- PE 150

- Posts

- Why Illiquidity May Be PE’s Greatest Advantage (The Data Says So)

Why Illiquidity May Be PE’s Greatest Advantage (The Data Says So)

Illiquidity’s edge, biotools’ exit reset, private credit’s quiet outperformance, and semiliquid AUM at $344B—the signals that matter for PE returns now.

Good morning, ! This week we’re analyzing why Illiquidity matters and how it pays a premium in private Markets. Pharma biotools exits, Private Credit updated performance across asset classes, and semiliquid fund net assets.

Want to advertise in PE 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

The Math Behind Illiquidity’s Edge

Our analysis argues that illiquidity isn’t a drawback, it’s a feature. Public assets, marked to market and driven by sentiment, are volatility magnets. In contrast, private equity’s slower cadence avoids panic selling and thrives on operational execution. The data’s blunt: the NASDAQ 100’s sensitivity to rates is -0.57, compared to just -0.23 for mid-market PE deals. And when uncertainty spikes, public market volatility surges—private equity barely flinches. With MSCI PE up nearly 3,000% since 2007, versus the S&P 500’s 267%, the case is clear: long-term patience beats short-term optionality.

TREND OF THE WEEK

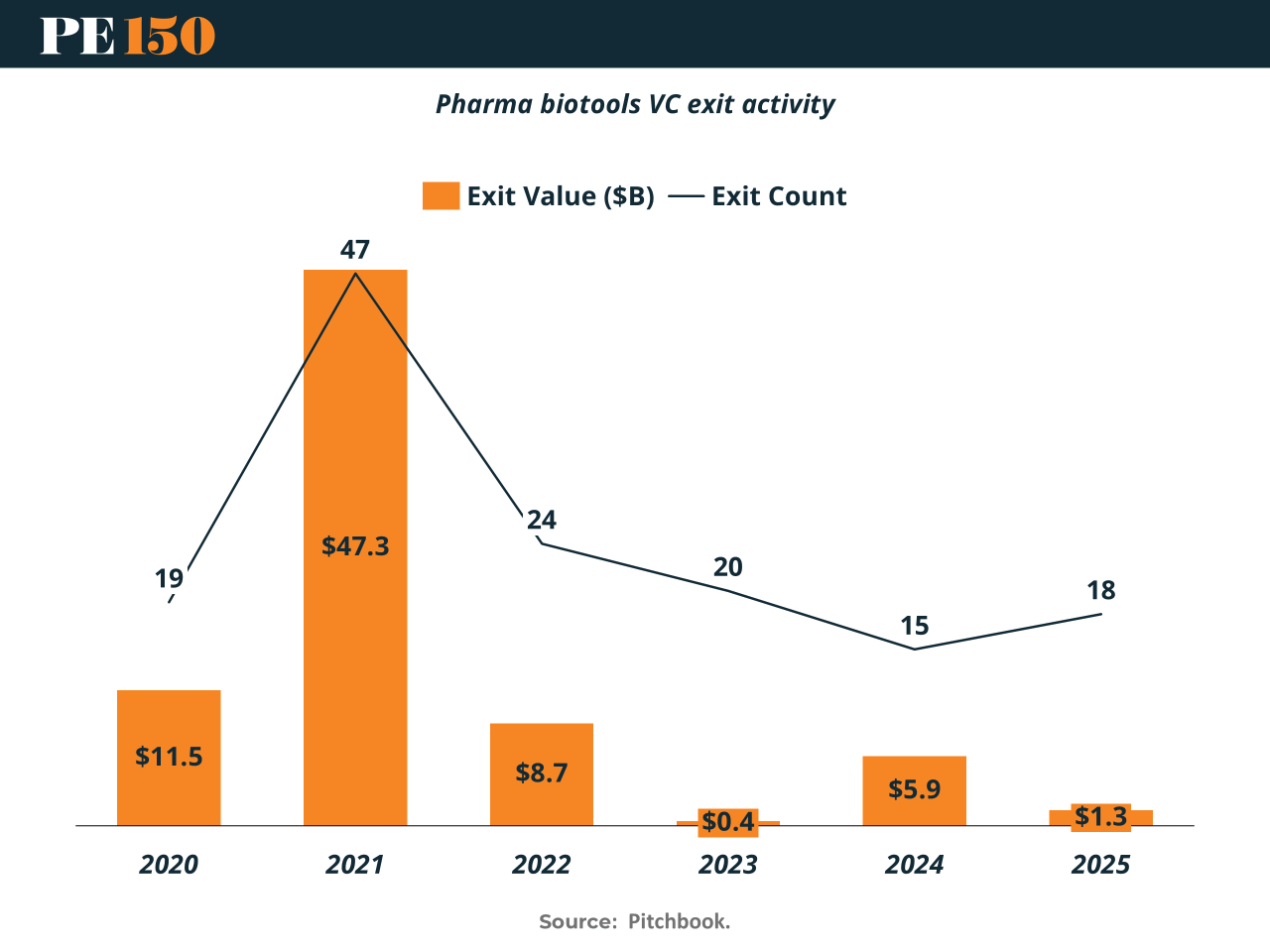

The Great Biotools Hangover

After the 2021 sugar high—$47.3B in exits—the pharma biotools sector is now nursing a three-year comedown. By 2023, exits barely cleared $400M, and while 2024 saw a partial rebound at $5.9B, 2025 YTD is tracking at just $1.3B. The chart is telling: deal counts are steady, but values cratered. Translation: we’re no longer in IPO-palooza territory; it’s smaller trade buys and tuck-ins. For PE, that’s both opportunity and headache. Lower valuations create cheaper entry points, but the recycling of VC-backed assets has slowed to a trickle. Until capital markets stabilize, expect fewer fireworks and more mid-market, build-and-bolt plays. (More)

PRESENTED BY PACASO

It May Not Be Trading on the Nasdaq, But You Can Still Buy This Unlisted Stock

Over 10,000 people have already invested in Pacaso. The same firm that has backed large-cap S&P 500 companies has invested too. And now everyday investors like you have the chance to invest before the opportunity ends on Sept. 18.

Created by a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of gross real estate transactions and service fees since inception across 2,000+ owners. That’s good for more than $100M in gross profit since 2021. They’ve even reserved their Nasdaq ticker.

But time’s running out and the investment opportunity closes on 9/18.

Become a Pacaso shareholder before this offering ends.

This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals.

LIQUIDITY CORNER

Semiliquid, Fully in Demand

Assets in semiliquid funds—including interval funds, nontraded REITs, and BDCs—have surged to $344B in 2024, up 60% from $215B in 2022. What used to be a niche corner for qualified purchasers is now the go-to for high-net-worth investors chasing private equity, credit, and real estate returns—without the decade-long lockups.

These vehicles promise periodic liquidity and smooth return profiles, making them especially attractive in a volatile public market backdrop. But don’t confuse “semiliquid” with actually liquid—monthly redemptions are a privilege, not a right, especially when markets turn.

The growth is real, but so is the risk. With more capital pouring in and NAVs looking too good to be true, semiliquid is fast becoming the most crowded “not-quite-private” trade on the street. (More)

DEAL OF THE WEEK

Carlyle’s $20B Liquidity Play

Carlyle just raised $20B for its latest push into the secondaries market, led by its AlpInvest Partners arm. The breakdown: $15B for the flagship fund, $3.2B in co-invests, and another $2B from private wealth. Why it matters: with 29,000 portfolio companies worth $3.6T stuck on PE balance sheets, secondaries have become the release valve. LPs get liquidity (at a discount), while buyers get instant diversification. The market nearly doubled since 2019, now at $601B AUM, or about 5% of global PE. Translation: Carlyle isn’t just raising a fund, it’s positioning itself as the pressure manager of a backlog-heavy industry. (More)

TOGETHER WITH SYNTHFLOW

The Smart Way to Deploy Secure Voice AI

Learn how security unlocks Voice AI for enterprise teams. This guide covers HIPAA, GDPR, and SOC 2 readiness—plus how to deploy agents across 100+ locations without slowing down procurement or risking compliance.

PRIVATE CREDIT

Credit's Quiet Climb—High Yield Outpaces Equities (YTD)

In a year dominated by tech-fueled equity headlines, credit markets are quietly delivering. As of June 2025, U.S. High Yield leads fixed income returns at 6.8% YTD, outpacing the Dow (4.5%) and trailing only the S&P 500 (6.2%). Even U.S. Loans posted a positive 2.8%, despite tighter spreads and a sluggish M&A cycle.

What’s behind the resilience? PE sponsors and credit funds continue to lean on structured capital—especially unitranche and hybrid deals—to bridge valuation gaps. At the same time, high rates are providing the yield cushion credit investors have long waited for.

Why it matters: The line between private credit and public high yield is narrowing. With public high yield outperforming in H1 and direct lending spreads compressing, allocators may start asking harder questions about risk-adjusted returns. For private credit managers, differentiation—through origination, structuring, or sector insight—is no longer optional. (More)

MICROSURVEY

As deal flow evolves and competition intensifies, what gives your firm the greatest edge in sourcing quality deals?Answer options: |

MACROVIEW

The Fed’s Dilemma Has a Name: Fiscal Dominance

Fiscal dominance isn’t a forecast — it’s a working theory with a live test subject: the U.S. economy. With debt over $33T, multi-trillion-dollar deficits still rolling in, and 80% of debt now held by the public, the Fed’s “independence” is starting to look more ceremonial than practical. The 6.3% deficit-to-GDP ratio screams crisis, but unemployment is low. Translation: we’re borrowing like it’s 2009, minus the recession. Investors are responding: TIPS allocations are up, and sovereign hedging is in vogue. As monetary policy gets boxed in by fiscal needs, long-duration assets, LBO math, and fixed income arbitrage are all under new stress tests. (More)

THIS WEEK IN HISTORY

September 6, 2008: The U.S. Government Seizes Fannie Mae and Freddie Mac

Fifteen years ago this week, the U.S. government officially took control of Fannie Mae and Freddie Mac, placing the two mortgage giants into conservatorship. At the time, they guaranteed or held roughly $5.3 trillion in mortgage-backed securities—nearly half the U.S. housing market.

The move came after months of escalating concern over the firms’ solvency amid rising mortgage defaults. Despite their quasi-government status, markets had lost confidence in their capital base. Treasury Secretary Hank Paulson stepped in, calling the takeover "necessary and unavoidable" to restore confidence in the financial system.

The takeover didn’t prevent the 2008 crisis—it preceded Lehman Brothers' collapse by just 9 days—but it signaled the start of full-scale federal intervention in financial markets. The U.S. would later inject capital into major banks, rescue AIG, and launch TARP. But this was the first domino.

Why it matters: It redefined moral hazard in U.S. finance and cemented the government's role as the ultimate backstop in housing. The GSEs still haven’t exited conservatorship—17 years later—and their legacy continues to shape debates over market risk, government guarantees, and the limits of privatization. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

CVC Capital Partners is being added to Amsterdam’s benchmark stock index, more than a year after the private equity firm made its market debut

— Bloomberg (@business)

6:02 PM • Sep 9, 2025

"The purpose of our lives is to add value to the people of this generation and those that follow."

Buckminster Fuller