- PE 150

- Posts

- Illiquidity and the Preservation of Wealth

Illiquidity and the Preservation of Wealth

Why Private Markets Protect Capital in a Headline-Driven World.

Executive Premise

Modern public markets are optimized for speed, not for truth. They are extraordinarily efficient at transmitting narratives, headlines, and signals—but far less effective at patiently weighing fundamentals as they unfold over time. This structural characteristic of liquidity creates a persistent risk for long-term investors: value can be destroyed or inflated rapidly through coordination and perception, even when underlying economics remain unchanged.

This report reframes volatility and mispricing not as behavioral accidents, but as predictable outcomes of game theory, asymmetric information, and forced mark-to-market dynamics. It then contrasts this fragility with the structural resilience of private markets, where illiquidity acts as a stabilizing force rather than a constraint.

The conclusion is deliberately uncomfortable for traditional asset allocation frameworks: illiquidity is not merely a risk to be managed—it is a premium that protects wealth.

Part I: Liquidity, Signals, and Coordination Failure

At the core of public market instability is not irrationality, but rational behavior under imperfect information.

Fundamentals always exist, but they are not directly observable. Investors infer reality through signals: prices, volumes, headlines, commentary, and peer behavior. Some participants are better informed than others, but all are constrained by what can be observed in real time.

When a public signal appears—whether accurate, noisy, or misleading—it becomes common knowledge. Everyone sees it. Everyone knows that everyone else sees it. From that moment, the signal’s informational content becomes less important than its coordination power.

In liquid markets, price itself becomes the message.

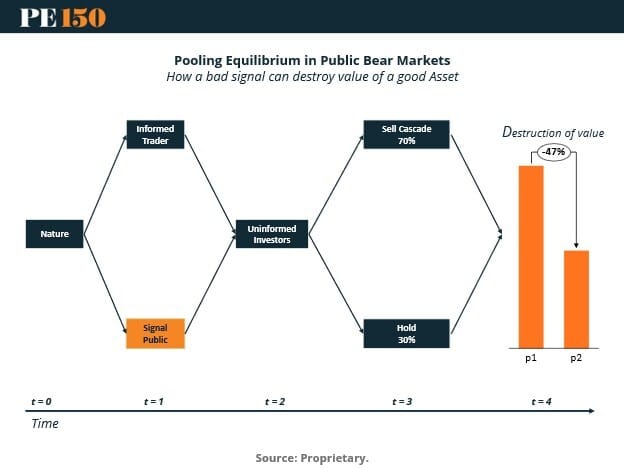

Uninformed investors cannot distinguish between selling driven by deteriorating fundamentals and selling driven by strategic or defensive behavior. Faced with that ambiguity, the rational response is not to debate intrinsic value, but to infer that others may know something they do not. This dynamic produces a pooling equilibrium, where good assets and bad assets generate identical observable behavior: selling.

Once selling reaches a critical mass, the equilibrium flips. Holding becomes irrational—not because fundamentals collapsed, but because coordination failed. Prices adjust sharply to reflect beliefs rather than cash flows. Value is destroyed or created long before reality has time to assert itself.

This is not chaos. It is structure.

Part II: Case Studies in Narrative Acceleration

The following cases illustrate the same mechanism operating across different sectors, geographies, and narratives. The order is intentional: from the most widely held and institutionally owned assets to the most extreme expression of narrative-driven pricing.

Case 1: Credit Card Stocks and the Cost of Political Language

Public comments about capping credit card interest rates triggered a broad sell-off across lenders and payment networks. The price action implied that a binding, enforceable regulatory regime had arrived overnight.

In reality, no legislation existed. No regulatory framework had been drafted. No implementation timeline had begun.

Credit card economics are complex and adaptive. Even under restrictive regulation, industry responses would occur over years through repricing, product changes, credit tightening, and cost restructuring. Cash flows would adjust gradually, not instantaneously.

But liquid markets do not price timelines—they price possibilities. Words were treated as laws. Potential futures were collapsed into present valuations.

The result was not a reassessment of intrinsic value, but a reflexive repricing driven by speed and coordination.

Case 2: Venezuela, Oil, and the Illusion of Instant Transformation

News surrounding political upheaval in Venezuela sparked a rally in U.S. energy stocks, as markets rushed to discount a future in which world largest oil reserves would suddenly become accessible.

The Public markets response ignored nearly every constraint that matters: capital requirements exceeding $100 billion, years of infrastructure rebuilding, legal uncertainty, sanctions, governance risk, and execution complexity.

Political change does not rebuild pipelines. Headlines do not restore refineries. Cash flows do not appear simply because optimism arrives.

Markets priced decades of investment and transition into a single session. Probability was confused with possibility. Time was erased.

Once again, sentiment moved faster than fundamentals could ever justify.

Case 3: Nvidia and the Velocity of Narrative Risk

A single competitive headline involving a Chinese AI startup erased roughly $600 billion from Nvidia’s market capitalization in one day—an amount comparable to the annual economic output of a G20 country.

No revenue collapsed. No backlog vanished. No customer behavior shifted overnight. Supply chains, ecosystems, and long-term demand remained intact.

What changed was belief.

Highly liquid markets are exceptional at transmitting dominant narratives. When a core story is challenged, algorithms react, momentum traders follow, and risk managers reduce exposure. Liquidity amplifies urgency, not accuracy.

The scale of the move reveals the flaw. Fundamentals do not change at the speed implied by price. Expectations do.

Case 4: GameStop and the Pure Form of Narrative Markets

GameStop represents the extreme, unfiltered version of the same mechanism.

Prices detached entirely from cash flows and competitive reality, driven instead by coordination, participation, and belief. Valuation ceased to matter. Price became the story.

The subsequent collapse was not sudden—it was slow and fundamentally grounded. As narrative liquidity faded, reality reasserted itself.

GameStop did not break markets. It revealed them.

Part III: Why Illiquidity Changes the Outcome

Private markets sit at the opposite end of the liquidity spectrum. They are slower, less transparent, and less flexible—and because of that, structurally insulated from narrative cascades.

They are not repriced continuously. Capital is committed for years. Valuations are negotiated, not auctioned. Strategies are executed operationally, not traded tactically.

This insulation is not philosophical. It is mechanical.

Periods of elevated uncertainty consistently produce volatility spikes in public equities, particularly long-duration, growth-heavy indices. Private equity volatility, by contrast, remains muted—not because private assets avoid stress, but because they are not forced into daily coordination games.

Regression evidence reinforces the distinction. Public equities exhibit strong sensitivity to interest rate movements and macro signals. Private middle-market transactions display materially lower sensitivity.

In simple terms: public markets are fragile to narratives; private markets are resilient by design.

Part IV: Illiquidity as a Compounding Advantage

Long-term data shows that private equity has significantly outpaced public benchmarks over full cycles. This is often attributed to manager skill, but that explanation is incomplete.

Outperformance is also compensation for illiquidity—for being structurally removed from forced selling, headline risk, and coordination failure.

Illiquidity prevents panic. It prevents premature exits. It forces investors to focus on cash flows, execution, and value creation rather than optics.

Public markets reward speed. Private markets reward patience.

Conclusion: The Real Case for Alternatives

Liquidity is not free. It carries a hidden cost: exposure to narrative acceleration, belief synchronization, and value destruction unrelated to fundamentals.

Alternatives and private markets do not outperform despite their constraints. They outperform because of them.

In a world where headlines travel faster than reality, where markets price futures that may never arrive, and where daily pricing often overwhelms long-term value, illiquidity is not a weakness.

It is a defense.

For investors focused on preserving and compounding wealth across cycles, the lesson is clear:

Speed destroys context. Liquidity amplifies fear. Illiquidity protects value.

Sources & References

ABC News. (2026). Stocks of credit card companies slump as Wall Street overall drifts in mixed trading. https://abcnews.go.com/US/wireStory/stocks-credit-card-companies-slump-wall-street-drifts-129120491

Barron`s. (2026). JPMorgan Chase, AmEx, Capital One and More Stocks Dive. Trump’s Credit-Card Plan Sparks Panic. https://www.barrons.com/articles/chase-capital-one-bank-of-america-credit-card-stock-price-51aaf01e

CBS News. (2026). Trump says he will seek to ban institutional investors from buying single-family homes. https://www.cbsnews.com/news/trump-ban-institutional-investors-single-family-homes/

CBS News. (2025). What is DeepSeek, and why is it causing Nvidia and other stocks to slump? https://www.cbsnews.com/news/what-is-deepseek-ai-china-stock-nvidia-nvda-asml/

Market Watch. (2026). Why Visa and Mastercard are seeing their sharpest stock drops in half a year. https://www.marketwatch.com/story/why-visa-and-mastercard-are-seeing-their-sharpest-stock-drops-in-half-a-year-69fc0c5b

MEXC. (2026). Blackstone (BX) Stock Falls as Trump Proposes Ban on Institutional Home Buying. https://www.mexc.com/news/432648

PE150. (2026). Maduro’s Capture and the Re-Opening of Venezuela. https://www.pe150.com/p/maduro-s-capture-and-the-re-opening-of-venezuela

PE150. (2025). Volatility Destroys Wealth. https://www.pe150.com/p/macroeconomic-environment-and-fiscal-outlook-fcb2

Reuters. (2026). Financial stocks fall as Trump's credit card rate cap plan rattles investors. https://www.reuters.com/business/finance/us-financial-stocks-fall-after-trump-calls-credit-card-rate-cap-2026-01-12/

Reuters. (2025). DeepSeek sparks AI stock selloff; Nvidia posts record market-cap loss. https://www.reuters.com/technology/chinas-deepseek-sets-off-ai-market-rout-2025-01-27/

Wealth Stack Weekly. (2025). Volatility Destroys Wealth. https://wealthstack1.com/p/volatility-destroys-wealth-563c94aa8673b098

Wealth Stack Weekly. (2025). The Power of Illiquidity. https://wealthstack1.com/p/the-power-of-illiquidity

Yahoo Finance. (2026). Trump wants to ban Wall Street investments in single-family homes. Experts aren’t sure it would help much. https://finance.yahoo.com/news/trump-wants-to-ban-wall-street-investments-in-single-family-homes-experts-arent-sure-it-would-help-much-170203252.html?guccounter=1

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|