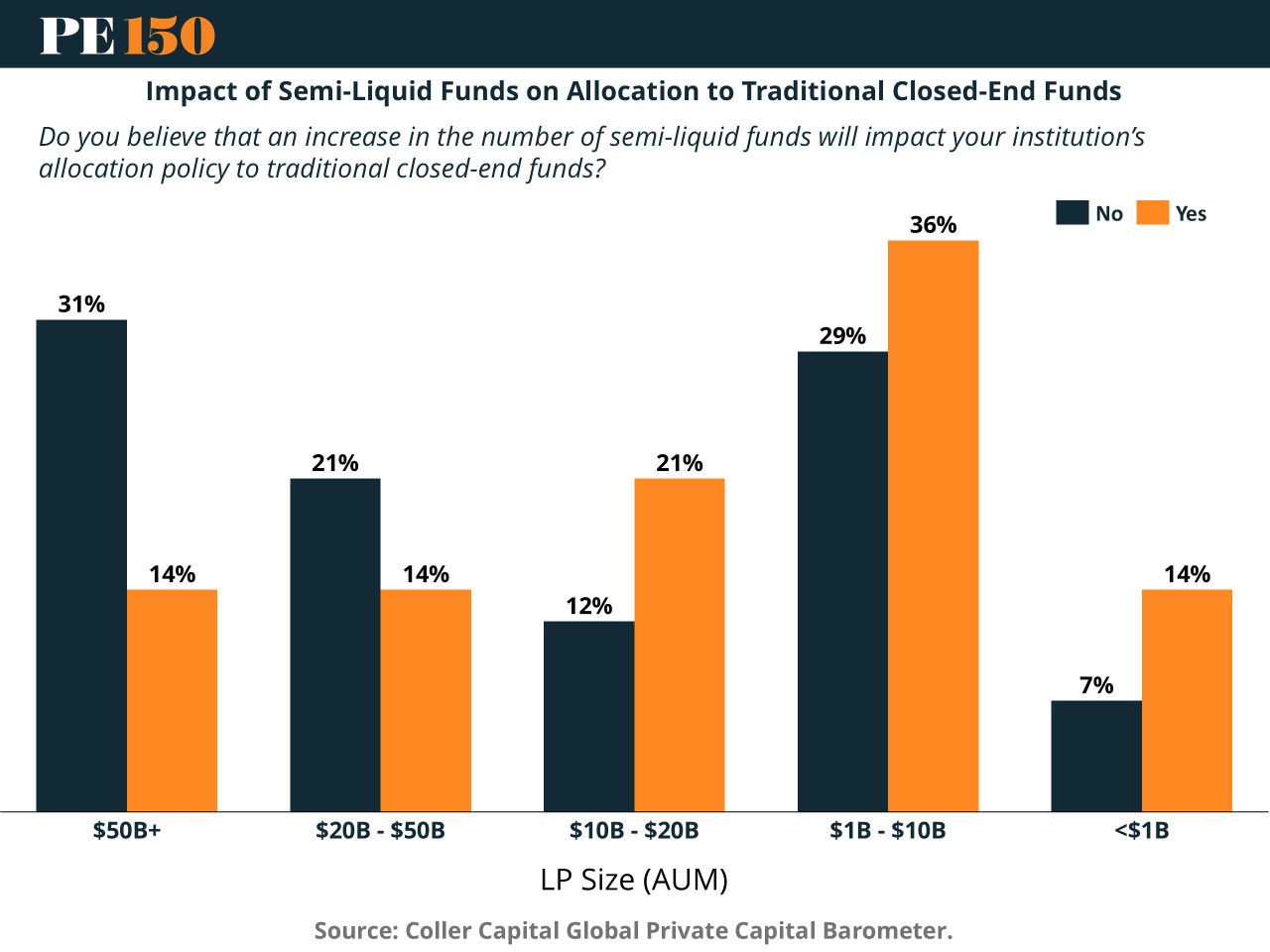

But LPs aren’t sold yet. According to Private Equity International, some question whether evergreen structures introduce misaligned incentives—especially when GPs are both buyer and seller. With 56% of failed continuation fund deals citing valuation conflicts, skepticism is not unfounded. LPs want better governance and clearer valuation protocols as a condition for greater adoption. Meanwhile, NAV loans and tender offers have become stopgaps, but few offer the same permanence or scale as true evergreen solutions.

Asia’s Turn to Liquidity Innovation

In Asia-Pacific, the liquidity conversation has its own drivers. According to PwC, investor interest in private markets is booming—but illiquidity remains a major barrier to access. In response, asset managers are piloting tokenization, interval funds, and hybrid fund structures that promise more predictable exits and better alignment with local capital preferences . Singapore’s regulators, for instance, are actively engaging with the industry to support innovations that open private equity to a broader investor base.

The Bottom Line

Evergreen funds and liquidity innovation are not just survival tactics—they are reshaping the private equity toolkit. For GPs, these tools offer a way to hold winners longer. For LPs, they offer new forms of optionality. But as evergreen structures proliferate, expect scrutiny over governance, fees, and transparency to intensify. In a market starved for exits but flush with capital, liquidity engineering is becoming the new frontier of differentiation.

Sources & References

Hamilton Lane. (2025). Evergreen Funds and Private Wealth. https://explore.hamiltonlane.com/2025-market-overview/evergreen-funds

Private Equity International. (2025). LPs question GPs on rise of semi-liquids and potential conflicts with funds. https://www.privateequityinternational.com/lps-question-gps-on-rise-of-semi-liquids-and-potential-conflicts-with-funds/

PwC. (2025). Evergreen funds - unlocking access and liquidity in Asia Pacific investing. https://www.pwc.com/sg/en/blog/unlocking-access-and-liquidity-in-asia-pacific-investing.html