- PE 150

- Posts

- ESG in private equity in Europe

ESG in private equity in Europe

Sustainability has emerged as a critical and transformative force within the global investment landscape.

Increasingly, investors and financial institutions recognize that Environmental, Social, and Governance (ESG) considerations are essential to responsible decision-making and long-term value creation. Sustainable finance broadly refers to the process of incorporating these ESG factors into investment decisions, steering capital towards economic activities and projects that support environmental preservation, social well-being, and sound governance practices. This approach not only aligns with growing societal expectations but also addresses the urgent need to mitigate risks associated with climate change, social inequality, and governance failures.

Environmental considerations within sustainability encompass a wide range of issues, including climate change mitigation and adaptation, biodiversity preservation, pollution prevention, and the promotion of circular economy principles. These factors are increasingly critical as scientific consensus highlights the limits of planetary boundaries and the risks of irreversible environmental damage. Social dimensions cover topics such as reducing inequality, enhancing inclusiveness, improving labor relations, investing in human capital and communities, and upholding human rights. Governance concerns focus on the structures and processes that ensure accountability, transparency, and ethical management, including executive remuneration and employee relations.

In the European context, sustainable finance plays a pivotal role in supporting the ambitious objectives of the European Green Deal, which aims for a climate-neutral Europe by 2050. This vision entails decoupling economic growth from resource consumption and ensuring a just and fair transition that leaves no individual or region behind. Achieving these goals requires substantial additional investments, estimated at hundreds of billions of euros annually, to accelerate the transition to a low-carbon, resource-efficient economy. The regulatory landscape has evolved rapidly to support this transition, with frameworks such as the EU Taxonomy, the Sustainable Finance Disclosure Regulation (SFDR), and the Corporate Sustainability Reporting Directive (CSRD) establishing rigorous standards for transparency, reporting, and accountability.

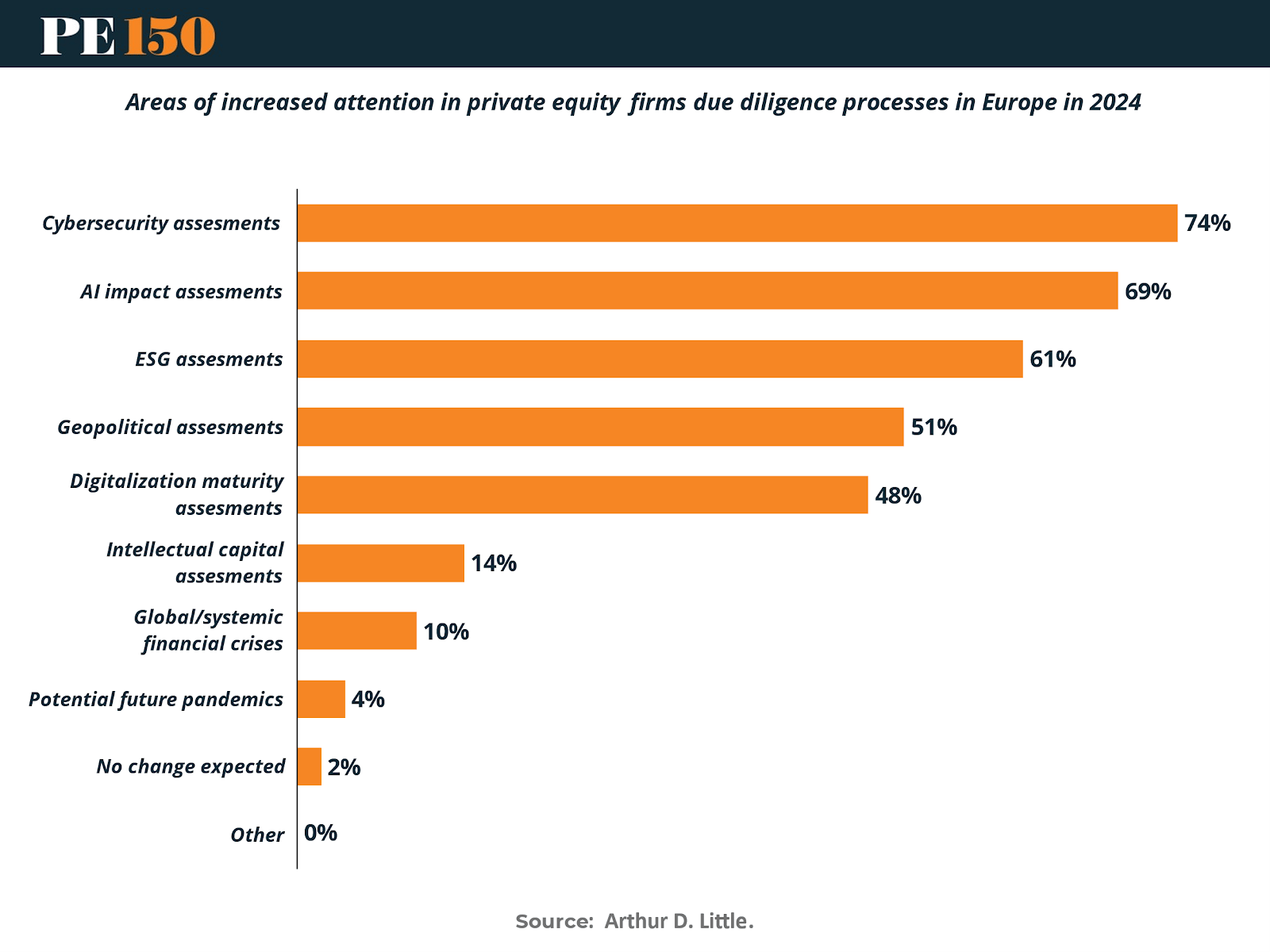

The growing regulatory and stakeholder pressure is also reshaping how private equity (PE) firms conduct due diligence. In 2024, a large share of PE firms in Europe report increased attention not only to cybersecurity and AI impact assessments, but notably to ESG assessments, which now rank as a top-three priority. According to recent data, 61% of firms indicated heightened focus on ESG during due diligence, underscoring its centrality to risk management and long-term value creation in the sector.

This shift reflects a broader redefinition of value and risk: ESG performance is no longer viewed as a peripheral or reputational issue, but as an operational, legal, and financial priority. In this context, sustainable finance is not merely about supporting environmentally friendly projects but encompasses a holistic approach that integrates environmental, social, and governance factors to foster resilient, inclusive, and sustainable economic growth. This report explores these dimensions in detail, focusing on how sustainability considerations are reshaping private equity investment strategies and driving the industry towards a more responsible and value-driven future.

Regulatory Landscape and ESG Reporting Standards in European Private Equity

The European private equity sector is navigating an increasingly complex and evolving regulatory environment designed to enhance transparency, accountability, and sustainability in investment practices. ESG considerations have transitioned from voluntary commitments to mandatory requirements that significantly influence how firms approach investment decisions, portfolio management, and reporting.

Key Regulations Shaping ESG Integration in 2025

Sustainable Finance Disclosure Regulation (SFDR):

SFDR remains the cornerstone of ESG regulation for asset managers, including private equity firms. It mandates detailed disclosures on how sustainability risks are integrated into investment processes and requires reporting on principal adverse impacts. The regulation classifies funds into categories based on their ESG focus, with Articles 6, 8, and 9 defining different levels of sustainability integration. In 2025, the European Commission is reviewing SFDR to simplify the framework and reduce greenwashing risks. Proposed changes include replacing the current fund categories with new classifications such as Sustainable, Transition, and ESG Collection funds, reflecting a more nuanced approach to sustainability claims and investor expectations.Corporate Sustainability Reporting Directive (CSRD):

The CSRD significantly expands sustainability reporting obligations for companies, including many portfolio companies of private equity funds. It introduces a double-materiality concept, requiring companies to disclose not only how sustainability issues affect their financial performance but also their impact on the environment and society. This directive, phased in from 2024 onwards, enhances data availability and comparability, enabling private equity firms to conduct more robust ESG due diligence and ongoing monitoring across their portfolios.EU Taxonomy Regulation:

The EU Taxonomy provides a classification system for environmentally sustainable economic activities, guiding investors in identifying investments that contribute substantially to climate mitigation and adaptation. Amendments in 2025 aim to clarify disclosure requirements and improve alignment with SFDR and CSRD, helping private equity firms better categorize and communicate the sustainability profile of their investments.Corporate Sustainability Due Diligence Directive (CSDDD):

This directive marks a shift from reporting to proactive due diligence, imposing obligations on companies and investors to identify, prevent, and mitigate adverse human rights and environmental impacts throughout their value chains. For private equity firms, this means enhanced responsibilities in managing ESG risks and engaging portfolio companies to ensure compliance and sustainable practices.

Diverse Enforcement Approaches Across Europe

European regulators are adopting varied enforcement strategies regarding ESG compliance. Some countries, like Austria and Belgium, have signaled strict penalties and fines for breaches, while others, such as Luxembourg and Italy, emphasize supervisory dialogue and corrective measures. This regulatory patchwork requires private equity firms to maintain high standards of ESG governance and compliance across jurisdictions to mitigate legal and reputational risks.

Implications for Private Equity Firms

The evolving regulatory landscape necessitates that private equity firms develop robust ESG governance frameworks, invest in comprehensive data management systems, and engage actively with portfolio companies to ensure compliance and value creation. While the regulatory demands can pose challenges, especially for smaller portfolio companies with limited resources, they also present opportunities to enhance risk management, operational efficiency, and investor confidence.

Moreover, high-quality ESG data enabled by these regulations facilitates benchmarking and targeted value creation initiatives, positioning firms to meet growing stakeholder expectations and capitalize on sustainability-driven market trends.

Looking Ahead

As Europe continues to refine its sustainable finance agenda, private equity firms must remain agile and informed. The ongoing SFDR review, the phased implementation of CSRD, and the introduction of new standards like the European Green Bond Standard will further shape the ESG landscape in 2025 and beyond. Firms that integrate regulatory compliance with strategic ESG management will be better equipped to unlock value, manage risks, and demonstrate leadership in sustainable investing.

ESG as a Strategic Pillar for Value Creation in Private Equity

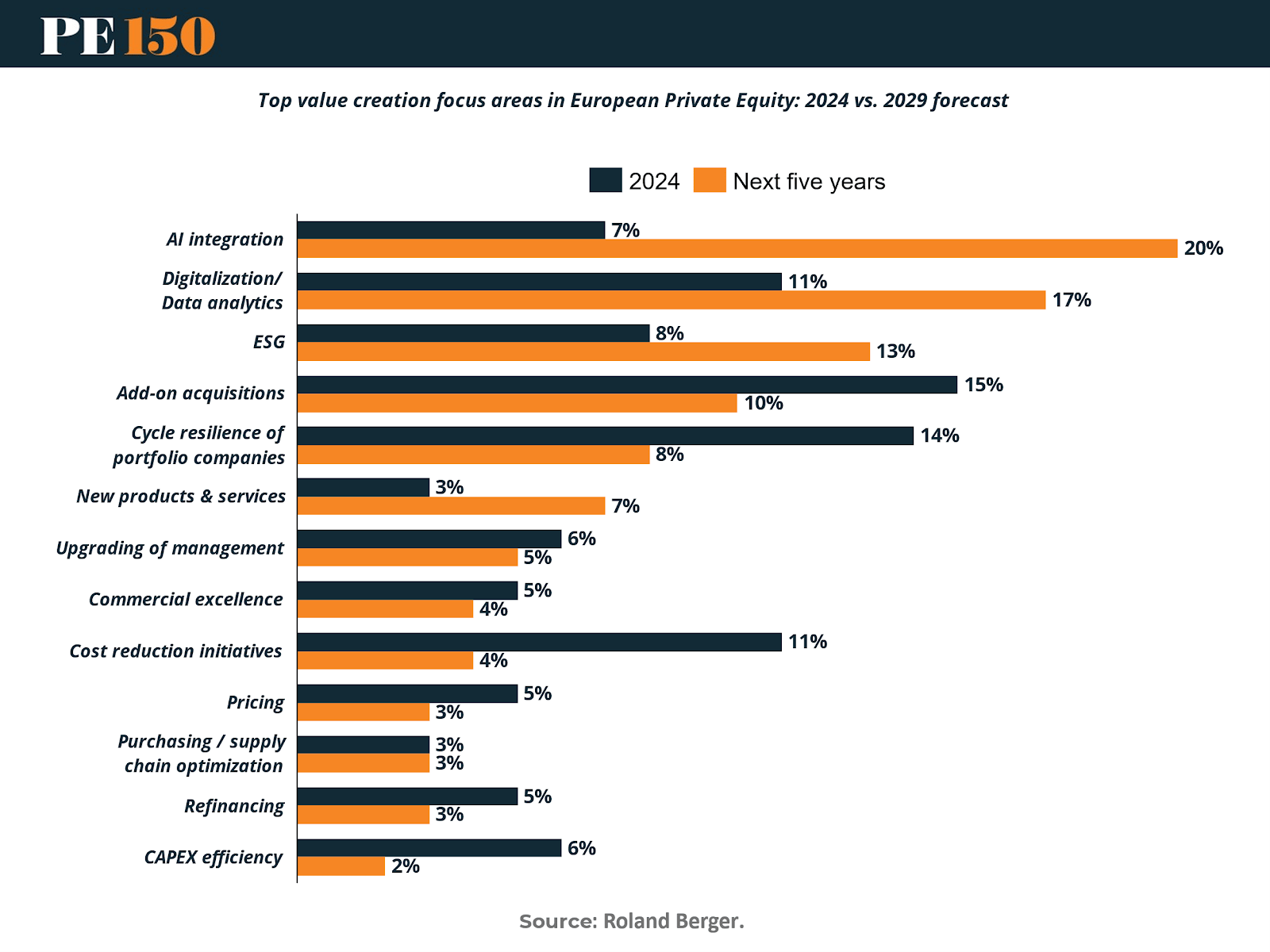

The role of ESG in private equity continues to mature, from a regulatory and reputational requirement to a core strategic lever for long-term value creation. According to recent data from PE professionals in Europe, 13% expect ESG to be among the top value creation measures by 2029, up from 8% in 2024. This growing focus reflects both investor pressure and a recognition that ESG integration improves resilience, operational efficiency, and exit potential.

More broadly, several other priorities projected to gain traction over the next five years also align with ESG-related objectives:

Cycle resilience of portfolio companies is expected to rise from 8% to 14%, indicating a shift toward climate and macroeconomic risk mitigation, especially relevant for companies exposed to environmental shocks or global supply chain volatility.

Digitization and data analytics (up from 11% to 17%) are key enablers of ESG transparency, allowing portfolio companies to track, report, and optimize sustainability performance, from carbon footprint monitoring to DEI metrics.

AI integration (rising sharply from 7% to 20%) also contributes by unlocking efficiencies in ESG compliance, smart resource allocation, and early identification of social or environmental risks across operations.

Upgrading of management teams and aligning incentives (projected to grow from 5% to 6%) is another area where ESG plays a role, particularly in fostering diverse leadership, improving governance structures, and embedding long-term thinking in incentive plans.

Interestingly, more traditional value creation levers such as cost reduction initiatives and capex optimization are expected to decline in importance. These shifts suggest that PE firms are moving away from short-term financial engineering toward holistic, stakeholder-driven strategies that create durable value while managing environmental and social risks.

This evolution positions ESG not as a separate track, but as a cross-cutting theme across multiple dimensions of portfolio management, operational resilience, technological modernization, governance reform, and impact measurement. As LPs and regulators increase scrutiny, firms that proactively integrate ESG across their playbooks will likely gain a competitive edge in both fundraising and deal execution.

ESG Integration in buy-side opportunity assessment and value creation

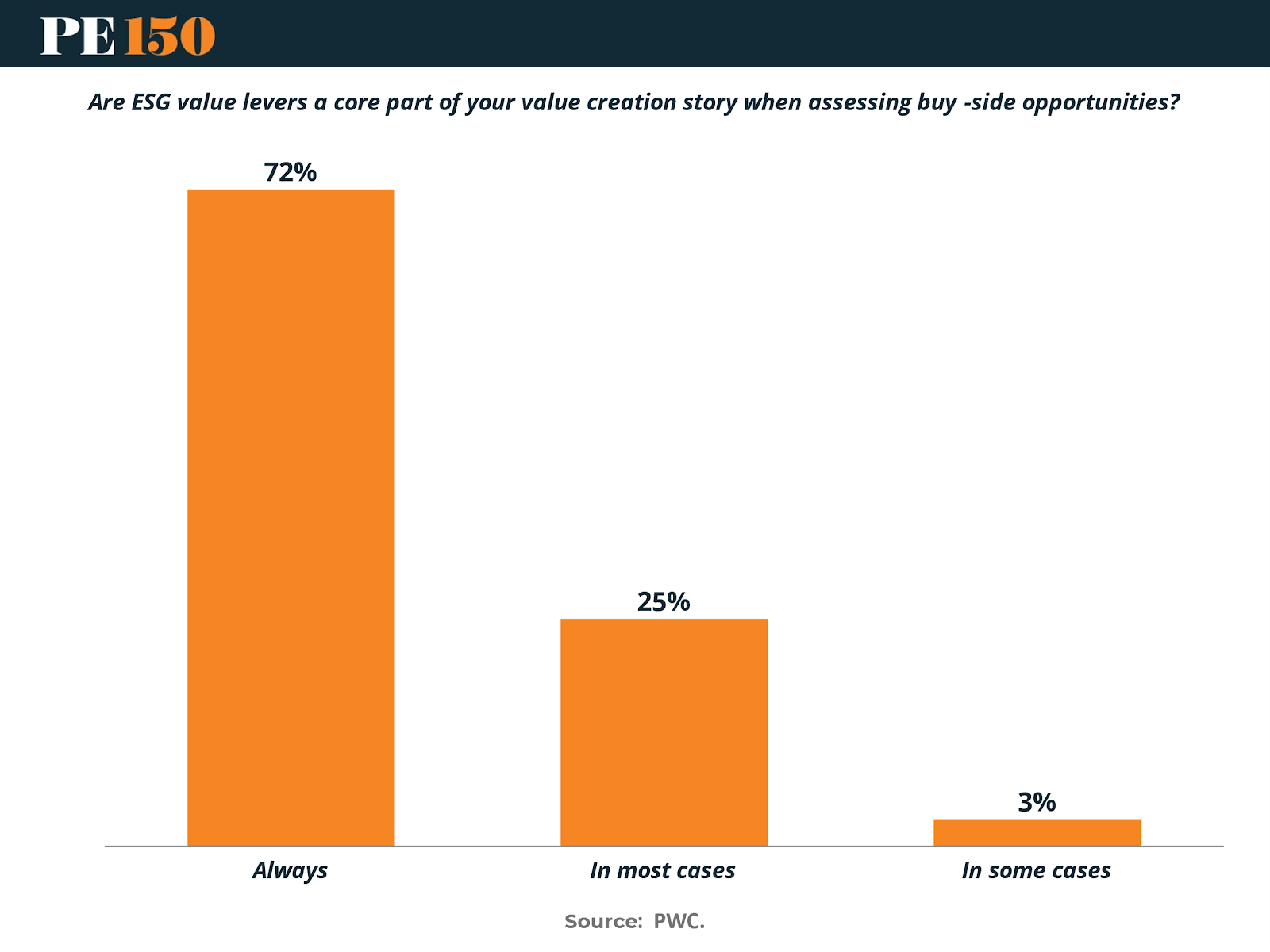

ESG considerations have become deeply embedded in the evaluation of buy-side opportunities within private equity firms across Europe. Recent data shows that approximately 72% of private equity professionals report that ESG value levers are always a core component of their value creation strategy when assessing potential acquisitions. An additional 25% indicate that ESG factors are central in most cases, underscoring the widespread recognition of ESG as a critical driver in deal sourcing and due diligence processes.

This strong emphasis on ESG during buy-side assessments reflects a fundamental shift in how private equity firms approach value creation. Rather than viewing ESG solely as a risk mitigation tool or compliance requirement, firms increasingly regard sustainable operational practices as key levers to enhance the intrinsic value of portfolio companies. While ESG initiatives may require upfront investment, they are seen as catalysts for long-term revenue growth, operational resilience, and improved exit prospects.

Moreover, the integration of ESG factors aligns with broader societal and market trends, including heightened consumer expectations, regulatory pressures, and evolving stakeholder demands. Firms are prioritizing investments in companies with strong ESG performance and are more likely to exclude targets with poor ESG compliance or rankings, recognizing the reputational, financial, and operational risks associated with inadequate ESG management.

The growing importance of ESG in buy-side evaluations is also reflected in the strategic priorities of private equity firms. Alongside ESG, areas such as portfolio company resilience to climate and macroeconomic risks, digitization and data analytics, and artificial intelligence are gaining prominence as complementary enablers of sustainable value creation. These capabilities enhance transparency, facilitate ESG performance tracking, and support proactive risk management.

In summary, ESG integration during buy-side opportunity assessment has become a standard and indispensable practice in European private equity. It represents a cross-cutting strategic dimension that not only mitigates risks but also unlocks new avenues for sustainable growth and competitive advantage throughout the investment lifecycle.

ESG metrics and measurement in private equity

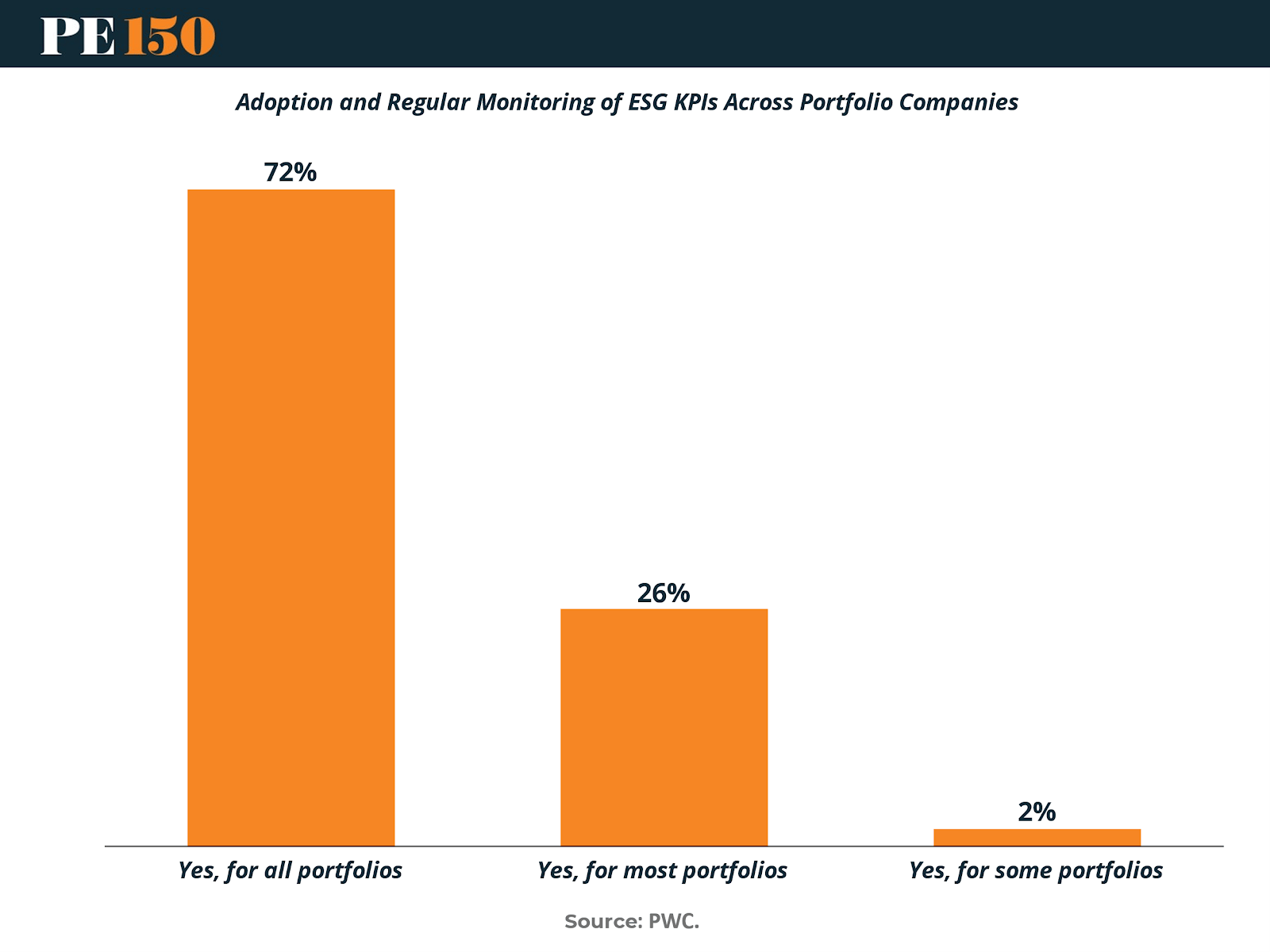

As private equity firms increasingly embed ESG considerations into their investment strategies, the systematic measurement and monitoring of ESG performance have become critical components of value creation. Just as PE houses rigorously track financial and operational KPIs to drive improvements and cost efficiencies, they are applying the same discipline to ESG-related metrics across their portfolio companies.

Recent research indicates a marked increase in the adoption of ESG-specific KPIs, with nearly three-quarters (72%) of private equity firms now setting and regularly monitoring these indicators for all portfolio companies. This represents a significant rise from 63% reported in the previous study, reflecting a growing consensus on the importance of quantifiable ESG targets as a tool for driving sustainable value.

The establishment of ESG KPIs enables firms to translate broad sustainability goals into actionable and measurable objectives. Common metrics span environmental factors such as carbon emissions, energy consumption, and waste management; social indicators including workforce diversity, employee health and safety, and community impact; and governance aspects like board composition, compliance frameworks, and ethical standards.

However, challenges remain in standardizing these metrics across diverse industries and geographies, as well as ensuring data quality and comparability. Many firms are investing in advanced data analytics, digital tools, and third-party verification to enhance the reliability of ESG reporting. This not only supports internal decision-making but also meets the increasing demands of investors and regulators for transparency and accountability.

Ultimately, the integration of ESG KPIs into portfolio management reflects a shift from ESG as a compliance or reputational exercise to a core driver of operational excellence and long-term financial performance. By embedding ESG measurement into their value creation frameworks, private equity firms can better identify risks and opportunities, align incentives, and demonstrate tangible impact to stakeholders.

Conclusion

The evolution of ESG integration in European private equity marks a decisive transformation in investment practices, positioning sustainability as a fundamental driver of both risk management and value creation. Regulatory advancements are compelling firms to enhance transparency and accountability, while technological innovations empower more precise and actionable performance measurement. This convergence fosters a more resilient, adaptive, and future-focused industry.

Firms that embrace ESG as a core strategic pillar, rather than a peripheral obligation, stand to benefit from improved operational efficiencies, stronger investor confidence, and enhanced competitive advantage. As capital flows increasingly favor sustainability-aligned investments, private equity’s commitment to ESG will be essential for navigating a complex market landscape and delivering enduring impact.

Sources and References:

Adapting to change: how private equity navigates the evolving ESG landscape

ESG in 2025: finding the sweet spot in a complex world

ESG and sustainability trends in private markets for 2025

Optimizing ESG in private equity to unlock value creation

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|