- PE 150

- Posts

- $500B Evergreen Surge, Broken Liquidity, and the $150M Compliance Trap

$500B Evergreen Surge, Broken Liquidity, and the $150M Compliance Trap

Evergreen funds grow 26% annually and Add-ons dominate buyouts, while fundraising strength masks a cash flow crisis.

Good morning, ! This week we're covering why $150M AUM has become a regulatory tripwire, how evergreen capital—now nearing $500B in AUM and growing ~26% annually—is reshaping return math, why $70B+ in annual mega-fundraising still isn’t fixing liquidity, what higher-for-longer rates mean for PE power dynamics, and why add-ons now account for the majority of global buyout deals.

Want to advertise in PE 150? Check out our ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

Evergreen Capital Is Quietly Rewriting Return Math

Stat: Unlisted evergreen and continuous capital vehicles grew from $245 billion in AUM in 2022 to an estimated $493 billion in 2025, a roughly mid 26% annual growth rate that materially outpaces traditional closed end fundraising. In parallel simulations, an evergreen fund structure delivered a 13.5 percent mean annual return, versus 12.7 percent for rolling drawdown funds, despite identical asset exposure and beta.

Context: The performance gap is not driven by asset selection. It is driven by capital utilization. Drawdown funds keep large portions of committed capital idle over time, averaging just 28.7 percent invested in the modeled scenario. Evergreen vehicles maintain near 90 percent continuous deployment, eliminating reinvestment gaps and volatility in exposure. Even small fluctuations in percent invested create a compounding drag that erodes geometric returns over long horizons.

Strategic Takeaway: Structure is becoming a return lever. As exit timing stretches and reinvestment risk rises, portfolio level compounding is emerging as a differentiator. For GPs, evergreen capital stabilizes fee bases and preserves exposure. For LPs, it reframes alpha away from timing luck and toward persistent capital at work. The real edge is not higher gross returns. It is fewer dead zones for capital.

TREND TO WATCH

Add Ons Are No Longer a Tactic. They Are the Market.

The chart tells a quiet but decisive story. Global PE buyout volume is no longer driven by new platforms. It is driven by add ons.

Since 2019, add on deals have consistently outnumbered platform buyouts by a wide margin. Even after the 2021 peak, when overall activity cooled, add ons proved far more resilient. In 2023, 2024, and 2025, platform deal counts stayed compressed while add on activity rebounded faster and held steadier. The mix has structurally shifted.

This is not just caution. It is strategy.

Higher rates and tighter credit have made underwriting new platforms harder to justify. Add ons solve that problem. They rely on existing capital structures, known management teams, and clearer synergy math. They also defer the hardest valuation debate in the room: what a clean platform is worth in a slow exit market.

The implication for GPs is uncomfortable but clear. Growth is increasingly manufactured inside portfolios, not sourced outside them. That raises execution risk. Integration, pricing power, and cost takeout matter more than multiple expansion.

Bottom line: Private equity is becoming less about finding the next great company and more about assembling one piece by piece. The firms that win this cycle will look less like deal shops and more like operators. (More)

PRESENTED BY WHEREBY

Switching video infrastructure can feel painful, but sticking with a “good enough” solution has a cost too.

When security and privacy aren’t communicated clearly, when calls fail or glitch, or when UX adds friction, the impact becomes measurable: lower patient engagement, higher no-shows and drop-offs, increased support and operating costs, and greater churn risk.

Whereby breaks down how these costs show up in practice and why early evaluation lowers risk by creating options before you’re forced into a rushed decision.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

LIQUIDITY CORNER

Big Funds Are Still Raising. Liquidity Is Still Not Flowing.

The chart shows a tension LPs feel every quarter. Capital raised by the top ten PE firms remains elevated even as distributions lag. After a $113.3B peak in 2021, fundraising fell but never collapsed. 2025 is tracking at $72.9B, below the highs but well above pre crisis norms.

That matters for liquidity because fundraising strength is masking a cash flow problem. Large platforms can still command commitments, but those dollars are increasingly recycling internally rather than flowing back to LPs. When mega firms raise $80B to $100B per year without matching exit volume, net cash flow stays negative.

The result is quiet pressure. LPs are not cutting managers. They are pacing commitments, favoring re ups over new names, and leaning harder on secondaries to manage exposure. The denominator effect may have faded, but the numerator has not shown up yet.

For GPs, this reinforces a structural shift. Fundraising is no longer proof of health. Distributions are. Until exits normalize, liquidity is being manufactured through continuation funds, NAV loans, and selective asset sales rather than clean realizations.

Bottom line: capital formation has stabilized. Liquidity has not. The firms that unlock cash fastest will earn more than goodwill. They will earn allocation priority. (More)

MACROVIEW

Rates on Hold, Power in Flux

The Federal Reserve kept rates on hold at 3.5–3.75%, reinforcing a higher-for-longer message as inflation remains above target and productivity-driven growth continues to surprise. For private equity, this implies no imminent relief on financing costs and sustained pressure on leverage-heavy strategies.

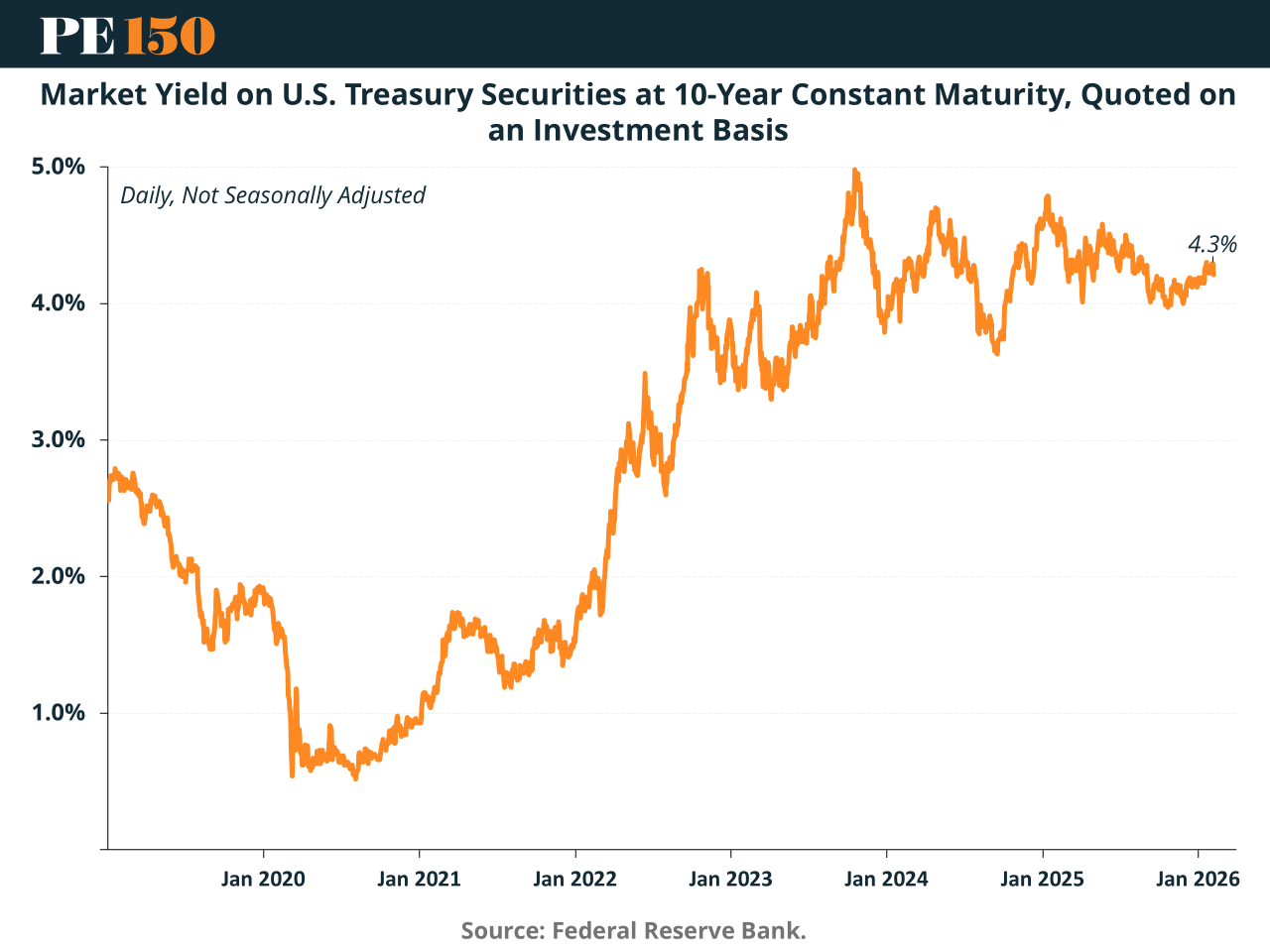

Long-term yields near 4.3% signal markets still price persistent nominal growth and fiscal risk, favoring operational value creation, pricing power, and capital discipline over multiple expansion. Meanwhile, the U.S. dollar remains structurally strong, despite recent volatility linked more to political signaling than fundamentals.

The bigger shift may be institutional. President Trump’s nomination of Kevin Warsh as next Fed Chair revives questions around central bank independence and the Fed’s expanded discretionary powers. While often labeled a hawk, Warsh has recently emphasized productivity gains as a rationale for measured easing, suggesting policy flexibility, not dogma.

For sponsors, the key risk is not a 25 bp cut, but credibility. A stable, independent Fed remains critical for valuation, exit timing, and long-duration capital deployment. (More)

COMPLIANCE CORNER

When $150M Becomes a Regulatory Tripwire

Private equity managers love clear lines. SEC registration finally gives them one — $150 million in private fund AUM. Cross it, and you’re generally in registered investment adviser territory. Stay below it, and you may qualify as an Exempt Reporting Adviser (ERA), with lighter filings but far from regulatory invisibility.

Why this matters now: the SEC’s 2024 private fund rules raise the bar across the board. Think quarterly fee and performance reporting, mandatory audits, and fairness opinions for adviser-led secondaries. These requirements don’t politely wait for firms to “feel ready.”

Risk zone: managers who delay registration, miscalculate AUM, or assume exemptions equal immunity. Enforcement priorities suggest otherwise.

Bottom line: Firms should reassess registration status annually, monitor evolving thresholds, and document compliance rigorously. Even smaller managers face higher expectations for transparency — and less patience from regulators. (More)

"You'll never do a whole lot unless you're brave enough to try."

Dolly Parton