- PE 150

- Posts

- What Matters Most When Underwriting a New Platform Today?

What Matters Most When Underwriting a New Platform Today?

In today’s more selective private equity environment, underwriting discipline has become as important as creativity.

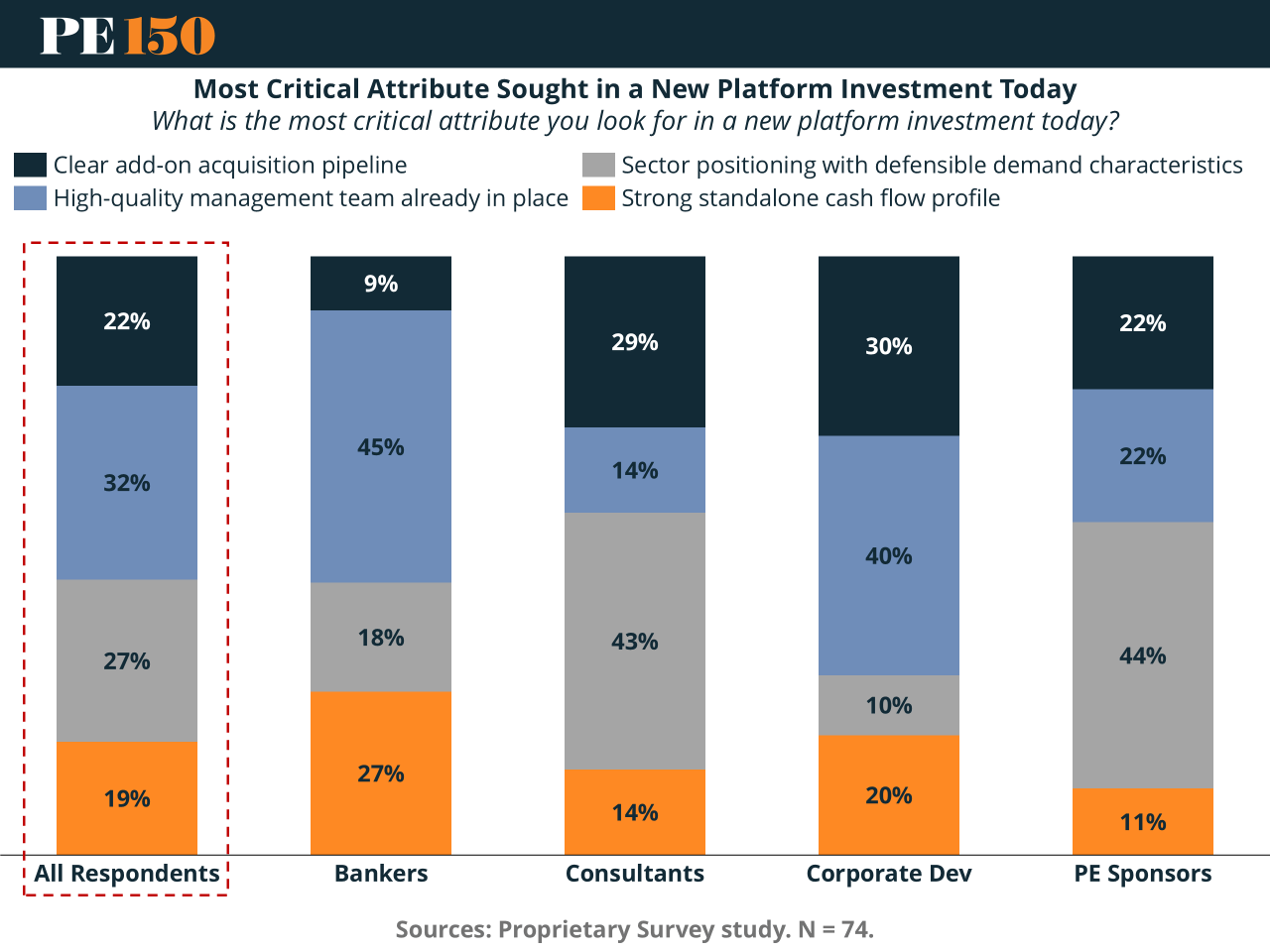

In today’s more selective private equity environment, underwriting discipline has become as important as creativity. To better understand how investors are prioritizing risk and value creation at the platform level, we asked a simple but revealing question in our latest survey: What is the most critical attribute you look for in a new platform investment today?

Across 74 respondents, including PE sponsors, bankers, consultants, and corporate development professionals, the results highlight a clear shift away from purely financial engineering and toward fundamentals that support durable growth.

Across all respondents, the top priority is a high-quality management team already in place (32%). This underscores a growing consensus that execution risk is paramount in the current market. With leverage more expensive, exits less certain, and organic growth harder to manufacture, investors increasingly value teams that can operate independently, integrate acquisitions, and adapt strategy without heavy sponsor intervention. The days of “we’ll fix the team later” underwriting appear largely behind us.

The second-most cited attribute overall is sector positioning with defensible demand characteristics (27%). This reflects heightened sensitivity to macro risk, cyclicality, and end-market exposure. Investors are placing a premium on industries with structural tailwinds, mission-critical offerings, and resilience through economic cycles—particularly as revenue visibility becomes more valuable than aggressive growth assumptions.

Clear add-on acquisition pipelines (22%) ranked next, reinforcing that buy-and-build remains central to the PE playbook, but not at any cost. Rather than speculative roll-ups, respondents appear focused on platforms where fragmentation, strategic fit, and integration logic are already well understood at entry.

Finally, strong standalone cash flow profiles (19%) ranked lowest overall, a somewhat counterintuitive result given today’s financing environment. However, this does not suggest cash flow is unimportant—rather, it may indicate that baseline cash generation is increasingly viewed as table stakes, while differentiation comes from people, strategy, and sector selection.

A Closer Look at PE Sponsors

When isolating PE sponsor responses, a more deliberate underwriting framework emerges. Sponsors place their greatest emphasis on sector positioning with defensible demand characteristics (44%), signaling a clear focus on capital preservation and exit certainty. This is followed closely by high-quality management teams (22%) and clear add-on acquisition pipelines (22%), suggesting that sponsors are balancing downside protection with scalable upside.

Notably, PE sponsors assign the least weight to standalone cash flow relative to other attributes. This reinforces the view that sponsors are underwriting platforms not just for near-term yield, but for long-term value creation, where sector resilience, leadership quality, and M&A optionality ultimately drive multiple expansion and exit outcomes.

The takeaway: platform underwriting today is fundamentally about risk management. In an environment where margin for error is thin, PE sponsors are prioritizing sectors and teams that can compound value across cycles, rather than relying on leverage, timing, or financial engineering alone.