- PE 150

- Posts

- End of Year Special Issue: A 2025 Review and 6 Topics for 2026 in Private Equity

End of Year Special Issue: A 2025 Review and 6 Topics for 2026 in Private Equity

A $10T succession wave and $2.4T in retail liquidity, while Buffett dumps tech and private credit grows 500%.

Good morning, ! As we head into the holidays—with Christmas just behind us and New Year’s Eve closing out the year—this special end-of-year issue looks at the moments that truly shaped Private Equity in 2025. From Electric Vehicles Charging Infrastructure and Value Creation priorities, we break down where value is being unlocked in the Private Equity Industry.

2026 comes with deep opportunities for capturing liquidity and new cash: 401K and the probable correction in the public markets could open the door to billions of dollars from retail investors into alternatives investing.

Wishing you a happy holidays.

Want to advertise in PE 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

2025 REVIEW: OUR TOP TOPICS

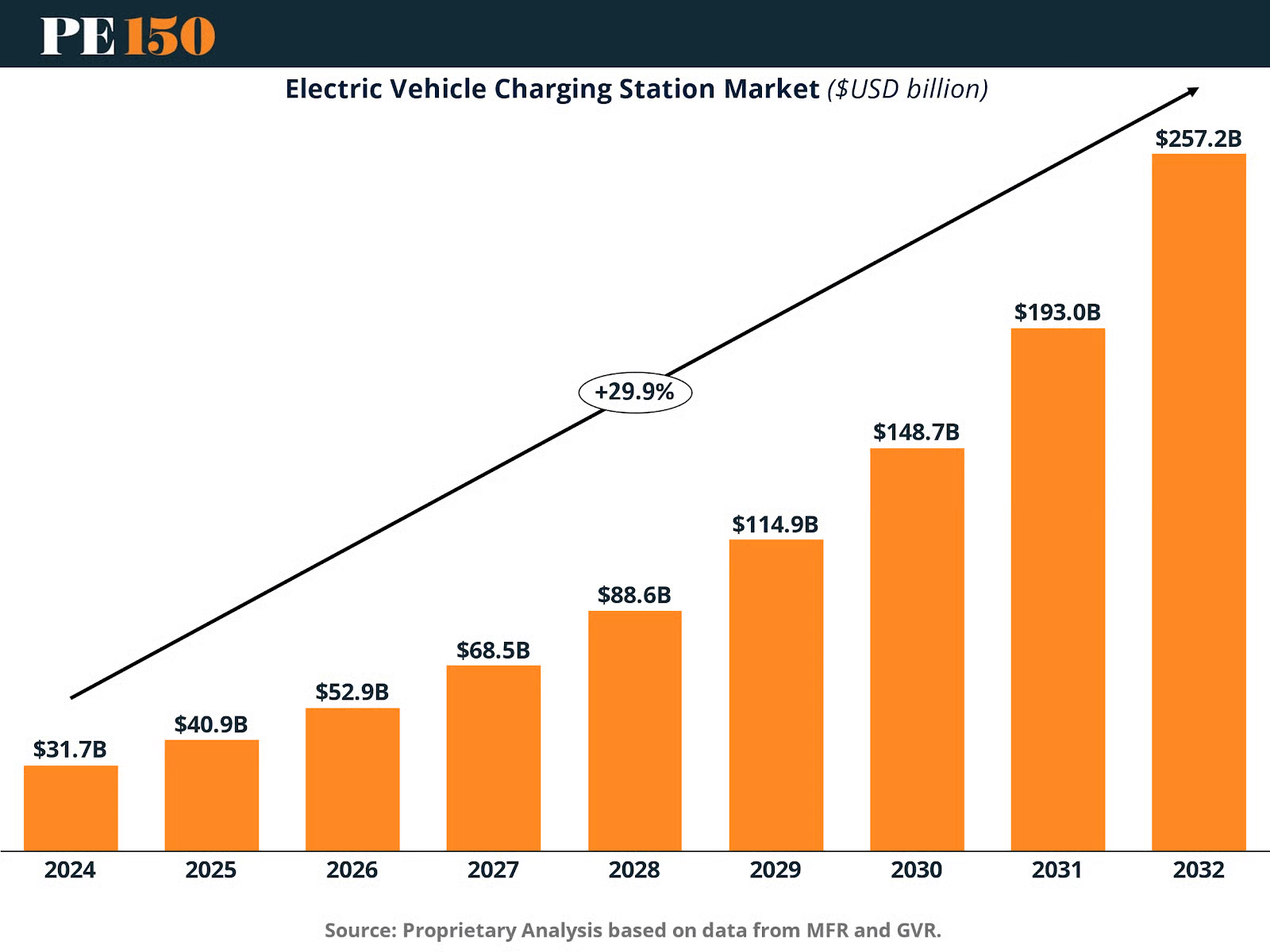

I. The EV Charging Arms Race

The gold rush isn’t in EVs—it’s in where they charge. The U.S. has more than 64,000 charging stations, but that’s a rounding error when EV sales are surging and charger-to-car ratios are starting to resemble Black Friday checkout lines (hello, New Jersey’s 41.3 EVs per port). With billions in federal funds, a fragmented market, and big players like Tesla still dominant, PE has a shot at building the “ExxonMobil” of electric mobility—just with better ESG optics. Bonus points if your target operates across the software, O&M, and hardware stack, because by 2040 this isn’t a product business—it’s a platform play. (More)

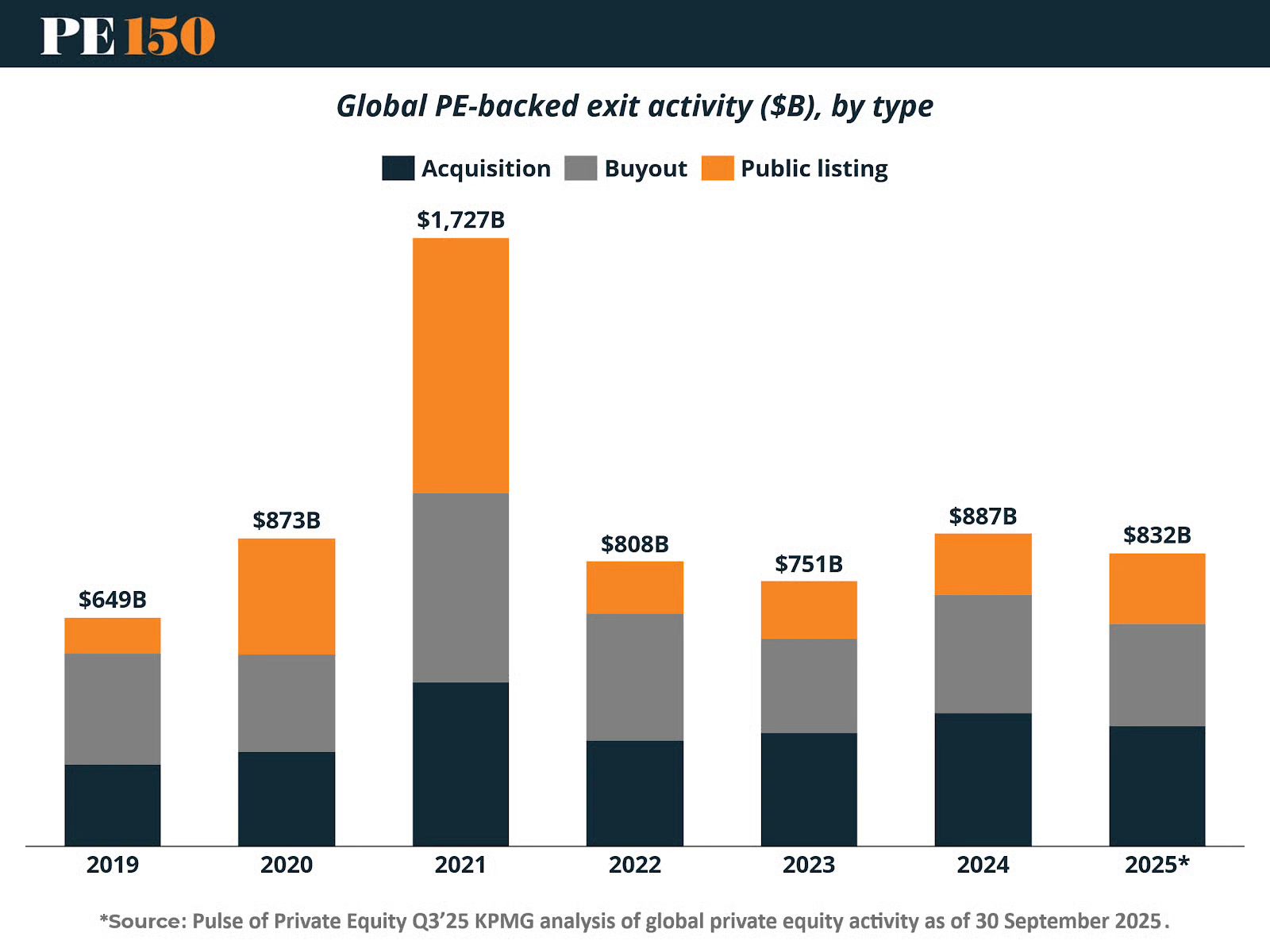

II. Exit? More Like Evolve.

Private equity exits in 2025 aren’t roaring back—they’re quietly mutating. At an estimated $832 billion, global PE exits are up, but still half the 2021 peak. What’s changed? Everything. Trade sales now lead the pack, with IPOs a distant third wheel. The big shift: liquidity is increasingly engineered, not discovered. Think continuation vehicles, NAV loans, and preferred equity—tools once niche, now necessary. Median hold periods are pushing six years, and sponsors are sweating out value creation with AI, talent depth, and cleaner EBITDA—because buyers aren’t buying the story without receipts. In this cycle, exit readiness is a verb, not a milestone. (More)

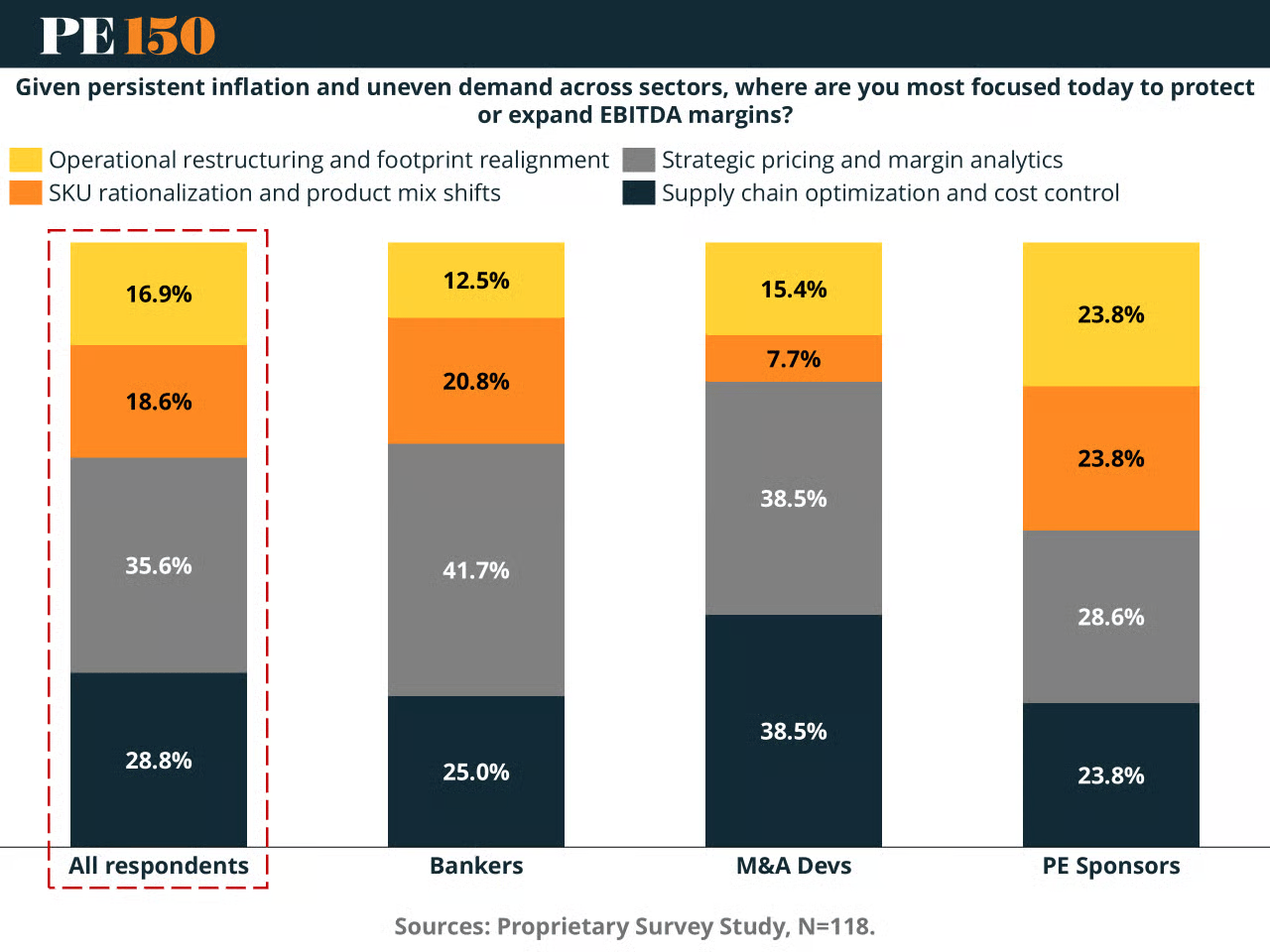

III. Value Creation Is the Whole Game Now

Gone are the days of coasting on multiple expansion and leverage. In 2025, value creation isn’t a lever—it’s the engine. With entry multiples elevated and inflation refusing to leave quietly, GPs are shifting hard into operational improvement, pricing precision, and digital enablement. Across stakeholder groups, cost control and margin analytics top the list, while talent gaps and bad data hygiene are the biggest blockers. It’s no longer enough to “professionalize” a business. Firms need to institutionalize adaptability—build in pricing agility, real-time analytics, and change-ready leadership before the first board meeting. Welcome to PE’s margin-obsessed era. (More)

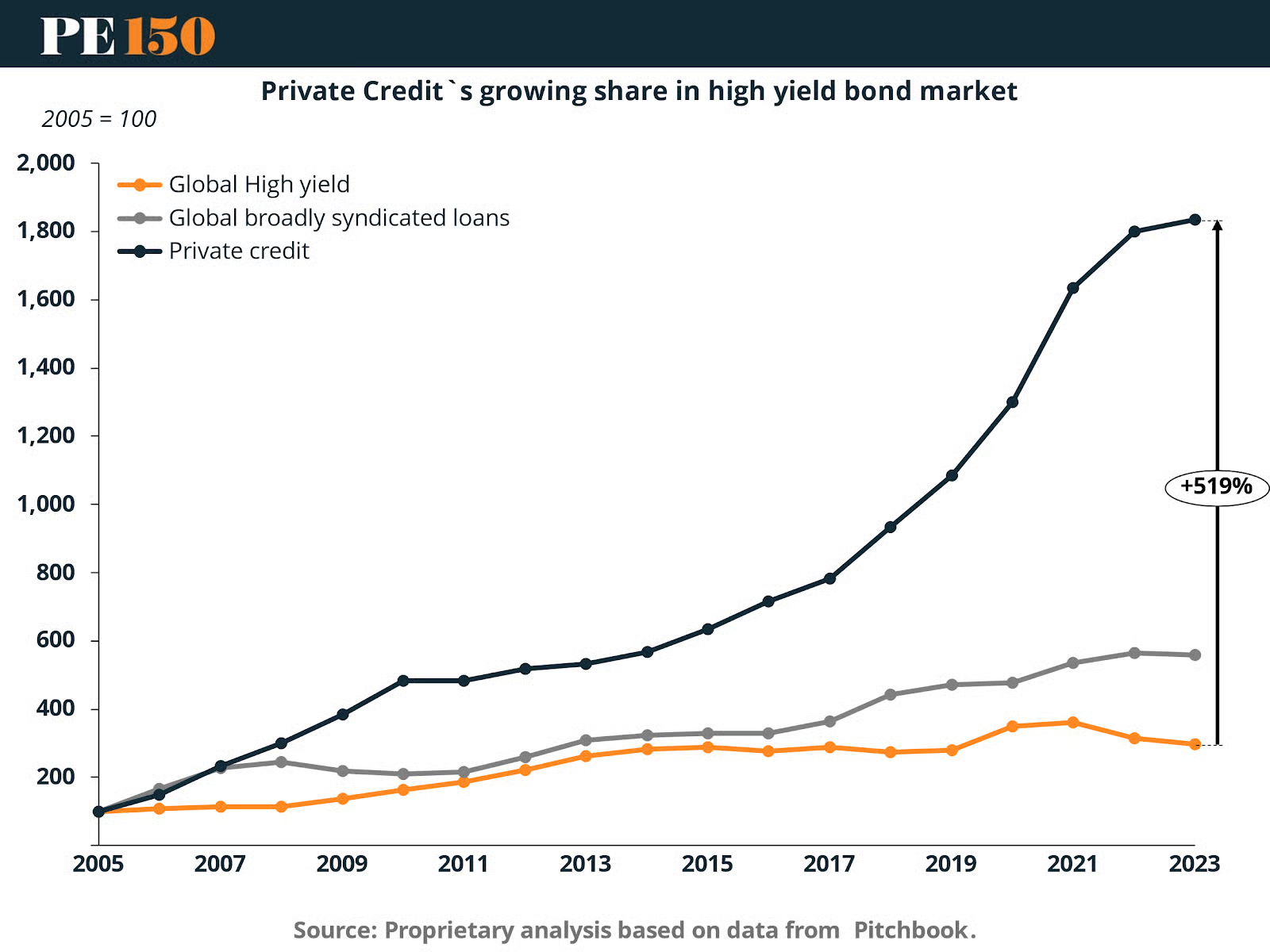

IV. Private Credit Is Eating the Loan Market

While banks wrestle with regulation and risk models, private credit is quietly devouring their lunch. Since 2005, it’s grown 500%, leaving syndicated loans and high-yield bonds in the dust. The real kicker? It’s not just growth—it’s displacement.

Direct lending, once a niche, now dominates fundraising and credit structuring, backed by institutional dollars hungry for floating rates, covenant control, and predictable yield. When capital calls, borrowers don’t wait 60 days for a loan committee—they go where speed and flexibility rule. Hint: it’s not a bank. (More)

V. When Everyone is Digging for Gold, Sell Shovels

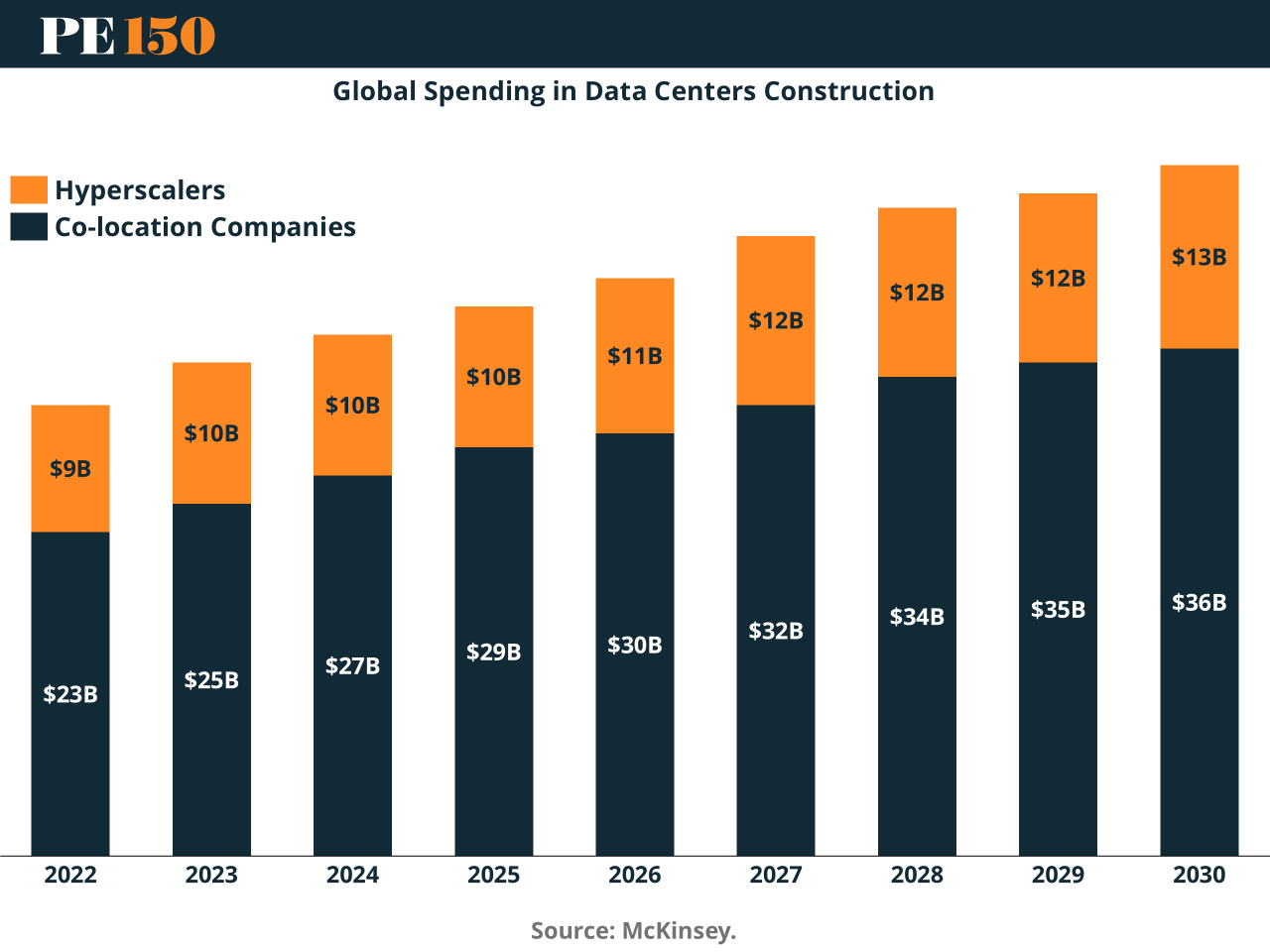

AI is hungry. Not for models, but for infrastructure. As GenAI pushes toward a $1.3 trillion market by 2032, the real bottleneck isn’t algorithms—it’s electricity, GPUs, and rack space. Data centers are being retooled as the new oil rigs of the digital economy, with 47 GW of incremental power and $50B in power gen capex expected by 2030. PE is all over it: direct builds, AI-optimized hardware, and grid-tied assets. Players like DigitalBridge, Stonepeak, and GI Partners are buying deep and wide, chasing the long-duration, high-margin backbone of AI’s exponential run. (More)

TOPICS FOR 2026

I. The New Tech Bust: Correction Risk Goes Institutional

When Buffett and Thiel dump their darlings, you know the cycle has turned. In Q1 2025, Berkshire Hathaway slashed its equity allocation to 2008-level lows and piled up $381.7B in cash. Peter Thiel’s fund offloaded its entire $5.8B stake in NVIDIA and sold 76% of its Tesla position. Not panic. Positioning.

It’s the kind of institutional behavior that signals a shift from growth-at-all-costs to liquidity-at-any-cost. Valuations are elevated, volatility is climbing, and leadership is narrowing to a few over-leveraged narratives.

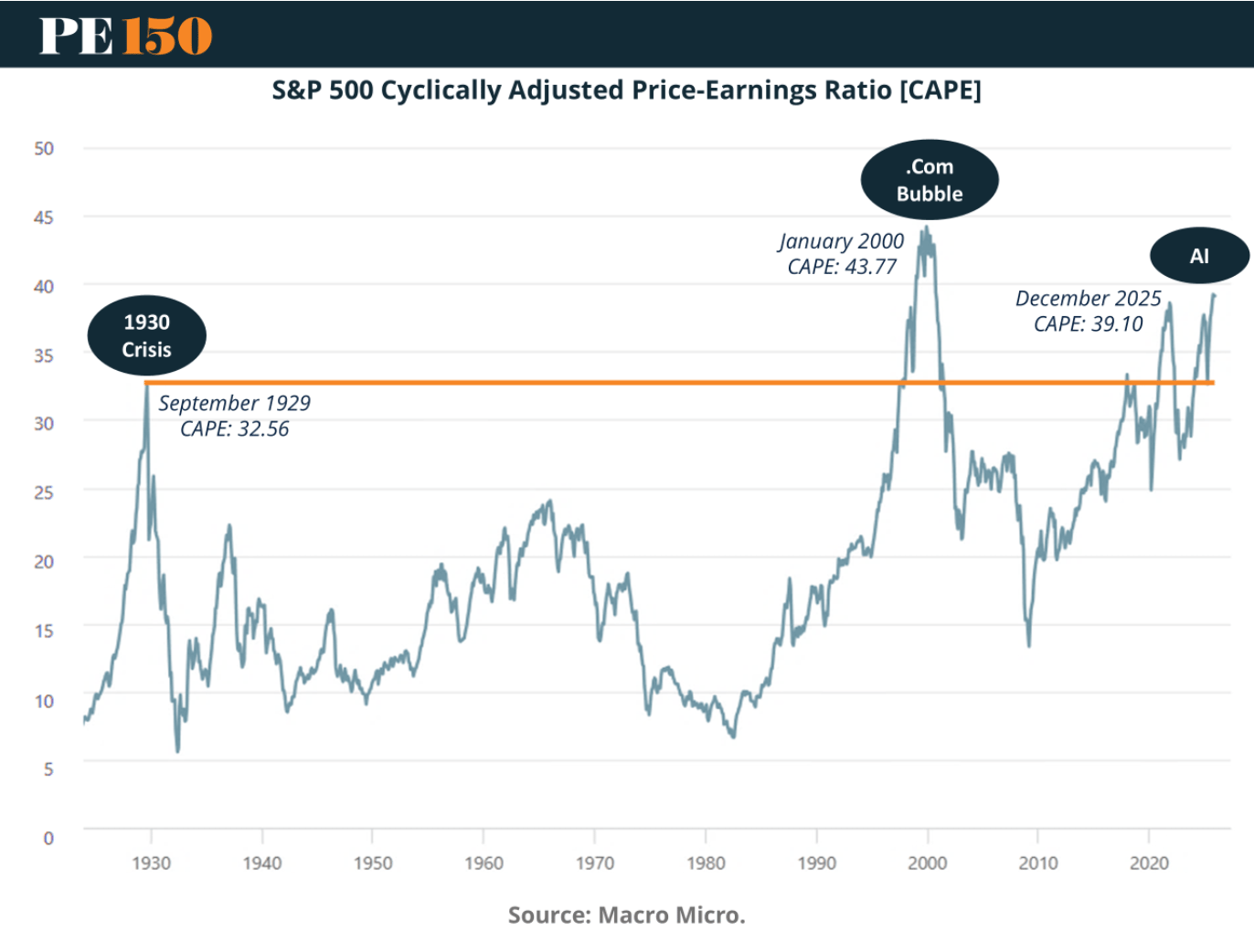

The CAPE ratio just crossed 39, breaching levels last seen at the dot-com peak and far above the 1929 high. This isn’t just historically rich — it’s historically vulnerable. As the multiple expands faster than earnings catch up, the risk/reward equation flips. With CAPE this high, forward returns compress — fast.

The story gets shakier when you look at market internals. AI megacaps are doing all the lifting, but the rest of the market is showing fatigue. Meanwhile, interest rates aren’t playing along.

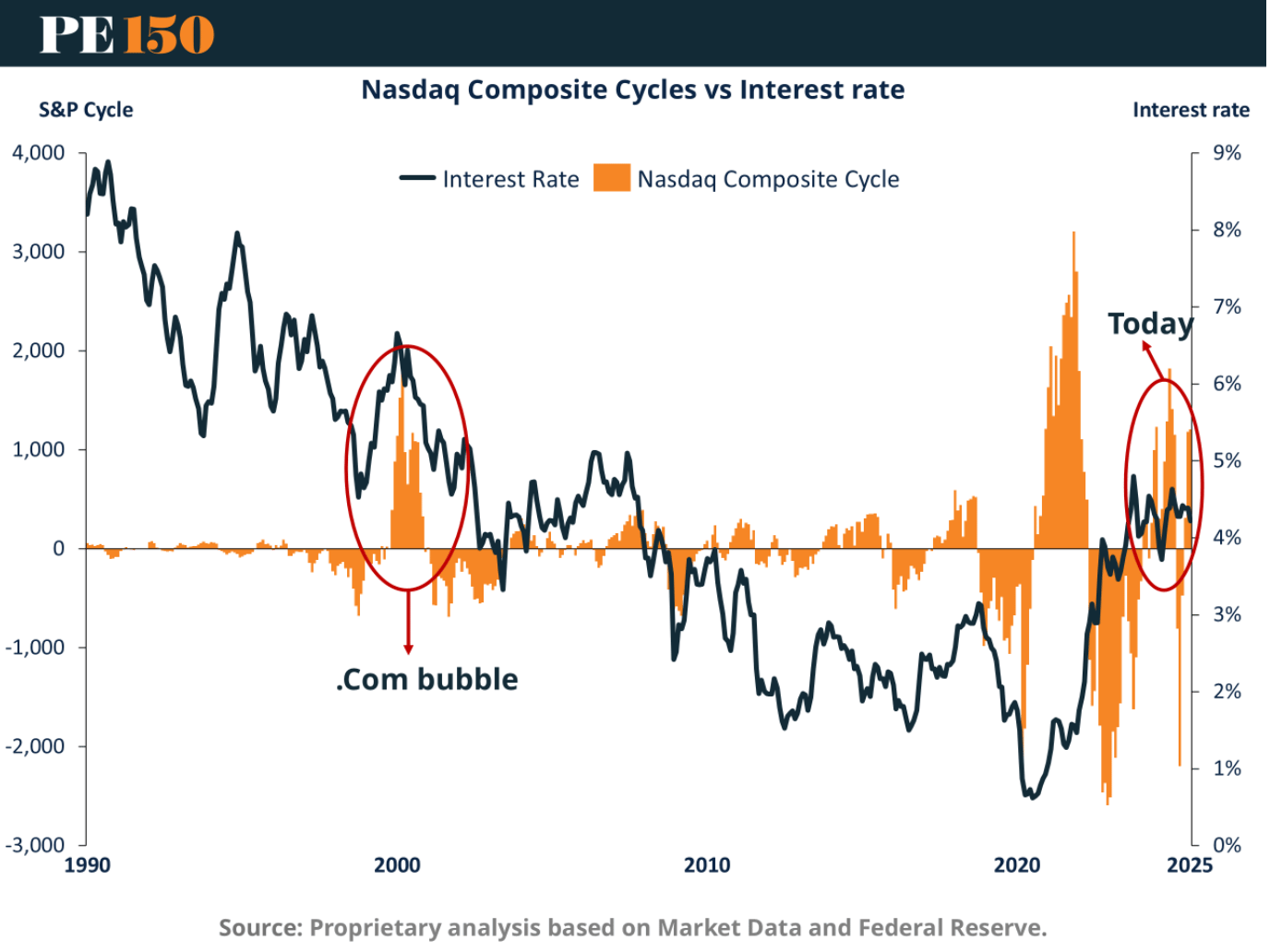

The chart above echoes the 2000 cycle — right down to the divergence between rising rates and elevated tech valuations. Today’s market is riding the same structural disconnect: euphoric asset prices floating above a tighter cost of capital. When that gap resolves, it doesn’t resolve slowly.

And it’s not just macro. Volatility itself is screaming.

This chart is the punchline: the AI-driven NASDAQ 100 cycle is 4.2x more volatile than the dot-com boom. Same pattern. Just louder. The emotional amplitude of this market — amplified by passive flows and leverage — is not sustainable. And when the unwind begins, liquidity exits first.

Bottom Line:

This isn’t a soft landing setup. It’s a late-cycle dislocation with insiders already stepping out. For allocators still chasing AI beta in public markets, risk is rising faster than return. For private equity? This is the time to pivot toward assets with pricing power, real cash flow, and zero exposure to ETF-driven whiplash.

II. The $10 Trillion Succession Wave: A Generational Private Equity Opportunity

Over $10 trillion in Baby Boomer–owned private businesses are expected to change hands this decade, as more than 500,000 owners retire annually. These companies represent nearly 30% of U.S. GDP and ~16.6% of public market cap—a generational asset transfer with few historical parallels.

The majority of these businesses fall in the Lower Middle Market—stable, cash-flowing, founder-led companies that have been undercapitalized and under-institutionalized for decades.

A Structurally Attractive Segment for Private Equity

For institutional investors, this is a clear long-term opportunity:

These businesses are often profitable, with recurring revenue and operational history.

Succession-driven sales reduce pricing pressure and increase seller openness to structured deals.

Fragmentation creates favorable conditions for platform roll-ups and professionalization plays.

While large-cap buyouts face increasing competition and compressed returns, the $20M–$100M enterprise value range remains relatively inefficient—offering opportunities to drive value through governance, systems, and bolt-on acquisition strategies.

Execution Path: Value Creation over Financial Engineering

PE firms deploying capital in this segment are building repeatable models around:

Operational transformation over 24–36 months

Margin improvement through system upgrades and team professionalization

Multiple expansion driven by consolidation and institutionalization

With disciplined execution, a $5–10M EBITDA business can generate outsized returns without dependence on leverage or market timing.

Takeaway

The generational transfer of business ownership is already in motion. For institutional private equity, this is a decade-long opportunity to invest in real economy assets—profitable, under-managed, and ready for scale.

Allocating to the lower middle market isn't a style shift. It's a strategic response to a demographic inevitability—with the potential to deliver durable, uncorrelated returns as capital continues to rotate out of aging ownership and into institutional hands.

III. A New Liquidity Wave for Private Equity—Via Retirement Plans

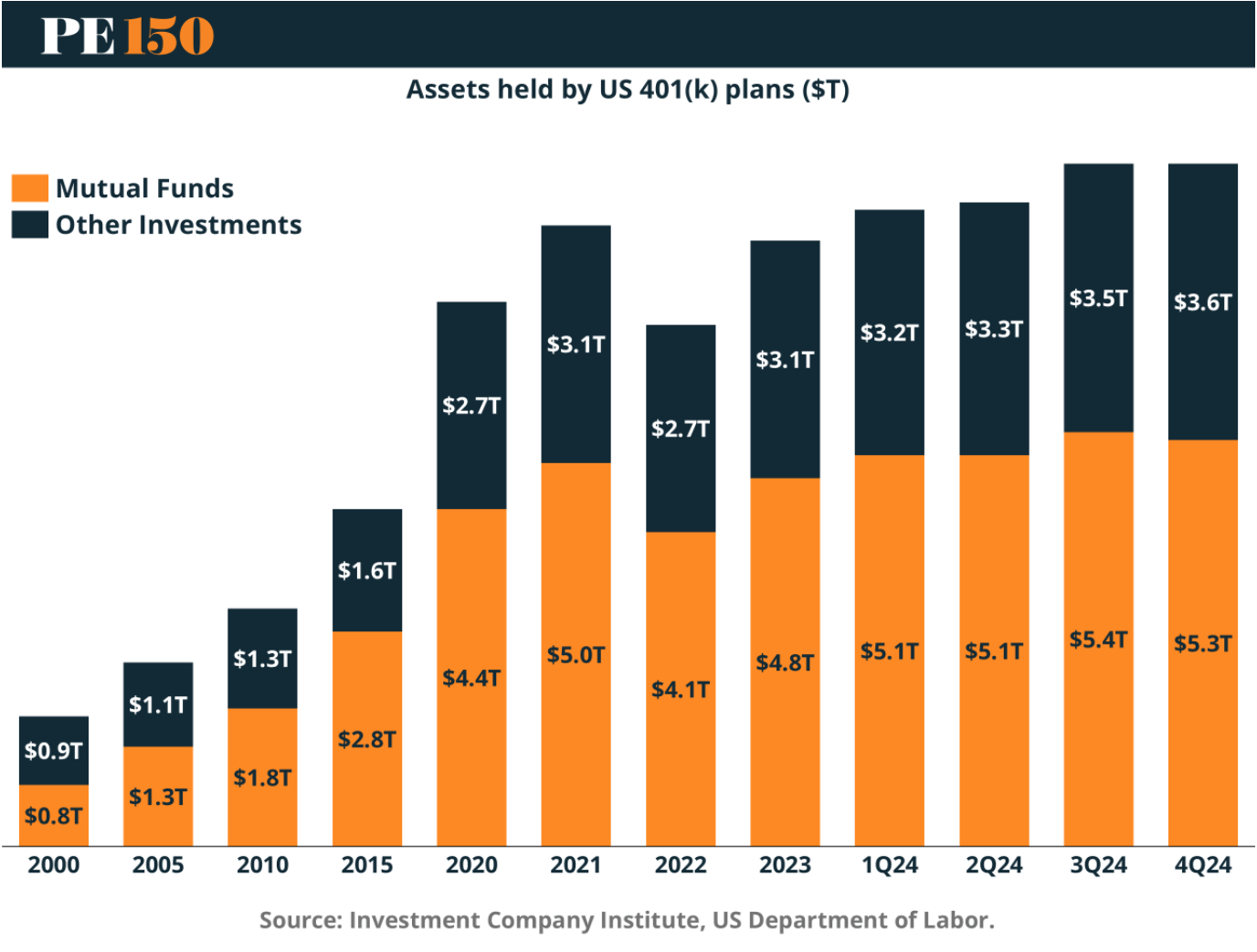

According to Deloitte, retail investor exposure to private capital is projected to grow from $0.1T in 2024 to $2.4T by 2030—a staggering +69.8% CAGR.

This isn’t a niche play anymore; it’s a foundational shift in long-term capital formation.

The driver? Policy momentum and product innovation. Regulatory initiatives—such as updated Department of Labor guidance and possible executive orders—aim to democratize access to private equity for defined-contribution plans. In parallel, fund structures like interval funds and target-date wrappers are making private capital allocations more accessible for retirement savers.

With $9T+ in total 401(k) assets (and nearly $3.6T in non-mutual fund allocations), even small reallocations into alternatives represent a material inflow opportunity. Deloitte predicts retirement-linked private capital AUM will rise sharply—driven by inclusion in mutual funds, ETFs, and professionally managed portfolios.

The Takeaway:

Private equity is no longer reliant solely on institutional LPs and sovereigns. The next multi-trillion-dollar liquidity source is retail—channeled through the $9T+ defined-contribution ecosystem. The capital is long-term, sticky, and under-allocated to alternatives. The only question is which managers will build the structures—and trust—to capture it.

"Get busy living or get busy dying."

Stephen King