- PE 150

- Posts

- Mid-Market Money Flows | Private Credit Platforms | Olo’s 65% Pop

Mid-Market Money Flows | Private Credit Platforms | Olo’s 65% Pop

Tight vacancies, muted new supply, and a wall of PE capital are turning apartments into 2025’s most defensible—yet still discounted—real-asset play.

Good morning, ! This week we’re covering PE’s fundraising rebound across mid-market and distressed, the platform era in private credit, why secondaries are holding up the exit market, and how multifamily is turning fundamentals into opportunity.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

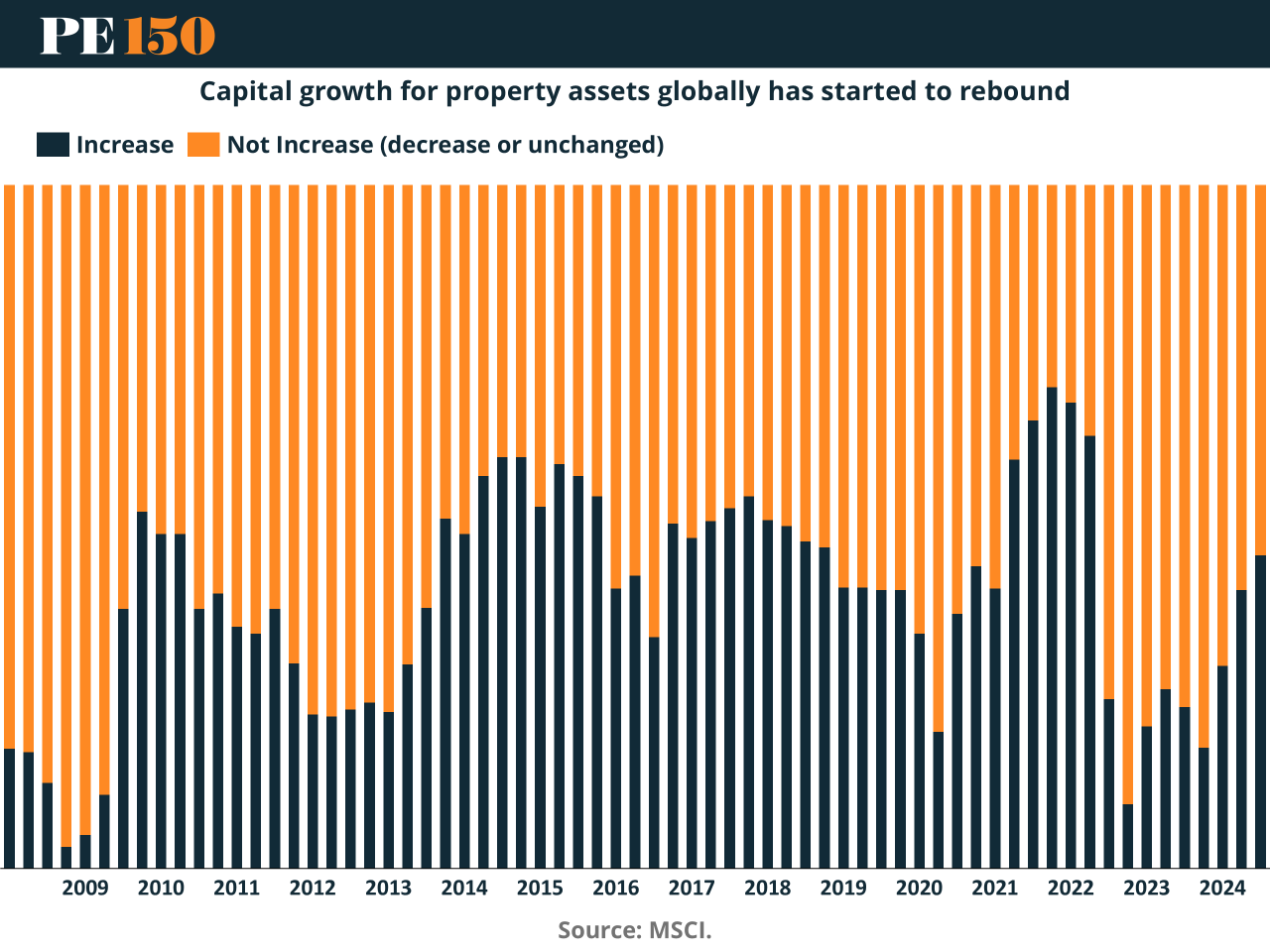

Multifamily’s Moment (Again)

2025 is looking like a GFC sequel—same playbook, different cycle. Multifamily is once again the MVP, thanks to tight supply, solid wage growth, and 25-year-low vacancy rates. Construction starts are down 13%, but PE is up: armed with dry powder, longer horizons, and operational chops. With private credit filling bank-sized gaps in the capital stack, the smart money is betting on revitalization markets and thesis-led acquisitions. Translation: fundamentals are back in fashion, and multifamily is on clearance—for now.

TREND OF THE WEEK

PE Fundraising Is Back—And It's Not Just Big Checks

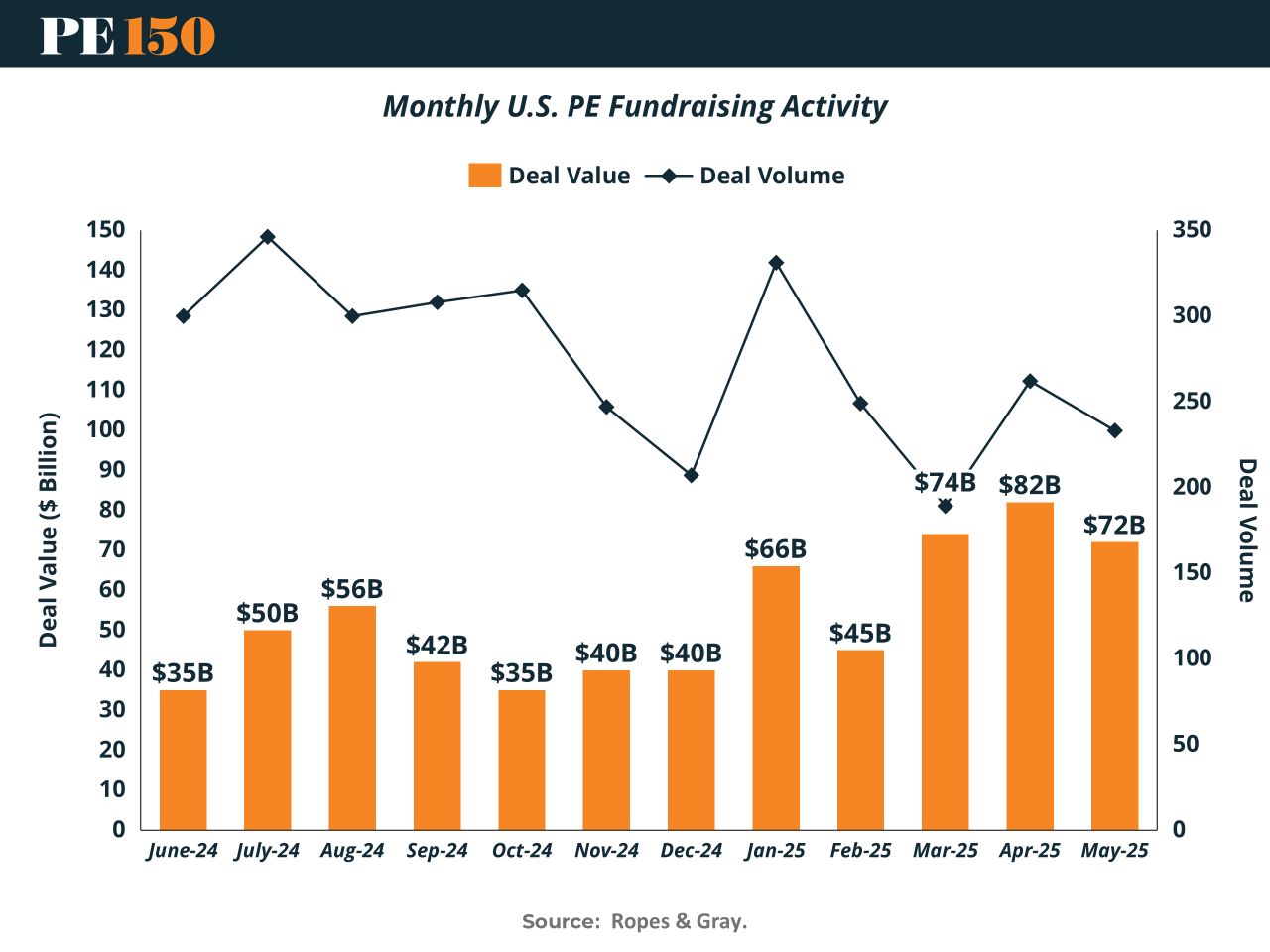

After a bruising 2024, U.S. private equity fundraising is finally showing signs of real muscle. Deal value nearly doubled from February ($45B) to April ($82B, marking the strongest single month since early 2024. May held strong at $72B, signaling that this isn’t a sugar high—it’s a trend.

But the kicker? Deal volume is back, too—climbing past 250 deals in April and May, after dipping below 200 at year-end. It’s not just mega-funds writing checks; it's mid-market and distressed players getting active.

Behind the bounce: Dry powder fatigue, rate stability, and a rotation into AI infra, healthcare, and logistics. If this pace holds, Q3 2025 could rival the 2021 boom. (More)

PRESENTED BY PACASO

Wall Street Insiders Love This “Very Disruptive” Ticker

From his days as an NFL linebacker to exits totaling nearly $1B, Wall Street insider Jon Najarian knows what it takes to reach the top. When it comes to Pacaso, he has three words: “I love it.”

He’s not alone. Pacaso’s luxury real estate disruption has already earned investment from major firms like Maveron, Greycroft, and Fifth Wall. By turning luxury vacation homes into co-owned assets, Pacaso is turning a $1.3T market on its head.

Look no further than the $110M+ they’ve earned in gross profits thus far, including 41% YoY growth last year alone. They even reserved the Nasdaq ticker PCSO.

And you can join these major firms as a Pacaso investor today.

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public.Listing on the Nasdaq is subject to approvals. The testimonials presented are the opinions of the individuals providing them. They may not represent the experience of all clients or investors and are not a guarantee of future performance or success.Individuals were compensated $50,000 for providing these testimonials and therefore, have a financial or other interest that could affect the objectivity of their statements.

LIQUIDITY CORNER

Exit Momentum Stalls in Q1—But Secondaries Stay Strong

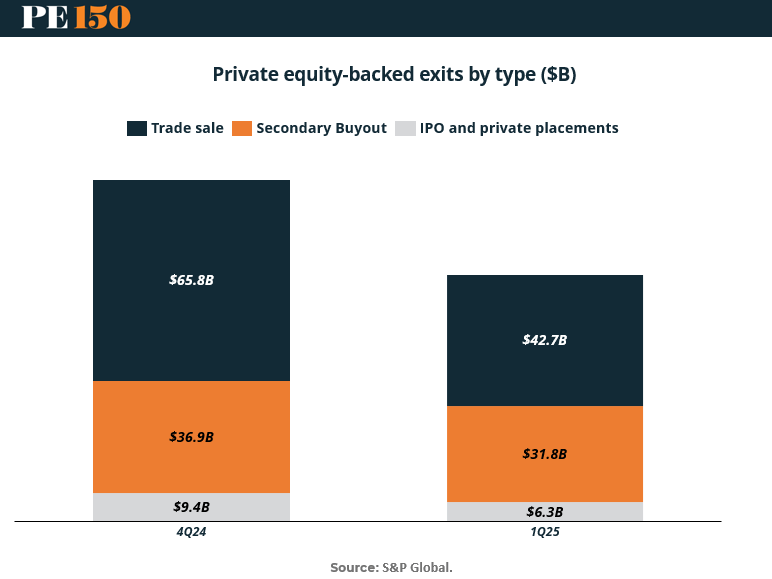

Private equity exits dropped sharply in Q1 2025, falling to $80.8B from $112.1B in Q4 2024—a 28% decline. Every exit type saw a contraction, but trade sales bore the brunt, tumbling from $65.8B to $42.7B.

The standout? Secondary buyouts. At $31.8B, they accounted for nearly 40% of total exit value in Q1—a high watermark for their share. This reflects a growing trend: sponsors increasingly prefer recycling assets within the PE ecosystem over waiting for a choppy M&A or IPO window.

Why it matters: With IPOs still muted (just $6.3B in Q1) and trade buyers hesitant, the exit path of least resistance is often another sponsor. But that also raises strategic questions: are firms exiting because it’s time—or because they have no better option? For LPs hungry for distributions, secondaries may offer liquidity—but not always at premium value. (More)

DEAL OF THE WEEK

Olo Goes Private. Finally Gets a Tip Worth 65%

Olo is trading out its public table for a private booth. Thoma Bravo will acquire the restaurant tech firm in a $2 billion all-cash deal, paying $10.25 per share — a 65% premium over its pre-deal price. With 750+ brands and 88,000 locations on its SaaS platform, Olo’s client list reads like a food court greatest hits: P.F. Chang’s, Denny’s, Nando’s. The deal gives founder Noah Glass a chance to speed up growth, without public-market scrutiny.

Goldman Sachs advised Olo, with Goodwin Procter on legal; Kirkland & Ellis backed Thoma Bravo. The transaction includes a $73.7M breakup fee and is expected to close by year-end. Apparently, software isn’t the only thing Olo’s good at optimizing — its exit multiple just got supersized. (More)

Presented by CapLink Group

Inside Nasdaq: Where Capital Meets Conversation

This fall, a select group of private equity leaders will gather inside the Nasdaq studio—where Fast Money airs and global markets converge—for an off-record dinner designed around real conversation, strategic alignment, and long-term opportunity creation.

Immediately following the CapLink Private Capital Summit, this private dinner will convene 10–15 senior decision-makers across buyout, growth, credit, and strategic corporate investment.

Limited to One Sponsor Only. As a presenting partner, your firm will have the opportunity to:

Co-curate the guest list alongside our editorial and events team, targeting by AUM, sector focus, or firm type.

Address the room with brief welcome remarks (3–5 mins).

Be featured in PE150’s post-event recap (200K subscribers), with optional on-record insights.

Receive premium brand placement onsite (menus, signage, photography).

Join the dinner with two senior seats, including pre- and post-event introductions to targeted attendees.

This is not your average networking event—and that’s by design. Access is limited. Alignment is curated.

To inquire about sponsorship, contact: [email protected]

PRIVATE CREDIT

Private Credit’s Toolbox Is Getting Heavier

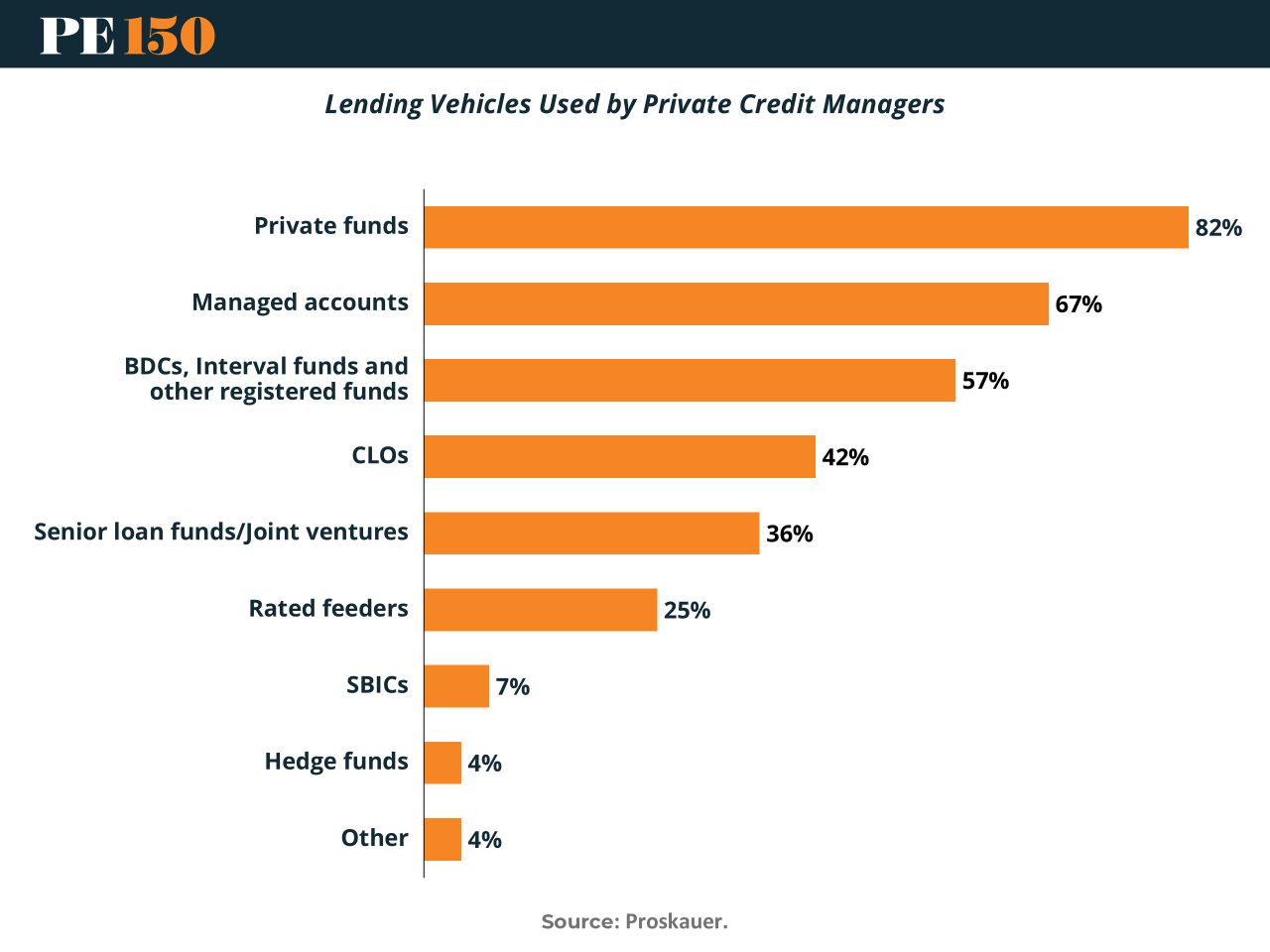

Private funds still rule the private credit roost—82% of managers use them—but cracks are forming. That number was 91% in 2021 (U.S.) and 97% (UK/EU). Today? 81% and 86%, respectively.

Why the drift? Scale, strategy, and investor customization. Managed accounts (67%) and BDCs/Interval funds (57%) are on the rise. CLOs (42%) and joint ventures (36%) are now standard for diversified deployment. Even niche plays like rated feeders (25%) and SBICs (7%) are creeping into the mix.

The takeaway: Managers aren’t just raising funds anymore. They’re building platforms that flex across regulations, LP appetites, and liquidity needs. In the next phase of growth, structure may matter as much as spread. (More)

MICROSURVEY

Private Equity’s AI Scorecard: Mixed Results, Mild Optimism

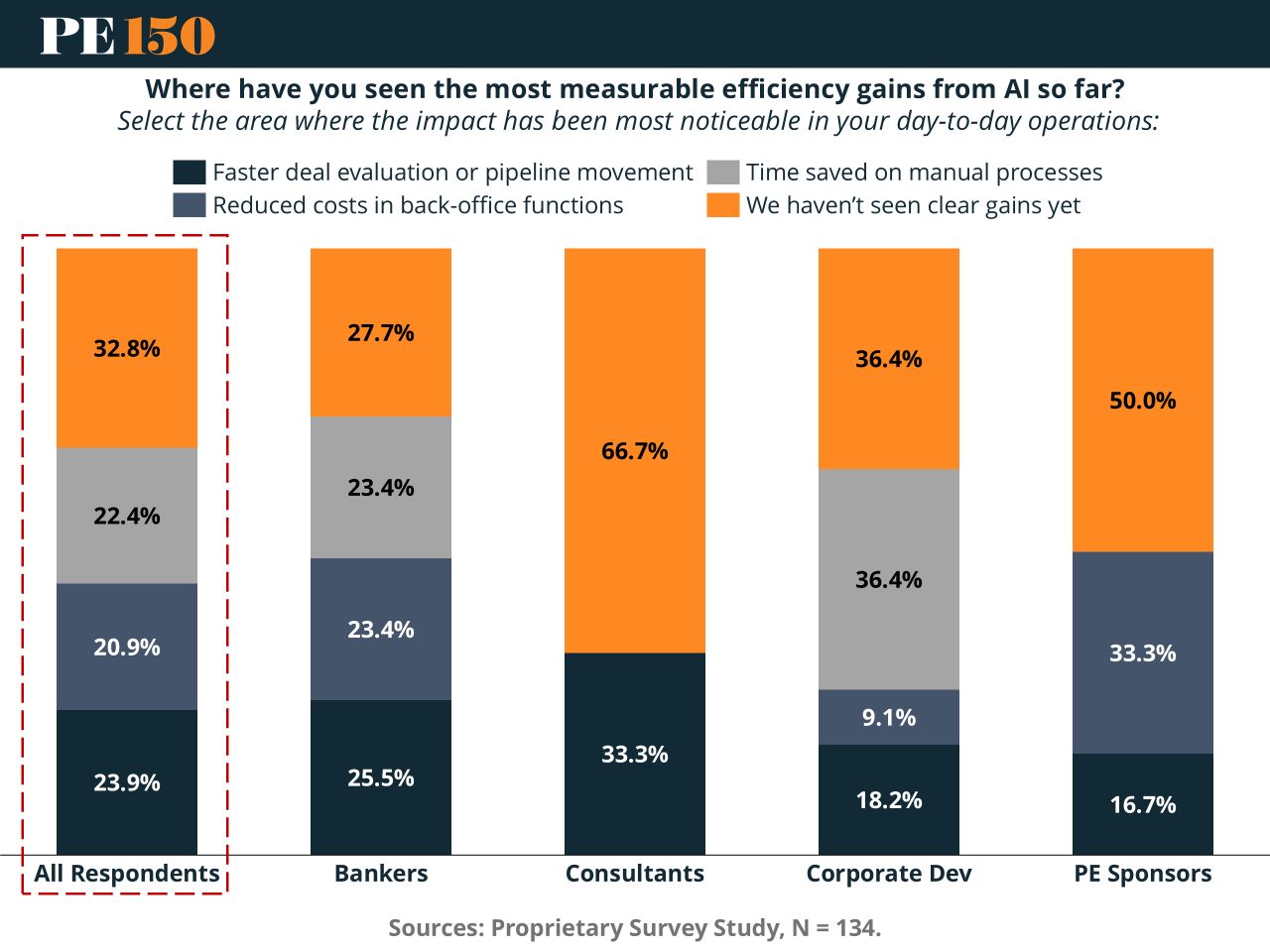

Our last week’s survey confirms what many suspected: AI hasn’t yet cracked the PE code. A full 33% of respondents reported zero measurable gains, despite the tech being everywhere from pitch decks to partner meetings. For those who have seen impact, the benefits are fragmented—deal triage, manual task reduction, and back-office cost cuts each got a slice. Sponsors remain the most skeptical (half saw no benefits), while consultants are nearly unanimous in their indifference (66.7% say nada). Corporate dev folks are split—AI helps with grunt work, but the strategic lift is missing. Meanwhile, bankers lead the optimism pack, hinting that AI is better suited to pipeline-heavy roles for now. TLDR: it’s not a revolution—yet. Just cautious pilots with hints of promise. (More)

MACROVIEW

Sentiment Shift = Capex is Back

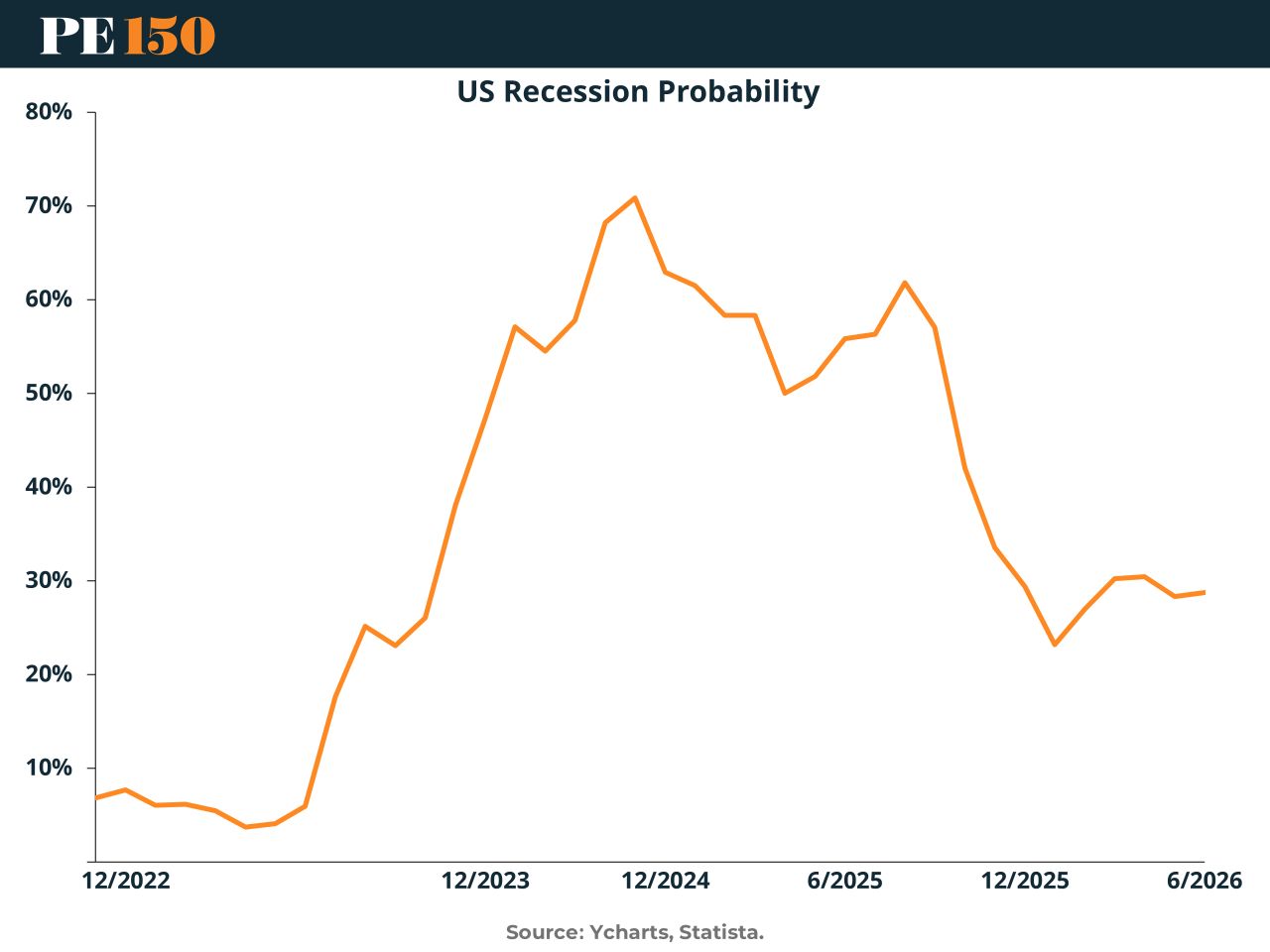

The recession probability chart is doing a solid impression of your last disappointing deal exit — steep drop, sharp regrets. From 70% in early 2024 to 30% mid-2025, fears of a downturn are cooling fast. That matters because sentiment drives spending, and businesses are finally starting to unpause capex. With policy risks receding, CEOs are flipping from doomsday prep to cautiously optimistic — and that’s big for PE firms sitting on record dry powder.

Bonus depreciation is back. Intellectual property capex is sticky. Tariffs are (mostly) untangled. Expect investment momentum to build into 2026, especially in sectors less interest rate-sensitive. The Fed is eyeing a December cut, and that guidance alone is catalyzing deferred capital deployment.

Translation: Q4 might be the beginning of an M&A reawakening — not because fundamentals are better, but because expectations are less terrible. (More)

THIS WEEK IN HISTORY

Puerto Rico’s Political Compromise Turns 73

On July 25, 1952, Puerto Rico became a Commonwealth of the United States, formalizing a hybrid political identity that remains a subject of debate seven decades later. Championed by Luis Muñoz Marín, the island’s first elected governor, the move granted Puerto Rico local self-governance while preserving its territorial status under U.S. sovereignty.

The change followed decades of shifting legal and political frameworks after the U.S. acquired Puerto Rico from Spain in 1898. With commonwealth status, Puerto Ricans received U.S. citizenship but remained excluded from voting in federal elections or having full congressional representation.

Why it mattered: For private equity and corporate strategists eyeing Puerto Rico, this ambiguous status presents both opportunity and complexity. The island benefits from U.S. legal frameworks, a dollarized economy, and favorable tax structures like Act 60, making it attractive for investors. But ongoing debates over statehood, independence, and economic policy introduce an undercurrent of political uncertainty that savvy investors must navigate.

Puerto Rico’s commonwealth status wasn’t just a political compromise—it set the tone for decades of tension between autonomy and integration, and it's a reminder that jurisdictional nuance can be as strategic as capital structure. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

LVMH’s Bernard Arnault is stepping into private aviation with an $800M equity stake in Flexjet via L Catterton, valuing the company at ~$4B. It’s the largest equity investment ever made in a private jet operator. Unlike Buffett’s full buyout of NetJets, Flexjet stays independent.

— Wall St Engine (@wallstengine)

5:46 PM • Jul 21, 2025

"In the middle of every difficulty lies opportunity."

Albert Einstein