- PE 150

- Posts

- Micro-survey Insights: AI's Efficiency Gains Still Uneven Across PE Landscape

Micro-survey Insights: AI's Efficiency Gains Still Uneven Across PE Landscape

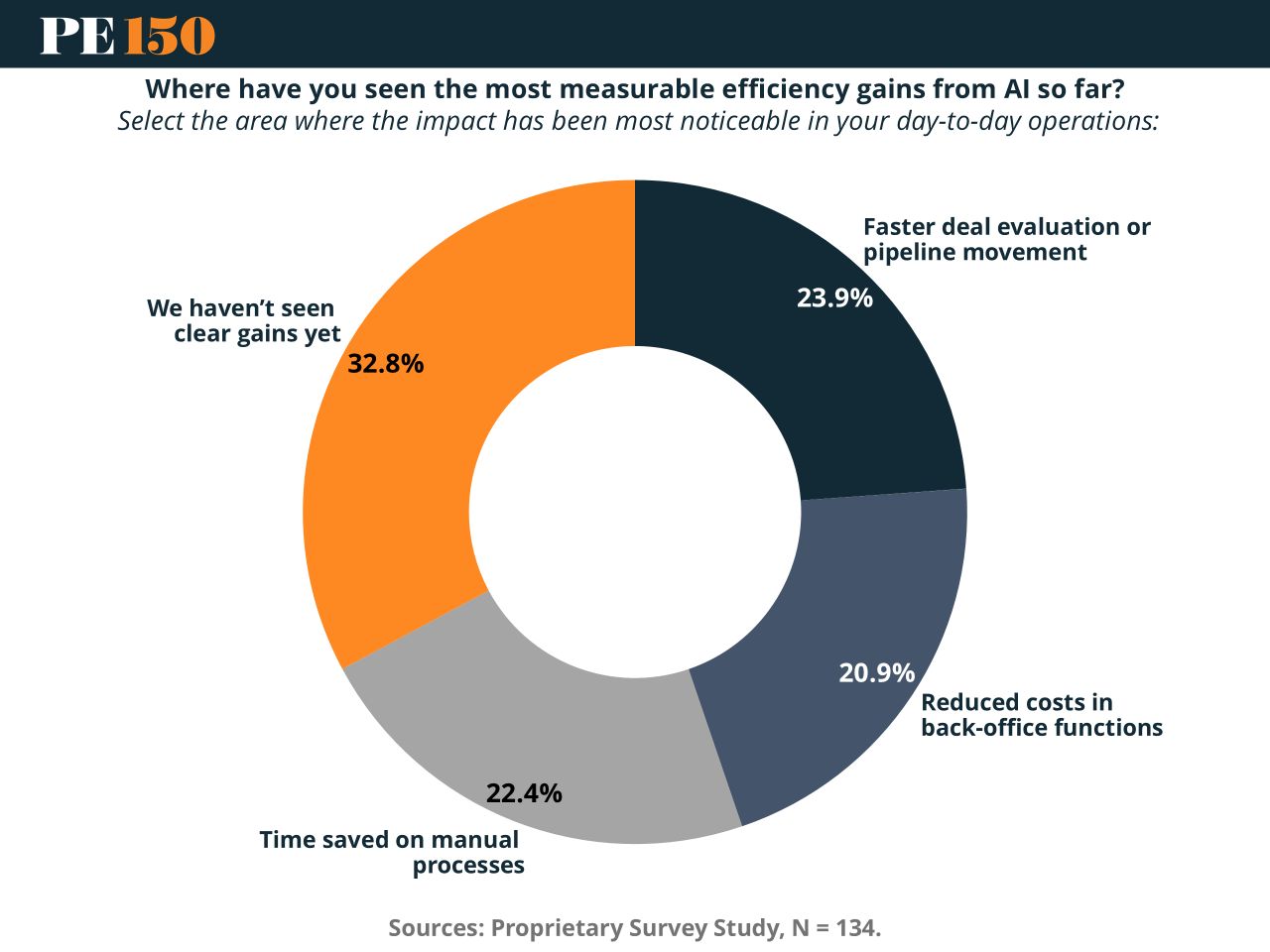

In last week’s micro-survey, we asked our community where they’ve seen the most measurable efficiency gains from AI in their day-to-day work.

In last week’s micro-survey, we asked our community where they’ve seen the most measurable efficiency gains from AI in their day-to-day work. The results paint a nuanced picture of AI’s current traction across private equity and adjacent roles.

One-Third Still Waiting on Results

Across all respondents, the most common answer—by a notable margin—was that no clear gains have been seen yet. Nearly 33% of participants indicated that AI has not produced tangible, day-to-day improvements in their workflows yet. This is a critical insight: despite the ubiquity of AI in industry headlines and tech roadmaps, many professionals remain in a wait-and-see phase when it comes to realizing actual operational impact.

Yet for the remaining two-thirds, AI is starting to deliver real value. Responses were fairly evenly distributed across three key areas: faster deal evaluation, time saved on manual processes, and back-office cost reductions. This spread suggests that while no single use case has emerged as dominant, AI is beginning to influence multiple touchpoints along the deal and operations continuum.

Role-Based Contrasts: A Mixed Reception

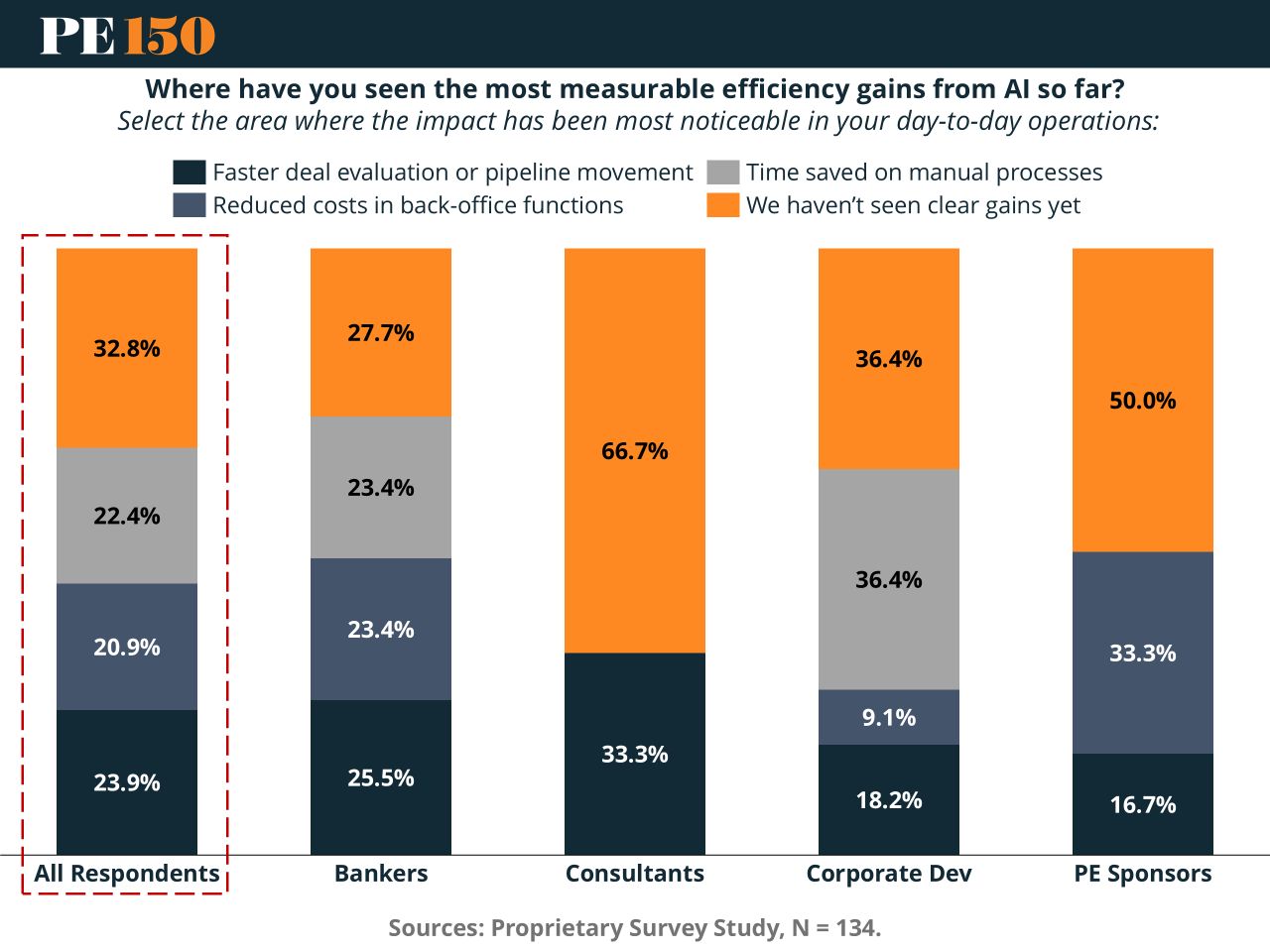

A deeper dive into the data by respondent type reveals more pointed differences:

Private Equity Sponsors are the most skeptical group, with half reporting no clear AI gains. That said, one-third did cite improved efficiency in back-office functions, hinting at some success with automation or streamlined fund admin.

Corporate Development professionals reported high levels of both manual process improvement and ongoing skepticism—with an even 36.4% split between the two. This suggests AI is helping with repetitive or data-heavy tasks, even as strategic benefits remain elusive.

Consultants had the highest rate of respondents seeing no benefit at all—66.7%. This could reflect the complexity of applying AI consistently across diverse client engagements or the slower pace of tech adoption in advisory environments.

On the flip side, Bankers were the most optimistic. Just 27.7% said they hadn’t seen results, and their responses were spread relatively evenly across all benefit areas. Their focus on deal flow and pipeline velocity may align well with current AI use cases.

The Verdict: Early Signals, But Not Yet a Wave

While AI is beginning to show pockets of measurable impact, particularly in deal acceleration and task automation, a substantial portion of our audience is still waiting for it to move the needle. The data suggests that current AI deployments may be too narrow or nascent to register across the broader private equity workflow.

Still, the foundation is being laid. As tools mature and use cases become more specialized, we expect more distinct gains to emerge. Until then, the story remains one of cautious experimentation rather than transformational change.