- PE 150

- Posts

- Just Announced: CapLink x PE 150, NYC Summit w/ HarbourVest CEO, $6.4B Exit & $3T Credit Surge

Just Announced: CapLink x PE 150, NYC Summit w/ HarbourVest CEO, $6.4B Exit & $3T Credit Surge

New data confirm private equity’s muted rate sensitivity and 18× volatility shield—turning market chaos into cut-price entry points.

Hi,

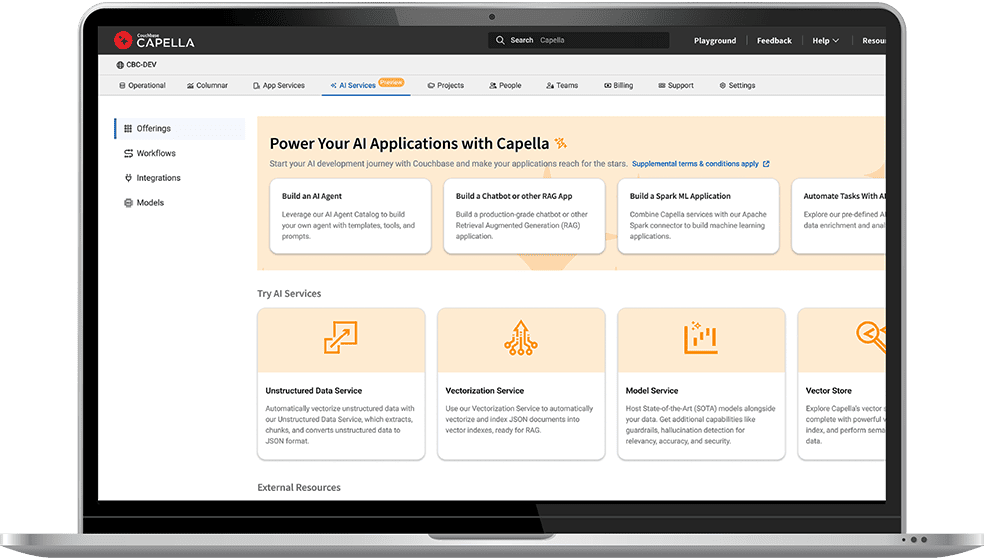

This Wednesday we’re excited to announce a strategic partnership between PE 150 and CapLink Group, combining two trusted forces in private markets media and events.

Together, we’re launching PE 150 x CapLink Group—a unified platform for investors, operators, and service providers who want to reach the heart of the private capital ecosystem.

From live summits and bespoke research to precision-targeted newsletter advertising to 400,000 investors and executives every week, we now offer a complete, high-conversion media stack to help you grow your presence in this sector.

In our regular schedule, we’re covering private equity’s mega-deal momentum, NAV lending’s rise as the new liquidity engine, a €6.4B European banking exit masterclass, and why 2025’s playbook demands macro flexibility. Also inside: private credit’s $3T ascent and the lesson Smoot-Hawley still teaches today.

Want to reach 400,000+ executive readers? Start Here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

The Illiquidity Premium Isn’t Just Real—It’s Defensive

New data shows what every PE sponsor has felt since 2020: public markets are drama queens. When rates jump or macro headlines spike, NASDAQ valuations nosedive. PE? Not so much. Regression coefficients clock NASDAQ’s interest-rate sensitivity at -0.57, versus just -0.23 for middle-market PE deals. Even more telling: volatility in public markets scales 18x faster during uncertainty spikes. Why? PE firms don’t mark to market daily, don’t chase exits in Q3 because of rate scares, and don’t get margin-called by Twitter. Private equity eats volatility for lunch—then shops distressed deals for dessert.(Read Full Report Here)

TREND OF THE WEEK

JV or Not JV?

As the M&A engine sputters, joint ventures (JVs) are quietly proving their staying power. In 2020, while M&A volume dropped by 8–10%, JV activity rose by 6%. Now, as dealmakers brace for higher rates and sticky inflation, JVs offer something traditional deals can’t: downside insulation and flexibility. According to BCG, 60% of executives see alliances as more crucial than M&A for future growth. Why? It's simple portfolio math: would you rather back two wholly-owned bets or six capital-light plays that spread the risk? In a world of constrained dry powder and uncertain valuations, JVs are the PE answer to optionality. The chart makes it clear: this isn’t a blip—it’s a rebalance. (More)

PRESENTED BY MONEY

Outsmart college costs

Ready for next semester? June is a key time to assess how you’ll cover college costs. And considering federal aid often isn’t enough, you might have to consider private student loans.

You’re just in time, though—most schools recommend applying about two months before tuition is due. By now, colleges start sending final cost-of-attendance letters, revealing how much you’ll need to bridge the gap.

Understanding your options now can help ensure you’re prepared and avoid last-minute stress. View Money’s best student loans list to find lenders with low rates and easy online application.

LIQUIDITY CORNER

Capital Raises Are the New Liquidity Events

Private companies are staying private longer—and planning liquidity events accordingly. According to new data, 56% of private firms expect to raise capital while remaining private, with 86% targeting a raise within two years.

But this isn’t evenly distributed. Appetite for capital is notably higher among:

Early-stage companies (Series A–C): 74%

Younger firms (<10 years old): 68%

Smaller businesses (<$100M in revenue): 64%

The trend is clear: younger, leaner firms see capital raises not as a step toward IPO, but as a way to unlock liquidity while avoiding public markets altogether.

For secondary investors and continuation fund managers, this creates a growing pipeline of targets—firms eager for cash, but unwilling to sell. Expect more NAV-based deals, structured secondaries, and bespoke capital solutions in the near-term, especially as exit routes remain constrained. (More)

DEAL OF THE WEEK

Advent Buys Spectris in £3.8B All-Cash Play

Advent International is acquiring precision measurement firm Spectris for £3.8 billion, sending shares up 15% on announcement. The private equity giant will pay £37.63 per share, including an interim dividend, marking an 84.6% premium to the pre-deal price.

Why the splashy valuation? Spectris owns high-spec assets across advanced materials, sensing, and simulation—core picks for sectors like semiconductors, life sciences, and energy. The business generated £1.4B revenue and £203M adjusted operating profit in 2024, with recent bolt-ons (Micromeritics, SciAps) boosting strategic heft. The purchase values Spectris at 18.5x EBITDA, a rich multiple even by UK industrials standards.

Advent’s move underscores two trends: top-tier UK public companies remain PE targets amid discounted valuations, and precision tech is a high-conviction vertical. If closed, this would be one of the largest UK take-privates this cycle.

Completion expected in Q1 2026, pending regulatory clearance. (More)

IN PARTNERSHIP WITH CAPLINK GROUP

The Private Markets Intelligence Summit of the Year

📍 October 15, 2025 | Well& by Durst, NYC

Join 300+ private markets leaders—GPs, LPs, operating partners, and advisors—for a single day of insights, strategy, and dealmaking at the New York Private Capital Summit.

This isn’t another networking event. It’s where strategy meets substance:

→ Keynotes from HarbourVest, Bloomberg, Australian Super

→ Deep-dives on secondaries, direct lending, GenAI, and ESG

→ Practical panels on fund formation, human capital, and tax strategy

→ A spotlight on emerging liquidity tools and NAV-based financing

With over 50 senior speakers from firms like Apollo, KKR, Carlyle, Neuberger Berman, and Warburg Pincus, the Summit is designed for decision-makers driving the next decade of private capital.

Reserve your seat before it sells out: Early Bird Access

PRIVATE CREDIT

Private Credit’s New Frontier

With 67% of investors planning to increase allocations to private debt by 2025, it's clear the asset class is moving from niche to necessity. But it’s not just about size—strategy is shifting, too. Faced with slower LBO activity, private credit firms are pouring capital into specialty finance: from aircraft leasing and receivables to NAV loans, sports lending, and royalties. These deals aren’t just creative—they’re cashflow-linked, inflation-hedged, and bankruptcy-remote. That’s catnip in today’s volatile rate environment. For GPs, specialty finance offers better documentation and diversification. For LPs, it’s a yield game with structural upside. The next phase of growth? Private credit goes bespoke. (More)

MICROSURVEY

Execution Over Strategy: Top Challenges in Private Equity Value Creation

A survey of 126 professionals across private equity, banking, consulting, and corporate development highlights execution as the critical barrier to value creation. Among private equity sponsors, 57% identify talent gaps and resistance to change as their biggest challenge, emphasizing the vital role of leadership and human capital. Data quality and performance tracking limitations are the top concern for 33% of all respondents—especially consultants (46%) and bankers (35%)—underscoring the need for reliable, real-time data to drive decisions. Technology integration remains a significant hurdle for corporate development teams, with 33% citing legacy systems as a key obstacle. Additionally, aligning portfolio company leadership with PE value plans is a consistent concern across all groups, affecting roughly one in five respondents. These insights confirm that while technology and data are essential, people and change management remain the cornerstone of successful private equity value creation. (More)

MACROVIEW

The Fed’s Waiting Game: Blame Trade, Not the CPI

Forget the soft CPI print—tariffs are the new inflation wildcard. The Fed is keeping rates pinned while it watches whether Trump-era trade skirmishes evolve into a cost spiral. Goods with elastic demand are shielding consumers—for now. But once pre-tariff inventories deplete, that buffer’s gone. The result: no policy loosening until trade talks settle. PE dealmakers should watch rate outlooks like they would a volatile GPAC partner—calm on the surface, chaos just beneath. No cuts till September at the earliest, and even that’s conditional. Inflation may be low, but uncertainty is still running hot. (More)

THIS WEEK IN HISTORY

June 29, 2007 – The iPhone Lands, and Capitalism Hasn’t Looked Back

Eighteen years ago this week, Apple released the first iPhone—and unknowingly redrew the strategic map for almost every industry it touched. What began as a sleek touchscreen phone quickly evolved into a platform that upended not just telecoms, but media, software, payments, advertising, and consumer behavior itself.

For investors, the ripple effects were seismic. Telcos lost pricing power. Print media bled audiences. Retail banking had to go mobile. And consumer tech multiples started baking in not just hardware margins, but platform dominance and recurring revenue. Apple, of course, became the first $3T company. But it also became a case study in vertical integration, ecosystem control, and user lock-in.

Why it matters: The iPhone wasn’t just a product—it was a thesis. One that continues to influence investment playbooks in mobile infrastructure, digital payments, app-based services, and now AI interfaces. In a business where distribution is everything, Apple’s pocket-sized portal is still the benchmark. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

KKR battles Advent for Spectris and PHP for Assura, and London’s luxury property downturn looks set to get worse -- get briefed ahead of your morning calls with The London Rush

— Bloomberg (@business)

7:30 AM • Jun 23, 2025

"The future belongs to those who believe in the beuty of their dreams"

Eleanor Roosevelt