- PE 150

- Posts

- Private Equity Opportunities in a $1.8 Trillion Market Defined by Capital Scarcity, Selective Risk-Taking, and Structural Bottlenecks

Private Equity Opportunities in a $1.8 Trillion Market Defined by Capital Scarcity, Selective Risk-Taking, and Structural Bottlenecks

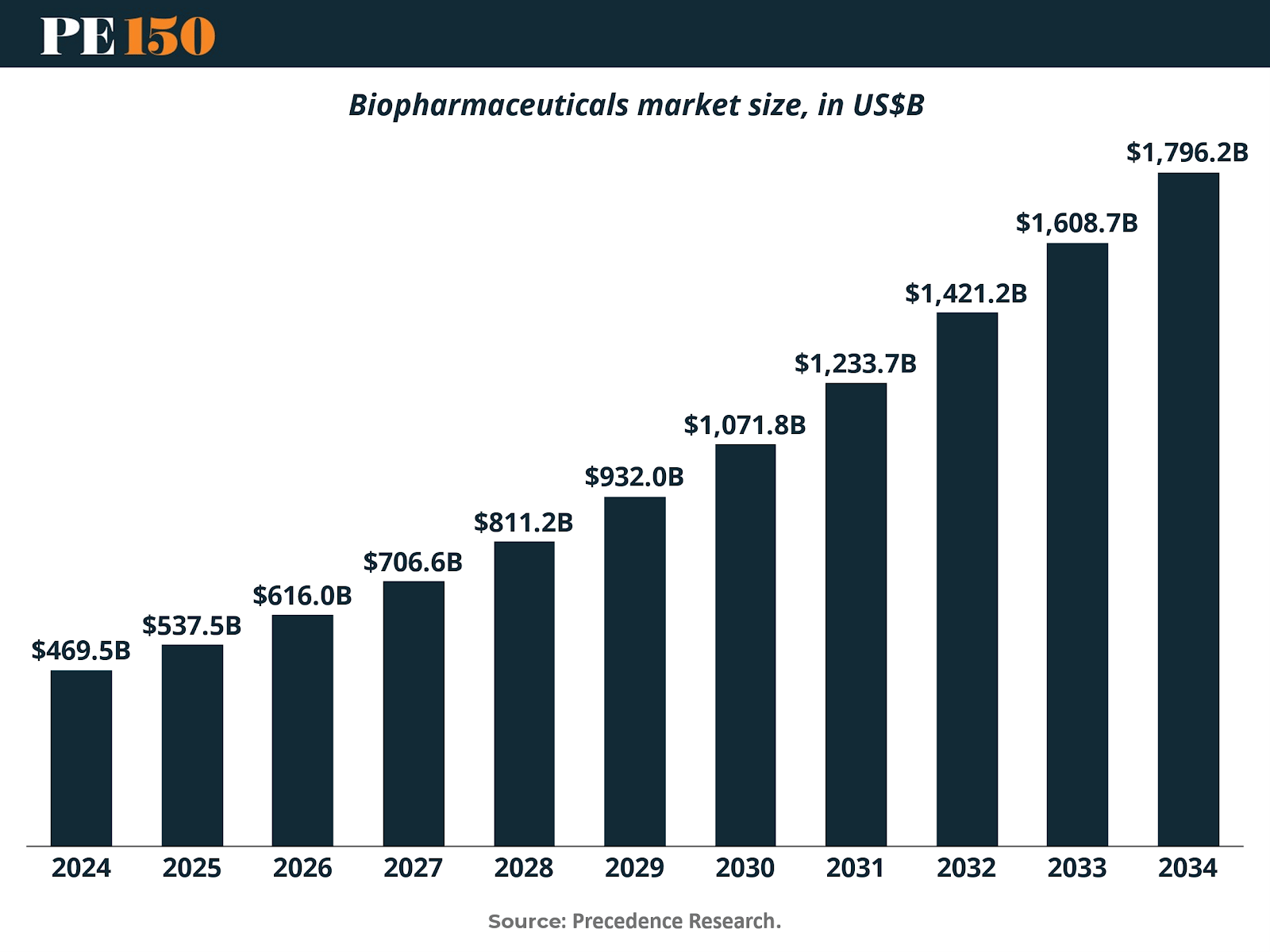

The global biopharmaceuticals market is on track to expand from $469 billion in 2024 to nearly $1.8 trillion by 2034, compounding at 14% annually.

Introduction

For private equity and growth investors, this surge represents not only one of the fastest-growing healthcare segments but also a market where capital scarcity, valuation resets, and structural bottlenecks are opening new entry points.

The expansion is driven by demographic tailwinds—aging populations and rising demand for high-efficacy treatments—combined with scientific breakthroughs in monoclonal antibodies, cell and gene therapies, and AI-enabled discovery platforms. Oncology remains the largest therapeutic area, but neurology, autoimmune, and metabolic disorders are rapidly scaling, creating a wider funnel of investable targets.

North America still dominates, capturing 46% of global revenue in 2024 thanks to deep R&D ecosystems and mature capital markets, yet emerging biotech hubs in Asia and Europe are drawing increasing investor attention. Importantly, the capital cycle has shifted: after two years of retrenchment, financing is rebounding, but in a more selective, disciplined manner. Platform companies with differentiated technology stacks and clinical proof points are attracting mega-rounds, while early- and mid-stage firms face capital rationing—conditions that favor consolidation, secondary transactions, and creative capital structures.

For private equity, this is not just a rebound in biotech. It is a reinvention of the investment landscape—one where speed, precision, and capital discipline are becoming as important as scientific risk.

Biopharma First-Funding in the US and Europe: A Partial Recovery Marked by Concentration Risk

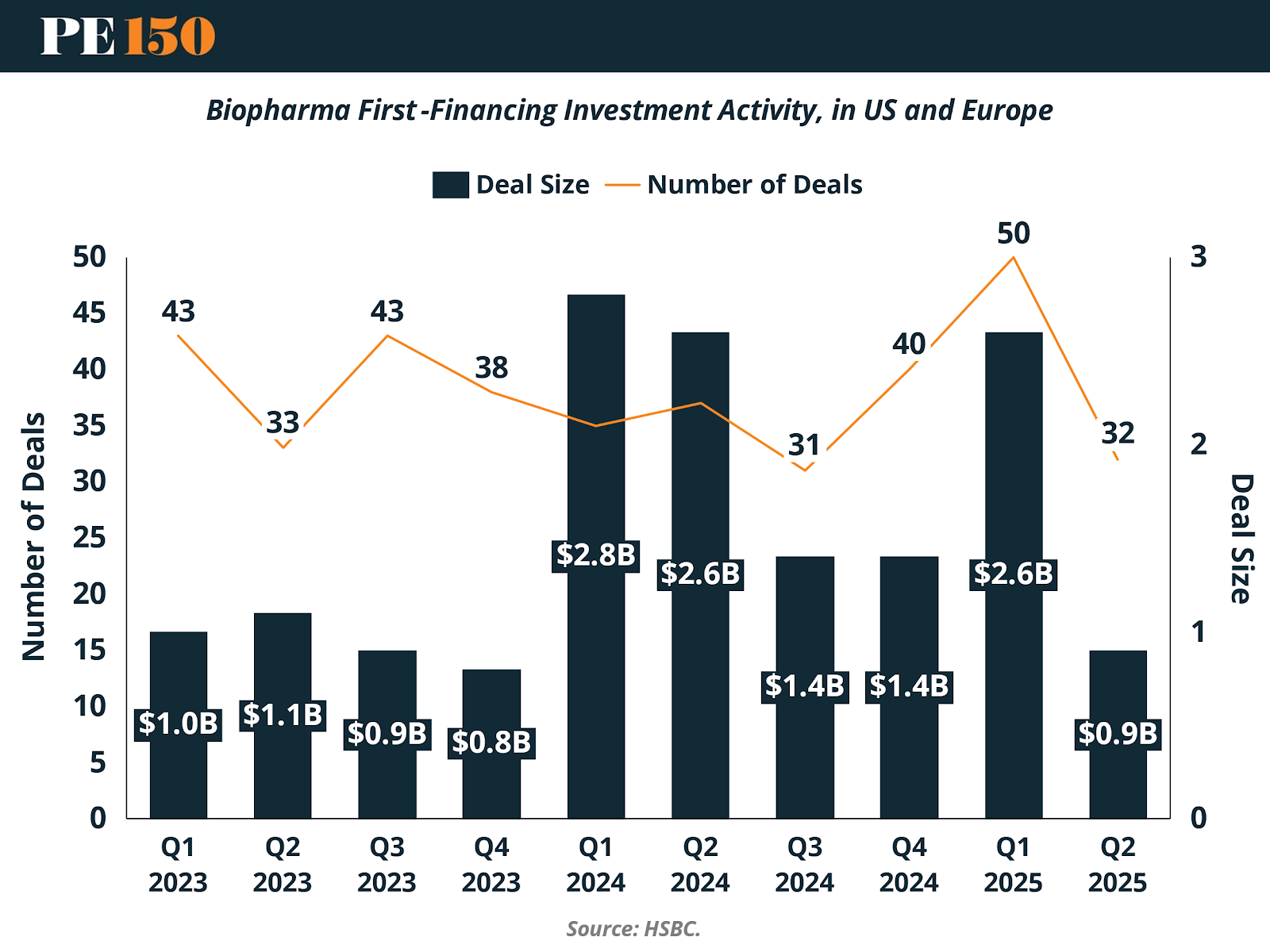

After two years of contraction, biopharma venture funding in the US and Europe began to rebound in 2024, with first financings reaching $8.2 billion across 143 deals. For investors, this marks a shift in sentiment toward early-stage science, especially in capital-intensive platform companies. But while the headline points to recovery, capital is flowing in a highly concentrated and selective manner.

In Q1 2025, momentum was strong: several high-profile rounds and the re-entry of crossover investors pushed six financings above $100 million, absorbing 73% of all capital deployed. The standout was Isomorphic Labs’ $579 million raise, a deal that underscored the premium investors are willing to place on AI-driven drug discovery and scalable R&D infrastructure.

That optimism faded quickly in Q2 2025, when deal volume dropped to 32 transactions and first financings fell to $900 million, the lowest in over a year. Rising interest rates and equity market volatility pressured dealmaking, forcing investors to retreat to safer ground.

The more important development is a structural reallocation of capital:

Later-stage, well-networked companies are absorbing the bulk of funding, while seed and emerging platforms face rationing.

Many sub-$50 million raises in H1 2025 were insider-led, with minimal new institutional participation.

Capital discipline is now the norm, with investors concentrating on companies viewed as IPO-ready or closer to commercialization.

For private equity and growth investors, this bifurcation presents both risk and opportunity. The narrowing of early-stage funding could compress the innovation funnel, but it also creates entry points for investors able to provide:

Alternative financing structures (convertibles, structured equity, continuation funds).

Secondary transactions, as early backers seek liquidity in an illiquid market.

Roll-up or consolidation strategies targeting underfunded but differentiated platform companies.

While the US and European ecosystems show signs of stabilization, the concentration of capital is reshaping deal dynamics. For PE investors, the environment is less about chasing broad recovery and more about exploiting capital scarcity, identifying assets priced below replacement cost, and structuring deals to capture dislocation-driven upside.

Diverging Investment Patterns: Indication-Specific Flows and the Rise of Mega Rounds

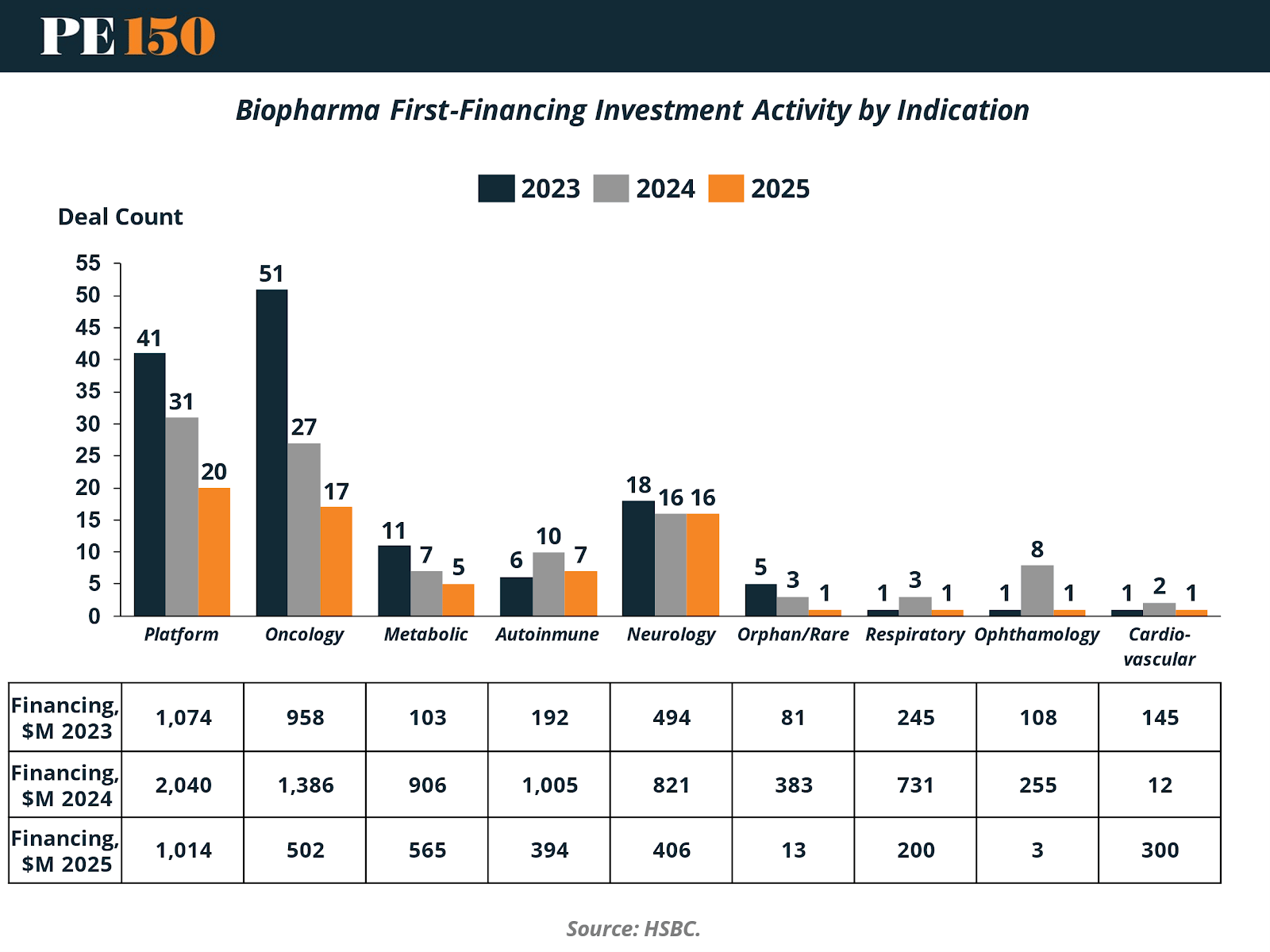

While aggregate biopharma financing in the US and Europe shows signs of recovery, capital deployment by therapeutic area reveals a more uneven picture—one marked by concentration, selectivity, and bifurcated risk-taking. For investors, the data underscores both the durability of certain indications and the potential openings created by areas currently out of favor.

Oncology, long the anchor of biotech VC, has seen a sharp pullback: first financings dropped from $1.39 billion in 2024 to just $502 million in 1H 2025. Similarly, the broad Platform category contracted from $2.04 billion to $1.01 billion over the same period. Importantly, a handful of large rounds—Callio, Antares, and Pheast—absorbed most of the oncology capital, while the majority of new companies raised sub-$12 million financings. The result is a high bar for new entrants and a funding gap that could open the door for strategic consolidation or secondary entry points.

By contrast, autoimmune, metabolic, and select neurology segments have become hotspots for capital. Autoimmune startups raised $394 million across seven deals, while metabolic companies secured $565 million across five financings. These are small in count but large in size, signaling concentrated investor conviction in science with clearer commercial pathways and reimbursement prospects. For PE investors, these areas reflect premium-priced growth opportunities, but also a narrow syndicate that may limit broader participation.

At the other end of the spectrum, seed-stage deals rebounded, with 42 financings in 1H 2025, up from 32 in all of 2024. Median deal size held at $5 million, underscoring continued discipline and milestone-driven investing. Investors are backing experienced teams and indications with clearer regulatory visibility, but the capital intensity of scaling beyond seed remains a challenge—one where growth equity and structured capital could step in.

Strategic implications for investors:

Mega rounds are sustaining late-stage momentum, but risk concentrating value creation in a shrinking pool of companies.

Seed-stage science is showing resilience but remains undercapitalized relative to long-term development needs.

Underfunded segments such as respiratory and ophthalmology represent potential mispricings, where capital scarcity may create attractive entry points.

Valuations and deal sizes reflect a disciplined market, which tempers risk but also constrains scaling—opening space for investors with patient or flexible capital structures.

In short, the first half of 2025 illustrates a market defined by selective risk-taking and concentration. For private equity, the opportunity lies not only in following the momentum of mega rounds, but also in targeting capital-starved indications and deploying creative financing solutions where traditional venture funding is pulling back.

Biopharma Investment Activity (All Deals): Fast Start, But Cracks Emerge in 2025

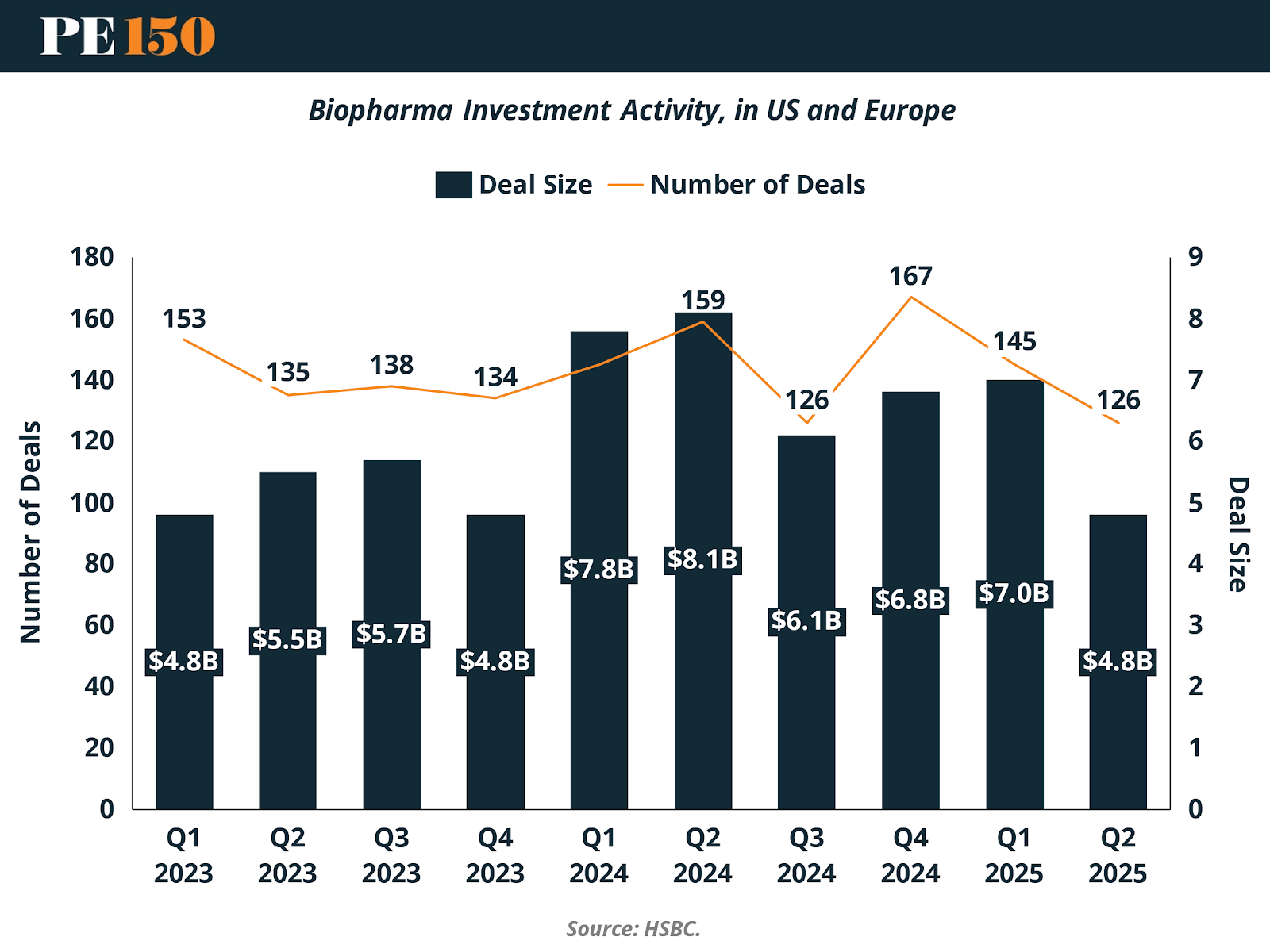

While early-stage biopharma funding showed a mixed recovery through the first half of 2025, the broader investment picture across all deal stages in the US and Europe reveals an even more volatile narrative. Total private venture-backed biopharma investment reached $11.8 billion across 271 deals in 1H 2025, putting the year on track to fall below 2024’s $28.7 billion and 597-deal total. This pullback reflects a bifurcated environment where strong Q1 enthusiasm gave way to a steep Q2 slowdown.

The first quarter of 2025 saw $7.0 billion deployed across 145 deals—fueled by 21 mega-round financings ($100M+), above the average quarterly pace in 2024. High-profile transactions like Isomorphic Labs' $579 million raise exemplified investor willingness to bet big on differentiated platforms, particularly those aligned with AI and advanced drug discovery infrastructure. However, this momentum proved unsustainable.

In Q2, funding plummeted to $4.8 billion across just 126 deals—marking the lowest quarterly deal volume in three years. The number of mega rounds dropped to just 16. Investors grew more cautious in the face of rising interest rates, persistent macroeconomic uncertainty, and a thinning IPO/M&A pipeline. Private companies reliant on extended insider rounds began facing harder realities, including cost-cutting measures and layoffs. This weakness has begun to ripple into mid-cap and clinical-stage public biopharma names, suggesting systemic constraints beyond just early-stage capital.

A closer look also reveals a potential overhang from mezzanine and crossover investments made in 2022–2023. Approximately 45 companies that raised large pre-IPO rounds during that time may now struggle to secure follow-on funding, particularly as crossover and hedge funds pull back. Many of these companies remain private and are consuming cash rapidly, raising the risk of shutdowns, consolidations, or distressed exits.

Strategic Signals from the Broader Market:

Insider-led financing rounds are becoming the norm as external capital retreats, limiting valuation growth and optionality.

Late-stage crowding is increasing capital density in a small set of known names, leaving others behind.

Extended timelines to exit are reshaping the fundraising calculus for both founders and investors, making capital efficiency and milestone clarity more critical than ever.

While the early months of 2025 suggested a durable return of investor confidence, the subsequent pullback highlights the fragility of the recovery. The second half of the year now looks increasingly uncertain—particularly for companies outside the mega-round spotlight. Whether this marks a healthy reset or the beginning of a more protracted capital constraint phase will depend on macro conditions and the ability of the sector to deliver on clinical and commercial milestones.

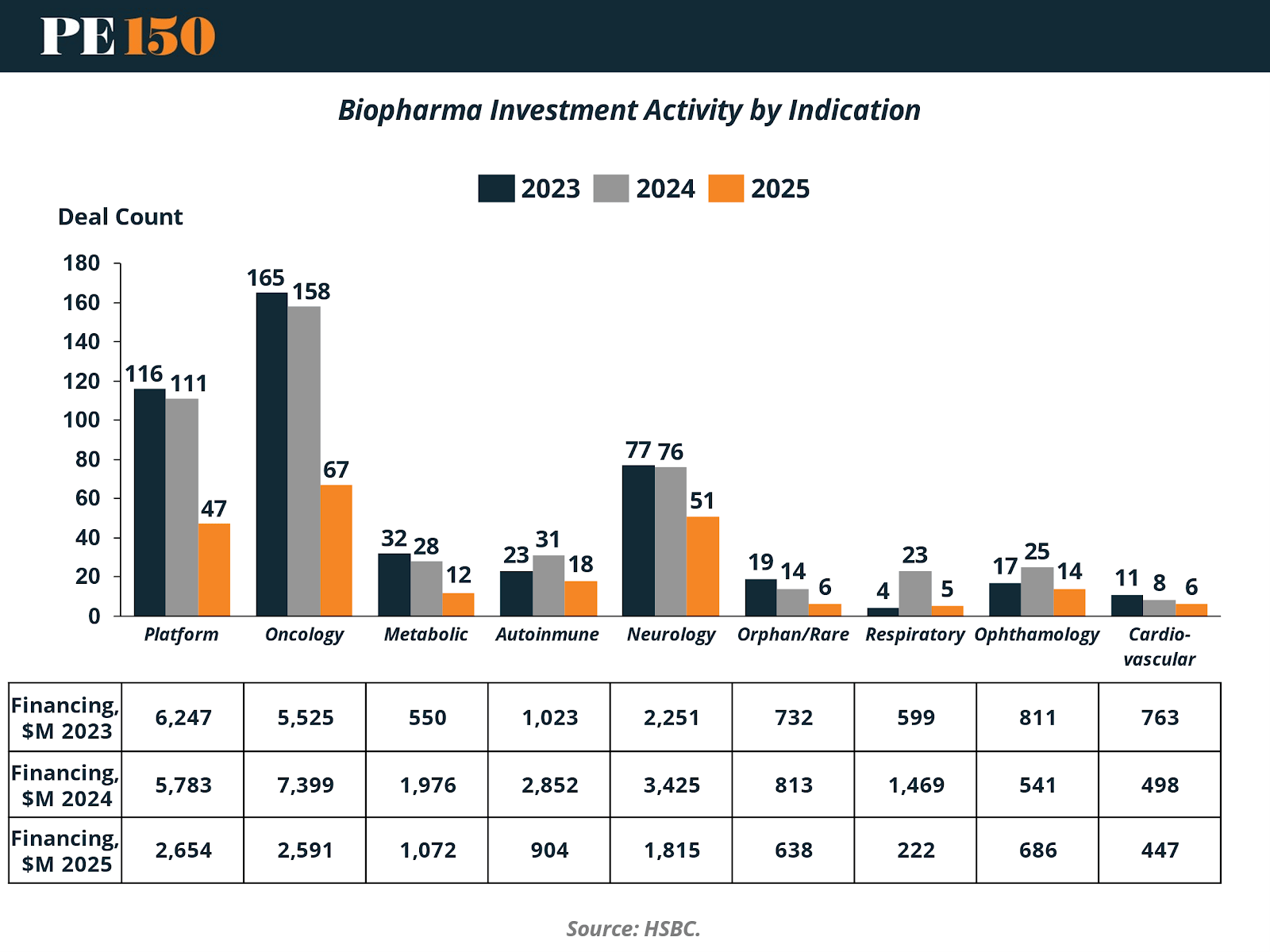

Indication Trends Show Fragmented but Focused Investment Landscape

An analysis of biopharma investment by indication across the US and Europe in 2023–1H 2025 reveals a fragmented but increasingly strategic deployment of capital. While overall deal activity has slowed, investors are continuing to prioritize high-conviction areas, especially those with late-stage clinical visibility or platform potential in underpenetrated diseases.

The sharpest pullback occurred in Oncology, historically the sector’s funding magnet. After reaching $7.4 billion in 2024, oncology investment fell to $2.6 billion in the first half of 2025. This mirrors the trend seen in first financings and reflects growing caution around first-line assets, crowded pipelines, and geopolitical uncertainty, particularly around China-based platform players.

The Platform category also saw continued contraction, with investment dropping from $5.8 billion in 2024 to $2.7 billion in early 2025. While these companies once attracted broad venture interest for their technological breadth, many are now being reassessed for clinical translatability and capital intensity, especially in a slower exit environment.

By contrast, Autoimmune and Metabolic indications continued to attract large-scale investment, underscored by a series of $100M+ mega rounds. Metabolic companies raised $1.07 billion in 1H 2025, already more than 50% of 2024’s total. In autoimmune, despite a decline to $904 million, the presence of four $100M+ financings—including China-partnered and early-stage deals—speaks to continued enthusiasm for precision immunology.

Neurology and Ophthalmology emerged as breakout categories. Neurology investments reached $1.82 billion in 1H 2025, with the bulk flowing into late-stage clinical assets in neuropsychiatry. Meanwhile, Ophthalmology surpassed 2024’s total at midyear, led by mid- to late-stage trials in gene and cell therapy, and preclinical platform innovators like Character.

Lower levels of capital continue to challenge Respiratory and Cardiovascular indications. With just $222 million and $447 million raised respectively in 1H 2025, these areas remain underfunded despite growing patient needs and technological opportunities—risking long-term innovation blind spots.

In sum, the funding landscape reflects a refined investor focus: one that backs scaled innovation, rewards clinical traction, and remains cautious on broad platform narratives without near-term catalysts. This environment may accelerate development in favored indications but leaves early-stage science in many fields facing substantial capital headwinds.

Conclusion

The biopharmaceutical industry stands at the threshold of a new growth era—defined by scientific momentum, maturing global ecosystems, and rising demand for precision therapies. The projected fourfold increase in global market value over the next decade underscores the sector’s transformation into a cornerstone of modern healthcare innovation. Yet beneath this strong macro-outlook lies a more complex and uneven investment reality.

The rebound in venture funding—particularly in first financings—marks a tentative return of investor confidence, but one shaped by heightened selectivity and capital concentration. Mega rounds and late-stage platforms continue to capture substantial backing, especially in autoimmune, metabolic, and neurology indications. Meanwhile, oncology, respiratory, and cardiovascular are experiencing sharp pullbacks. Combined with the retreat of crossover investors and rising macroeconomic pressures, this environment is producing both capital scarcity and structural bottlenecks across much of the innovation pipeline.

For private equity, this duality creates a differentiated set of opportunities. Late-stage concentration favors investors with appetite for growth capital, continuation vehicles, and structured financings around proven platforms. At the same time, early-stage bottlenecks and underfunded indications offer attractive entry points for firms willing to provide bridge, consolidation, or expansion capital where venture funding is retreating.

In short, biopharma is not simply recovering—it is recalibrating. The path forward will favor investors who can balance financial discipline with visionary risk-taking, and who recognize that today’s overlooked segments may deliver tomorrow’s outsize returns.

Sources and References:

Biopharmaceuticals Market Size, Share, and Trends

HSBC - 2025 mid-year venture healthcare report

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|