- PE 150

- Posts

- Transatlantic Tech Alliance: The $42 Billion US-UK Tech Prosperity Deal and the Road Ahead

Transatlantic Tech Alliance: The $42 Billion US-UK Tech Prosperity Deal and the Road Ahead

The United States and the United Kingdom have taken their most ambitious step yet toward cementing a transatlantic technology alliance

The recently signed $42 billion “Tech Prosperity Deal”, announced during US President Donald Trump’s state visit to London and endorsed by Prime Minister Keir Starmer, represents not only the largest single wave of US tech investment in the UK but also a strategic attempt to reshape the global innovation landscape.

The pact includes headline commitments from Microsoft ($30 billion), Google/Alphabet ($5.9 billion), and Nvidia with its massive AI chip deployment. It builds on an already deep flow of venture capital, private equity, and corporate investment across the Atlantic, while adding layers of policy coordination around AI, nuclear energy, and quantum technologies. Beyond the immediate funding, the deal could trigger a new cycle of deal-making if central banks—the Federal Reserve and the Bank of England—continue to ease interest rates into 2025, enabling a so-called “soft landing.”

A Landmark Deal for Technology and Energy

The deal, enshrined in a Memorandum of Understanding (MOU) between Washington and London, goes beyond capital commitments. It establishes a framework for long-term cooperation in AI, nuclear energy, and quantum technologies. The language of the MOU emphasizes a “next Golden Age of Innovation,” with joint programs across government agencies such as the US Department of Energy, National Science Foundation, UK Research and Innovation, and others.

Key pillars include:

AI Infrastructure: Building AI supercomputers, sharing compute access, and fostering joint research in biotech, medicine, and space applications.

Civil Nuclear Energy: Coordinating reactor licensing, advancing advanced fuels, and aiming for independence from Russian nuclear supplies by 2028.

Quantum Cooperation: Launching joint benchmarking, coding challenges, and industry exchange programs.

Frontier Technologies: Aligning research security, 6G telecommunications development, and cybersecurity standards.

The MOU also creates a ministerial-level working group, ensuring annual assessments to keep the collaboration aligned with shifting market and geopolitical dynamics.

Microsoft, Nvidia, Google, and Beyond

At the corporate level, the commitments are staggering. Microsoft alone pledged $30 billion to create the UK’s largest AI supercomputer in collaboration with OpenAI and Nscale, marking a cornerstone of the Stargate project. Satya Nadella positioned this as part of ensuring America remains “a trusted partner” for Britain in technological leadership.

Nvidia committed to deploying 120,000 GPUs, with further plans for 60,000 Grace Blackwell Ultra chips, providing a backbone for the UK’s AI infrastructure. As Nvidia’s David Hogan said, this would make the UK “an AI maker, not an AI taker.”

Google’s $6.8 billion investment in new data centers at Waltham Cross, alongside its continued support through DeepMind, bolsters cloud resilience. CoreWeave added $2 billion in scalable, energy-efficient data facilities. Other firms, from Salesforce to Amazon Web Services, pledged further complementary capital, ensuring the deal spans both cloud and enterprise applications.

Venture Capital and Private Equity: A Deepening US Footprint

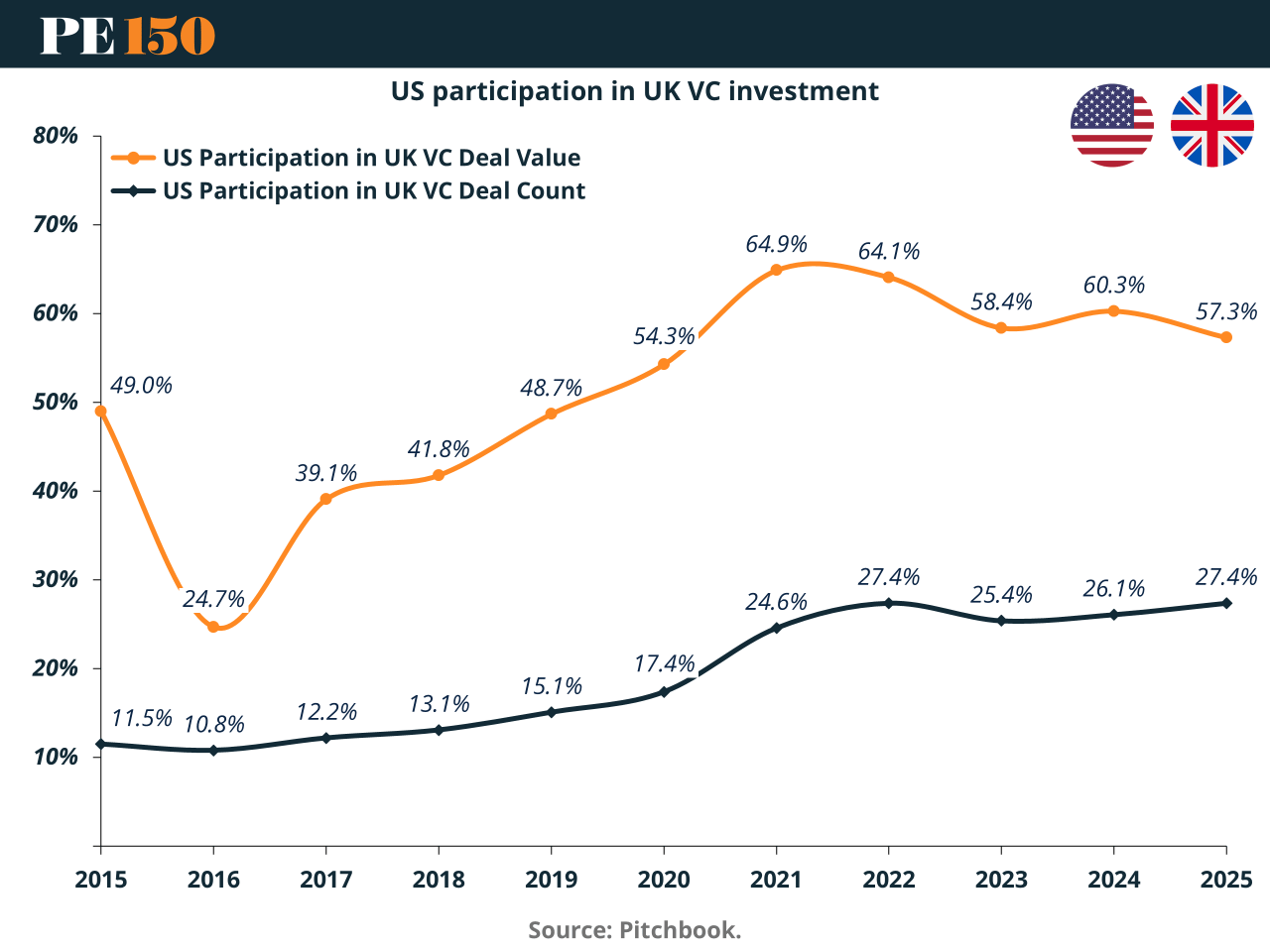

This surge of corporate commitments reflects a longer-term pattern: growing US participation in UK venture capital and private equity deals. According to PitchBook data, US investors were present in 27.4% of all UK VC rounds in 2025, consistent with recent years and a testament to the embedded role of American capital in British innovation.

The data shows US involvement in UK VC deals rising sharply from just 10–15% in 2015 to nearly 30% by 2025 in deal count, with deal value consistently higher, hovering between 50–65% in recent years. This underscores how American investors have been disproportionately influential in larger, more capital-intensive UK deals, especially in AI, fintech, and deep tech.

Private equity tells a similar story. US participation in UK PE deals has climbed steadily, from 20.5% of total deal count in 2017 to over 31% by mid-2025, the highest in Europe. This shift brings both liquidity and competition to British markets, boosting valuations and accelerating deal cycles.

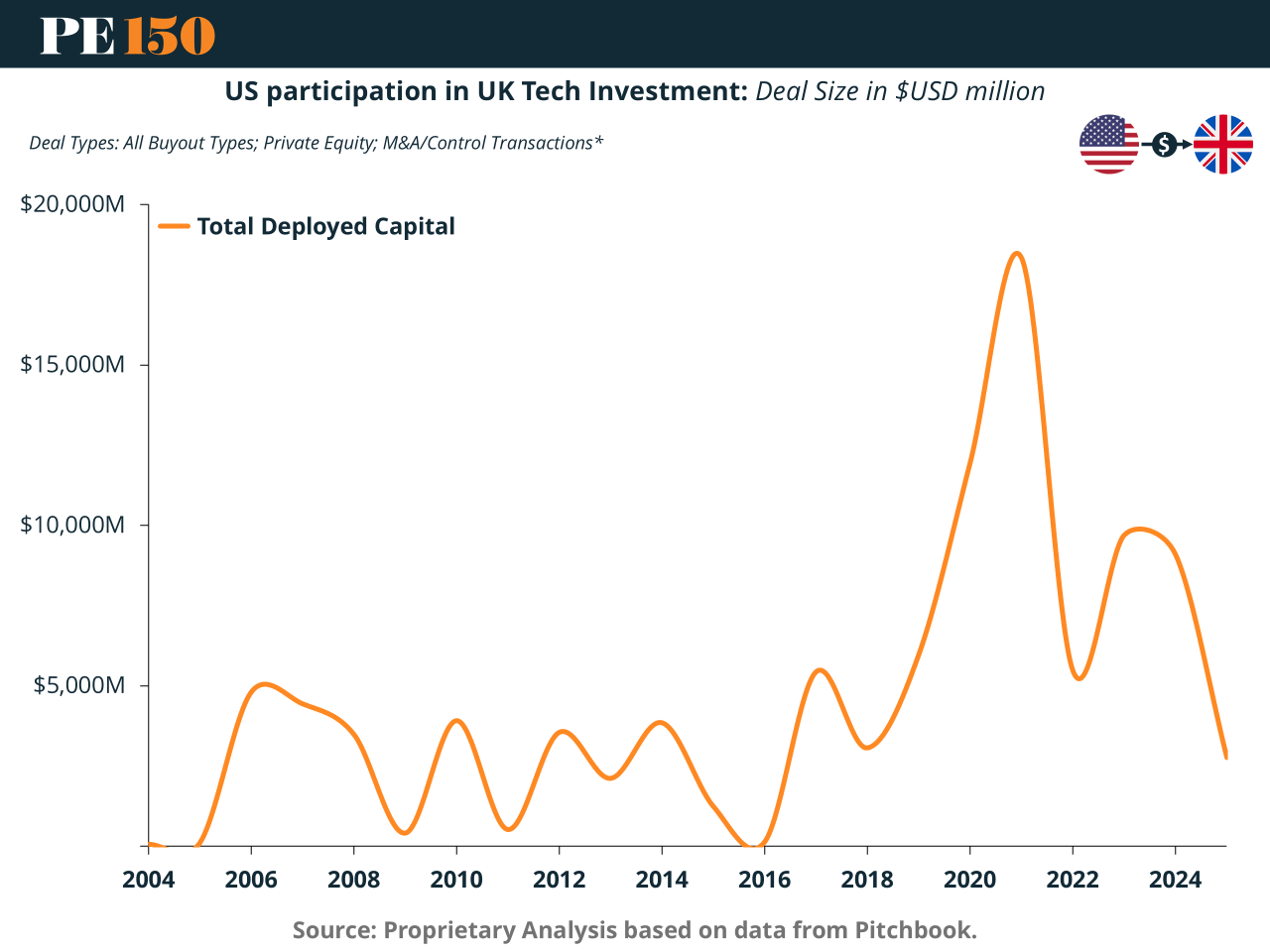

Deployed Capital: US into UK Tech

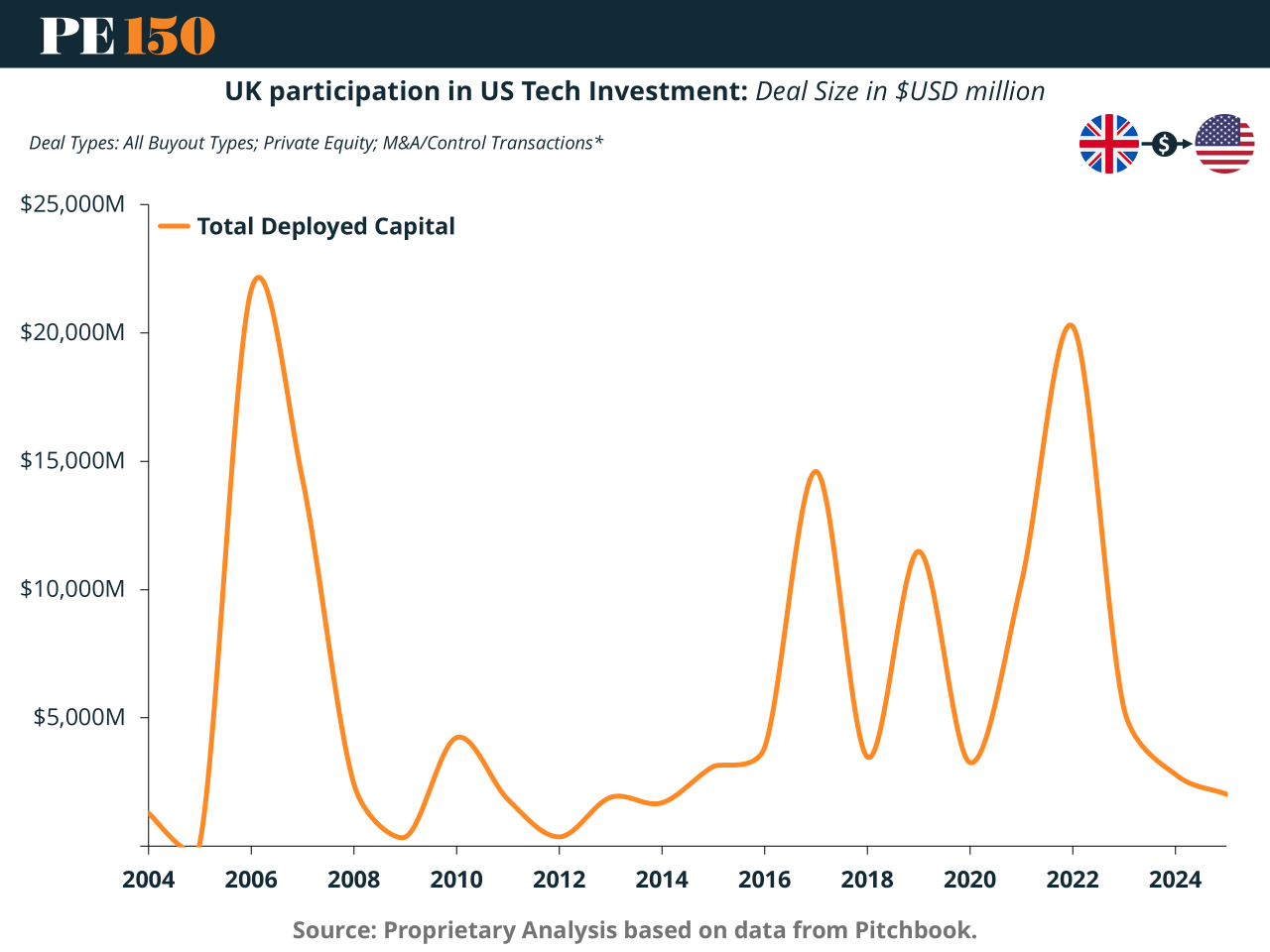

The flows of deployed capital from the US into the UK Tech space have shown cyclical peaks. Notably, deal size surged past $20 billion annually during the late 2010s, reflecting mega-deals in cloud, software, and biotech. The latest deal signals another upturn.

The chart illustrates sharp spikes in 2018–2020, followed by a slowdown, and then a rebound in 2023–2024. The $42 billion Tech Prosperity Deal is poised to reset the trendline upward, potentially returning deployed capital toward earlier peaks if favorable financing conditions persist.

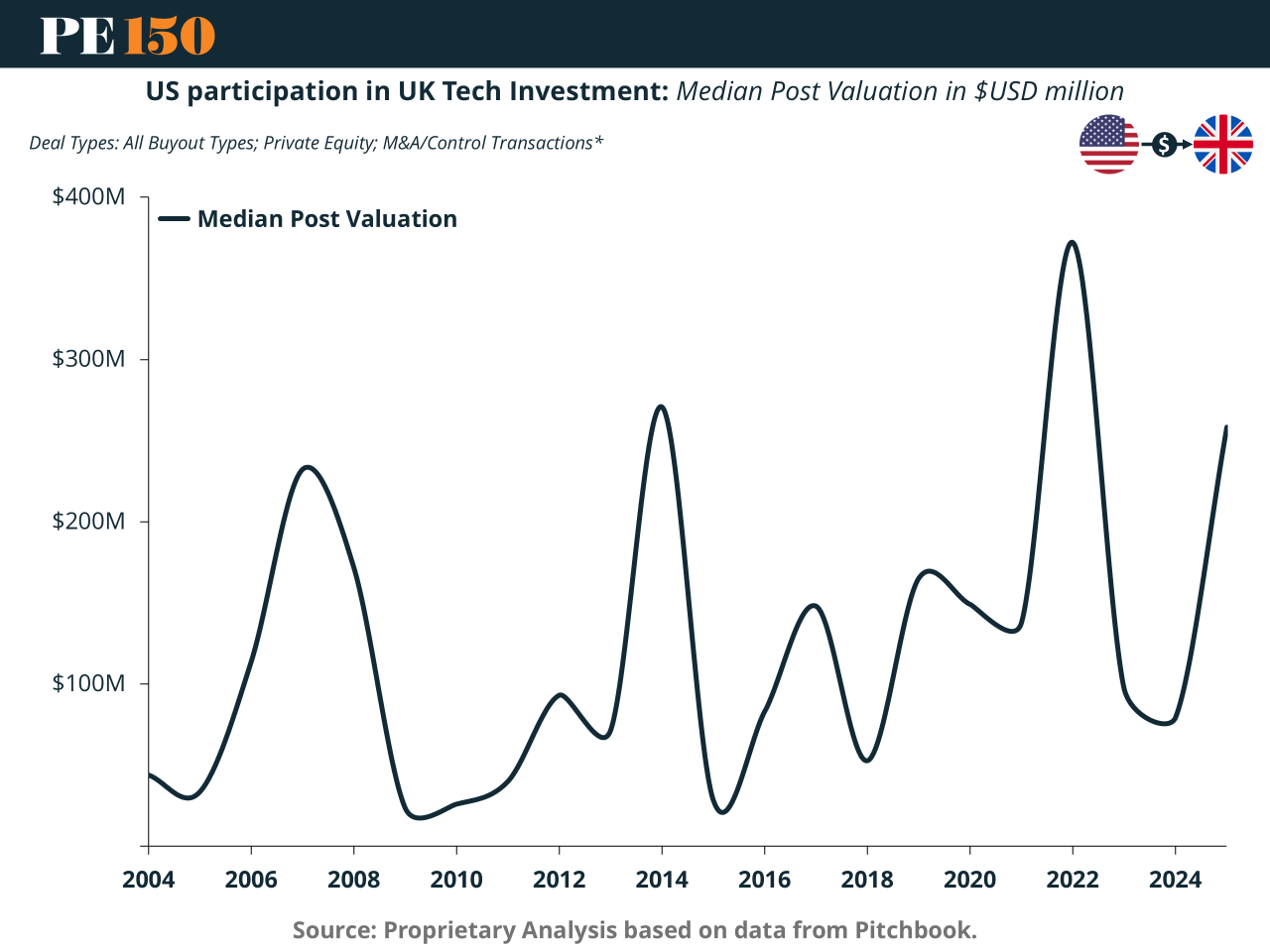

Rising Valuations

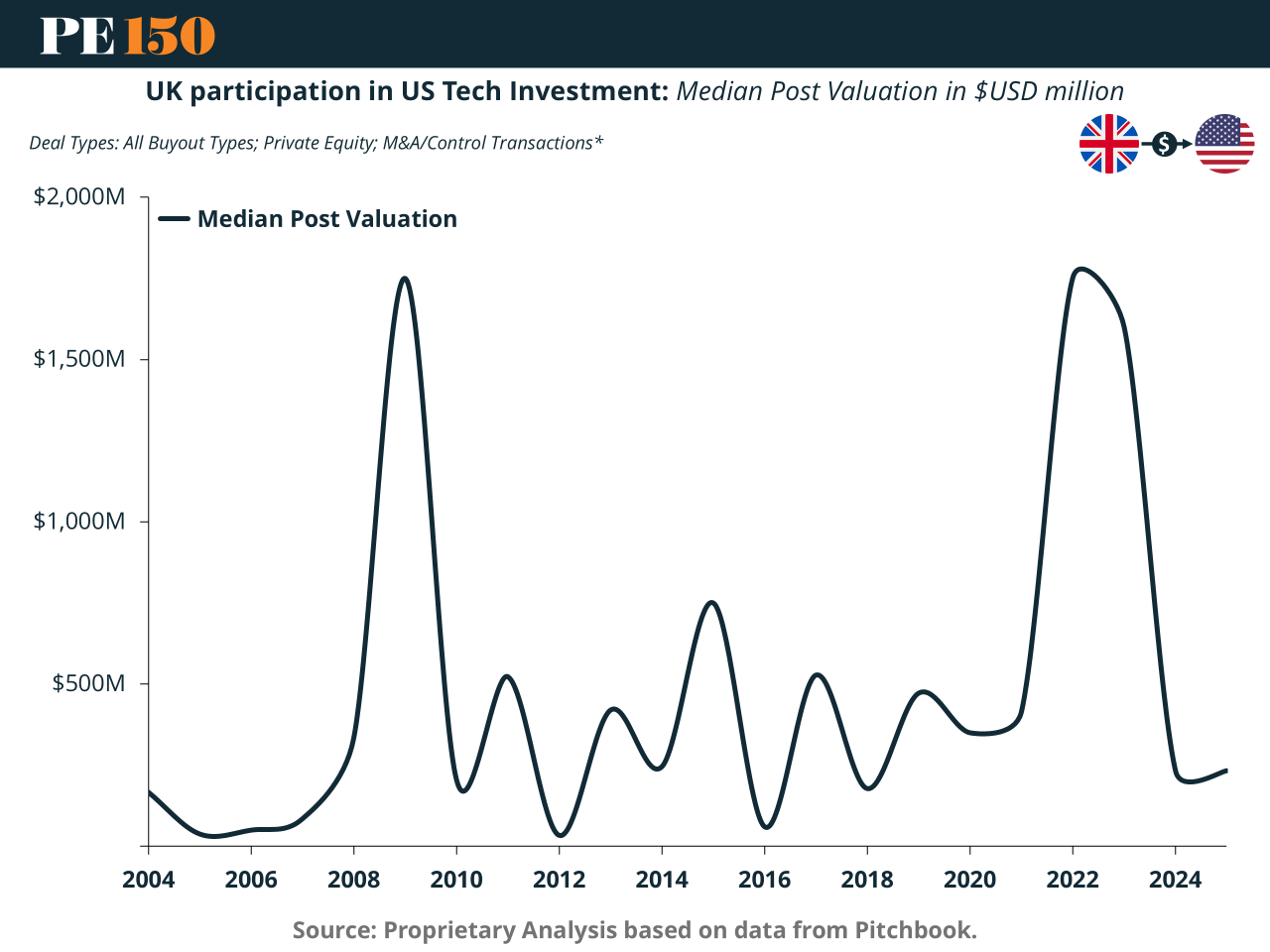

A second clear impact is on valuations. Median post-deal valuations for US participation in UK Tech investments have climbed steadily, hitting new highs above $300 million in certain years.

This valuation inflation reflects the intensity of US-driven bidding and capital availability. The 2025 deal wave will likely add further upward pressure, particularly for AI, data infrastructure, and biotech startups.

The Reverse Flow: UK Capital into the US

While the narrative has often focused on US capital flooding the UK, there is also meaningful UK outbound investment into the US Tech ecosystem.

UK firms have periodically deployed between $5–25 billion annually into the US, often targeting biotech, fintech, and energy. However, these flows have been more volatile, spiking in 2006, 2017, and 2021, before cooling again. With UK-based private equity giants such as Blackstone planning £90 billion in UK allocations alongside US plays, future flows may balance out.

UK Investors Face Valuation Pressures in the US

Median post valuations for UK investors in the US market are far higher than what American investors face in the UK.

The chart shows UK investors often paying $1 billion-plus median valuations, peaking near $2 billion in 2009 and 2022. This reflects the premium of competing in the world’s deepest tech ecosystem. Whether UK investors can capture equivalent returns depends on both deal selection and macroeconomic conditions.

Macroeconomic Tailwinds: Interest Rates and the Prospect of a Soft Landing

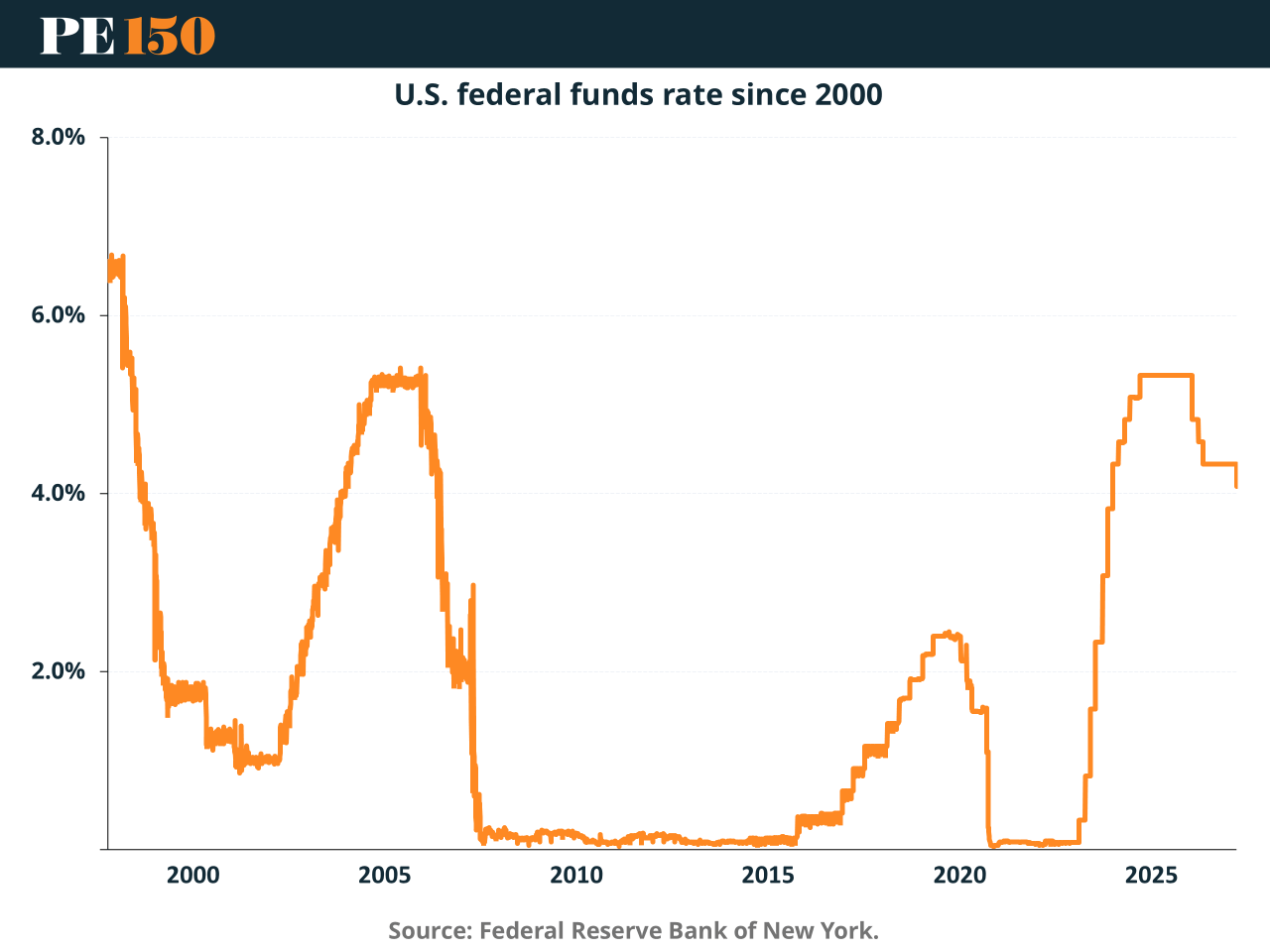

The broader context for this transatlantic tech surge is monetary policy. Both the Federal Reserve and the Bank of England have shifted toward easing after years of rate hikes. Inflationary pressures have cooled, while growth remains steady, raising hopes for a “soft landing”—a slowdown without recession.

Lower interest rates mean cheaper financing, higher valuations, and renewed appetite for cross-border dealmaking. For US investors, it makes scaling into the UK’s AI and data infrastructure plays even more attractive. For UK investors, it improves the economics of participating in high-valuation US rounds.

If this easing continues, several pipeline opportunities could open:

AI Infrastructure Scaling: Expansions beyond London into Manchester, Cambridge, and Scotland, supported by Nvidia and CoreWeave facilities.

Quantum Commercialization: Joint ventures in quantum software for healthcare and finance, building on the transatlantic Quantum Code Challenge.

Civil Nuclear Projects: Co-financing of advanced reactors and fusion energy testbeds, with streamlined licensing promising faster deployment.

Biotech Collaborations: Expanded joint funding for AI-driven drug discovery, particularly as AstraZeneca and GSK recalibrate investment strategies.

6G Telecommunications: Early partnerships in telecom standards could drive industrial-scale deals once private capital flows into infrastructure.

Challenges and Criticisms

Not everyone is convinced. Critics like Nick Clegg have warned of the UK becoming overly dependent on US tech infrastructure. Pharmaceutical firms have also expressed frustration with the UK’s business climate, with Merck and AstraZeneca pausing or redirecting investments. Domestic job creation projections—7,600 jobs from the deal—are positive but modest compared to overall payroll declines.

The central tension is whether this deal helps the UK generate homegrown champions or locks it into hosting the platforms of others. For now, the optimism outweighs the skepticism, but policymakers will need to balance openness with national capacity building.

Conclusion: Toward a Transatlantic Tech Century?

The $42 billion Tech Prosperity Deal is more than just capital. It’s a statement: the US and UK intend to lead the next wave of innovation together, across AI, nuclear, quantum, and digital infrastructure. With macroeconomic winds shifting toward cheaper capital, the deal may spark a sustained surge in cross-border transactions.

The UK gains a revitalized reputation as Europe’s tech hub; the US secures a trusted Atlantic partner at a time of rising competition with China and the EU. The future pipeline—from quantum breakthroughs to civil nuclear applications—suggests this is not the last major deal we’ll see. If the soft landing materializes, it could be just the beginning of a new era of transatlantic tech hegemony.

Sources & References

BBC. (2025). US firms pledge £150bn investment in UK as tech deal signed. https://www.bbc.com/news/articles/cx2nllgl3q7o

Pitchbook. (2025). $42B US-UK pact offers ‘shot in the arm’ for British tech. https://pitchbook.com/news/articles/42b-us-uk-pact-offers-shot-in-the-arm-for-british-tech

Technology Magazine. (2025). Can a US$42bn US-UK Tech Deal Reshape AI and Energy? https://technologymagazine.com/news/uk-us-sign-us-42bn-tech-pact-to-boost-ai-and-cloud

The White House. (2025). MEMORANDUM OF UNDERSTANDING BETWEEN THE GOVERNMENT OF THE UNITED STATES OF AMERICA AND THE GOVERNMENT OF THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND REGARDING THE TECHNOLOGY PROSPERITY DEAL. https://www.whitehouse.gov/presidential-actions/2025/09/memorandum-of-understanding-between-the-government-of-the-united-states-of-america-and-the-government-of-the-united-kingdom-of-great-britain-and-northern-ireland-regarding-the-technology-prosperity-de/