- PE 150

- Posts

- Private Equity 2025 Mid-Year Review: Finding Alpha in a Reshaped Landscape

Private Equity 2025 Mid-Year Review: Finding Alpha in a Reshaped Landscape

In an era of volatility and higher-for-longer rates, alpha is shifting from financial engineering to precision execution and global opportunity.

Introduction

The first half of 2025 confirmed what many GPs and LPs had long suspected: private equity is not just experiencing a cyclical shift — it is operating under a new structural regime. Higher-for-longer interest rates, slower exits, and tighter capital flows have accelerated a transformation across the industry. Firms are no longer optimizing for expansion in a rising tide; they are navigating through friction, adapting playbooks, and redefining how and where value is created.

The legacy model — financial engineering, leverage, and multiple arbitrage — is giving way to a more granular and operationally intensive approach. In today’s environment, alpha is not being found in broad market beta, but in pricing discipline, supply chain optimization, and sector-specific resilience. Our data shows a sharp pivot toward margin engineering and cost control as sponsors wrestle with elevated rate sensitivity, thinner bid-ask spreads, and rising recession expectations.

But this recalibration is not limited to the developed world. As deal flow slowed across North America and Europe, capital rotated outward. The globalization of the PE playbook is no longer aspirational — it is operational. In the Middle East, sovereign wealth funds are actively driving deal volume in tech, infra, and services. Latin America is showing resilience through regional infrastructure and a maturing local PE base. Africa’s leapfrogging into digital commerce presents a platform opportunity with strong demographic tailwinds. And Europe’s embrace of ESG as a capital magnet shows how regulation and returns can align when values are integrated into strategy.

Throughout H1 2025, we’ve tracked these shifts through weekly research and field-level data — from macro-level trends like rate-driven repricing and global allocation shifts, to micro-level developments such as the rise of cybersecurity platforms, continuation vehicles, AI adoption in deal sourcing, and evolving ESG and talent mandates.

This mid-year report brings those insights together into a single narrative. Each section highlights a core theme shaping the future of private capital, backed by proprietary charts, data-driven commentary, and sector-specific implications. What emerges is not just a snapshot of 2025, but a map of where the industry is heading.

If the last cycle rewarded leverage and scale, this one will reward precision, resilience, and cross-border conviction. The firms that thrive in the second half of the year — and beyond — will not be those chasing momentum. They will be the ones asking sharper questions: Where is the capital really flowing? Which sectors have true structural tailwinds? And what will it take to win when the old rules no longer apply?

Volatility, Value Creation & the New Playbook

Private equity is no longer operating in an environment of easy capital, steady macro conditions, and predictable growth. Since the pandemic and into the tightening cycle, the market has shifted into a new era—one defined by persistent volatility, interest rate sensitivity, and a fundamental evolution in value creation models. This section explores how these forces are reshaping the industry, based on original analysis and survey data.

1. Volatility Kills Wealth

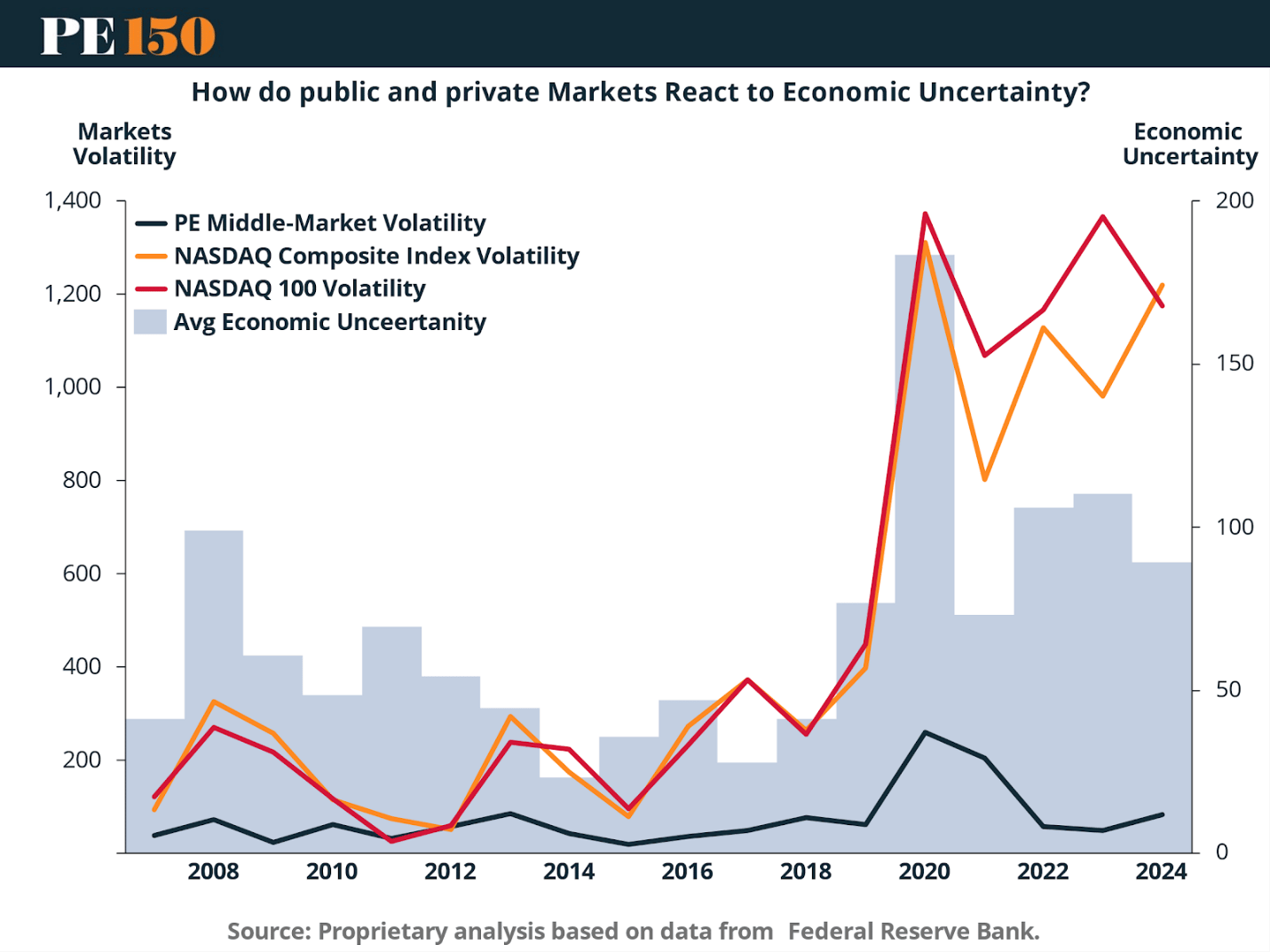

While public markets react swiftly—and often sharply—to macro uncertainty, private equity behaves differently. The chart below compares annualized standard deviations across the NASDAQ Composite, NASDAQ 100, and U.S. PE Middle-Market assets relative to macro uncertainty levels. What it shows is striking:

During moments of heightened macro stress—such as in 2020—public market volatility surged. The NASDAQ 100, for example, saw volatility spikes of over 1,200 points. In contrast, middle-market private equity remained significantly more stable, with only a modest and temporary increase in volatility.

This resilience is not accidental. It reflects the structural strengths of private equity: the absence of daily repricing, the discipline of commitment-based capital, and the buffer of illiquidity. These traits insulate portfolios from short-term sentiment and enable investors to stay invested through the cycle. For allocators, this asymmetry offers a strategic advantage—private equity acts as a volatility dampener during macroeconomic instability.

2. Private Equity’s New Value Creation Formula

As volatility persists, the private equity model itself is undergoing transformation. Gone are the days when value was created mostly through financial structuring or multiple expansion. In today’s market, margin resilience has become the cornerstone of value creation.

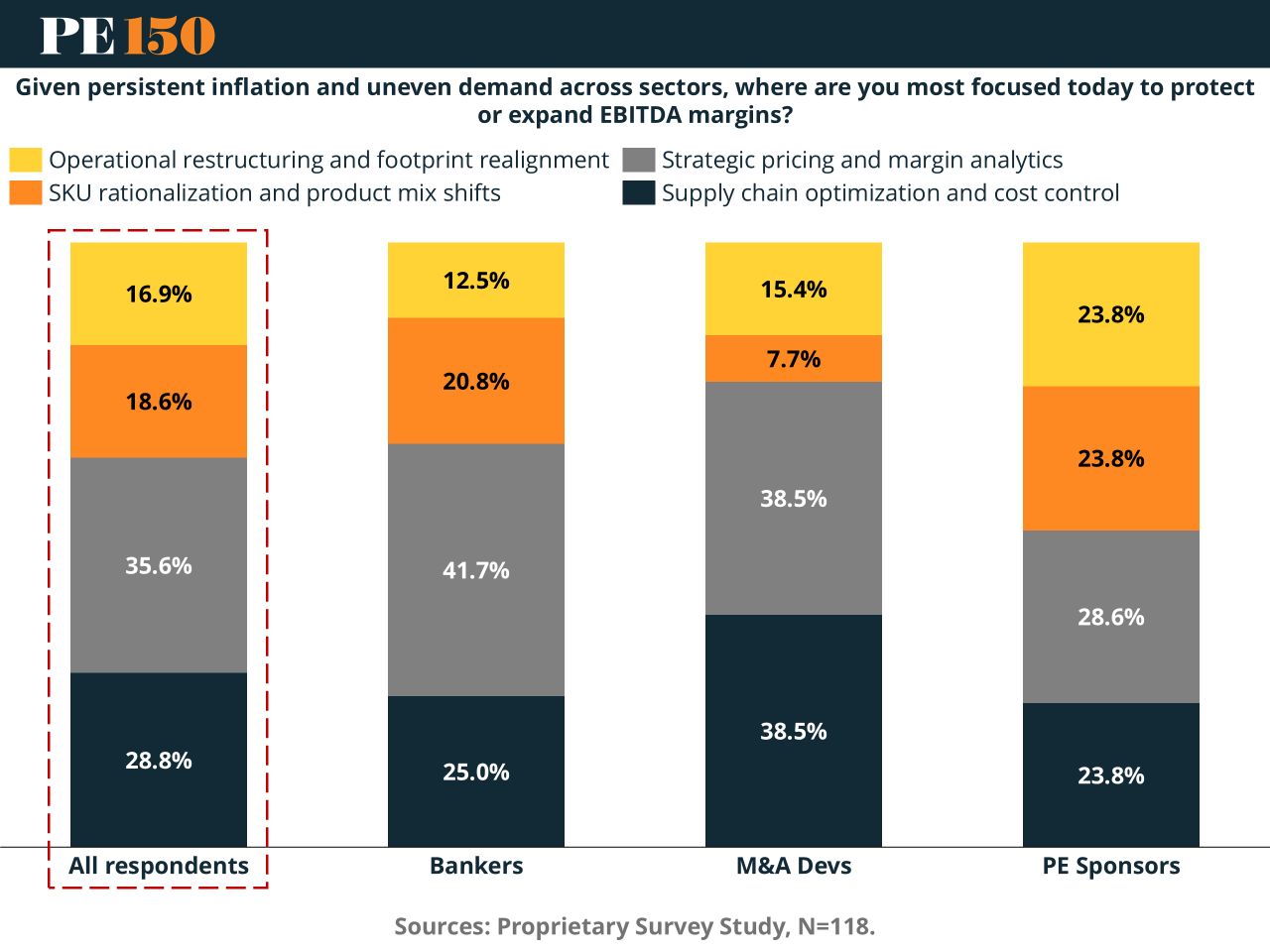

One of our PE150 microsurvey, covering 118 PE professionals across sponsors, corporate M&A, and banking, reveals a sharp pivot toward operational levers:

The focus now is clear:

Strategic Pricing & Margin Analytics (35.6%)

Supply Chain Optimization & Cost Control (28.8%)

Together, these represent over 64% of strategic emphasis in active portfolios. Among PE sponsors specifically, the trend is even broader—many are leaning into SKU rationalization, product mix shifts, and footprint realignment to drive cost discipline.

This shift marks a philosophical evolution: private equity is no longer about broad-based growth but rather precision margin engineering. In a world where top-line growth is uneven and inflation sticks, GPs are refocusing on fundamentals—controlling the controllables to protect EBITDA, drive DPI, and preserve exit flexibility.

3. Interest Rate Sensitivity in the Middle Market

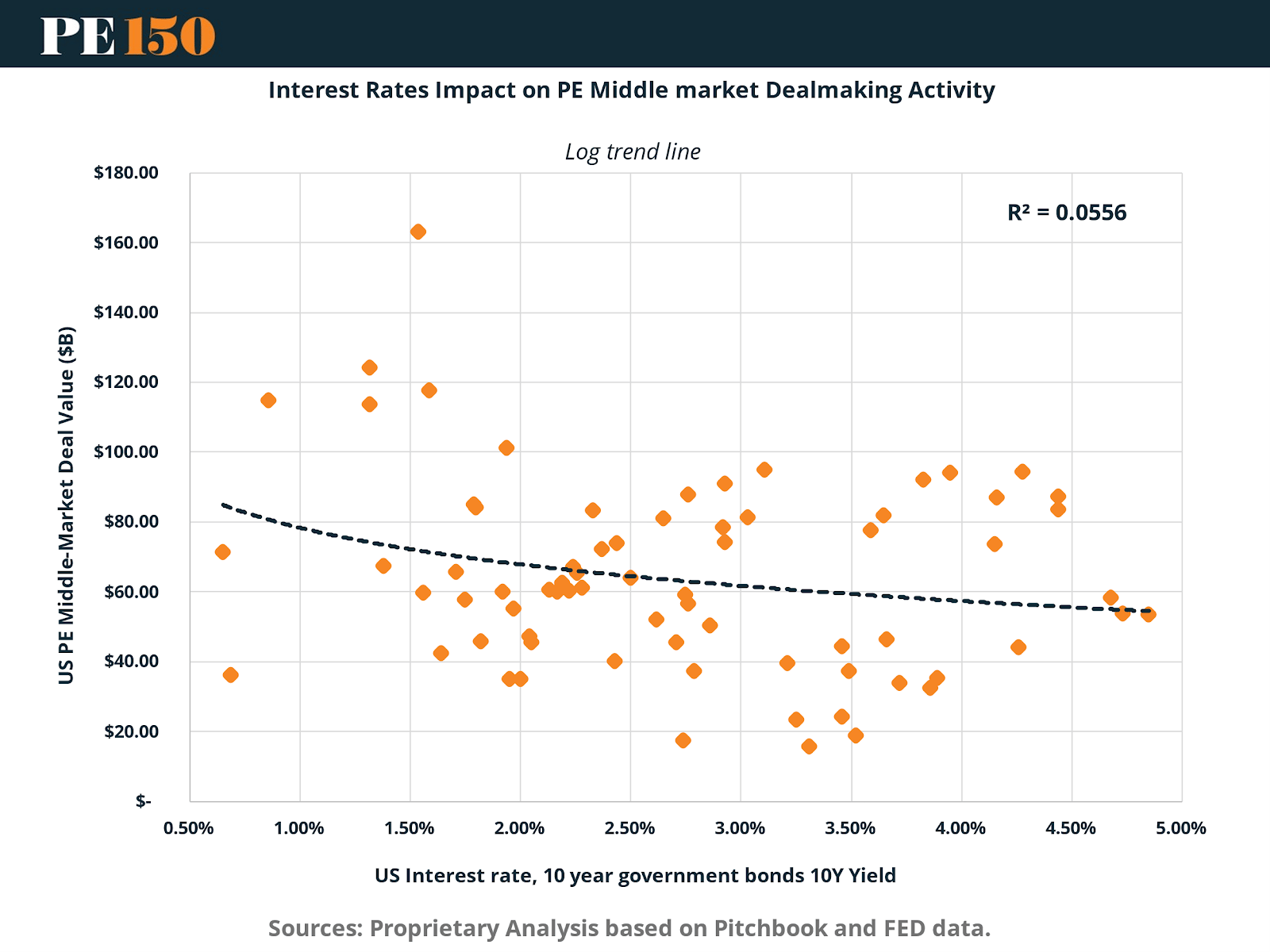

The rapid rise in interest rates has put further pressure on deal dynamics—particularly in the middle market. This segment, reliant on leverage for deal construction, has shown a clear negative correlation between interest rates and transaction volume.

The data shows that as 10-year Treasury yields rise, PE middle-market deal value declines. The relationship is modest (R² = 0.0556), but directionally significant. Elevated borrowing costs have compressed valuations, widened bid-ask spreads, and forced greater pricing discipline.

Importantly, this rate sensitivity is not just a headwind—it is a signal. It underscores the reality that cheap leverage is no longer the engine of private equity. To succeed in this environment, GPs must rethink capital structures, increase equity contributions, and lean harder into operational value creation. As rates begin to stabilize, this recalibration may create an opening for capital deployment—especially for firms with dry powder and adjusted return expectations.

4. Sector-Level Rate Sensitivity: Finding Resilience

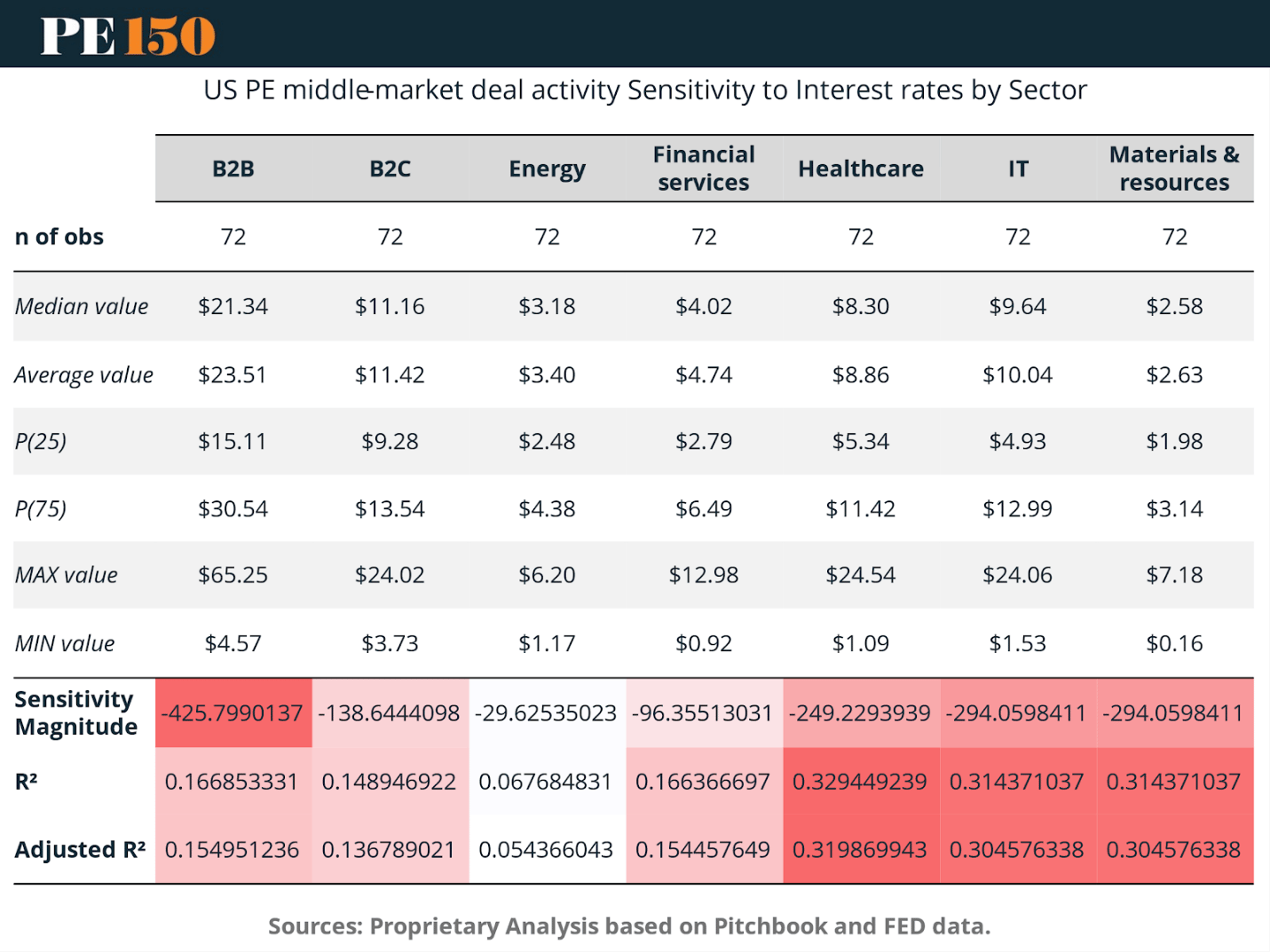

Not all sectors react equally to interest rate pressure. A deeper look into sector-level data reveals where middle-market private equity can find insulation—and where caution is warranted.

Among all sectors, B2B deals show the strongest rate sensitivity, with steep negative responsiveness to rising yields. Consumer sectors and financial services follow, reflecting their cyclical exposure and reliance on financing. In contrast, Healthcare and IT show greater resilience, with relatively muted responses to rate shifts.

This nuance matters for deal sourcing and portfolio strategy. GPs seeking to deploy capital in a high-rate environment are gravitating toward secular growth sectors like healthcare and tech—areas where demand is stickier, and valuations less rate-sensitive. Meanwhile, deals in B2B and consumer spaces require more cautious underwriting, especially when leverage plays a central role.

Soft Landing or False Hope? The Recession Expectations Divide

If interest rates have forced a repricing of deals, recession expectations are forcing a repricing of conviction.

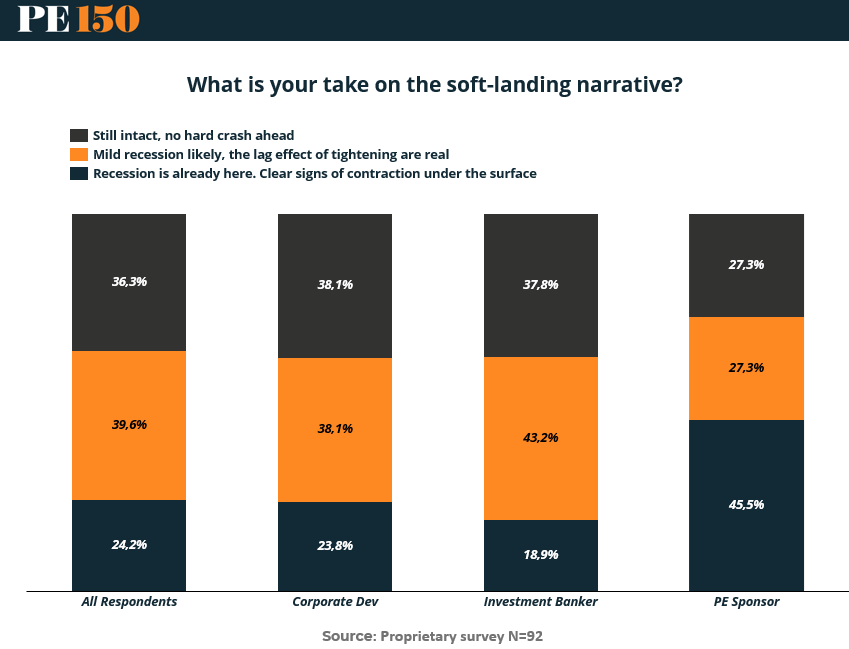

In one of our PE150 microsurvey, private equity sponsors were the most bearish on the macro outlook: 45.5% believe a recession is already underway, compared to 43.2% of investment bankers expecting only a mild slowdown, and 38.1% of corporate development leaders still betting on a soft landing.

This sentiment divide is more than a psychological split—it reflects a fundamental divergence in exposure and incentives. Sponsors, embedded in portfolio company operations, are confronting margin erosion, tightening credit, and longer exit timelines firsthand. Bankers, whose revenues are transaction-dependent, remain structurally optimistic. And corporate development teams, playing longer games, can afford to look through near-term noise.

This matters because expectations shape strategy. If GPs see contraction on the ground, they are more likely to extend hold periods, increase equity cushions, and focus on cost discipline. Conversely, bullish actors may push for faster exits or more aggressive growth underwriting.

And the macro data? It has mixed. Inflation is cooling—but inconsistently. Labor markets are softening—but not cracking. Growth has stabilized—but indicators like freight volumes, housing starts, and consumer sentiment are flashing yellow.

In this in-between zone, scenario planning has replaced forecasting. Sponsors are no longer building portfolios for a base case—they are engineering flexibility for multiple outcomes. Structured equity, continuation vehicles, and opportunistic M&A have emerged as tools not of creativity, but of necessity.

Strategic Takeaway:

The soft landing may be priced in, but it is far from guaranteed. PE firms are preparing for contraction—even if they hope for resilience. That preparation is reshaping capital deployment, diligence processes, and value creation playbooks in real time.

The Takeaway

This first section reveals the strategic adaptation of private equity in real time. Facing volatility, inflation, and monetary tightening, GPs are:

Relying on structural resilience to cushion market shocks

Pivoting to operational excellence to drive returns

Navigating interest rate pressure with sharper underwriting

Allocating toward sectors with rate immunity and long-term growth

These are not just temporary adjustments—they are the foundation of the new PE playbook.

Globalizing the PE Playbook

Private equity’s mid-decade expansion strategy has turned increasingly global — not merely by necessity, but by design. As deal flow in developed markets stalled under the weight of rising interest rates and valuation uncertainty, GPs began looking outward. The emerging world—long positioned as an aspirational frontier—stepped into the spotlight in 2024. Middle Eastern sovereign wealth funds, Latin America’s deal rebound, Africa’s surging digital infrastructure, and Europe's ESG-driven transformation all combined to globalize the PE playbook. Regional asymmetries are no longer inefficiencies to be arbitraged; they are the next chapter of growth.

1. Middle East: From Energy to Everything

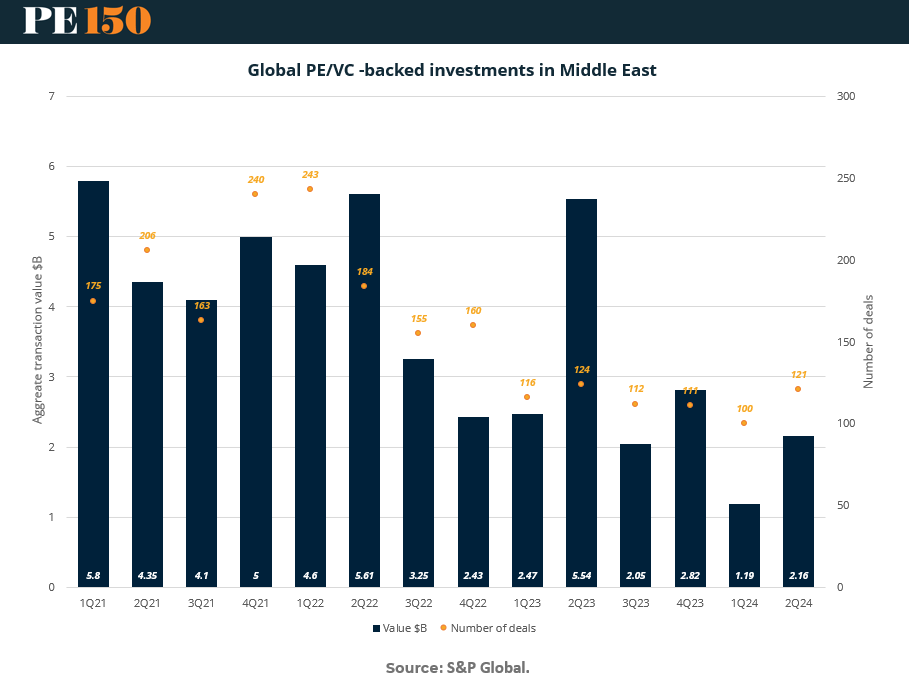

Private equity and venture capital activity in the Middle East surged into sharper focus in 2024, as investors aligned with the region’s economic diversification goals. While traditional hydrocarbon sectors remain a backdrop, the real momentum has shifted toward high-growth areas like technology, infrastructure, and services.

After a sharp dip in early 2024, aggregate transaction value rebounded in Q2 to $2.16B, accompanied by a modest uptick in deal volume. This reflects a potential bottoming-out after a volatile period marred by geopolitical tensions and regional uncertainty. The Middle East’s investment narrative is now defined by two forces: the deep-pocketed support of sovereign capital (notably in Saudi Arabia and the UAE), and a strategic pivot away from oil dependence — positioning the region as a platform for high-growth alternatives rather than a volatile energy proxy.

2. Latin America: Rebound Meets Risk

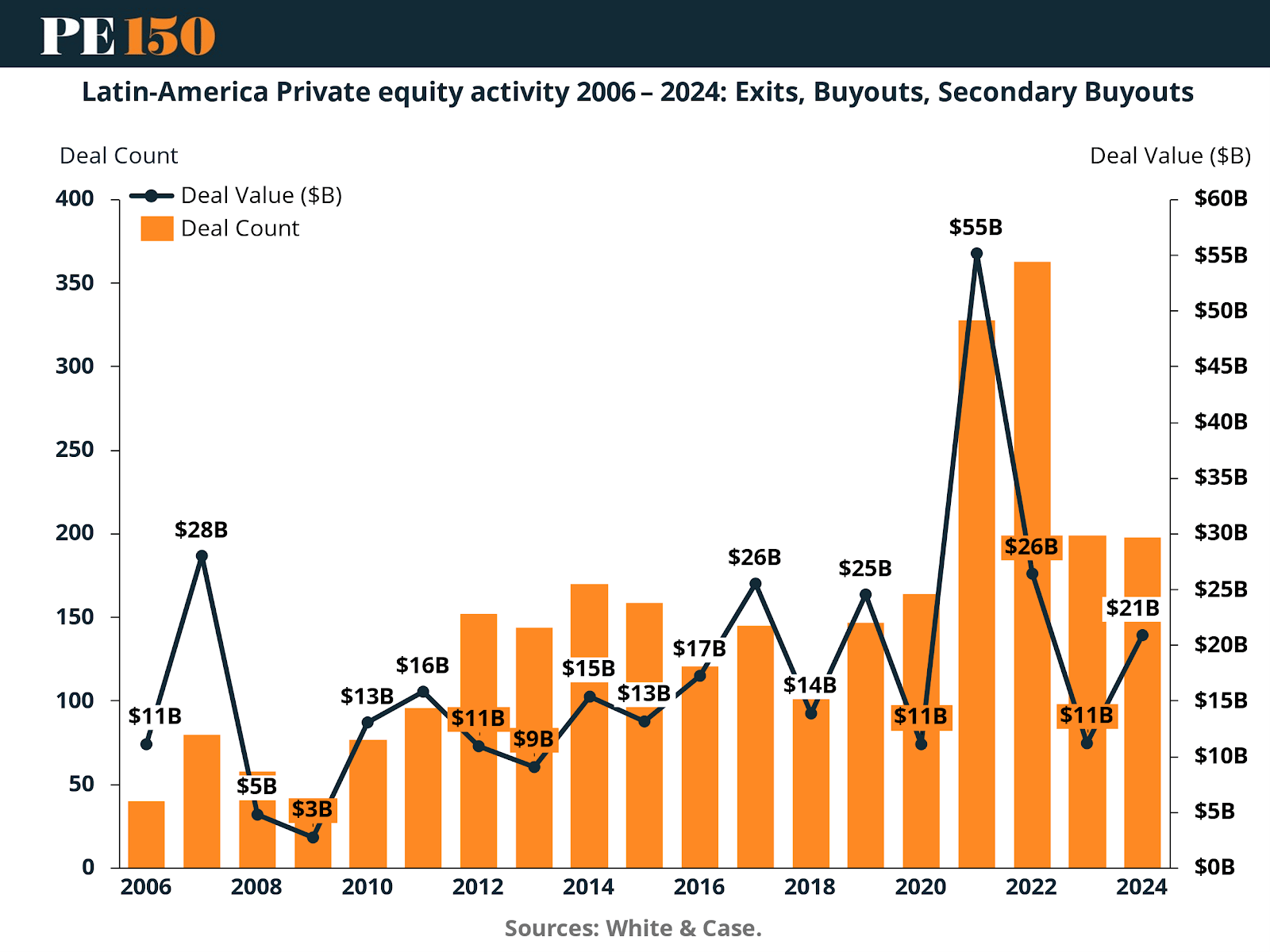

Latin America’s private equity ecosystem has weathered multiple cycles, but the 2021 post-COVID liquidity surge reignited investor interest at historic levels. That momentum, however, has since tempered. By 2023 and 2024, economic pressures—rising interest rates, political uncertainties, and particularly volatile U.S. trade policies—began to dampen deal volume and value. The 2024 recovery remains uneven.

Still, the region continues to show pockets of strength. The rise of regional infrastructure investments, technology adoption, and a growing middle class offer long-term tailwinds. What distinguishes Latin America now is not merely cyclical rebounds but the emergence of local PE maturity—firms that are increasingly skilled at navigating political transitions, capital flight, and regulatory complexity.

3. Africa: Platforming Growth Through eCommerce

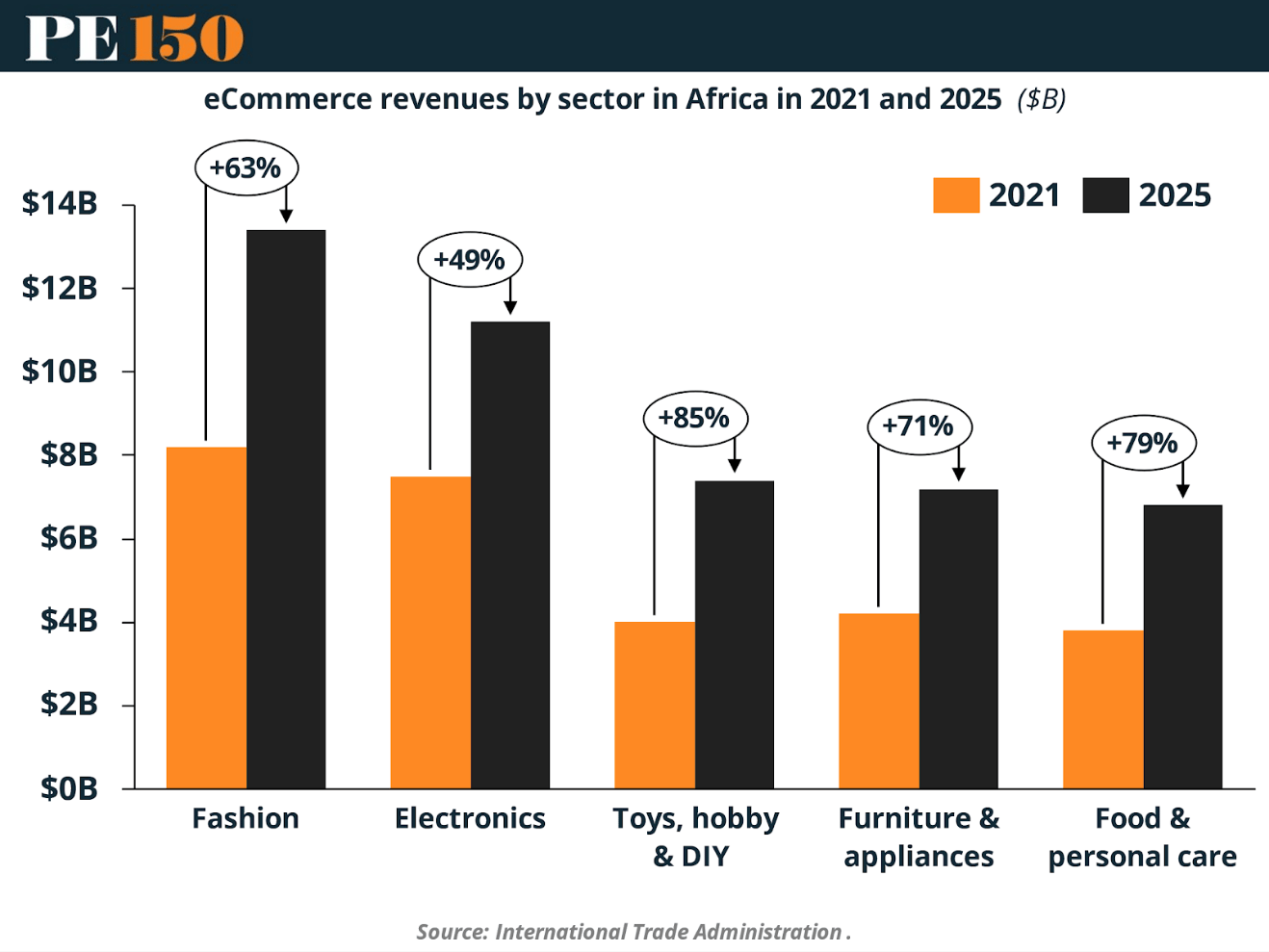

Africa’s PE opportunity is increasingly digital. While still early-stage by global standards, the continent’s ecommerce sector is rapidly expanding — not just in headline revenue, but in structural depth. Between 2021 and 2025, every major ecommerce vertical is projected to grow at double-digit CAGRs, with segments like Toys, Hobby & DIY and Food & Personal Care exceeding 12% annually.

What makes this trend investable is not only the scale of growth, but its directionality: Africa’s young, urban, and mobile-first population is leapfrogging legacy infrastructure. For PE firms, this represents a rare alignment of demographic tailwinds and scalable platforms. Investments in African ecommerce are no longer acts of developmental goodwill — they are competitive strategies in a digitally native market.

4. Europe: ESG as a Capital Magnet

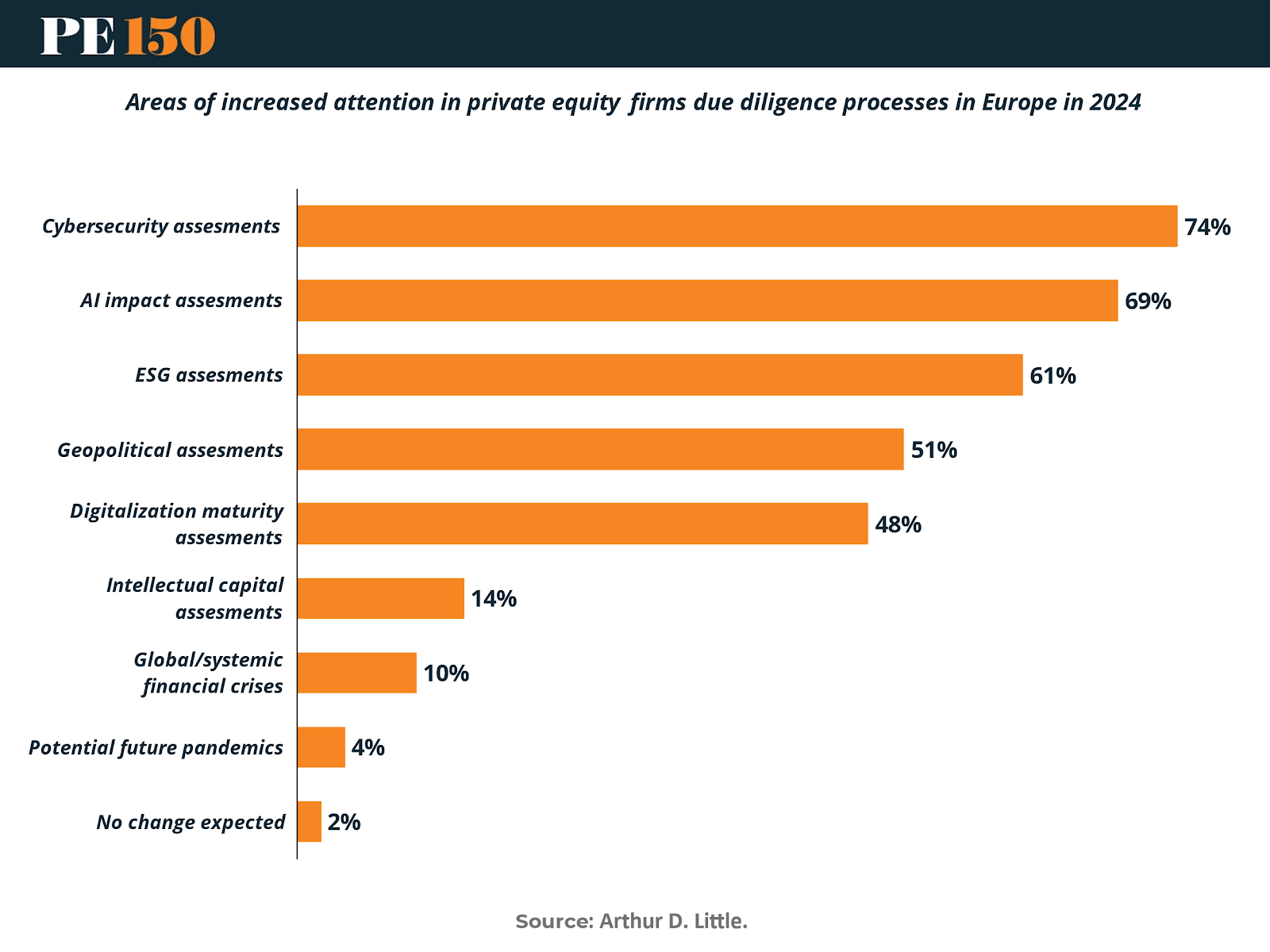

In Europe, ESG has evolved from a reporting requirement to an alpha strategy. PE firms operating across the continent are increasingly embedding sustainability not just into operations, but into the fabric of investment selection, due diligence, and portfolio management. According to recent surveys, 61% of European PE firms now list ESG as a top-three consideration during diligence — on par with cybersecurity and financial risk.

The shift has been accelerated by EU regulatory pressure, including the Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD). But the real change is cultural: LPs are demanding sustainability metrics not as a side note, but as a core tenet of fiduciary responsibility. ESG is no longer a filter — it is a frame.

The Global Thesis Is Now Operational

In 2024, PE's global expansion ceased to be a thesis — it became an operating reality. Whether in Riyadh or São Paulo, Nairobi or Paris, capital is chasing new value curves: sovereign alignment, digital infrastructure, policy tailwinds, and sustainability-led alpha. The globalization of the PE playbook is not just about going where the money flows — it is about building where the next decade of value will be created.

Conclusion

As we pass the midpoint of 2025, it is clear that private equity is not simply adapting to new market conditions — it is being redefined by them. The era of easy capital, broad beta, and linear growth is over. What replaces it is a model marked by operational depth, global diversification, and a sharper lens on risk and return.

In developed markets, GPs are becoming more selective, relying less on leverage and more on real margin discipline to drive value. The shift toward cost control, pricing precision, and sector-specific resilience is not temporary — it is foundational. Meanwhile, interest rate normalization has forced the industry to reconsider not just how it structures deals, but how it underwrites them, prices them, and exits them. This recalibration, though painful for some, is creating new clarity about what durable value creation actually requires.

Globally, the industry’s center of gravity is tilting outward. Emerging markets are no longer “next” — they are now. Sovereign wealth capital is not passive — it is directional. And the ESG agenda is not cosmetic — it is capital-forming. From Africa’s ecommerce platforms to MENA’s infrastructure buildout, from LATAM’s resilience to Europe’s sustainability flywheel, the PE playbook is global by necessity, and local by execution.

Private equity's future will not be defined by macro tailwinds or liquidity cycles. It will be shaped by how firms navigate volatility, create alpha through control, and deploy capital where old inefficiencies are turning into new engines of growth.

The next chapter belongs to the builders — not the passengers.

Sources and References:

Africa’s eCommerce Boom: A $112B Private Equity Opportunity by 2029

ESG in private equity in Europe

Latin America’s Private Equity Outlook: Resilient, Volatile, Rising

Middle East PE in Transition: From Oil to Innovation

Rational Expectations in Private Equity: A 2025 Outlook

The Rising Imperative of Value Creation in Private Equity

The State of Private Equity Middle-Market in US

Volatility Destroys Wealth

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|