- PE 150

- Posts

- PE’s $1.8T Tightrope: Exits, Deals, and the Next Capital Shift

PE’s $1.8T Tightrope: Exits, Deals, and the Next Capital Shift

From biopharma’s boom and EA’s $55B take-private to the $42B US-UK tech pact and a $10.5T allocator reshuffle—why private equity’s future hinges on flexibility.

Good morning, ! This week we’re covering biopharma’s $1.8T tightrope, AI reshaping IFRS compliance, the record-breaking $55B take-private of EA, the slow return of IPO exits, the $42B US-UK “Tech Prosperity” deal, $10.5T in allocator capital shifts, and why private credit is sponsors’ new favorite +1.

Want to advertise in PE 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

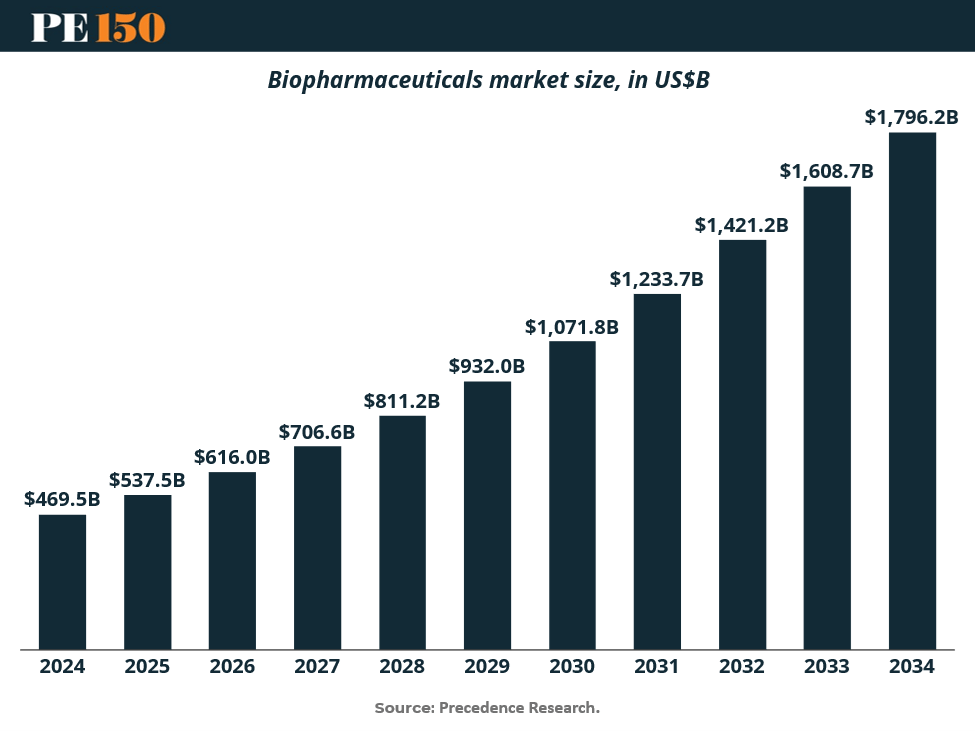

Biopharma’s $1.8T Tightrope

The biopharma market is marching toward $1.8 trillion by 2034, but don’t confuse growth with easy money. H1 2025 showed investors sprinting into AI-driven mega rounds (Isomorphic’s $579M raise), only to slam the brakes by Q2 as interest rates and market jitters kicked in. The result: a barbell market—late-stage giants still feast, while seed-stage science scrapes by with $5M median checks. Oncology funding cratered (-64% YoY), but autoimmune, metabolic, and neurology emerged as hot spots. For PE, the playbook isn’t chasing momentum—it’s structuring deals around scarcity, scooping up undercapitalized platforms, and exploiting valuation resets before the IPO window creaks open again.

Read the Full Report HERE

TREND OF THE WEEK

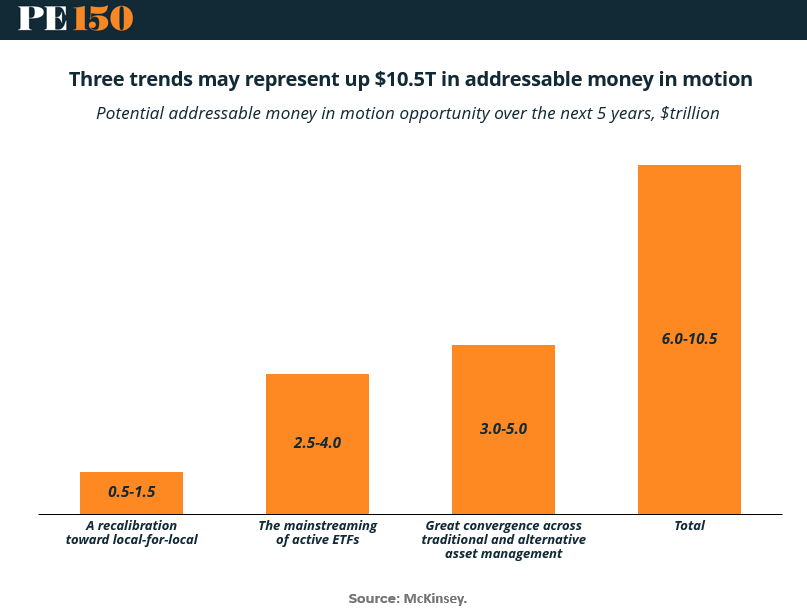

$10.5 Trillion in Motion: Where Asset Allocators Are Rewriting the Map

According to McKinsey, up to $10.5 trillion in global assets may shift across strategies and vehicles over the next five years — a capital rotation that could reshape the asset management and PE landscape.

Three structural drivers are behind the shift:

Local-for-local recalibration ($0.5–1.5T): Rising geopolitical friction is fueling regionalization, forcing allocators to reevaluate cross-border exposures.

Active ETF adoption ($2.5–4.0T): ETFs are no longer just passive. The mainstreaming of actively managed ETFs is opening new product strategies — and fee compression risks.

Traditional vs. alternatives convergence ($3.0–5.0T): Institutions are blending private and public sleeves, blurring lines between alpha, beta, and liquidity.

Why it matters: Asset allocators are moving out of rigid mandates and into more flexible, outcome-oriented models. For PE firms, this unlocks opportunity — but also competition. Winning capital in this environment will require more than returns. It will require distribution muscle, regulatory fluency, and product innovation at scale. (More)

Evolver: Reasoning Systems That Scale Institutional Investment Intelligence

Private equity success depends on applying decades of institutional knowledge consistently across complex, interconnected value creation challenges. Traditional tools automate tasks. Evolver builds reasoning systems that think.

Our platform doesn't just process data—it synthesizes your firm's collective investment intelligence, maintains contextual memory of portfolio evolution, and reasons through multi-layered operational interdependencies the way your most experienced professionals do.

Navigator learns from every deal outcome, building persistent institutional memory that gets smarter with each investment cycle. It reasons through complex scenarios: How does a pricing strategy in one business unit affect supply chain optimization in another? What patterns from your best exits should inform current transformation initiatives?

This isn't AI automation—it's augmented institutional intelligence. Our reasoning systems apply your firm's investment philosophy and decision-making frameworks consistently across every portfolio company, learning and adapting based on real outcomes.

Stop competing on experience alone. Scale your institutional reasoning across every investment decision, operational challenge, and value creation opportunity.

Experience strategic intelligence that thinks like your best investment professionals—with perfect memory and pattern recognition across your entire portfolio history.

LIQUIDITY CORNER

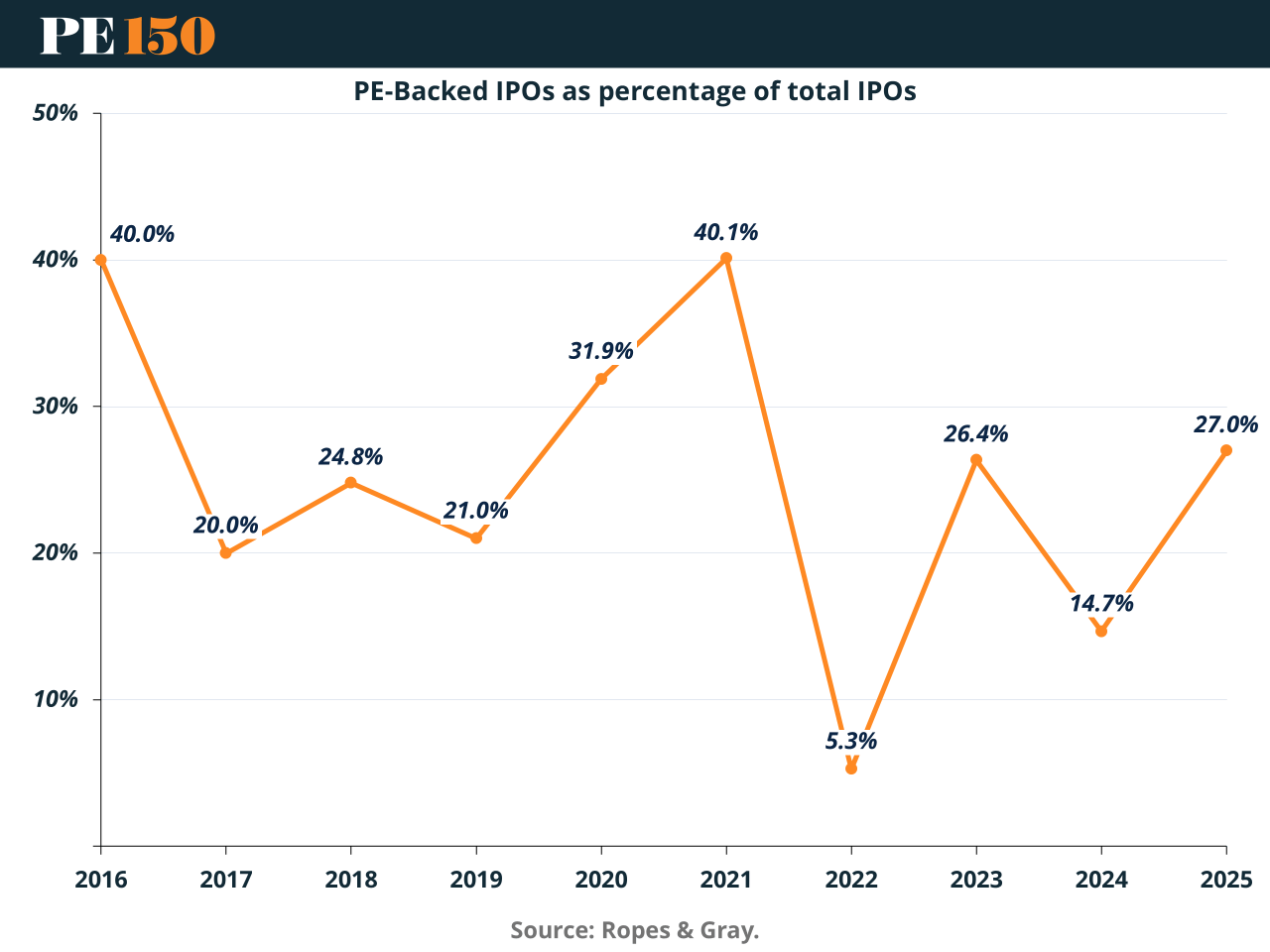

Popping Bottles... Slowly

Private equity firms got a taste of liquidity this summer — thanks to a surprise rebound in PE-backed IPOs — but the champagne’s still on ice. Despite a few high-profile listings, distributions remain at decade lows, and average holding periods are now 6.4 years, an all-time high. Exits are up compared to 2024, but nowhere near enough to clear the backlog. Secondaries remain the only real cash machine, hitting $100B+ in H1 and continuing to surge. If the Fed plays nice and rates drop, expect the IPO window to widen into 2026 — but for now, LPs are still waiting at the bar, wondering when it’s their turn to cash out. (More)

DEAL OF THE WEEK

The $55 Billion Respawn: EA Goes Private

Electronic Arts just scored the largest leveraged buyout in history—$55B—with a 25% premium on its share price. The all-cash deal, led by Saudi Arabia’s PIF, Silver Lake, and Jared Kushner’s Affinity Partners, takes the gaming giant off Nasdaq and loads it up with $20B in debt. The bet? That tentpoles like Madden, Battlefield 6, and the newly rebranded EA Sports FC will keep the cash flowing. EA CEO Andrew Wilson stays in charge, but the debt burden raises flags across the industry. PIF now effectively controls one of gaming's crown jewels, continuing its broader push to turn oil wealth into esports dominance. (More)

TOGETHER WITH BELAY

Drowning in Details? Here’s Your Life Raft.

Stop doing it all. Start leading again. BELAY has helped thousands of leaders delegate the details and get back to what matters most.

Access the next phase of growth with BELAY’s resource Delegate to Elevate.

PRIVATE CREDIT

Sponsors’ New Favorite +1

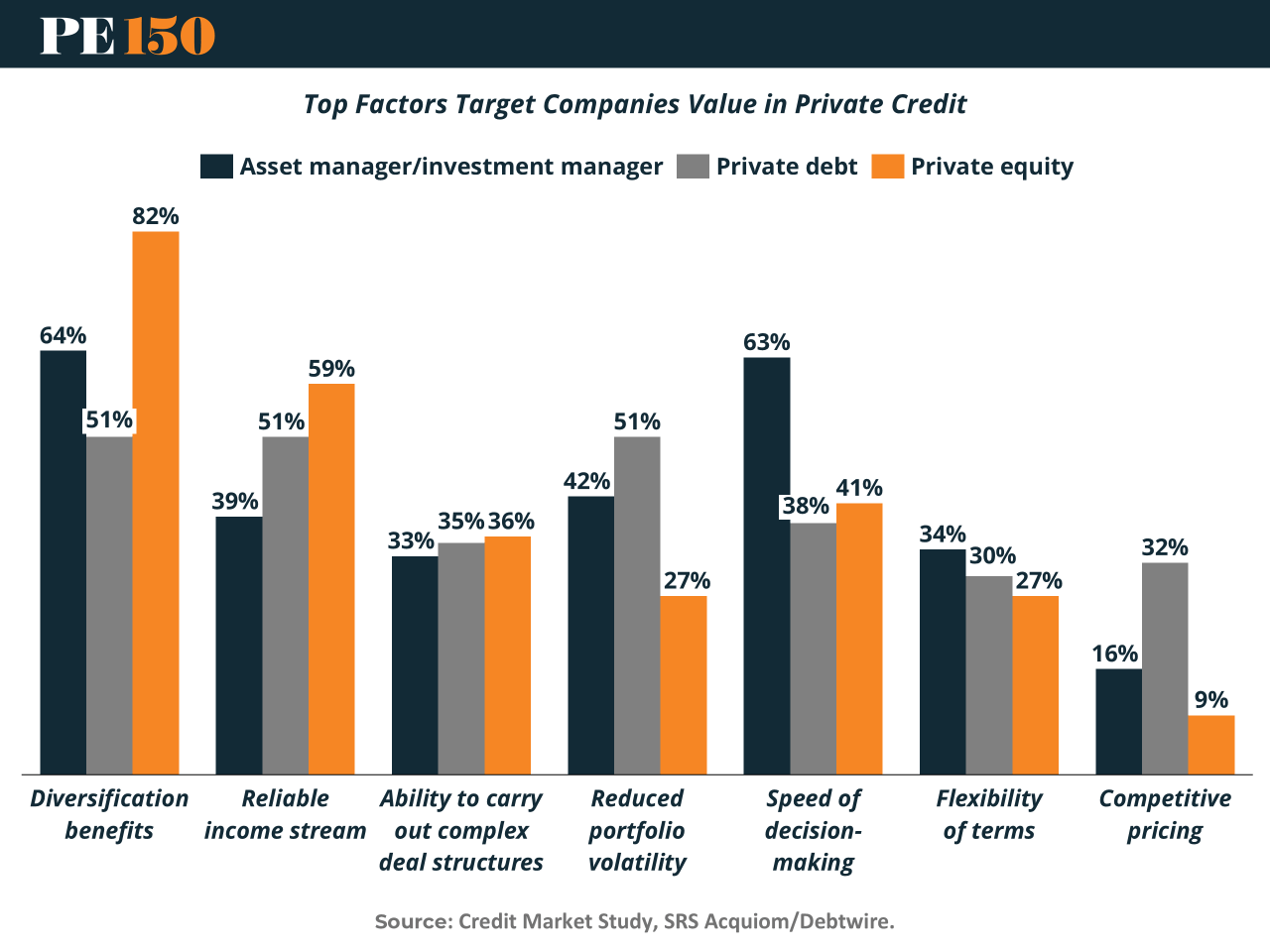

Private equity sponsors have always been the architects of leverage. But their new best friend? Private credit providers. With 82% of sponsors citing diversification as a key value, the appeal is obvious: less reliance on the sometimes-fickle syndicated loan market. Instead, sponsors can run dual-track financing — a polite term for playing lenders off each other. The outcome? More options, stronger negotiating power, and capital that doesn’t vanish during market stress. Private credit has quietly rebranded itself: not a niche asset class, but a core partner in deal-making. (More)

MICROSURVEY

Exit Markets: No Clear Winner

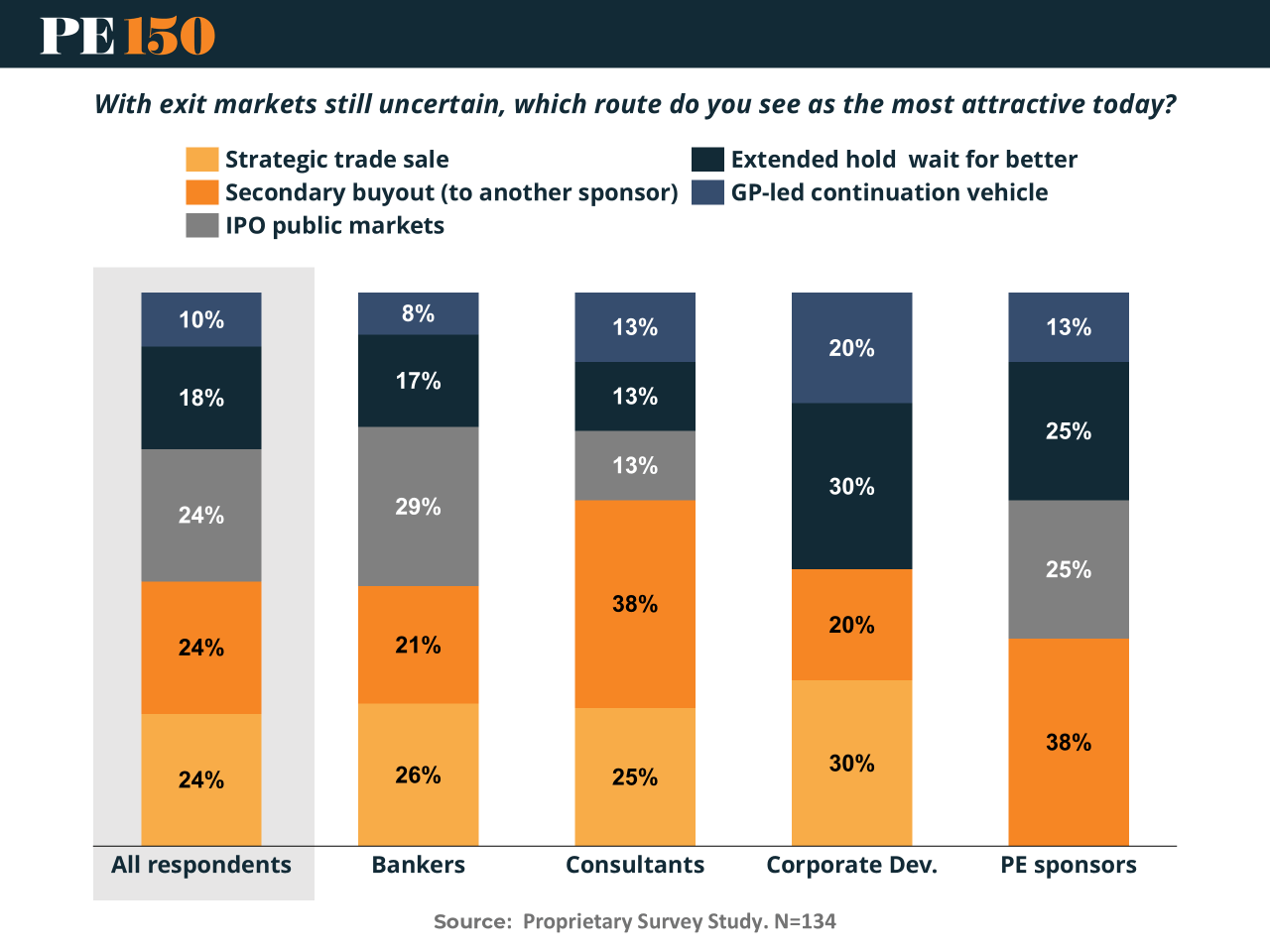

With IPOs sluggish and valuations mixed, private equity sponsors are weighing exits more carefully. Our survey of 134 market participants shows no dominant route. Secondary buyouts and strategic trade sales tied at 24% each, as sponsors lean on one another for liquidity and corporates pursue selective M&A. IPOs (24%) still attract some optimism, while extended holds (18%) and GP-led continuation vehicles (10%) reflect a growing appetite for flexibility.

Notably, 38% of PE sponsors favor secondary buyouts, while corporate development teams tilt toward strategic M&A (30%). The message is clear: in today’s uncertain market, flexibility—not a single playbook—is the key to successful exits. (More)

MACROVIEW

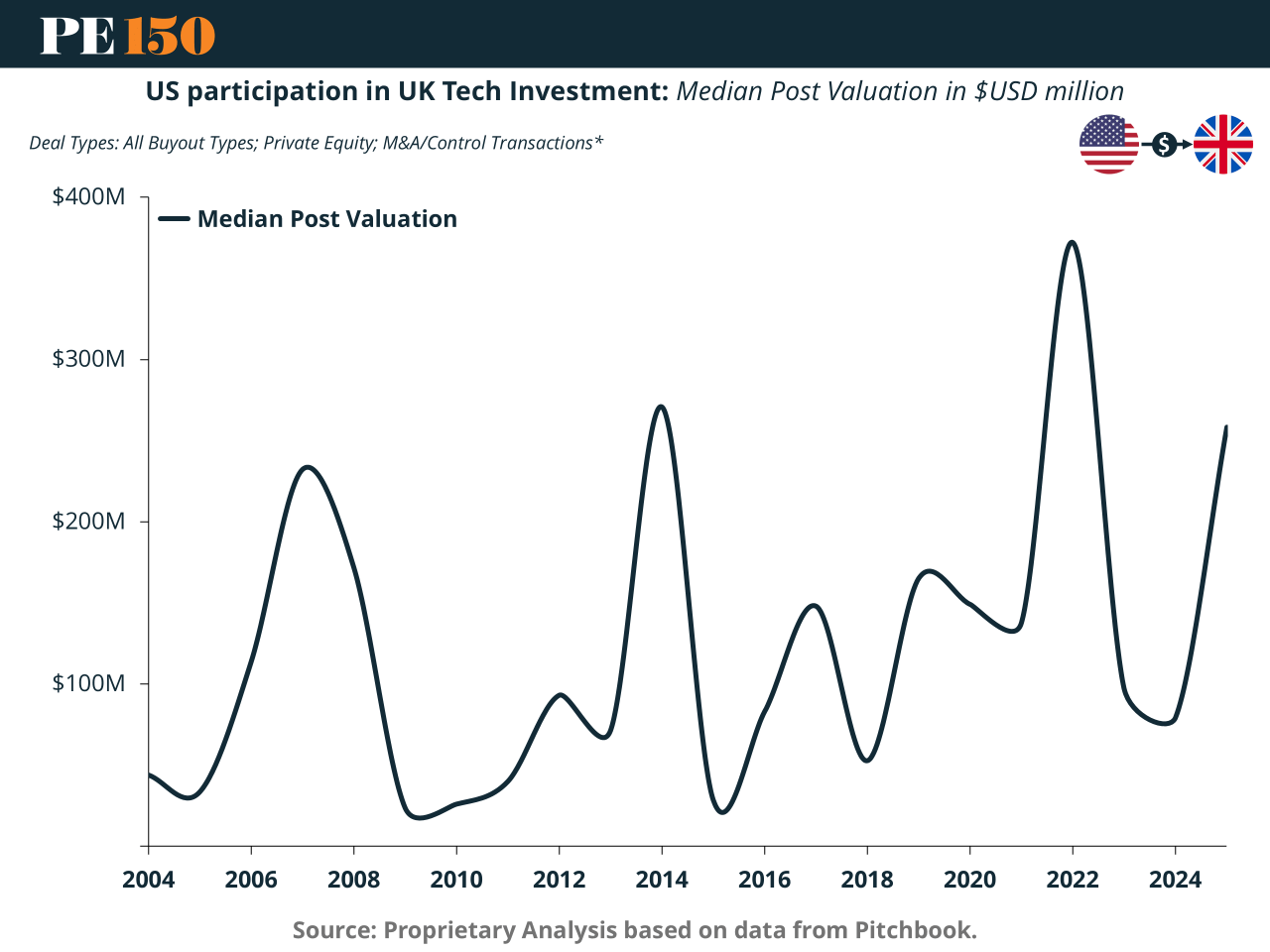

US-UK Deal: Techno-Soft Landing

The $42B US-UK “Tech Prosperity Deal” is less about AI supercomputers and more about macroeconomic tailwinds. With central banks easing rates, this mega-pact arrives just as the cost of capital drops—a rare alignment of geopolitics and monetary policy. Think of it as QE for quantum infrastructure. If the Fed and BoE stay dovish, expect cross-border M&A to accelerate, especially in AI, biotech, and civil nuclear energy. A “soft landing” used to be a macroeconomic pipedream. Now? It’s the potential launchpad for transatlantic PE expansion. (More)

COMPLIANCE CORNER

AI Meets IFRS: Compliance Just Got Smarter

As IFRS reporting grows more complex, especially for multinational portfolio companies, compliance is no longer just a checklist — it’s a risk vector. Enter AI.

From automating data collection to scanning unstructured contracts with NLP, AI is now helping finance teams preempt errors and flag noncompliance before the auditors do. Tools with real-time analytics and predictive monitoring are already streamlining year-end processes, reducing manual work, and tightening controls across reporting cycles.

Why it matters for PE:

For sponsors managing cross-border assets, inconsistent reporting can sink exit timelines or spark regulatory scrutiny. AI-driven financial systems help ensure standardized, audit-ready IFRS compliance, especially during M&A, carve-outs, or IPO prep.

But there’s a catch: AI introduces its own risks (e.g., model bias, opaque logic), so firms need governance frameworks that match the tech’s power.

Bottom line:

Compliance is no longer about keeping up — it’s about automating ahead. Firms that embed AI into reporting workflows today will likely face fewer surprises tomorrow. (More)

TOGETHER WITH FISHER INVESTMENTS

Retirement Planning Made Easy

Building a retirement plan can be tricky— with so many considerations it’s hard to know where to start. That’s why we’ve put together The 15-Minute Retirement Plan to help investors with $1 million+ create a path forward and navigate important financial decisions in retirement.

THIS WEEK IN HISTORY

WaMu's Collapse: The Day Liquidity Died

September 25, 2008 — U.S. regulators seized Washington Mutual, then the largest savings-and-loan in the country with $307B in assets, and sold its banking unit to JPMorgan for just $1.9B. It remains the largest bank failure in U.S. history.

The trigger? A 10-day, $16B depositor run. The cause? A perfect storm of subprime exposure, mispriced risk, and a buyerless market. WaMu was technically solvent — but in 2008, liquidity was the game, not capital.

Why it matters:

For PE investors building platforms in financial services, this collapse is a cautionary tale: market confidence is the real asset. In a crunch, speed and access to liquidity — not just asset quality — determine survival. Just ask the new wave of private credit lenders and bank-alternative platforms: the ghosts of WaMu are very much alive. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

Tech Private Equity ignored Europe for a decade.

Now 13,000+ software companies are waiting.

This is the next buyout frontier

Thread

— The Icahnist (@TheIcahnist)

5:12 PM • Sep 20, 2025

"You don't need to be a genius or a visionary or even a college graduate to be successful. You just need a framework and a dream."

Michael Dell