- PE 150

- Posts

- Private Equity in Latin America: Capital Rebounds, But Exits Remain Bottlenecked

Private Equity in Latin America: Capital Rebounds, But Exits Remain Bottlenecked

After two years of muted activity, private equity in Latin America is staging a comeback.

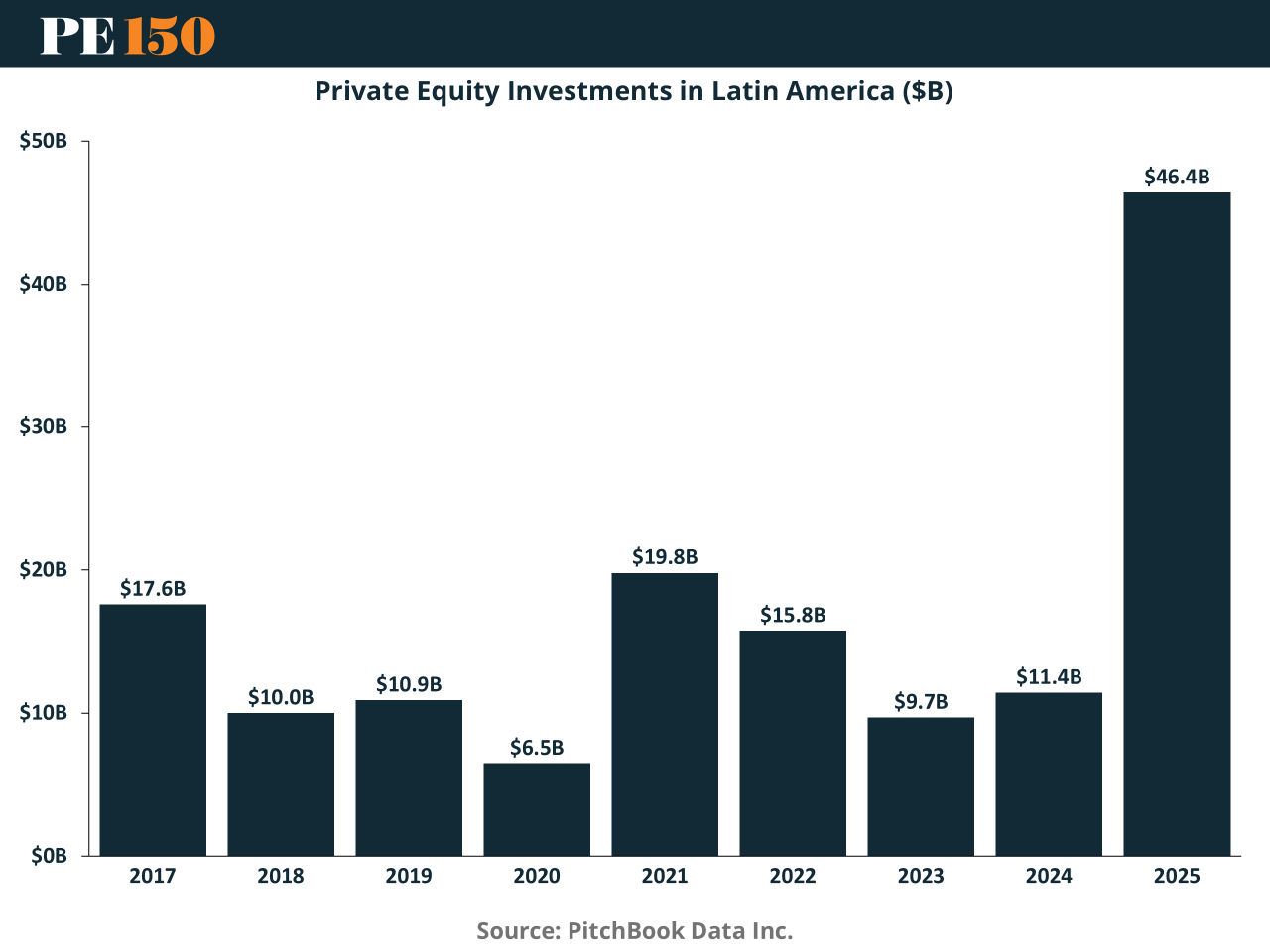

In 2025, total investment reached $46.4B, the highest annual figure on record, with Brazil and Mexico accounting for the lion’s share. Infrastructure, logistics, and digital services are drawing capital, supported by lower volatility, government-led reforms, and pent-up demand across consumer markets.

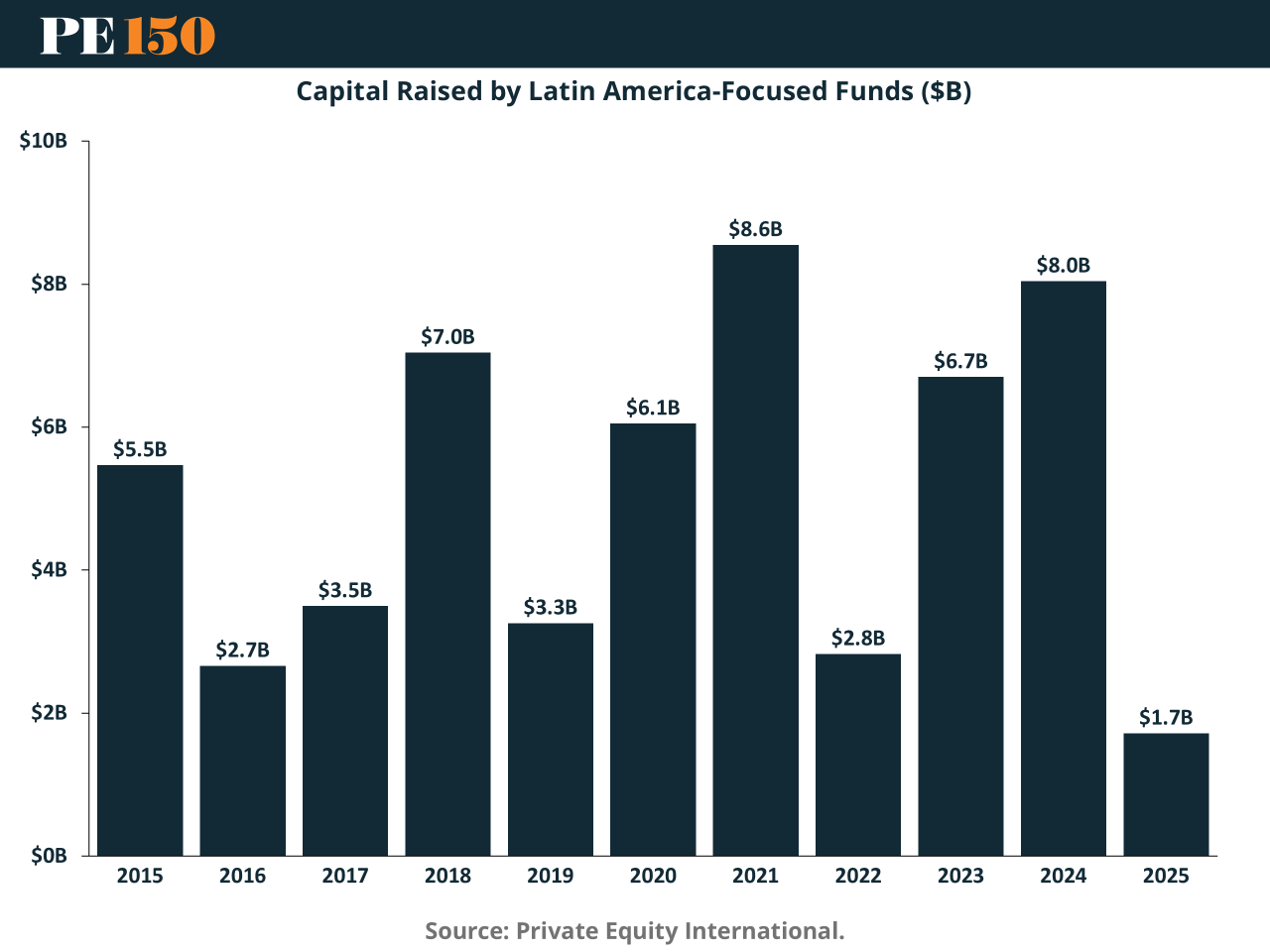

That capital deployment comes despite a sharp drop in fundraising. Latin America-focused PE funds raised just $1.7B in 2025—down from $8.0B in 2024 and $8.6B in 2021. GPs are being forced to stretch their deployment timelines and rethink their LP base. Volatility in global macro conditions and concerns around liquidity continue to spook international allocators.

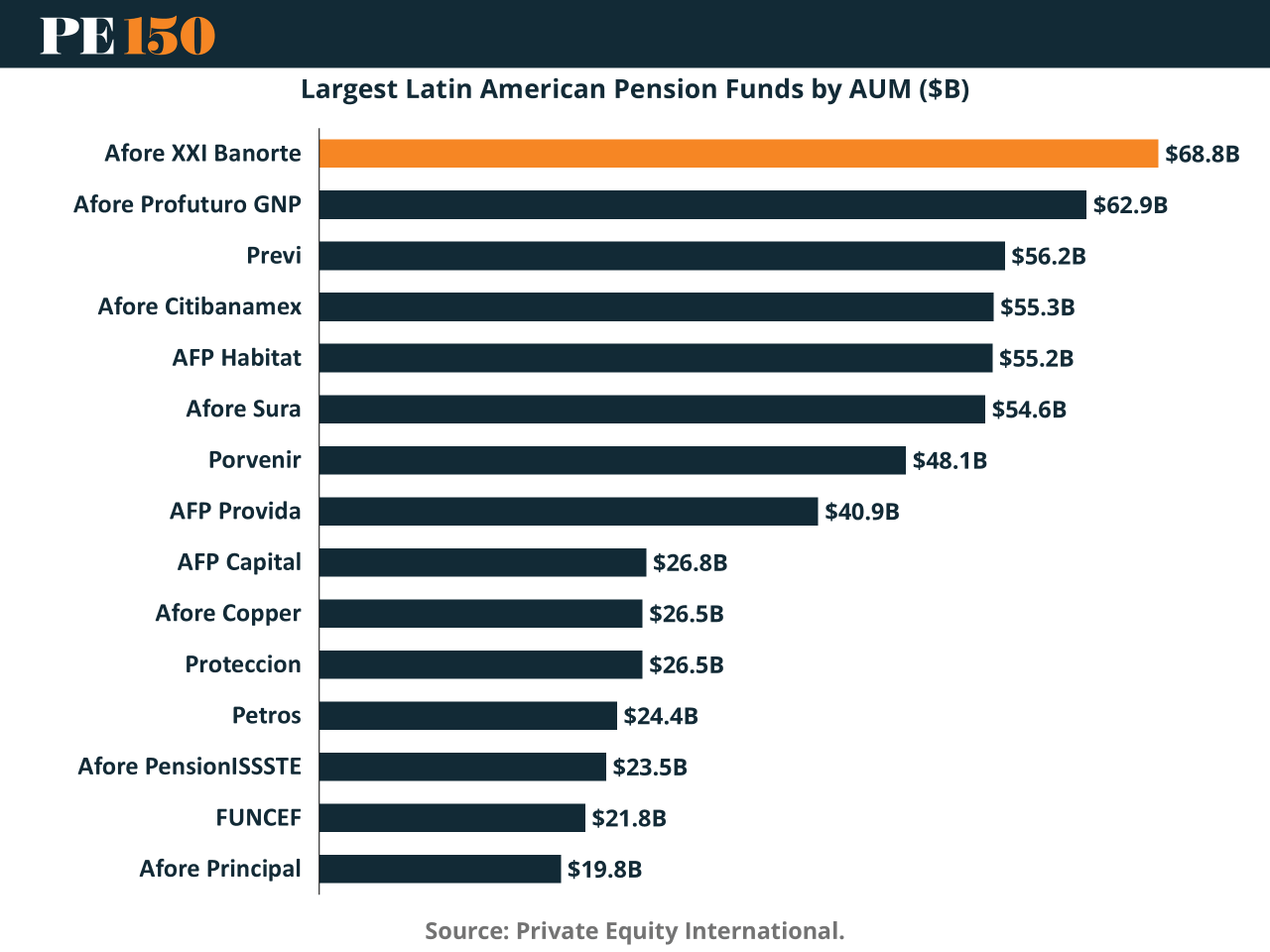

Local institutional capital could provide a structural solution. Pension funds across Brazil, Mexico, Chile, and Colombia control deep pools of capital, with some of the region’s largest AUM figures in emerging markets. Afore XXI Banorte alone holds over $68B, while Chile’s AFP Habitat and Brazil’s Previ each manage over $60B. But access remains limited. Regulatory hurdles, risk-aversion, and internal capacity constraints keep allocations to alternatives low—despite years of discussion about increasing exposure to private markets.

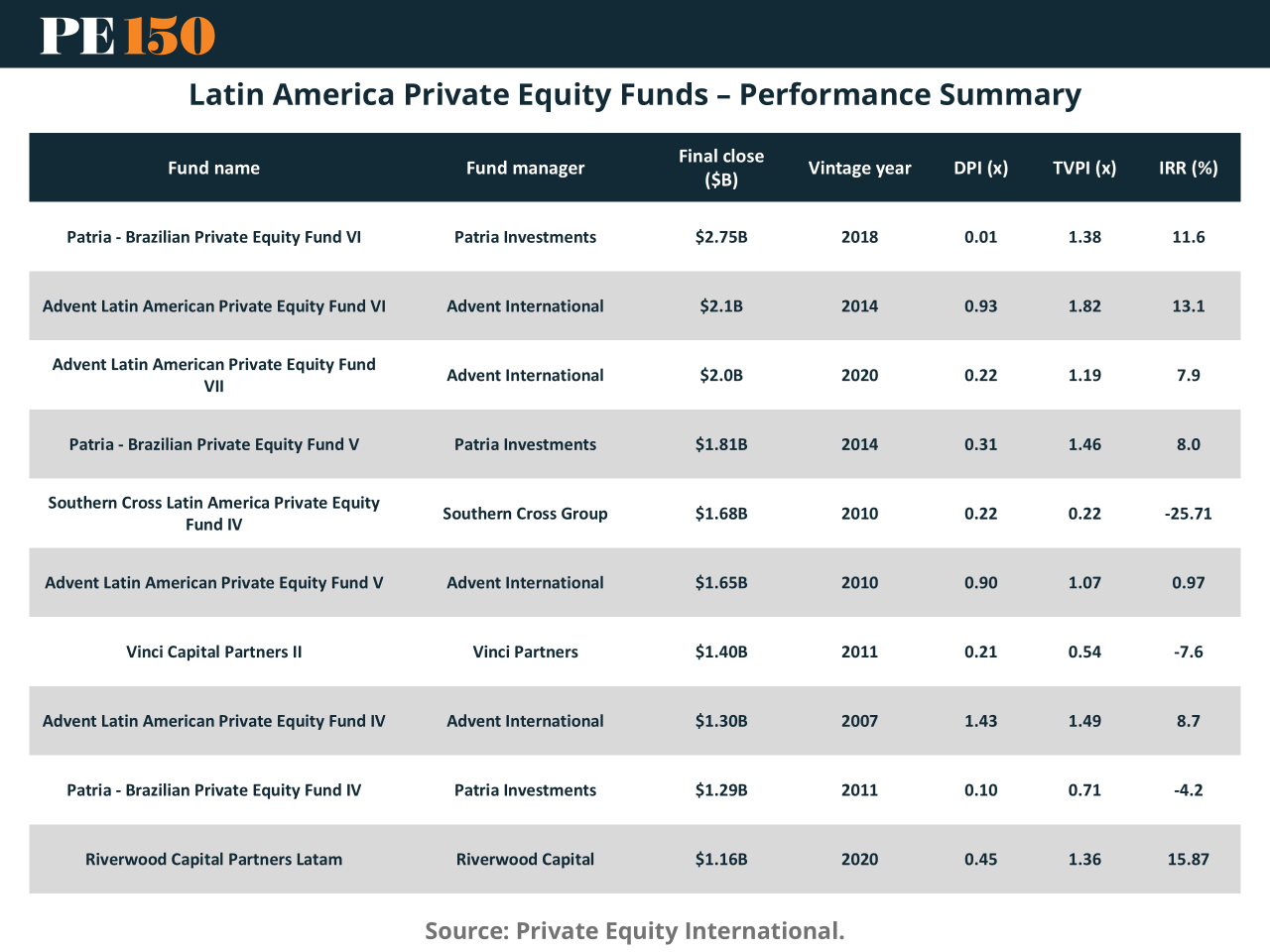

Returns across Latin American PE remain highly dispersed. Top-performing funds have delivered strong outcomes, but consistency is elusive. One 2020-vintage vehicle generated a 15.9% IRR with a 1.82x TVPI, while other funds from the past decade have posted negative returns. The gap between winners and losers is driven less by geography than by sector focus, execution capability, and timing of exits.

That last point is key: exit optionality remains the region’s limiting factor. Trade sales continue to dominate the landscape, especially in Brazil and Mexico, where strategic buyers—often local or regional corporates—are best positioned to navigate regulatory and FX risks. IPOs are virtually nonexistent; no sponsor-backed listings were completed in Brazil in 2023 or 2024. Dividend recaps and secondary buyouts remain niche, constrained by shallow debt markets and a limited pool of active sponsors.

Continuation funds are slowly gaining traction. A handful of GPs are using them to extend hold periods on infrastructure and renewables assets, particularly where exit timing is misaligned with fund life. But these remain the exception, not the norm. For most managers, illiquidity continues to weigh on DPI and pressure distribution timelines—especially for funds raised before 2020.

That’s part of why performance remains uneven. Firms able to extract operational value—and manage dual-track processes that include continuation, secondary, and strategic sale options—are preserving IRR in a tough environment. Others are stuck in holding patterns, unable to exit due to local market depth or buyer interest.

Despite that, Latin America is proving its resilience. The record $46B+ in 2025 investment shows that sponsors still see long-term opportunity. Energy transition, healthcare, logistics, and fintech continue to be favored sectors, and political risk has moderated in key economies. Valuations remain more attractive than in North America or Europe, and competition for deals—especially in the mid-market—is manageable.

The key constraint now is capital formation. If regional pension funds loosen the spigot—and if local capital markets can evolve to support more sophisticated exit routes—Latin America could enter a more mature phase of private equity activity. For now, the path forward remains opportunity-rich, but structurally bottlenecked.

Sources & References

Latin Lawyer. (2025). Private equity exits in Latin America: strategies for success in a dynamic market. https://latinlawyer.com/guide/the-guide-mergers-acquisitions/sixth-edition/article/private-equity-exits-in-latin-america-strategies-success-in-dynamic-market

PEI. (2025). How Private Equity Could Reshape Latin America. https://www.privateequityinternational.com/how-private-equity-could-reshape-latin-america/

PitchBook Data Inc. (2026). Latin America. https://pitchbook.com/tag/latin-america