- PE 150

- Posts

- Commercial Real Estate: 2013 Business Cycle 2.0—and the Multifamily Opportunity

Commercial Real Estate: 2013 Business Cycle 2.0—and the Multifamily Opportunity

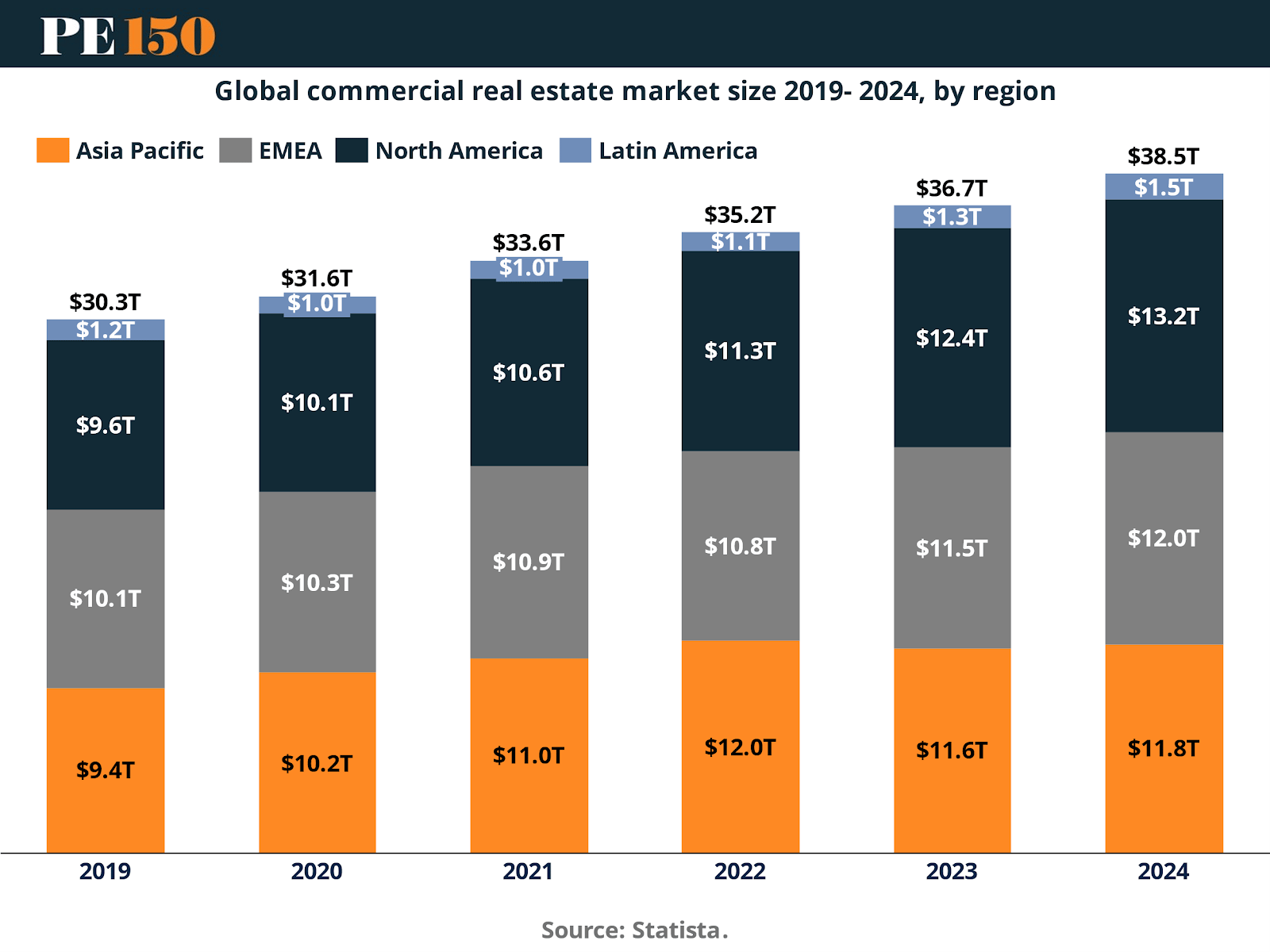

The commercial real estate (CRE) market is entering a critical inflection point that echoes the recovery trajectory of 2013.

Introduction: Mapping the Cycle Ahead

After a prolonged stretch marked by compressed asset valuations, erratic transaction activity, and macroeconomic uncertainty, conditions are aligning for the emergence of a new, sustained growth cycle. Once again, multifamily housing stands out as the sector offering the most compelling asymmetric upside.

Back in 2013, in the wake of the Global Financial Crisis (GFC), multifamily led a robust and resilient rebound in real estate. That period was defined by measured capital deployment, a normalization of cap rates, renewed rental demand stability, and a deliberate re-entry of institutional investors. Today, those same dynamics are reappearing—with striking similarity.

As we move through 2025, a growing body of evidence points to a CRE market that is mirroring the contours of that earlier cycle. Property valuations seem to have stabilized, private equity is cautiously returning, and limited new supply—particularly in the residential space—paired with healthy demand is creating favorable conditions for multifamily to lead once more.

This report examines the shifting CRE environment, highlights why multifamily is uniquely positioned to outperform, and outlines how investors can draw from the 2013 playbook to capture strong, risk-adjusted returns in the coming years.

The Current CRE Backdrop: Early Signs of Recovery

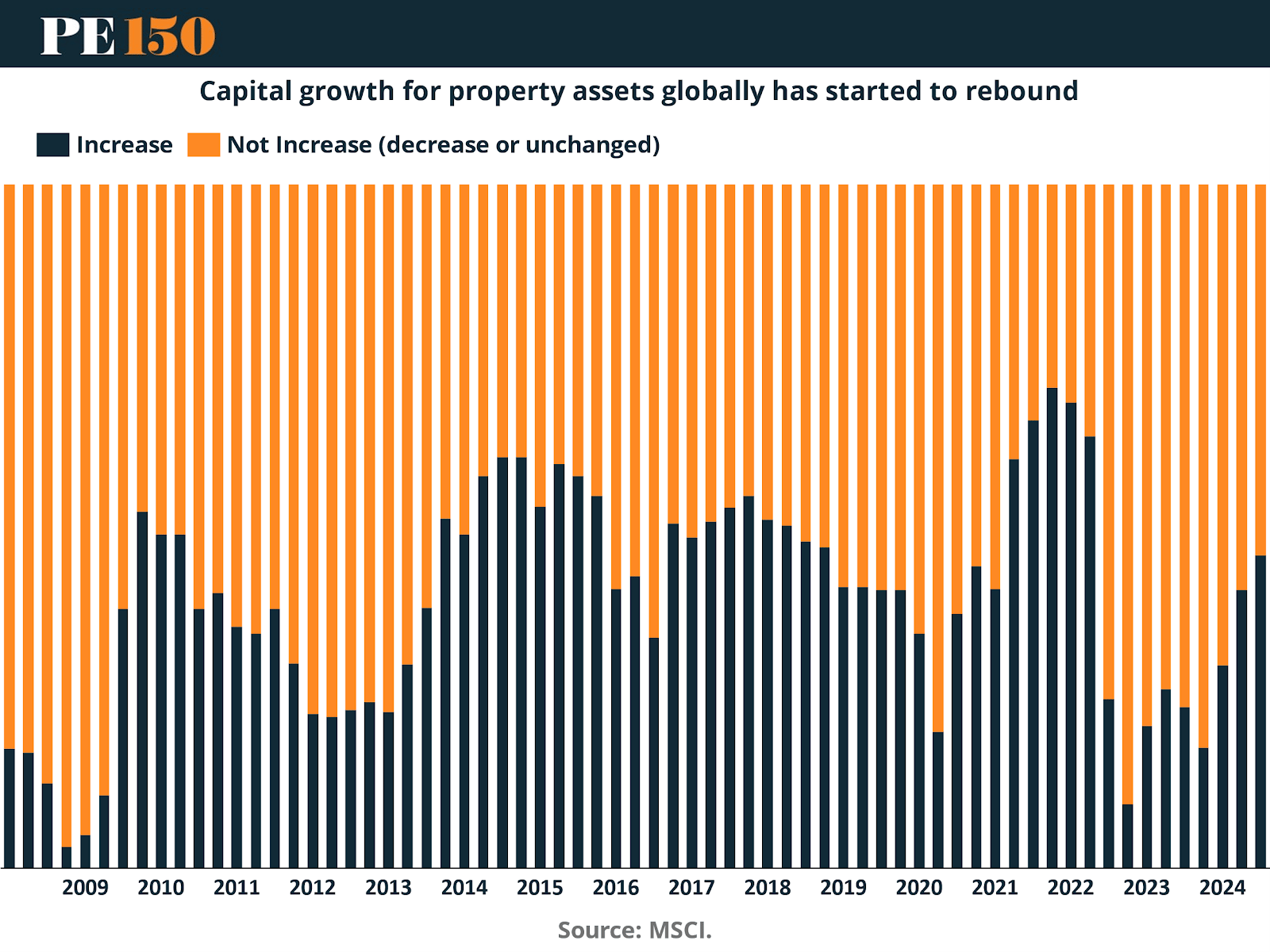

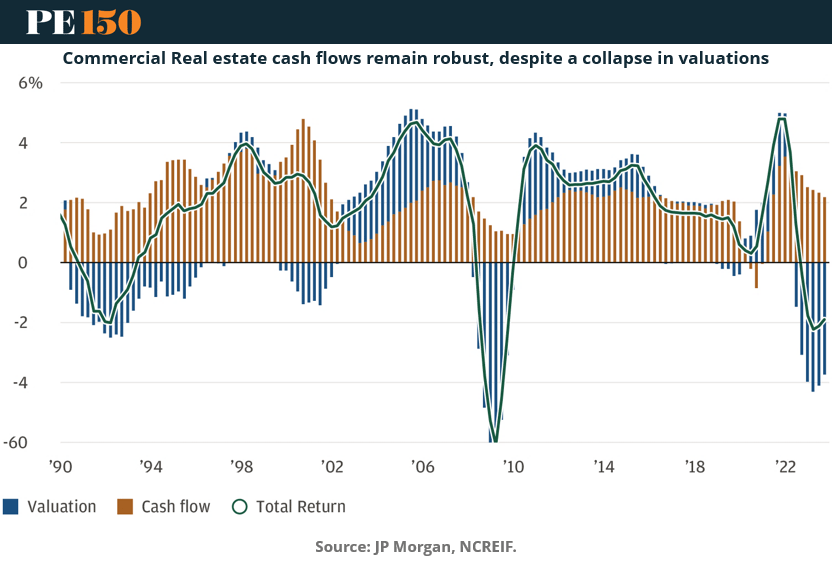

Following two years of valuation compression and subdued transaction volumes, the commercial real estate market is beginning to stabilize. According to MSCI, global property values were still down 6.3% year over year as of Q2 2024—but the pace of decline has clearly slowed, indicating a potential bottoming.

While transaction activity remains relatively subdued—31% lower year over year—there are encouraging signs: the gap between bid and ask prices is narrowing, suggesting buyers and sellers are aligning around more realistic valuations.

Deloitte’s latest CRE outlook further supports this emerging turning point. An overwhelming 88% of global real estate executives now anticipate revenue growth over the next 12 to 18 months—a stark contrast to the pessimism of the previous two years. Notably, 68% also expect improvements across key CRE fundamentals, including cost of capital, asset pricing, leasing velocity, and rental growth.

However, the recovery remains uneven across asset classes. The office sector continues to face structural headwinds tied to remote work and excess inventory. Retail is split—high-quality, well-situated assets are performing well, while older, less desirable centers continue to lag. Industrial remains fundamentally solid, though much of the valuation dislocation has already been absorbed.

Multifamily, once again, stands out as the sector showing the clearest and most promising signs of strength.

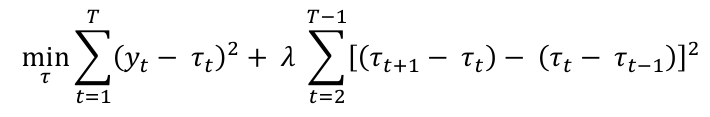

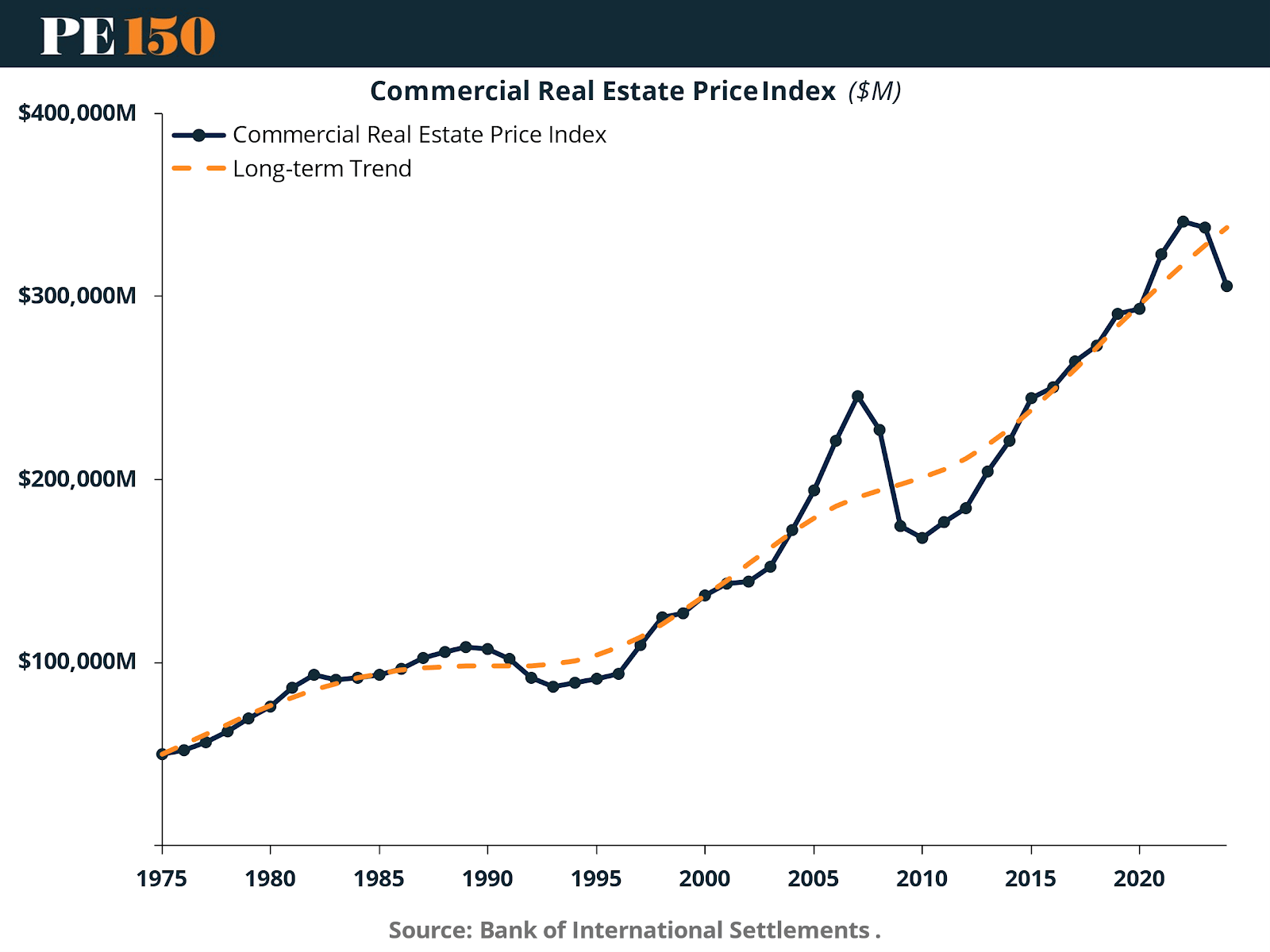

To better understand the underlying trajectory of Commercial Real Estate Price Index (see next chart, we applied the Hodrick-Prescott (HP) filter to the monthly data. This approach enables us to decompose the time series into its cyclical (short-term fluctuations) and trend (long-term trajectory) components, helping to distinguish between structural changes and temporary market noise.

The HP filter minimizes the sum of the squared deviations of the actual series from its trend component, penalizing rapid changes in the growth rate of the trend itself.

How Today’s Cycle Echoes 2013

The parallels between the current market environment and the setup in 2013 are striking—and far from coincidental.

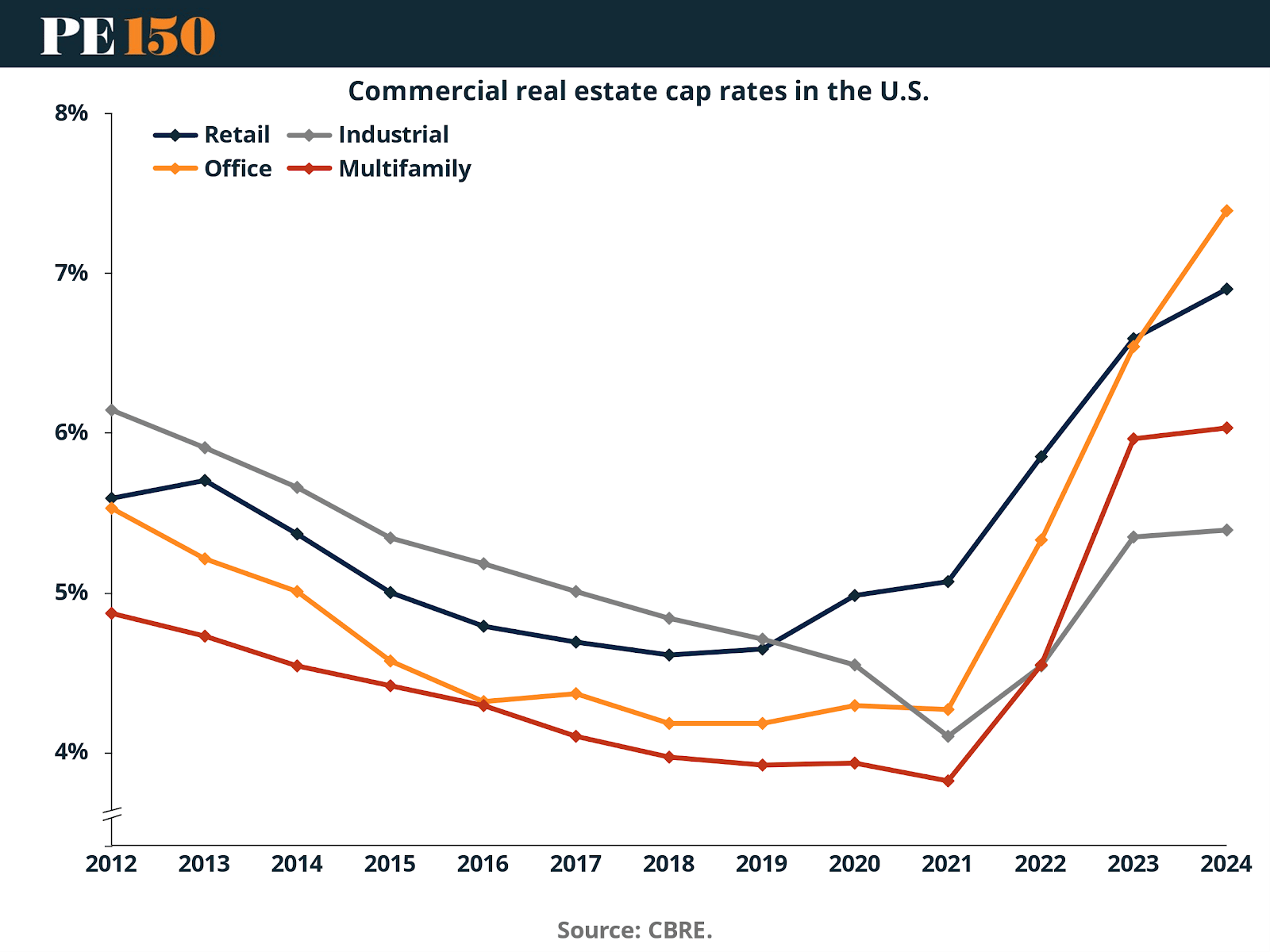

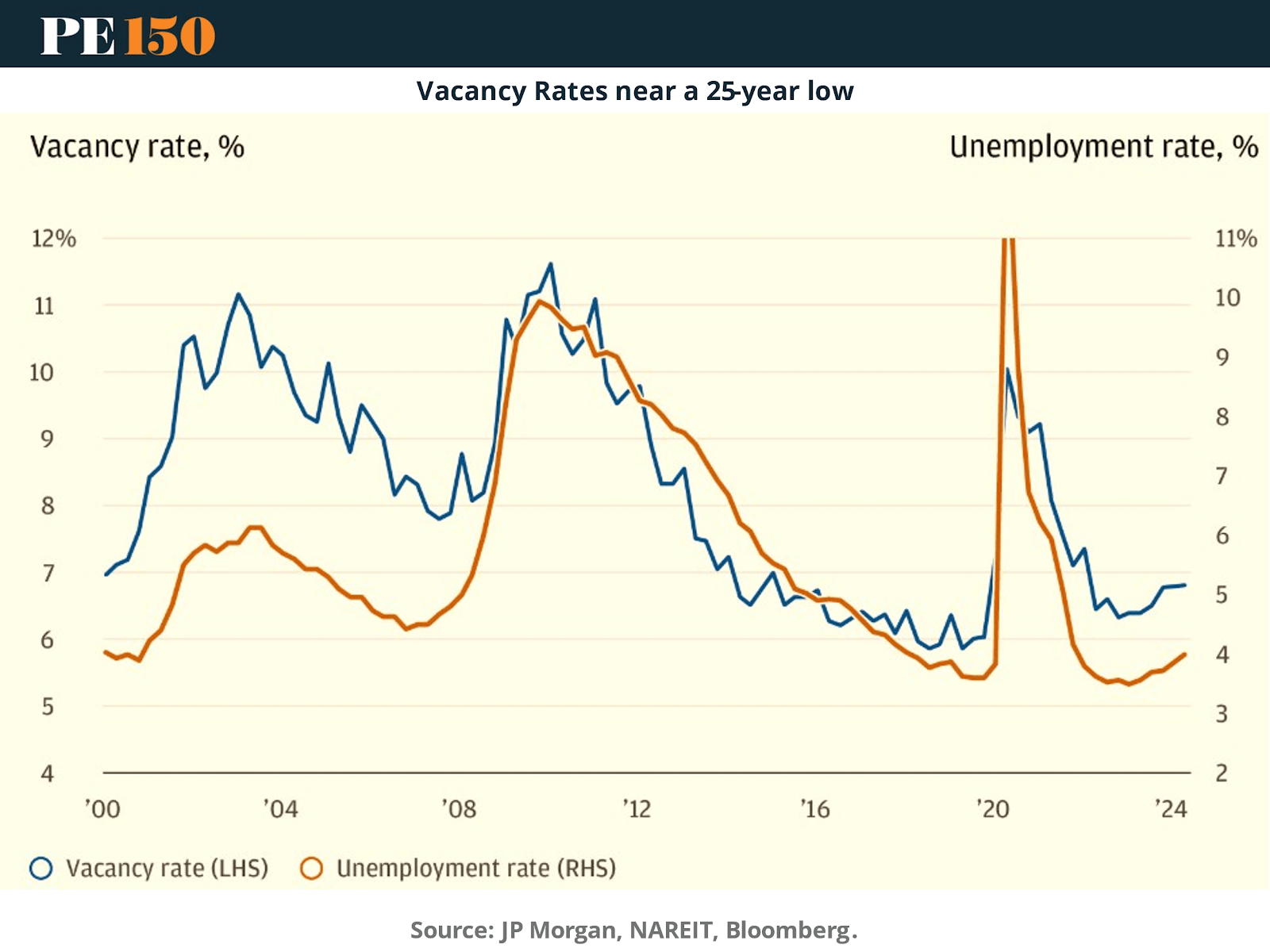

In 2013, U.S. multifamily building permits climbed to 155,000 units, a nearly 70% increase from the post-Global Financial Crisis (GFC) trough. This was a response to real, demand-driven fundamentals—not speculative excess. Vacancy rates had tightened from 10.5% in 2008 to 7.6% by 2013, while cap rates compressed from 7.5% to 6.2%, reflecting renewed investor confidence.

That period also marked a return to capital appreciation, even amid tight financing conditions. Transactions required strong fundamentals and a granular understanding of local markets. Investors succeeded by focusing on operational execution and value creation—not by relying on leverage or financial gimmicks.

Fast forward to 2025, and we see a similar story unfolding. Cap rates are adjusting to more sustainable levels after an extended period of distortion, rents are stabilizing alongside wage growth, and institutional capital is cautiously re-entering the space. Crucially, the speculative, “growth-at-any-cost” mentality that defined 2019 to 2021 has given way to a more disciplined, fundamentals-first approach.

In many ways, 2025 is shaping up to be a modern-day 2013: a cycle defined by sound underwriting, selective deployment, and a meaningful margin of safety.

Why Multifamily Represents a Clear Asymmetric Opportunity

Among all commercial real estate asset classes, multifamily housing stands out as offering the most compelling upside. Several structural and cyclical forces are converging to drive this opportunity.

To start, the supply pipeline is significantly constrained. JP Morgan reports that new multifamily construction starts are down 13% from their 2022 highs. Elevated construction costs have shifted the economics—making acquisition often more cost-effective than ground-up development.

On the demand side, rental housing continues to demonstrate resilience. With U.S. unemployment holding steady around 4%, and household formation accelerating—particularly among Millennials and Gen Z—demand for rentals remains robust. In fact, vacancy rates across U.S. multifamily assets are hovering near 25-year lows, despite broader macroeconomic uncertainty.

Meanwhile, cap rate spreads relative to Treasuries are once again becoming attractive. After compressing sharply during the 2021 liquidity surge, spreads are normalizing as rate volatility subsides—positioning multifamily for both yield generation and capital upside.

Finally, multifamily assets provide a natural hedge against inflation and a dependable source of income. As KKR highlights, residential real estate fundamentals remain strong, supported by enduring demographic trends and consistent long-term demand for housing.

The Role of Revitalization: Unlocking the Next Wave of Alpha

One of the strongest echoes of the 2013 cycle is the critical role of revitalization markets. In the years following the Global Financial Crisis, cities like Denver, San Francisco, and Boston emerged as leaders—fueled by a combination of public infrastructure investments and targeted private capital that transformed entire neighborhoods.

Today, a similar pattern is unfolding—this time in fast-growing secondary markets such as St. Louis, Indianapolis, Miami, Austin, and New Orleans.

Strategic public investments in transit systems, green infrastructure, and affordable housing are intersecting with a renewed wave of private capital. For investors willing to align with local stakeholders and pursue value-add strategies in early-phase revitalization zones, the potential for outsized returns is significant.

The blueprint from 2013 still applies: focus on thesis-driven acquisitions, maintain conservative leverage, prioritize operational execution, and build genuine community partnerships. In these evolving markets, that formula remains a reliable source of alpha.

The Private Equity Edge

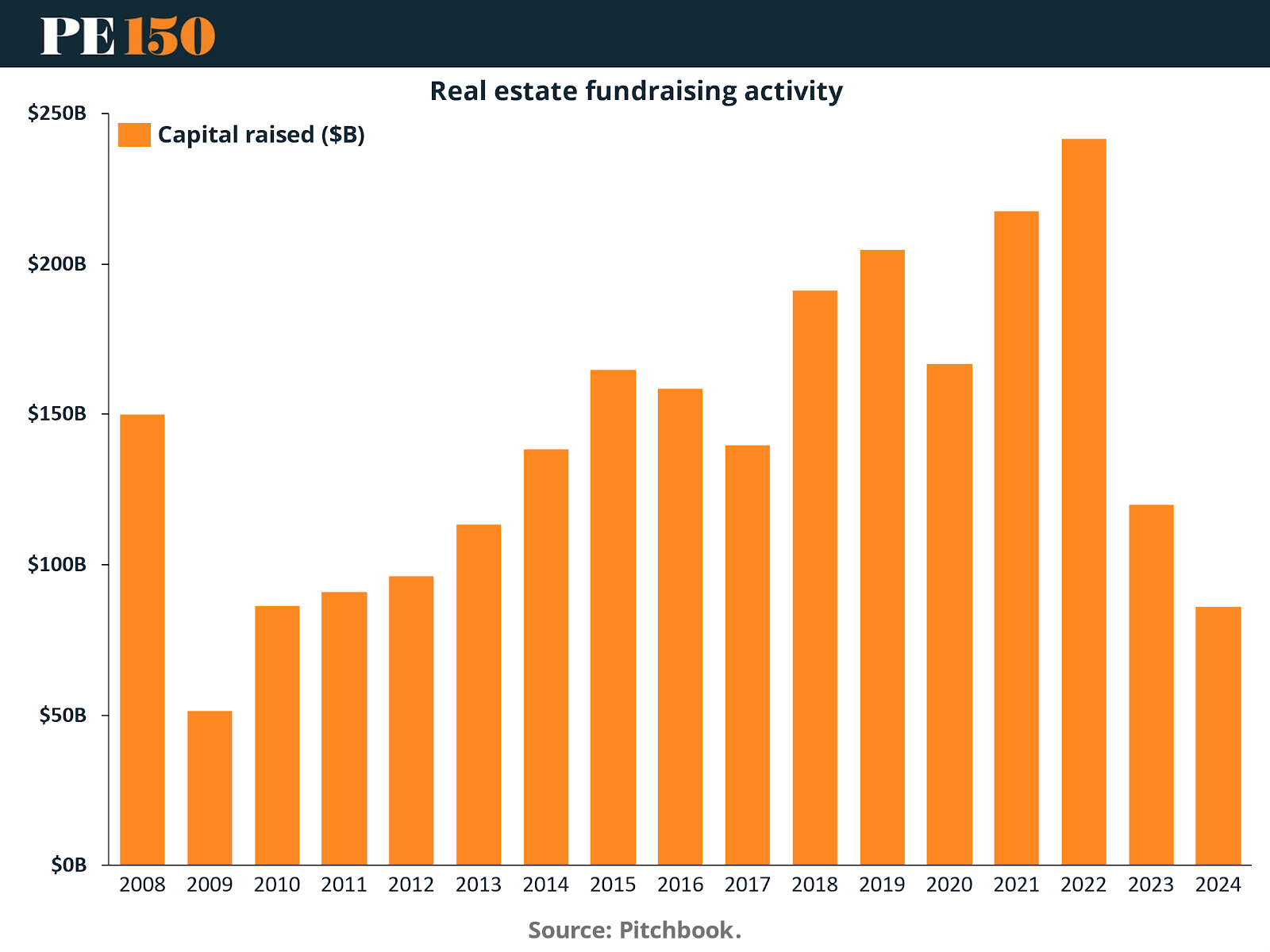

Private equity is uniquely positioned to take advantage of the current real estate cycle. Even amid recent volatility, private equity firms now account for more than 51% of U.S. real estate investment activity—highlighting their growing influence and capacity to deploy capital strategically in a rapidly evolving market.

What sets them apart is a distinct set of advantages: flexible capital, long-term investment horizons, and deep operational expertise. These capabilities align perfectly with the evolving demands of the multifamily sector—where returns increasingly depend on active asset management, tenant engagement, and operational precision.

Additionally, the current landscape of selective distress is well-suited to private equity strategies. With a significant volume of debt maturities—often referred to as the “wall of maturities”—looming in 2025 and 2026, many undercapitalized owners will be compelled to sell. PE firms with dry powder and a conviction-led approach will be well-positioned to acquire high-quality assets at attractive basis levels, setting the stage for strong future performance.

Capital Market Dynamics and Debt Availability

A key distinction between today’s market and that of 2013 lies in how capital is being sourced. One of the most notable shifts is the rise of private credit as a significant lender in commercial real estate—stepping in to fill the void left by traditional banks.

With bank lending still restrained, private credit is stepping in to provide acquisition and bridge financing, facilitating deal activity that might otherwise stall. At the same time, structures like NAV-based lending and continuation funds are gaining traction—offering private equity firms additional avenues for liquidity and portfolio flexibility.

This evolving capital stack is playing a critical role in supporting transaction flow, especially in the multifamily sector, where stable cash flows offer a solid underwriting foundation for lenders.

Conclusion: The Blueprint for 2025

As the commercial real estate market moves beyond the turbulence of recent years and into a more fundamentals-driven phase, multifamily housing stands out as the sector offering the most asymmetric opportunity. The strategy for navigating this moment is rooted in the proven framework of 2013: a return to disciplined capital deployment, hyper-local underwriting, and thoughtful value-add execution. Investors should focus on revitalization corridors and emerging growth markets, where demographic tailwinds and public-private investment are converging. The growing availability of private credit and flexible capital structures creates additional leverage for those able to act decisively amid selective distress. At the same time, the integration of ESG principles is no longer optional—it is a critical component of both risk management and long-term value creation. The firms that will lead this next phase of the cycle will look much like those that thrived a decade ago: thesis-driven, community-embedded, operationally excellent, and aligned with powerful secular trends. Far from being the end of a cycle, 2025 marks the beginning of a new chapter—and for multifamily investors, the window of opportunity is wide open.

Sources & References

Deloitte. (2024). 2025 commercial real estate outlook. https://www2.deloitte.com/us/en/insights/industry/financial-services/commercial-real-estate-outlook.html

CBRE. (2024). Capital Markets Activity Expected to Stabilize. https://www.cbre.com/insights/books/us-real-estate-market-outlook-2024/capital-markets

Fastmarkets. (2024). US housing market analysis: Recent trends shaping the market. https://www.fastmarkets.com/insights/us-housing-market-analysis-recent-trends/?gad_source=1&gad_campaignid=22545353907&gbraid=0AAAAABUTniyjapZ9Cmul1HxmnrIxIOY-6&gclid=CjwKCAjwr5_CBhBlEiwAzfwYuGnUxP0TkxjuNdu4KFZIh7BTKHv1rmeYiWSVVgHIo3C2wzDUBhUFLhoCdFoQAvD_BwE

Federal Reserve Bank. (2025). Commercial Real Estate Prices for United States. https://alfred.stlouisfed.org/series?seid=COMREPUSQ159N&utm_source=series_page&utm_medium=related_content&utm_term=related_resources&utm_campaign=alfred

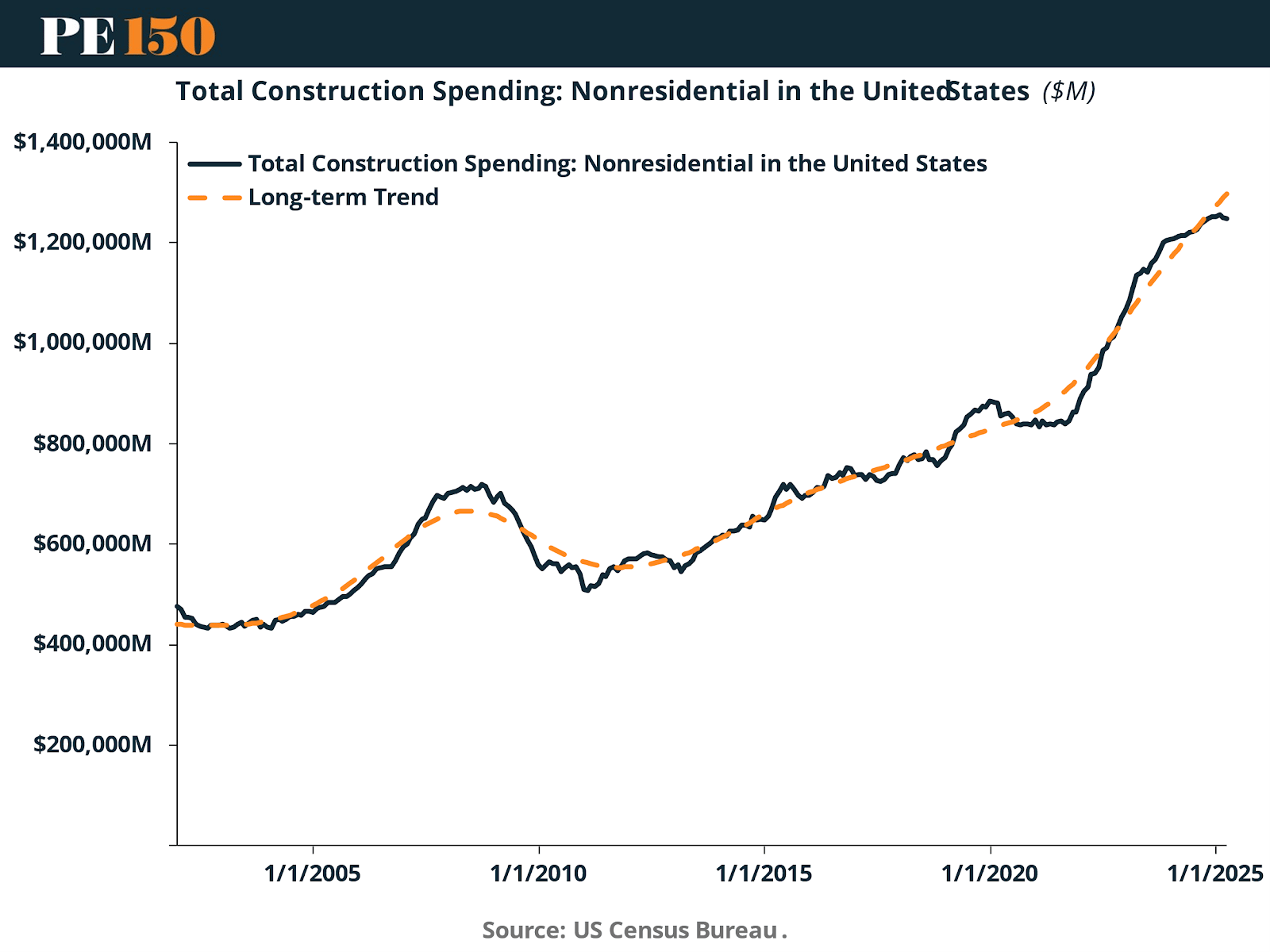

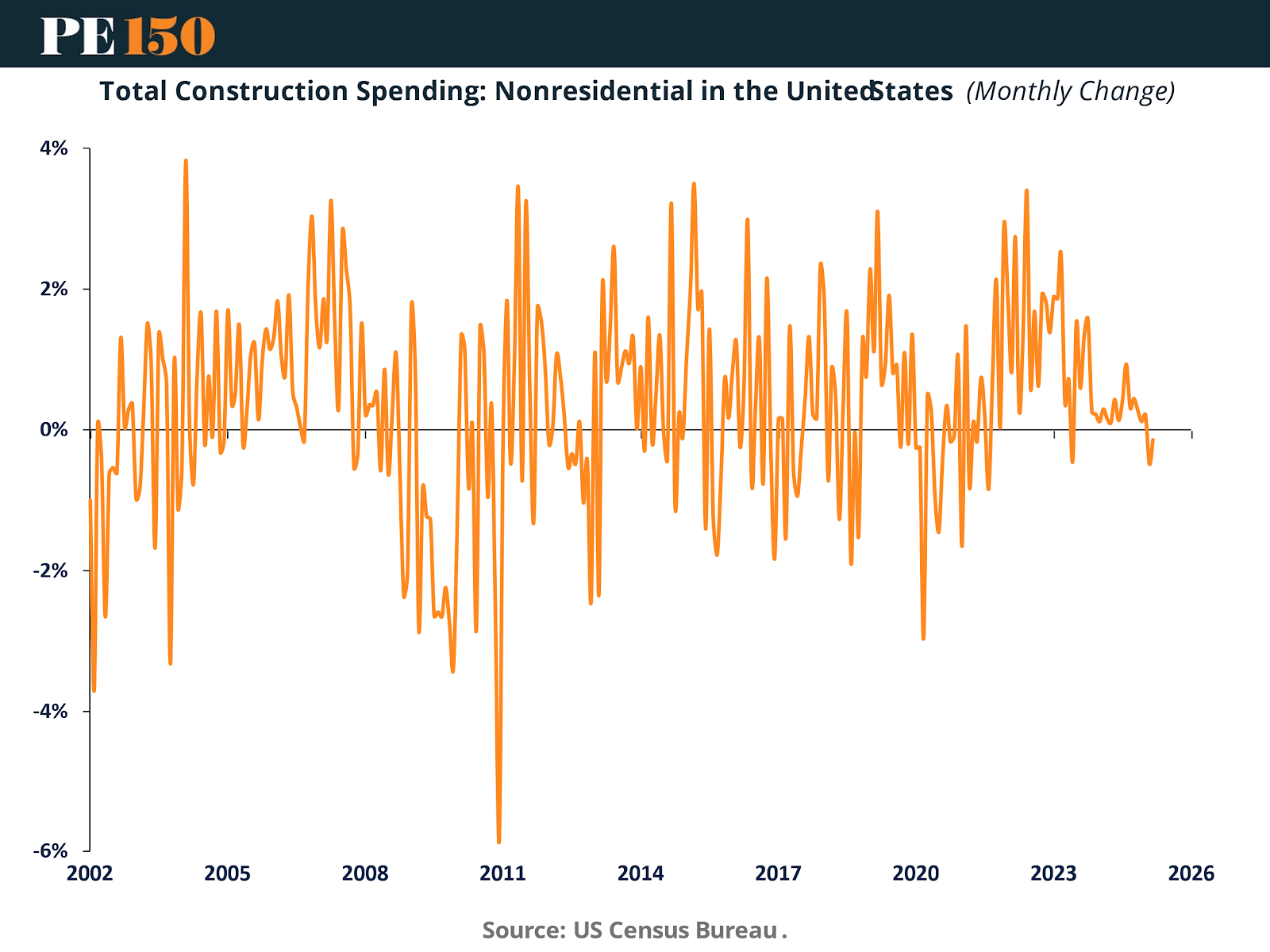

Federal Reserve Bank. (2025). Value of Construction Put in Place. https://fred.stlouisfed.org/release/tables?rid=229&eid=22348#snid=22545

JP Morgan. (2024). Three reasons we see a potential comeback in commercial real estate. https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/ideas-and-insights/three-reasons-we-see-a-potential-comeback-in-commercial-real-estate

KKR. (2024). Investing in the Real Estate Recovery. https://www.kkr.com/insights/real-estate-recovery#2

MSCI. (2025). Real Estate in Focus: 2025 Trends to Watch. https://www.msci.com/research-and-insights/blog-post/real-estate-in-focus-2025-trends-to-watch

RedFin. (2025). Data Center. https://www.redfin.com/news/data-center/

Riskwire. (2025). The Impact of Interest Rates on Real Estate Valuations. https://www.riskwire.com/the-impact-of-interest-rates-on-real-estate-valuations/

Statista. (2024). CoStar Commercial Repeat-Sales Index (CCRSI) for office real estate in the United States from March 1996 to March 2024. https://www.statista.com/statistics/1379467/ccrsi-office-real-estate-usa/

Statista. (2025). Quarterly office vacancy rates in the United States from 4th quarter 2017 to 1st quarter 2025. https://www.statista.com/statistics/194054/us-office-vacancy-rate-forecasts-from-2010/

U.S. Census Bureau, Total Construction Spending: Nonresidential in the United States [TLNRESCONS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TLNRESCONS, June 11, 2025.

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|