- PE 150

- Posts

- Underwriting Tightens, Credit Shifts, and EQT Drops a $50B AUM Bombshell

Underwriting Tightens, Credit Shifts, and EQT Drops a $50B AUM Bombshell

EQT acquires Coller Capital for up to $3.7B and management teams top underwriting priorities, while banks quietly fuel the private credit boom.

Good morning, ! Today we're covering the top underwriting priorities today for new deals, private credit is eating bank lending, LatinAmerica has growth potential but with restricted cash, and EQT is buying $50B of new AUM by acquiring Coller Capital.

Want to advertise in PE 150? Check out our ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link

PRIVATE CREDIT

Bank Lending to Private Credit: A Quiet but Critical Shift

Private credit has moved from the periphery of financial markets to the center of modern credit intermediation, and banks are playing a far more important role in that rise than is often recognized. While asset managers increasingly originate loans, banks have become the financial backbone of the system, supplying the leverage that allows private credit to scale.

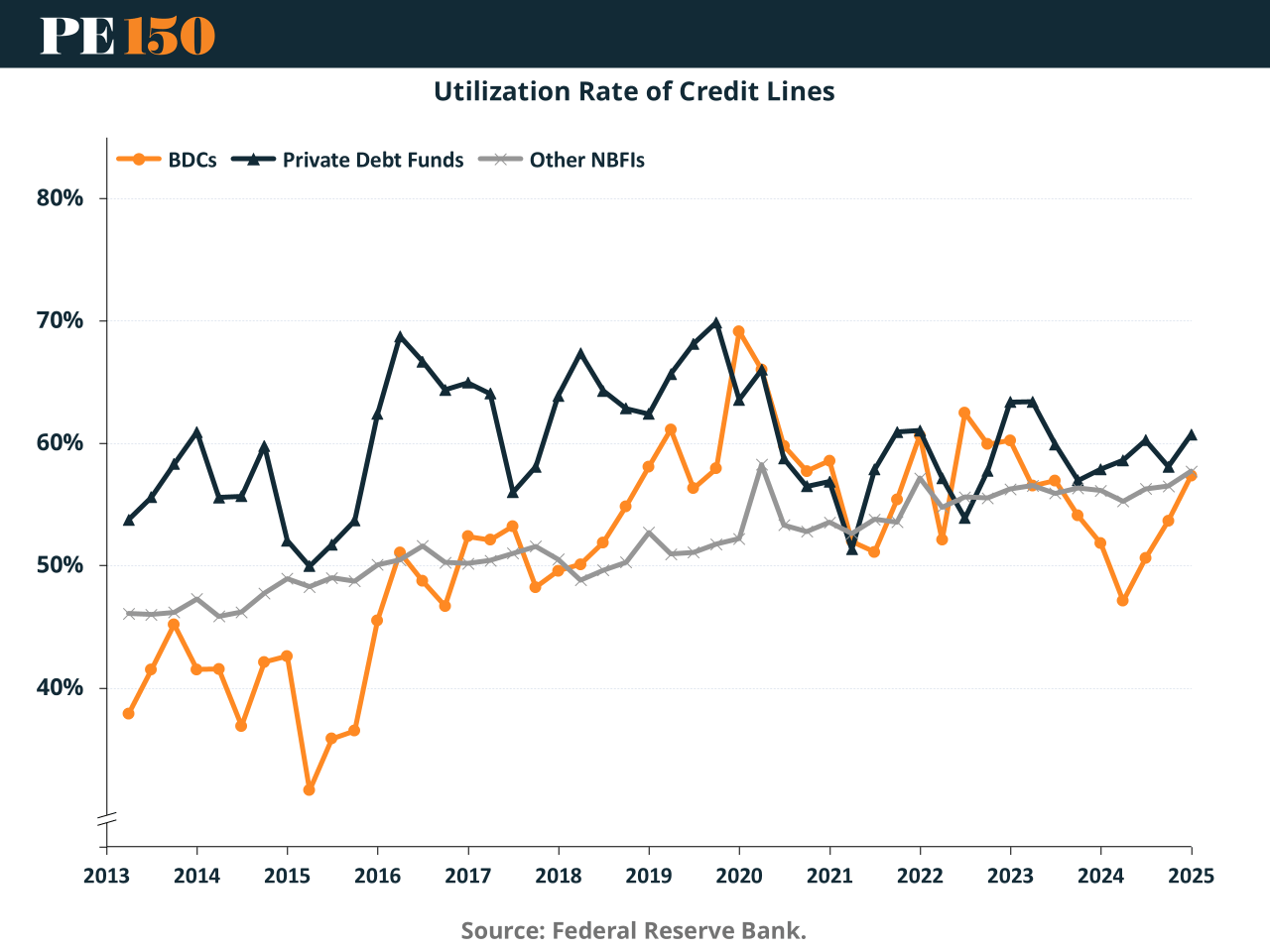

Over the past decade, utilization of bank credit by private credit vehicles has steadily increased, with BDCs and private debt funds now deploying more than half of their available credit lines. This reflects a structural change, not a cyclical one: banks are no longer merely competing with private credit, but actively enabling it.

From a balance sheet perspective, bank exposures remain investment-grade with low reported delinquencies, making the relationship appear stable. Yet credit risk has not disappeared; it has been transformed into counterparty risk to private funds whose liquidity and refinancing access now matter as much as borrower fundamentals.

For investors, private credit continues to offer superior risk-adjusted returns, but for banks and regulators, this growing web of connections deserves close attention. (More)

DEAL OF THE WEEK

EQT Buys Its Way Into Secondaries

EQT is acquiring Coller Capital in a deal valued at up to $3.7B, officially planting its flag in the fast-growing private capital secondaries market. The structure is classic modern PE: $3.2B paid in newly issued EQT shares, plus a $500m earn-out tied to performance.

Founded in 1990, Coller manages nearly $50B in AUM across institutional, private wealth, and insurance-related strategies, making this less bolt-on and more platform-defining. CEO Per Franzén framed secondaries as a response to rising demand for liquidity solutions and flexible portfolio construction—PE-speak for “LPs want options.”

The real eyebrow-raiser: EQT expects the deal to more than double Coller’s business within four years. Translation: secondaries aren’t a side hustle anymore—they’re becoming core infrastructure. (More)

MICROSURVEY

What really matters when underwriting a new platform

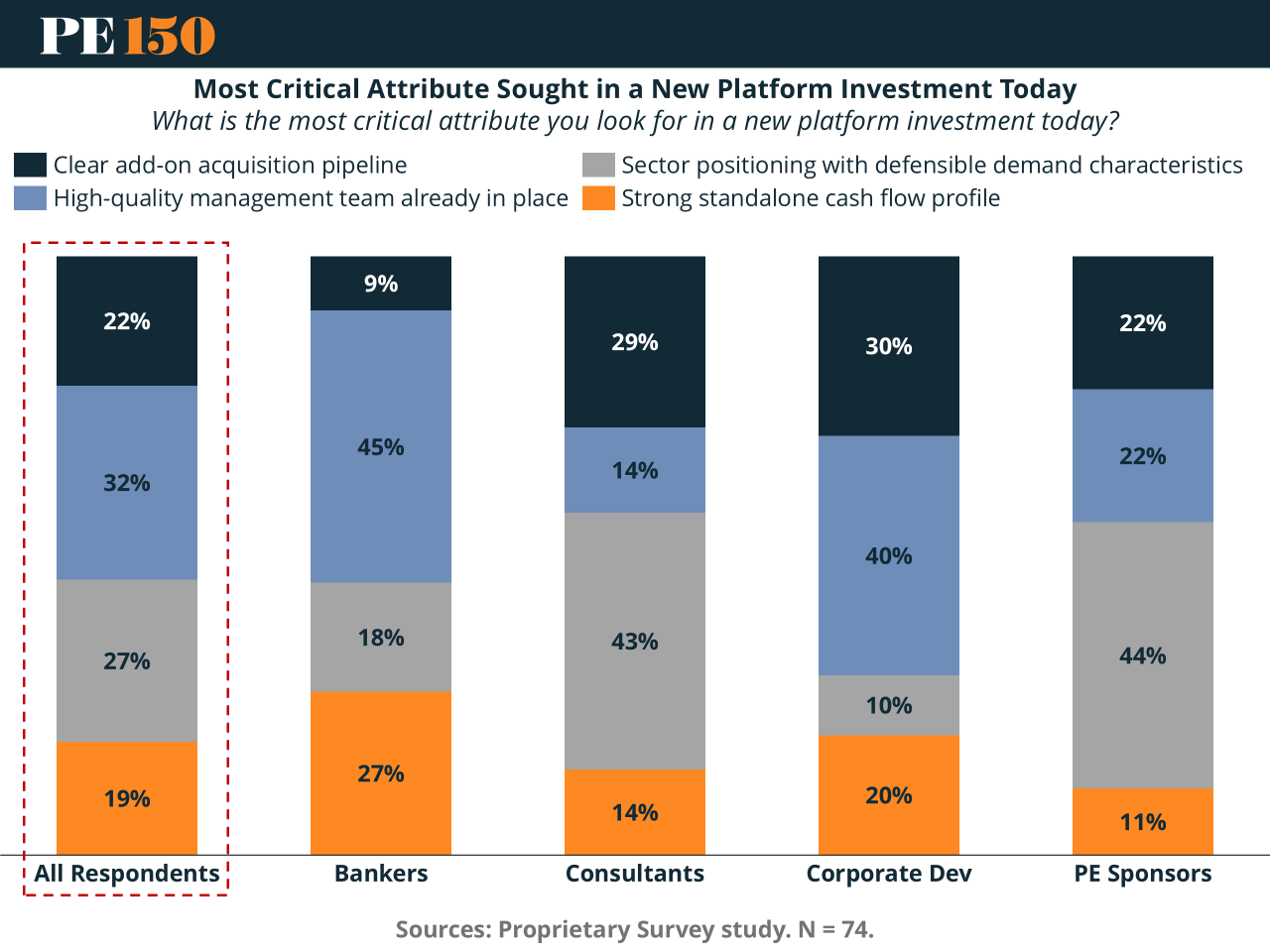

The answers are telling. In our latest survey of 74 market participants, the top underwriting priority today is not leverage or financial engineering. It is people.

Across all respondents, 32% cited a high quality management team already in place as the single most critical attribute in a new platform. That beats sector positioning with defensible demand at 27%, clear add on acquisition pipelines at 22%, and standalone cash flow at just 19%.

The message is subtle but important: Cash flow is now assumed. What is scarce is execution. In a market with higher rates, longer holds, and less margin for error, sponsors are underwriting their downside through leadership and sector durability, not balance sheet gymnastics.

PE sponsors sharpen that view even further. 44% rank defensible sector positioning first, while management teams and add on pipelines tie at 22% each. Cash flow again comes last.

The takeaway: platform underwriting has shifted from optimization to risk containment. Teams and sectors that can compound through cycles now matter more than clever entry math. (More)

REGIONAL FOCUS

Welcome to the Latin Illiquidity Trap

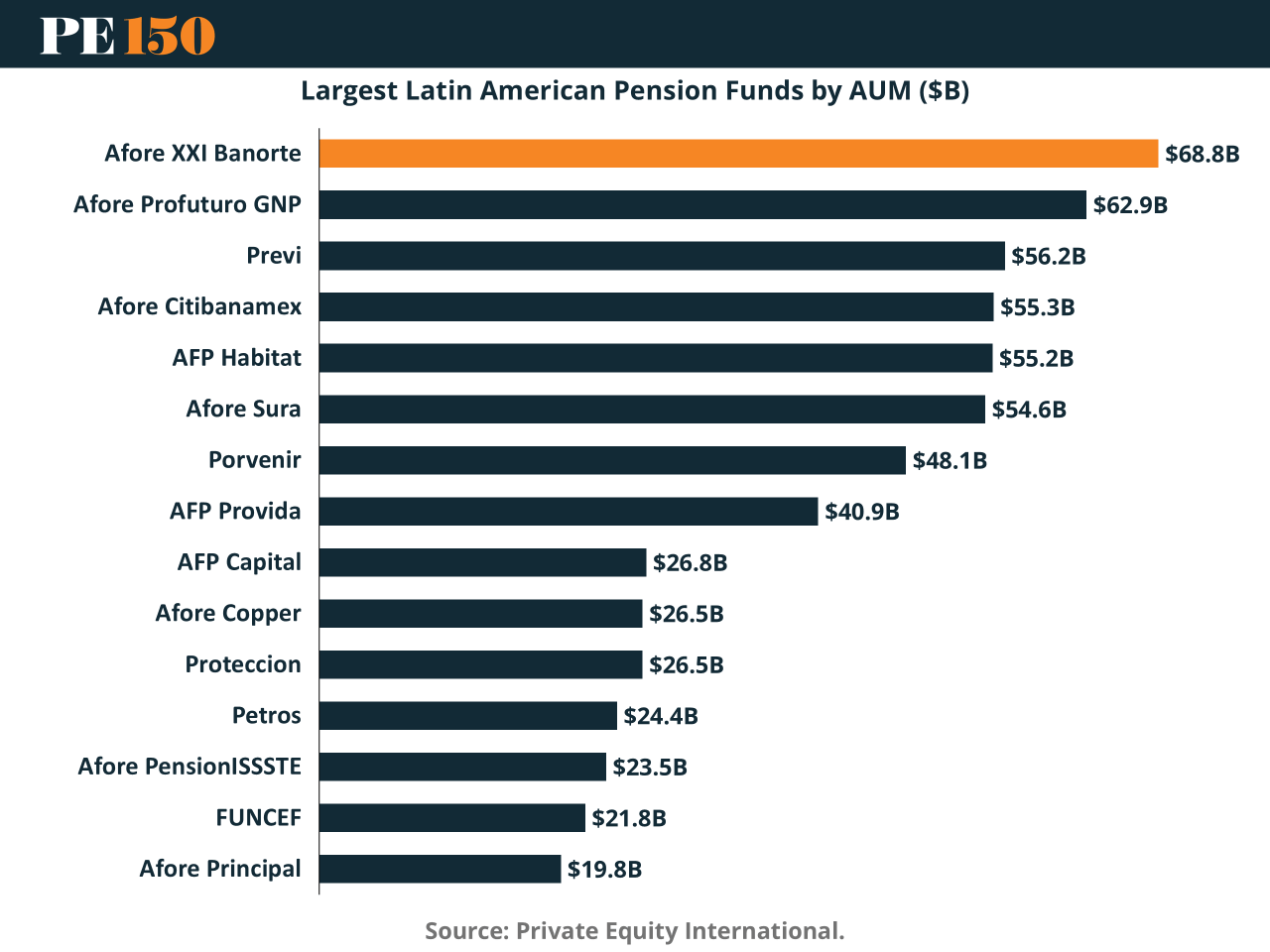

Private equity in Latin America is back—on paper. GPs deployed $46.4B last year, a new high. But beneath the surface, the region remains trapped in a structural illiquidity loop. Fundraising cratered to $1.7B, IPO windows are shut, and DPI remains stuck in neutral.

The missing piece? Local LPs. Pension whales like Chile’s AFP Habitat and Mexico’s Afore XXI Banorte could rebalance the ecosystem, but risk, regulation, and capacity gaps keep alternatives on the fringe. Meanwhile, trade sales still dominate exits, and continuation funds are barely a footnote.

Until domestic capital is unleashed and exit optionality expands, LatAm PE will keep dancing between boom and bottleneck. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

PUBLISHER PODCAST

No Off Button: Work/Life Lessons To Reach 700,000 Subscribers And #1 In Your Niche

Champions don’t slow down. They don’t wait for shortcuts. And they definitely don’t have an off switch. No Off Button is where Aram sits down with founders and creators who treat their craft like a long game—obsessive execution, high standards, and zero excuses.

This week’s guest is Rocky Xu, a finance filmmaker who built a 700,000+ subscriber audience and became #1 in his niche by skipping the creator playbook entirely. From day one, Rocky approached YouTube like a media company—producing Netflix-level documentaries from his bedroom and focusing on assets that compound, not viral hits.

The conversation digs into lessons PE minds will recognize instantly: why consistency beats hacks, why distribution is power, why AI is a tool—not a replacement for judgment—and why real value is built by owning evergreen catalogs, not chasing weekly spikes.

Why it matters: this is capital allocation and brand-building logic applied to media. Long-term thinking, defensible taste, and doing the work when no one’s watching.

"Always bear in mind that your own resolution to succeed is more important than any other."

Abraham Lincoln