- PE 150

- Posts

- Monetary Policy at a Crossroads: Rates, Credibility, and the Fed’s Expanding Power

Monetary Policy at a Crossroads: Rates, Credibility, and the Fed’s Expanding Power

The Federal Reserve’s latest decision to leave the federal funds rate unchanged—within a target range of 3.5% to 3.75%—was widely anticipated.

The 10–2 vote, with two dissenters favoring a modest 25-basis-point cut, reflects a Federal Open Market Committee (FOMC) increasingly convinced that the U.S. economy continues to outperform expectations. At the same time, the decision has landed amid heightened political scrutiny, as President Donald Trump moves to reshape the Federal Reserve’s leadership by nominating Kevin Warsh to succeed Jerome Powell in 2026.

The federal funds rate chart underscores the macroeconomic backdrop shaping the Fed’s stance. After remaining near zero through early 2022, policy rates were raised aggressively to counter the post-pandemic inflation surge, peaking above 5% before gradual easing began in late 2024. The current plateau near 3.6% signals a central bank that believes restrictive policy has succeeded in cooling inflation, but not sufficiently to justify a rapid pivot toward accommodation. Chair Powell’s assertion that “the economy has once again surprised us with its strength” reflects robust productivity growth and resilient demand, even as employment gains have moderated.

From the Fed’s perspective, slower job growth does not constitute a binding constraint. Policymakers attribute subdued payroll expansion largely to immigration-related limits on labor force growth, while productivity gains have allowed output to expand without proportionate increases in labor input. With unemployment still low and inflation running above target, the Fed sees little urgency to cut rates preemptively.

Financial markets broadly endorsed this interpretation. Equity prices and Treasury yields showed limited reaction following the meeting, suggesting that policy expectations were already well priced. The behavior of longer-dated yields, however, provides additional insight into investor beliefs about growth, inflation, and fiscal dynamics.

The 10-year Treasury yield has remained elevated around 4.3%, reflecting expectations of sustained nominal growth and persistent term premia. Unlike the policy rate, which the Fed directly controls, long-term yields incorporate market assessments of fiscal sustainability, inflation risk, and the credibility of future monetary policy. The resilience of long yields indicates that investors are not fully convinced inflation risks have been extinguished, reinforcing the Fed’s caution in signaling near-term easing.

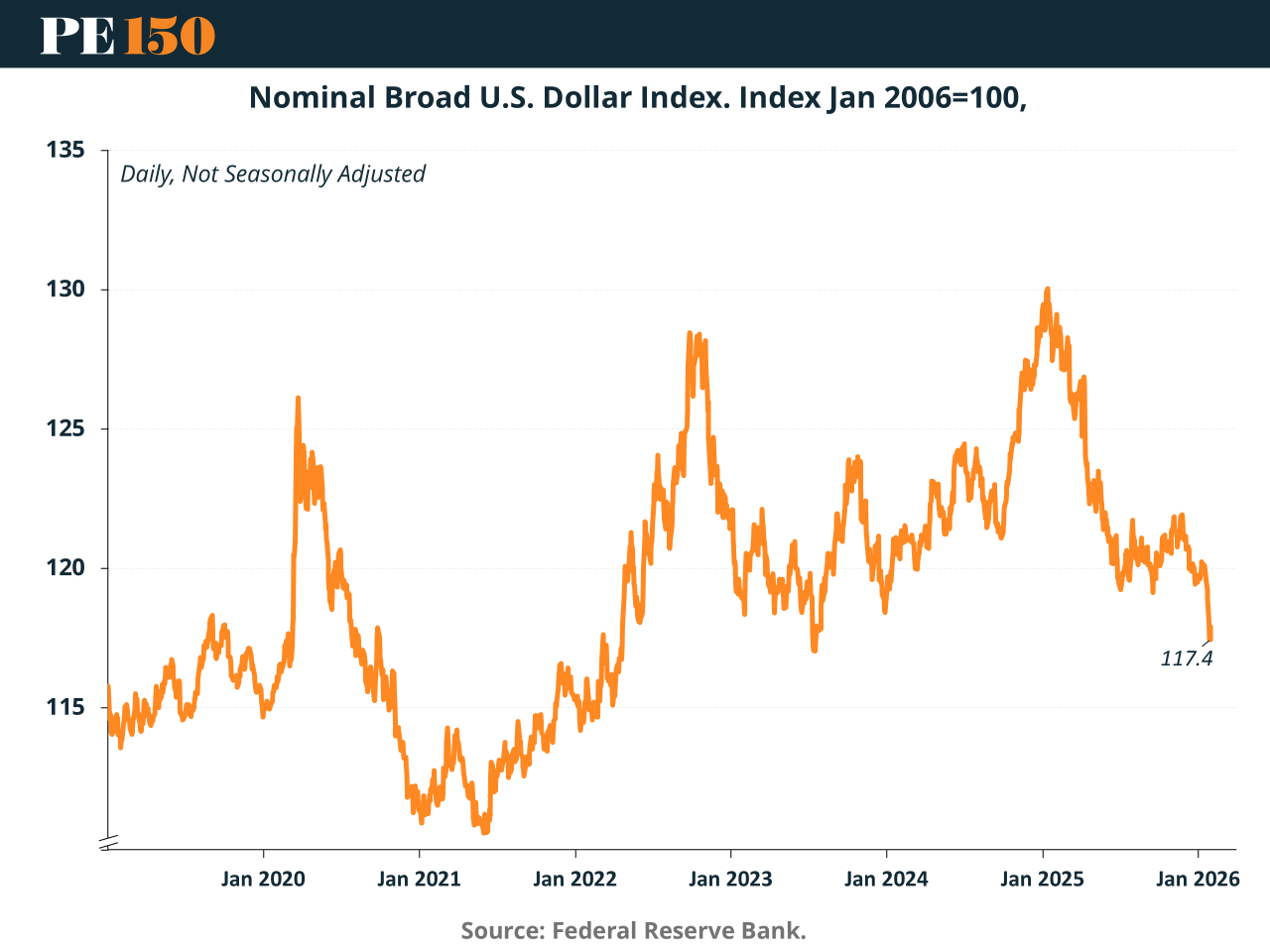

Currency markets, by contrast, exhibited greater volatility. Following the Fed decision, the U.S. dollar rebounded sharply, though the timing suggests that political communication—rather than monetary policy—was the dominant driver. Earlier comments by President Trump indicating indifference toward dollar weakness had contributed to depreciation. These were later offset by Treasury Secretary Bessent’s reaffirmation that a “strong dollar policy” rests on sound fundamentals, prompting a reassessment among foreign exchange traders.

The broad dollar index illustrates this dynamic clearly. While the dollar has fluctuated considerably since 2020, it remains historically strong despite recent softening. Notably, analysts at Commerzbank have emphasized that, relative to other G10 currencies, the dollar has been depreciating since the start of the year—suggesting that the post-nomination rally was more corrective than structural.

Against this backdrop, the nomination of Kevin Warsh introduces an additional layer of uncertainty. Warsh is often characterized as an inflation hawk due to his vocal opposition to quantitative easing during the global financial crisis. Yet his recent advocacy for rate cuts—grounded in optimism about productivity-driven growth—has led many strategists to question whether markets have misread his policy leanings. Some argue that Warsh may be more pragmatic than doctrinaire, and potentially more willing than Powell to endorse easing if inflation continues to decline.

More consequential than Warsh’s personal views, however, is the institutional context he would inherit. Over the past two decades, the Federal Reserve has accumulated vast discretionary powers—from standing repo facilities to expansive emergency lending programs—that now form a permanent part of the financial architecture. These tools have enhanced the Fed’s capacity to stabilize markets, but they have also blurred the boundary between monetary policy, credit allocation, and fiscal support.

This expansion of authority heightens the stakes of Fed leadership appointments. As political pressure intensifies, preserving institutional independence becomes increasingly challenging. Powell’s insistence on credibility and insulation from political influence may prove as important to macroeconomic stability as the precise path of interest rates.

In short, the Fed’s decision to hold rates steady reflects confidence in economic resilience, but the intersection of monetary policy, leadership transition, and institutional power suggests that the central bank is entering a more contested—and consequential—phase of its history.

Sources & References:

Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [DFF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFF, February 9, 2026.

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, February 9, 2026.

Board of Governors of the Federal Reserve System (US), Nominal Broad U.S. Dollar Index [DTWEXBGS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DTWEXBGS, February 9, 2026.

Deloitte. (2026). Weekly Global Economic Update. https://www.deloitte.com/us/en/insights/topics/economy/global-economic-outlook/weekly-update.html

Fund Selector Asia. (2026). New Fed chair may not be the hawk markets think. https://fundselectorasia.com/new-fed-chair-may-not-be-the-hawk-markets-think/

The Daily Economy. Nicolas Cachanosky. (2026). Warsh or Not, The Fed’s Next Chair Will Inherit Too Much Power. https://thedailyeconomy.org/article/warsh-or-not-the-feds-next-chair-will-inherit-too-much-power/