- PE 150

- Posts

- Receding Recession Fears

Receding Recession Fears

A Shift in Business Confidence and Investment Momentum.

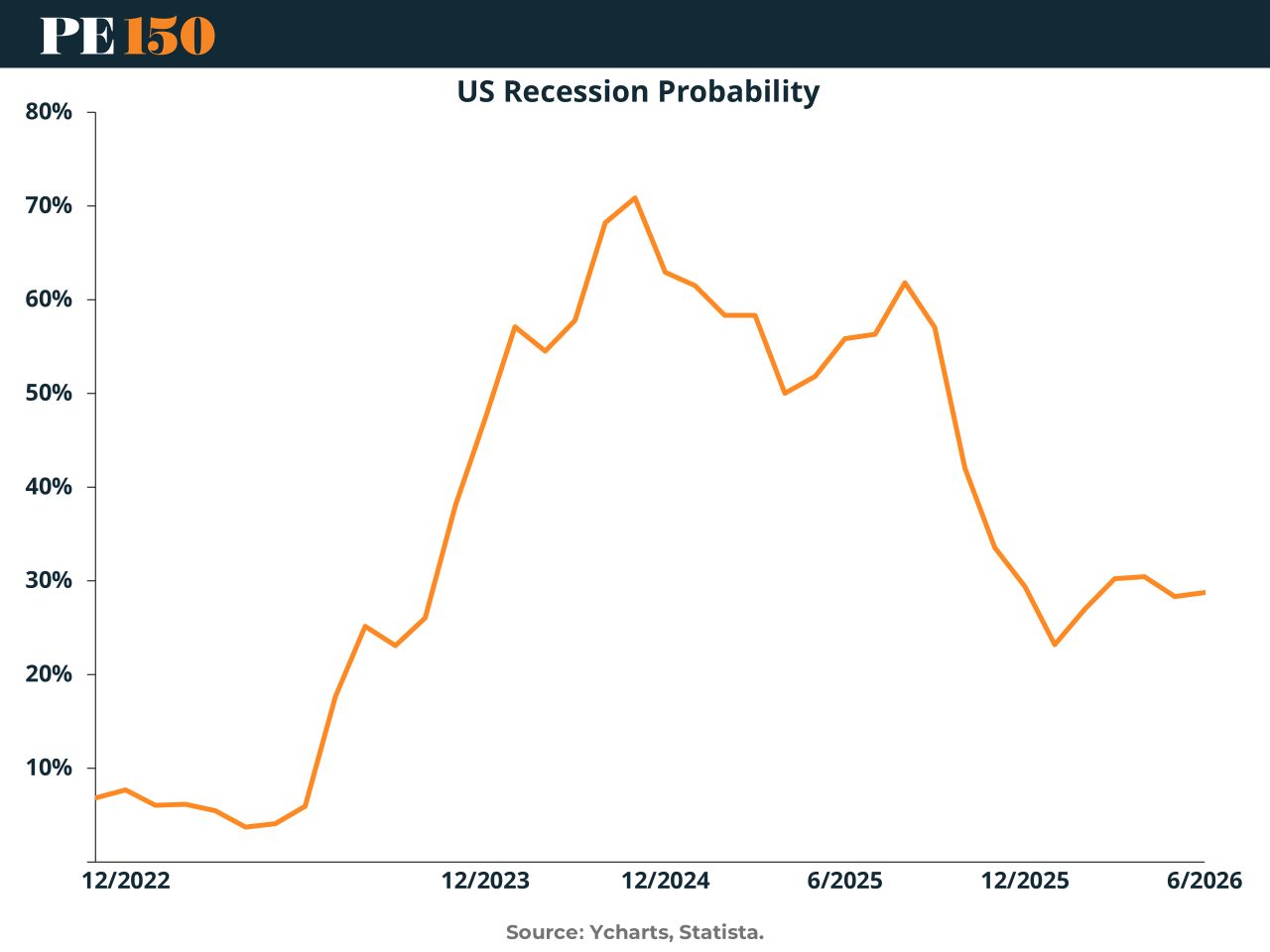

The probability of a U.S. and global recession has fallen markedly in recent months, driven by improving policy clarity, easing trade tensions, and more optimistic business sentiment. From a peak of nearly 70% in early 2024, the likelihood of a U.S. recession has declined to around 30% by mid-2025, according to recent data from YCharts and Statista. This downward revision in recession expectations aligns closely with a recalibration of macroeconomic risk perceptions by both investors and corporate leaders.

This drop in perceived recession risk reflects not just softer macroeconomic data but also a shift in expectations. The sharp spike in expected downturns seen in late 2023 and early 2024 — driven by aggressive tariff announcements and geopolitical uncertainty — has been tempered by recent policy reversals, particularly in trade. Notably, the Trump administration's pause or partial rollback of proposed tariffs on China and other trading partners has eased fears of a global trade war. This has lifted consumer and corporate sentiment, both key drivers of growth momentum.

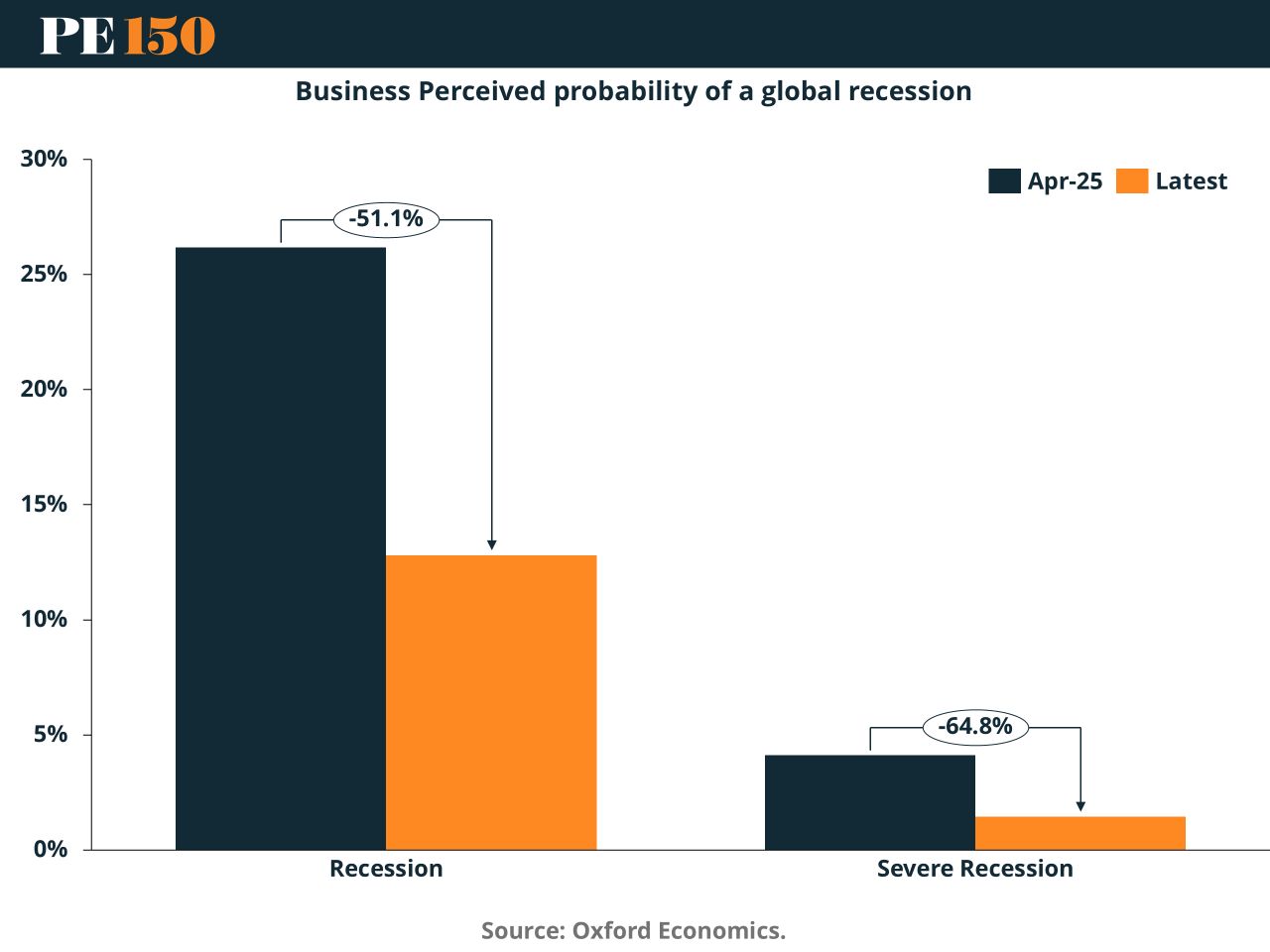

Global business leaders have echoed this shift. According to Oxford Economics’ June Global Risk Survey, the perceived probability of a global recession in 2025 has dropped from over 25% in April to less than 15%. The perceived risk of a severe recession has fallen even more sharply — down nearly 65% over the same period.

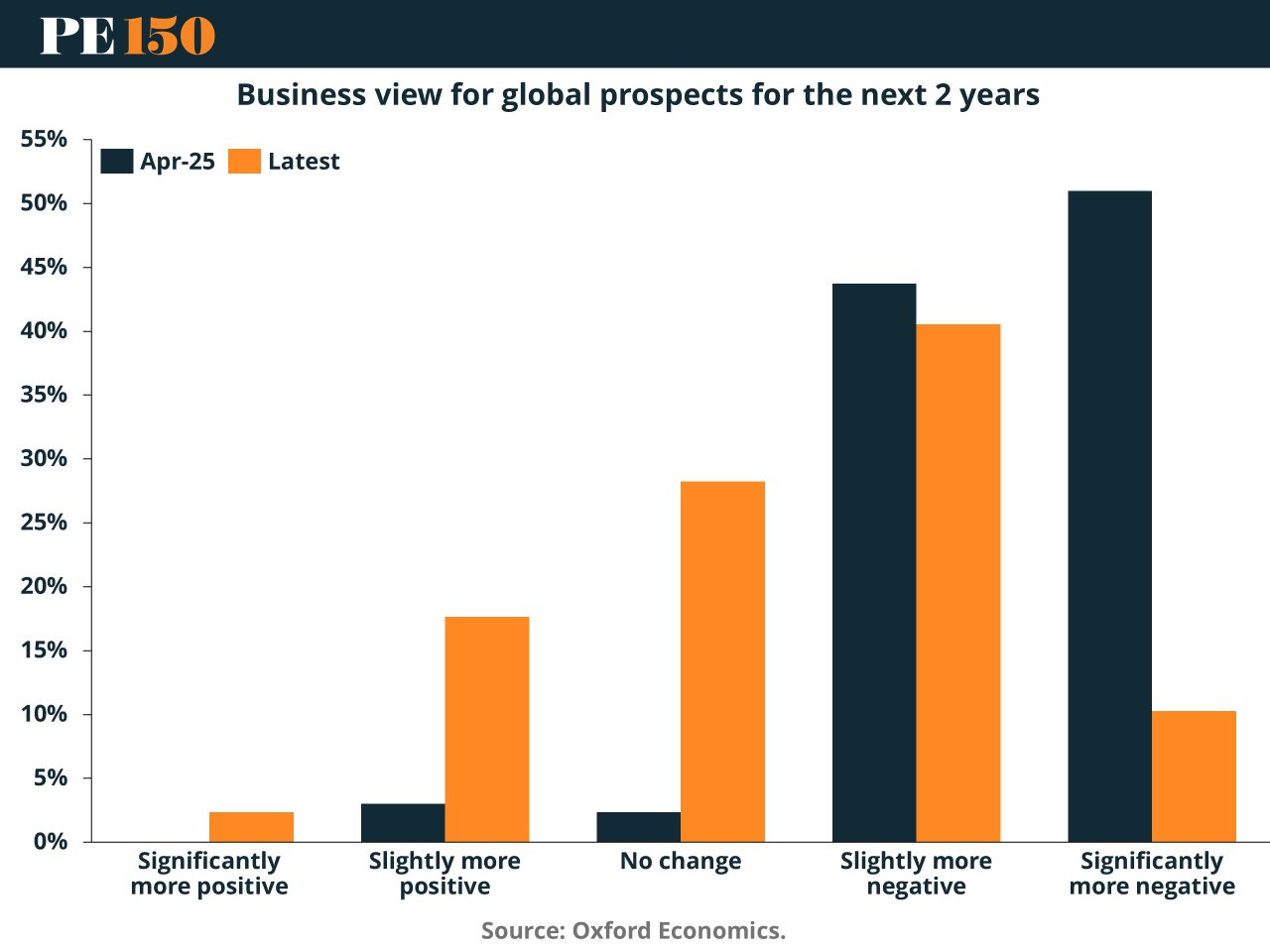

Importantly, sentiment around global economic prospects has become notably less bearish. In April 2025, more than half of surveyed businesses were significantly more negative about global prospects over the next two years. In the latest survey, that figure has plummeted, while the share of those expecting “no change” or even slightly more positive conditions has increased markedly. The proportion expecting “significantly more negative” outcomes has dropped from over 50% to just 10%.

This change in sentiment is critical. In financial markets and real economy decisions alike, expectations drive action. Recession fears often create self-fulfilling slowdowns as firms pause hiring and investment. The easing of those fears, therefore, can unleash previously delayed capital deployment — particularly in the business sector.

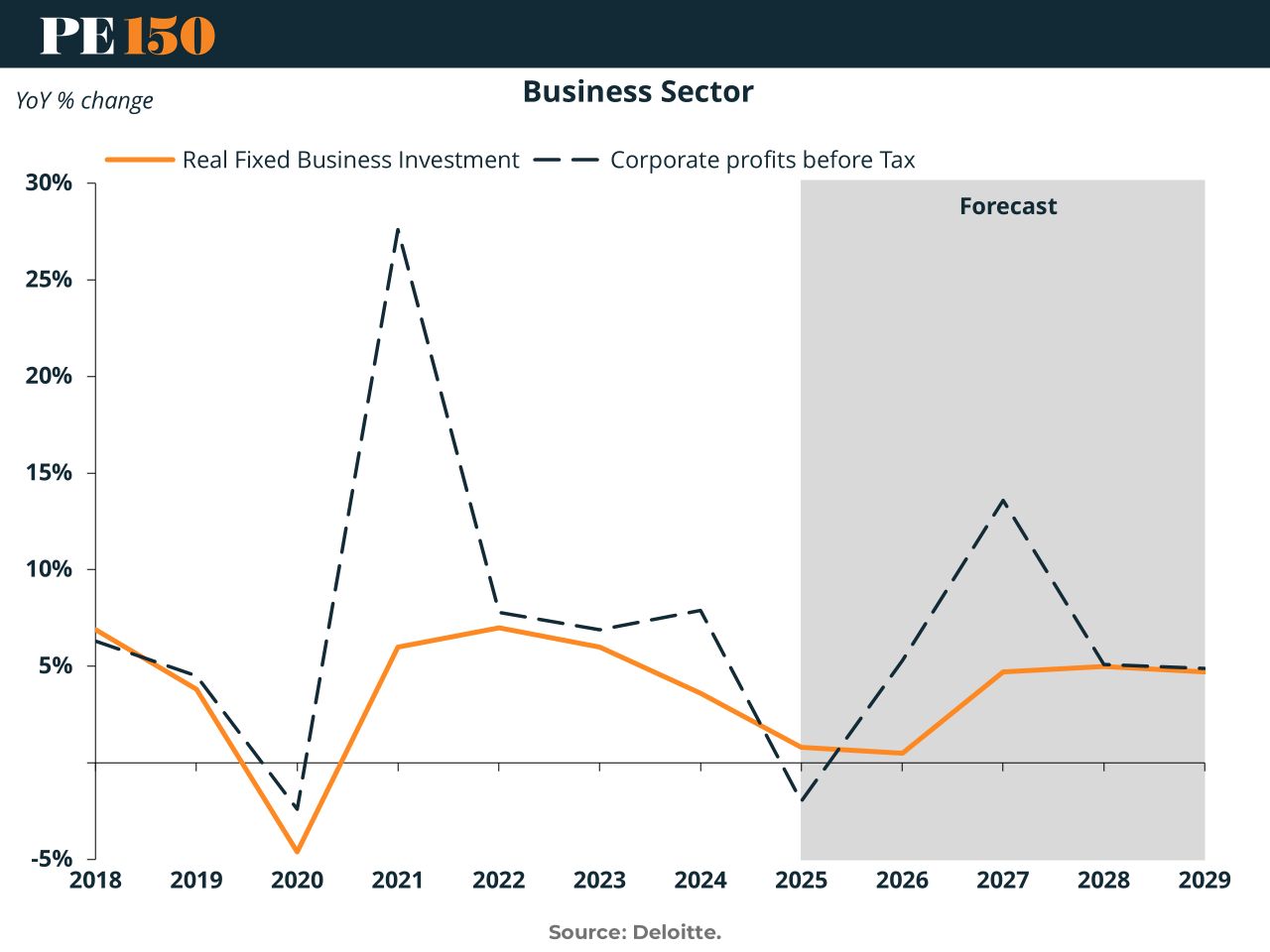

Indeed, we are now seeing this dynamic play out in business investment. Deloitte’s baseline forecast reflects a near-term slowdown in U.S. business investment growth in 2025 due to lingering high interest rates and tariff-related drag. However, this lull is expected to give way to stronger investment starting in 2026, particularly in equipment and intellectual property, as interest rates moderate and policy uncertainty subsides. By 2027, business investment is projected to grow at nearly 5% year-on-year — a critical boost to long-run potential output.

Investment, especially in structures, equipment, and intellectual property, is central to expanding an economy’s productive capacity. While 2025 may see a temporary dip, businesses’ improving outlook and resumption of bonus depreciation provisions under the Tax Cuts and Jobs Act are expected to support renewed capital expenditure. Notably, intellectual property investment — less sensitive to tariffs — is projected to remain resilient even during slower growth periods.

What is driving this investment rebound? A reduction in macro uncertainty is key. Tariff policy has stabilized somewhat, and the Fed has signaled a cautious but clear path forward on rate cuts starting in December. This clarity, coupled with robust balance sheets and improved cash positions among corporations, sets the stage for businesses to begin unlocking postponed investment plans.

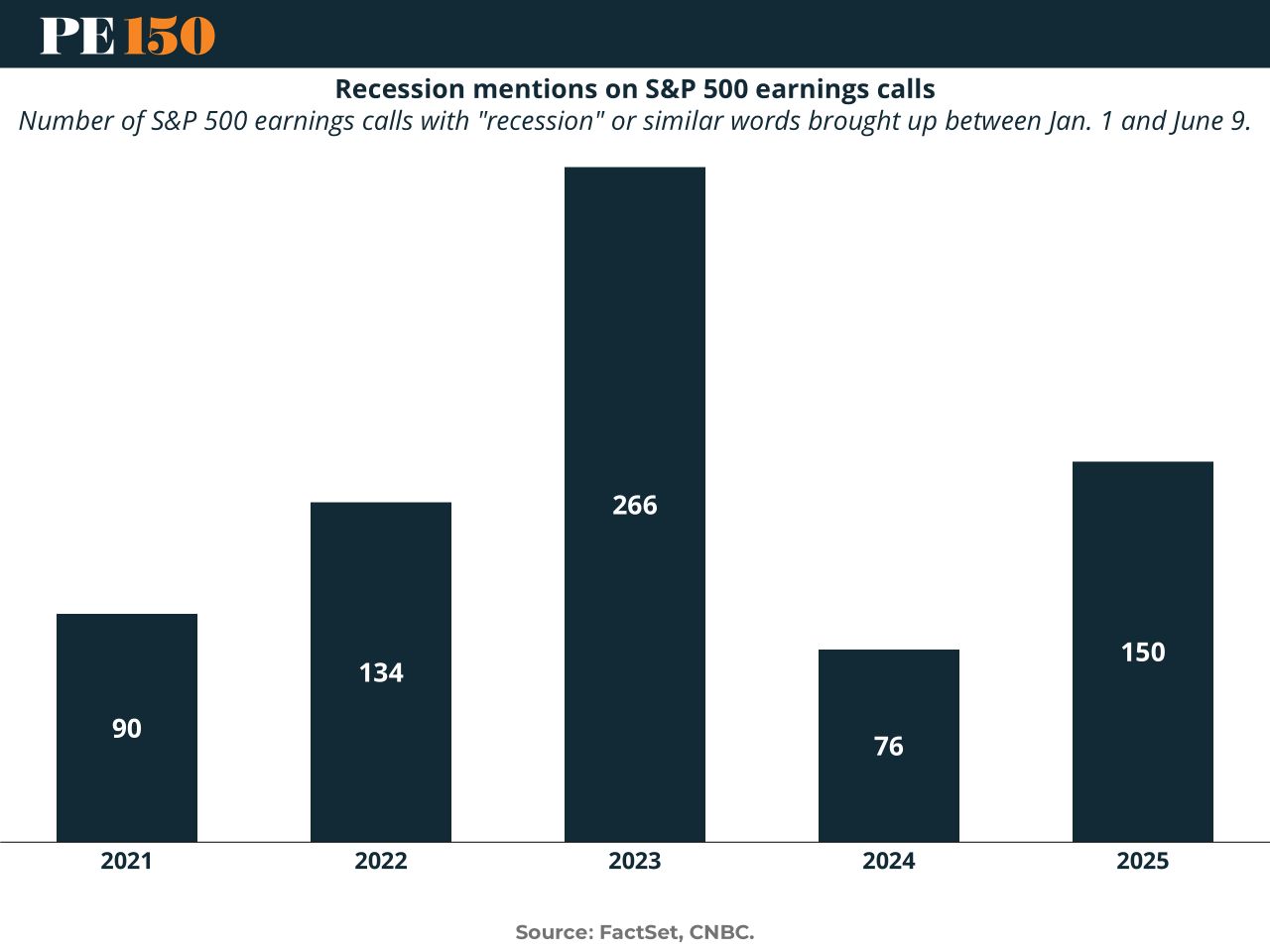

CEOs, too, appear to be reversing course. In Chief Executive Group’s June survey, only 30% of CEOs expected any type of recession in the next six months — down from more than 60% in April. This aligns with a broader sentiment shift across S&P 500 companies, where earnings call mentions of “recession” have declined significantly in 2024 compared to the peak in 2023. While mentions have risen again slightly in 2025, they remain well below last year’s levels, signaling a normalization of outlook rather than renewed panic.

In macroeconomic terms, the current environment resembles more of a “soft landing” than a deep contraction. U.S. GDP growth may remain sluggish — J.P. Morgan expects just 0.25% annualized growth in the second half of 2025 — but the economy is showing resilience. Global growth, while still under potential at around 1.3%, is holding up better than feared.

In conclusion, the collapse in recession expectations stems not from a dramatic improvement in current data, but from improving clarity and confidence in future conditions. As policy risks recede and global trade stabilizes, businesses are beginning to re-engage — particularly through renewed investment. That shift is pivotal: business investment is both a lagging and leading indicator, and its acceleration could mark the start of a broader cyclical upswing. Investors should watch this space closely, as sentiment-led momentum may soon give way to fundamentals-led growth.

Sources & References

CNBC. (2025). CEO recession expectations decline from April scare, survey says. https://www.cnbc.com/2025/06/09/ceo-recession-expectations-decline-from-april-scare-survey-says.html

Deloitte. (2025). United States Economic Forecast. https://www.deloitte.com/us/en/insights/topics/economy/us-economic-forecast/united-states-outlook-analysis.html

JP Morgan. (2025). The probability of a recession has fallen to 40%. https://www.jpmorgan.com/insights/global-research/economy/recession-probability