- PE 150

- Posts

- Bank Lending to Private Credit: Scale, Structure, and Strategic Implications

Bank Lending to Private Credit: Scale, Structure, and Strategic Implications

The rapid expansion of private credit has reshaped the modern financial system, blurring traditional boundaries between banks and nonbank lenders.

Once viewed as a niche complement to syndicated lending and high-yield markets, private credit now constitutes a structurally important channel for corporate and asset-backed finance. Central to this evolution is the increasingly deep interconnection between banks and private credit vehicles—through credit lines, warehouse facilities, term loans, and risk-sharing arrangements—which has elevated private credit from a peripheral asset class to a core component of credit intermediation.

Today, banks are no longer simply originators of loans held to maturity on balance sheet. Instead, they increasingly operate as liquidity providers, structurers, and senior creditors to a fast-growing ecosystem of private lenders. This shift alters not only how credit is distributed across the economy, but also how risk is transmitted and managed within the financial system.

Banks as the Financial Backbone of Private Credit

Private credit vehicles—including Business Development Companies (BDCs), private debt funds, and other nonbank financial intermediaries (NBFIs)—are fundamentally dependent on bank-provided leverage. Banks supply revolving credit lines, bridge facilities, and term financing that allow these entities to expand lending well beyond their equity capital. In effect, banks have become the balance sheet behind the balance sheet of private credit.

Unlike traditional bank-originated lending, where underwriting, funding, and risk retention are vertically integrated, private credit disaggregates these functions. Asset managers increasingly originate and manage credit risk, while banks specialize in senior secured funding, liquidity provision, and maturity transformation. This structural separation enables private credit to scale rapidly while allowing banks to earn attractive risk-adjusted returns with comparatively limited capital intensity.

However, this transformation also means that banks are exposed not just to individual borrowers, but to the operational and liquidity profiles of private credit funds themselves. The creditworthiness of the fund vehicle, the stability of its investor base, and its access to refinancing markets have become just as relevant as the quality of the underlying loan book.

Utilization of Bank Credit: A Measure of Embedded Leverage

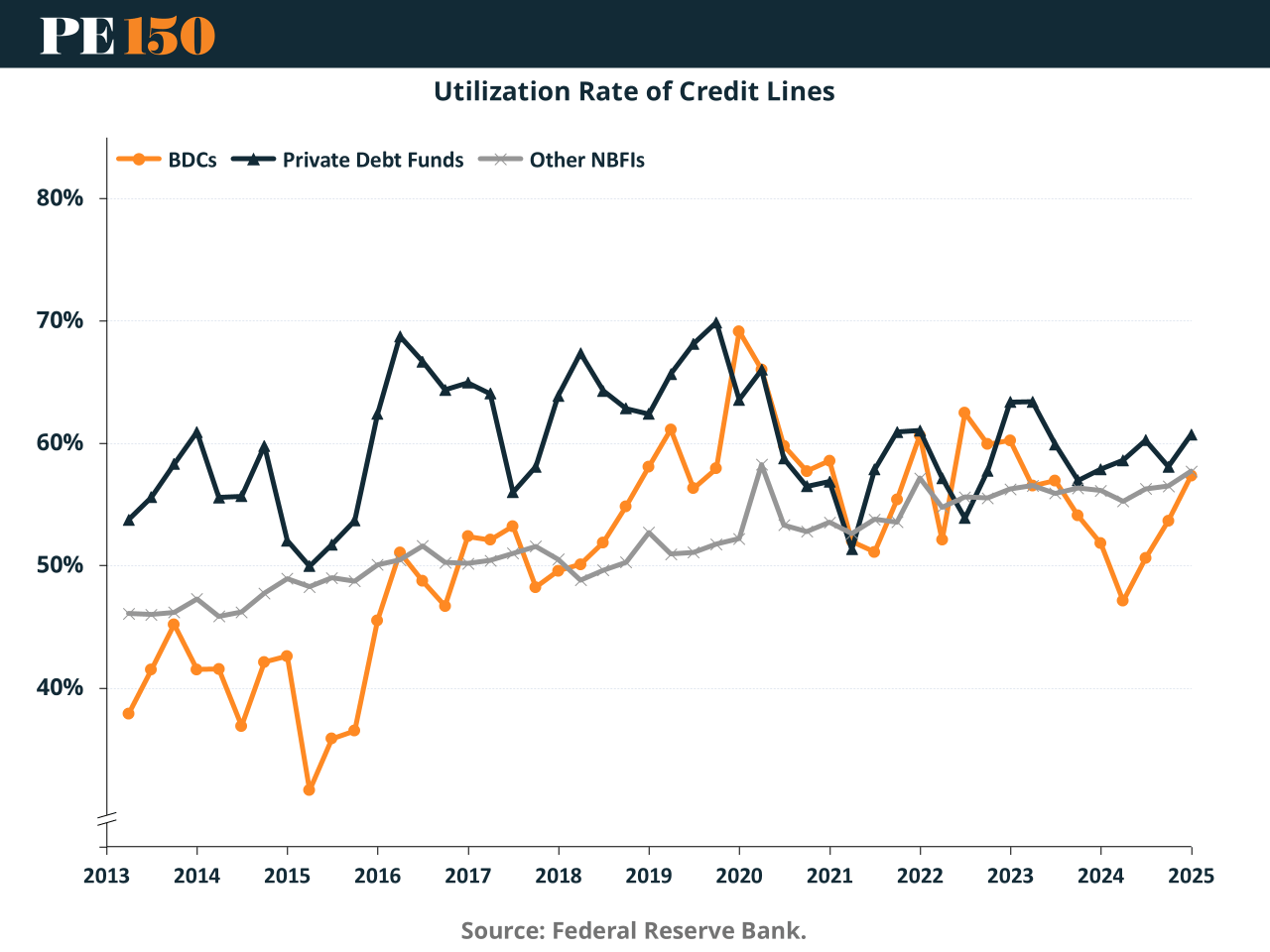

Credit line utilization rates offer a valuable window into how aggressively private credit vehicles are deploying bank-provided leverage. Since 2013, utilization across BDCs, private debt funds, and other NBFIs has trended upward, with periodic volatility reflecting broader market conditions.

BDCs display the most pronounced swings in utilization, consistent with their structurally higher reliance on revolving credit facilities to fund direct lending operations. Private debt funds, by contrast, show consistently elevated utilization, often exceeding 60 percent, indicating sustained reliance on leverage even during periods of monetary tightening. Other NBFIs, while less leveraged on average, also exhibit a clear upward drift over time.

Notably, utilization surged around 2020 as market stress triggered both defensive drawdowns and opportunistic deployment of capital. While utilization has since moderated, it remains structurally higher than in the early 2010s. This suggests that leverage is no longer merely cyclical but has become embedded in the private credit operating model.

The Long-Term Shift Toward Bank-Funded Credit Intermediation

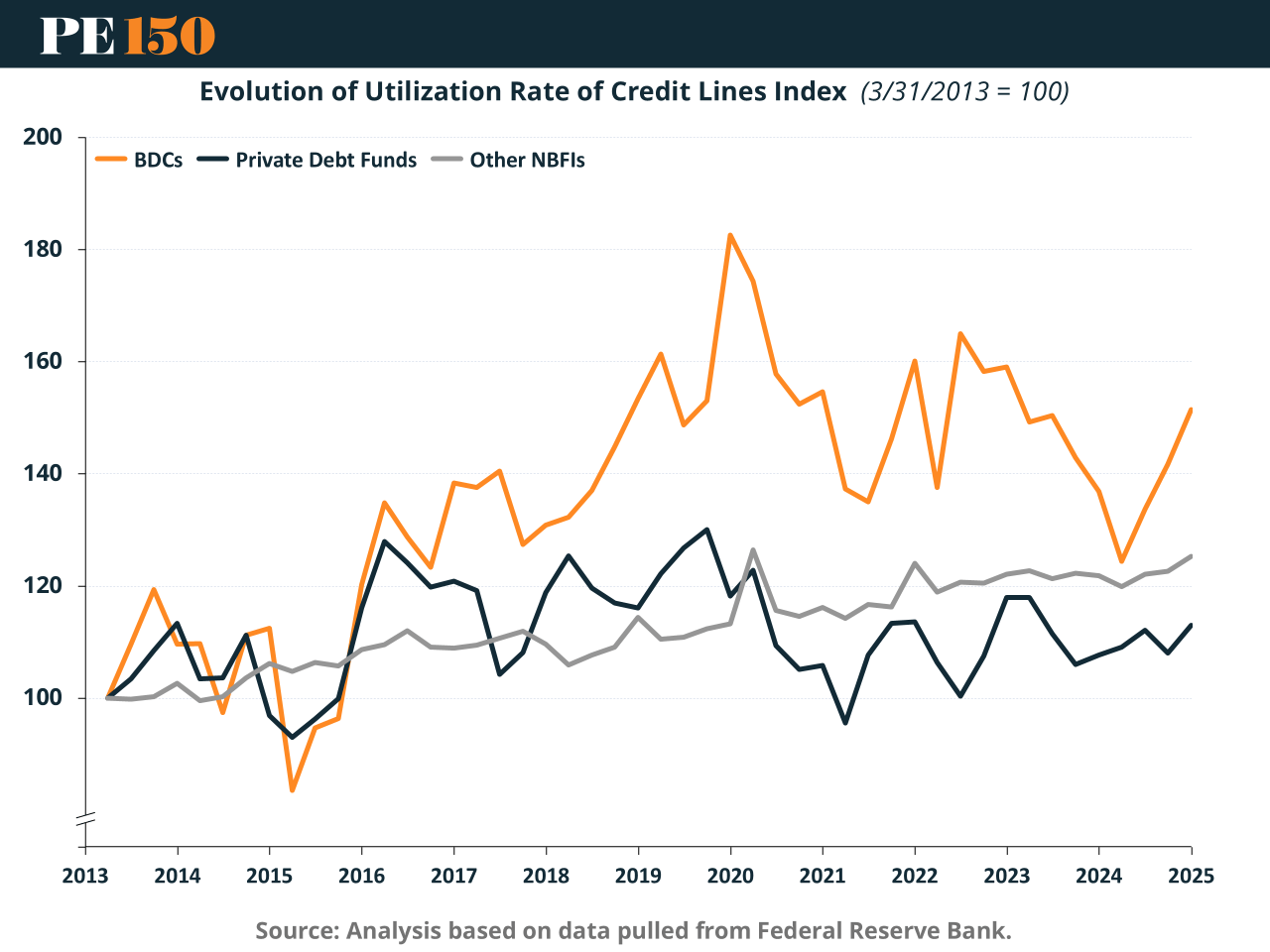

When viewed on an indexed basis relative to 2013 levels, the structural nature of this shift becomes even clearer. BDC utilization has nearly doubled over the period, reflecting their evolution into quasi-permanent credit intermediaries rather than episodic market participants. Private debt funds exhibit a similarly persistent upward trajectory, while other NBFIs show a steadier but still material increase.

Several structural forces underpin this transformation. Middle-market borrowers increasingly bypass traditional syndicated loan markets in favor of private lenders that offer speed, customization, and certainty of execution. Regulatory and capital constraints have made it more costly for banks to hold corporate credit risk directly, incentivizing them to intermediate through fund structures. Meanwhile, institutional investors have demonstrated sustained demand for floating-rate, illiquid yield, fueling capital inflows into private credit strategies.

The result is a financial architecture in which banks remain systemically central to credit provision, but increasingly operate one step removed from the ultimate borrower. This reconfiguration improves balance sheet efficiency but complicates traditional notions of where credit risk truly resides.

What Bank Balance Sheets Reveal About Private Credit Risk

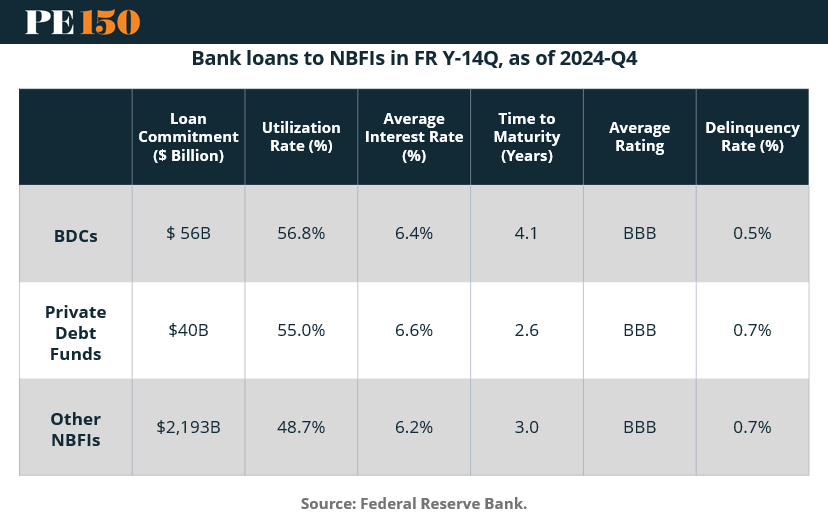

A snapshot of bank exposures to NBFIs reveals a sector that is both large and, at least superficially, benign. Other NBFIs dominate in absolute scale, with more than $2 trillion in loan commitments, far exceeding the exposure to BDCs and private debt funds individually. Yet utilization rates are highest among BDCs, reflecting their business model as permanent pools of leveraged lending capital.

Average interest rates on these exposures cluster between 6 and 7 percent, consistent with secured, institutional-grade lending. Credit ratings are uniformly investment grade, and reported delinquency rates remain low across all categories. From a narrow credit perspective, bank lending to private credit vehicles appears both profitable and well-controlled.

Nevertheless, these metrics warrant careful interpretation. The low delinquency rates partly reflect the seniority of bank claims within the fund capital structure and the ability of private credit managers to manage reported impairments. More importantly, they obscure second-order risks related to funding mismatches, investor redemptions, correlated exposures across funds, and refinancing dependency.

The Scale of the Opportunity and Why Banks Are Deeply Involved

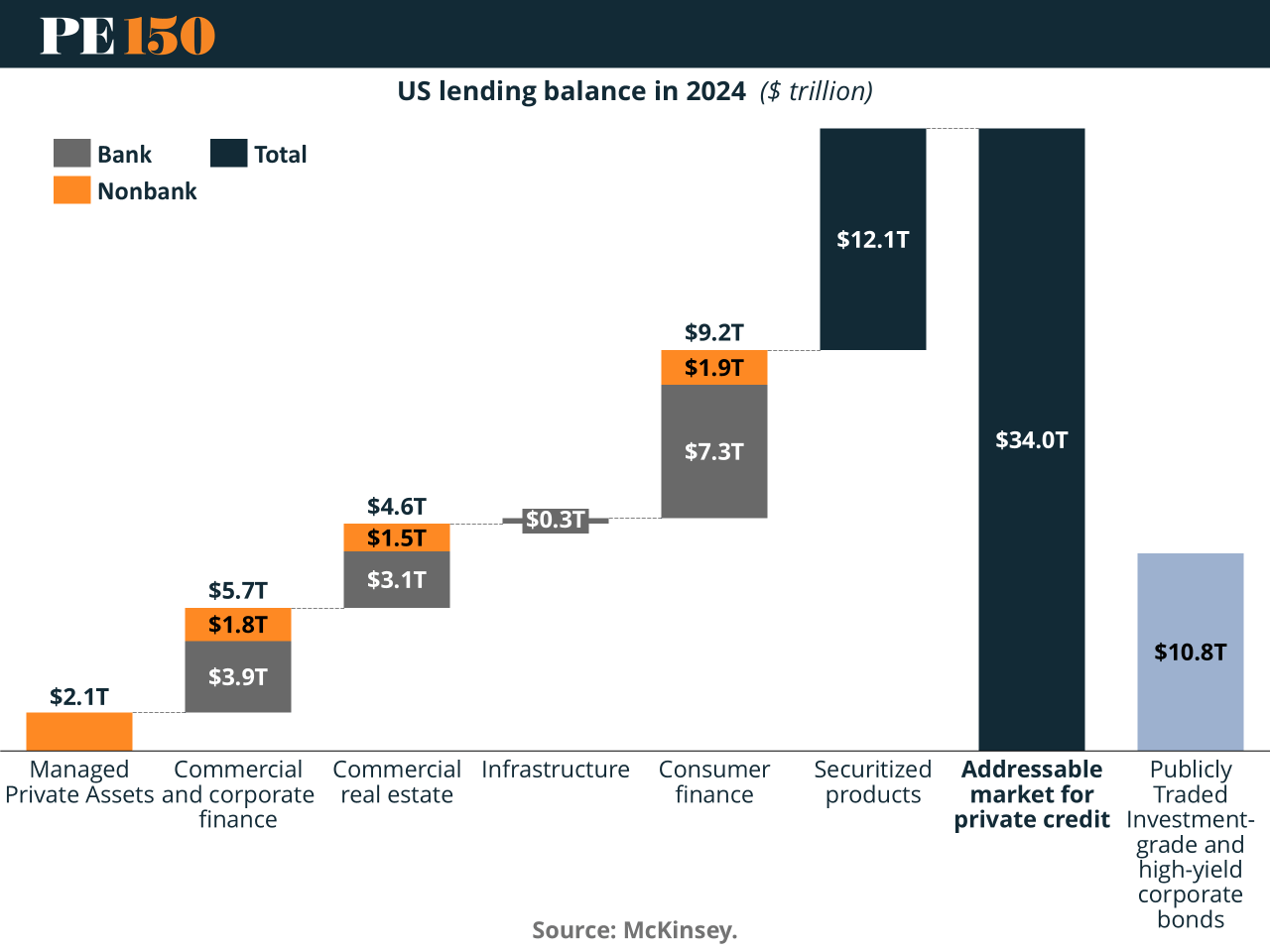

The magnitude of the private credit opportunity helps explain why banks are increasingly entwined with the sector. The addressable market now exceeds $34 trillion, spanning commercial and corporate finance, commercial real estate, consumer credit, infrastructure, and securitized products. Nonbank lenders already play a material role in commercial real estate and consumer finance, while infrastructure and structured credit represent fast-growing frontiers.

For banks, private credit is not primarily a competitive threat but a strategic extension of their franchise. By financing private credit vehicles rather than directly originating all loans, banks gain exposure to high-growth credit segments while optimizing regulatory capital usage and balance sheet turnover. They also generate ancillary revenues through fund finance, derivatives, collateral management, and advisory services.

This symbiotic relationship has allowed banks to remain deeply embedded in credit markets even as direct loan origination migrates outward to asset managers.

Risk, Return, and the Investor Perspective

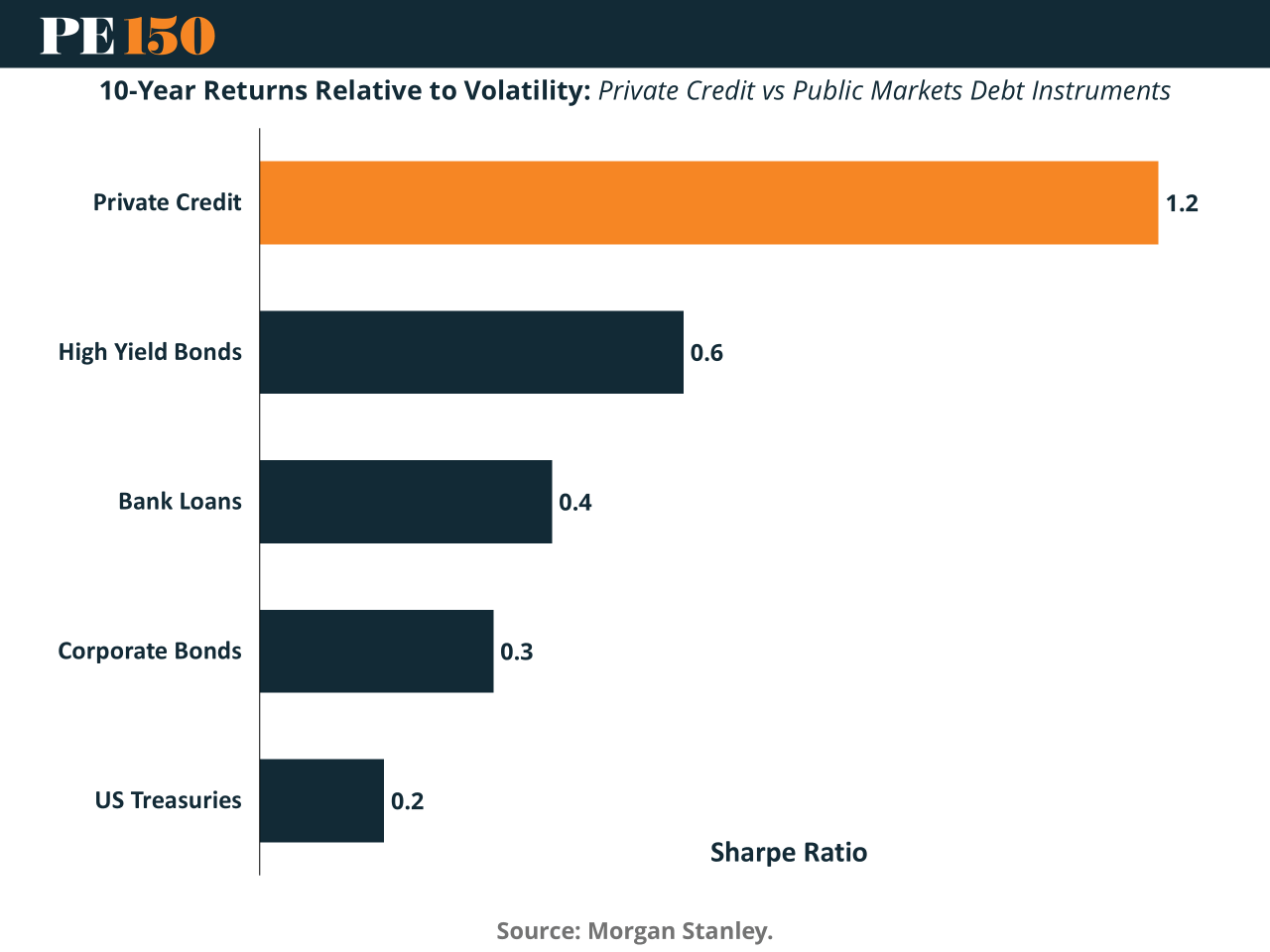

From the perspective of investors, private credit’s appeal is reinforced by its historical risk-adjusted performance. Over the past decade, private credit has delivered a Sharpe ratio roughly double that of high-yield bonds and significantly higher than bank loans, corporate bonds, or Treasuries. This superior risk-return profile reflects contractual cash flows, senior secured positioning, and limited mark-to-market volatility.

For banks, this investor demand translates directly into stable and scalable counterparties. As long as private credit continues to attract institutional capital, banks benefit from a growing base of leveraged but professionally managed borrowers. However, the very features that enhance private credit’s appeal—illiquidity, opacity, and valuation discretion—also complicate stress transmission during market dislocations.

Financial Stability Implications

The deepening ties between banks and private credit raise important financial stability considerations. While banks have reduced direct exposure to corporate borrowers in some segments, they have not eliminated credit risk; rather, they have transformed it into counterparty risk to private credit vehicles. In periods of stress, correlated drawdowns, margin calls, or refinancing disruptions could transmit shocks rapidly through bank balance sheets.

Moreover, the opacity of private credit portfolios limits the ability of market participants and regulators to assess system-wide concentrations and correlations. The growth of leverage embedded in fund structures also introduces procyclicality, as funds may be forced to deleverage simultaneously in adverse conditions.

At the same time, private credit can enhance resilience by diversifying funding sources for the real economy and reducing reliance on public markets during periods of volatility. The net financial stability impact therefore depends critically on risk management practices, transparency, and the robustness of bank underwriting standards applied to fund-level exposures.

Sources & References

Bank of International Settlements. (2025). The global drivers of private credit. https://www.bis.org/publ/qtrpdf/r_qt2503b.htm

Berrospide, Jose, Fang Cai, Siddhartha Lewis-Hayre, and Filip Zikes (2025). "Bank Lending to Private Credit: Size, Characteristics, and Financial Stability Implications," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, May 23, 2025, https://doi.org/10.17016/2380-7172.3802

EY. (2025). Financing the Economy: The Future of Private Credit. https://www.ey.com/en_lu/future-of-private-credit

McKinsey. (2024). The next era of private credit. https://www.mckinsey.com/industries/private-capital/our-insights/the-next-era-of-private-credit

Morgan Stanley. (2025). Understanding Private Credit’s Rapid Growth. https://www.morganstanley.com/ideas/private-credit-outlook-considerations

PE150.(2025). Banking Sector Retrenchment Created Tailwinds for Private Credit. https://www.pe150.com/p/banking-sector-retrenchment-created-tailwinds-for-private-credit-f83d