- PE 150

- Posts

- $200K Fundraising, 39% Tender Offers, 53% Semi-Liquid Capital

$200K Fundraising, 39% Tender Offers, 53% Semi-Liquid Capital

Semi-liquid strategies capture 53% of new capital and tender offers lead liquidity plans, while SEC rules open public fundraising doors.

Good morning, ! This week we're unpacking how PE fundraising is edging public under new SEC rules (with $200K/$1M investor thresholds), why illiquidity is being revalued as a structural advantage, how only 25% of companies have locked in their next liquidity event as tender offers lead at 39%, and why semi-liquid private credit has surged from 6% of new capital in 2020 to a projected 53% by 2025—just as tail risk quietly rises beneath calm markets.

Want to advertise in PE 150? Check out our ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

The Illiquidity Advantage: Why Private Markets Outperform in a Noisy World

In a public market governed by speed, signals, and coordination, rational investors are often forced into irrational behavior. A single political comment or headline—accurate or not—can trigger broad-based sell-offs, as seen in credit card stocks after offhand remarks about interest rate caps. No legislation. No timeline. Just the power of liquid markets pricing possibilities over probabilities.

This is not behavioral chaos. It’s structure: a game-theoretic environment where the price becomes the message, and ambiguity about who knows what leads to self-reinforcing panic. In that environment, illiquidity acts as a feature, not a bug. Private markets, by contrast, are structurally shielded from narrative whiplash and mark-to-market reflexes. They price fundamentals over time, not headlines in real-time.

The takeaway for allocators? Illiquidity isn’t a constraint—it’s a shield. In an era of media-saturated volatility, the slow-and-steady cadence of private markets may offer not just higher premiums, but more durable wealth preservation. When coordination breaks down, discipline wins.

PRESENTED BY WHEREBY

Virtual care is becoming the backbone of modern healthcare. But access and delivery are only the beginning. The real challenge is building virtual care systems people can trust, and that work reliably at scale.

In Whereby’s State of Virtual Care survey, telehealth leaders highlight the same pressure points that slow adoption: keeping patients engaged, building trust, and delivering a smooth experience without technical issues.

Whereby, a video call solution for telehealth platforms, pulled the key findings into a practical set of benchmarks you can use to check priorities for 2026.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

TREND OF THE WEEK

Liquidity, With an Asterisk

Private credit is quietly changing its funding model. Semi-liquid vehicles—evergreen, open-ended, wealth-friendly—have grown from 6% of new capital in 2020 to a projected 53% by 2025, per MSCI. Flows jumped from $10bn to $74bn, while traditional closed-end drawdown funds slowed.

The pitch is simple: flexibility. Periodic subscriptions. Quarterly redemptions. Fewer decade-long lockups.

The reality is messier. Redemption gates, limited windows, and GP-issued marks mean liquidity is more promised than delivered. When cash is needed, managers lean on cash buffers, NAV lines, or secondaries—tools that work until they don’t.

This creates a familiar tension: lending long while offering short-dated liquidity. The model hasn’t been stress-tested yet. The next downturn may decide whether this is financial innovation—or just a softer version of the same old mismatch. (More)

LIQUIDITY CORNER

Optionality Over Urgency

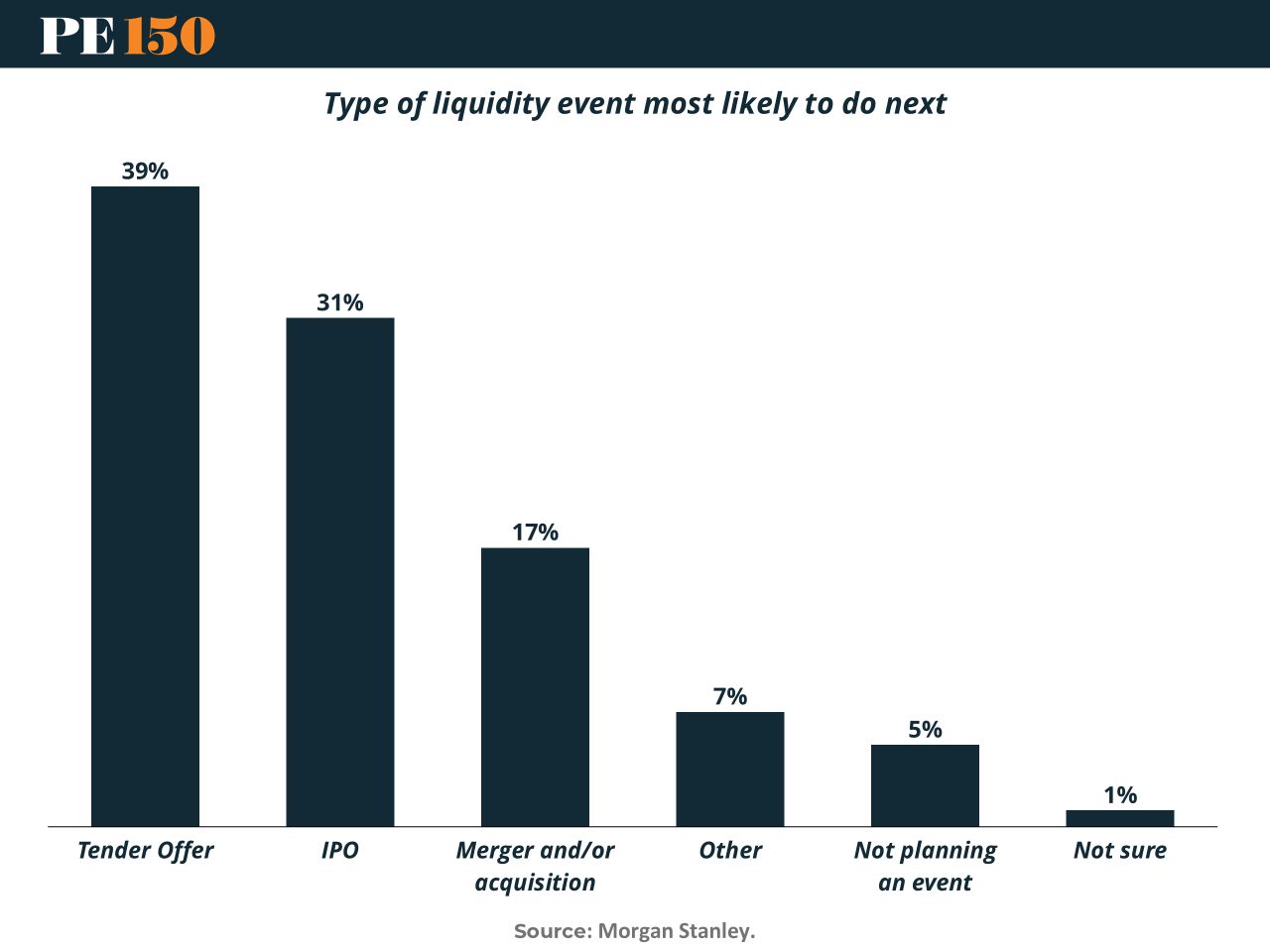

Liquidity decisions are getting modular. Only 25% of companies have locked in the structure of their next liquidity event—but most already know the direction of travel. The clear front-runner is tender offers, cited by 39% of respondents. It’s partial liquidity without the governance, disclosure, and timing risks of an IPO. Control stays put. Employees get paid. Everyone sleeps better.

IPOs remain relevant at 31%, reinforcing that public markets are still the endgame—just not today. Boards are watching valuations and volatility, waiting for a cleaner window rather than forcing the issue.

M&A, at 17%, plays a supporting role. Valuation gaps and founder reluctance to sell early are keeping strategic exits on the back burner.

The takeaway: companies are prioritizing flexibility, sequencing, and optionality. Liquidity is no longer a moment—it’s a menu. (More)

MACROVIEW

Tail Risk Rising, Markets Just Don’t See It Yet

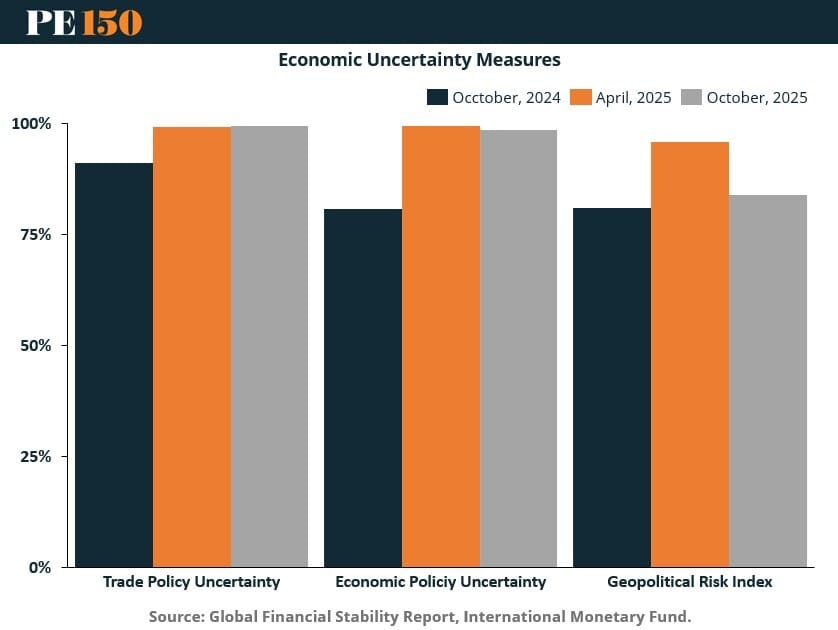

Markets look calm, but the IMF’s growth-at-risk framework tells a different story. Despite low volatility and rising equity prices, the 5th percentile tail risk for global growth has widened. Translation: the odds of a sharp macro shock are rising.

The tail risk increase comes as investors ignore persistent economic policy, trade, and geopolitical uncertainty. Even as tariffs re-emerge and fiscal deficits balloon, asset prices continue climbing. Meanwhile, the U.S. dollar has decoupled from interest rate differentials, and sovereign debt is increasingly held by price-sensitive buyers.

The signal for allocators: don’t mistake stability for resilience. With NBFIs now deeply embedded in sovereign and credit markets, liquidity shocks could spread quickly. The IMF stress test projects $300B in forced U.S. Treasury sales under a bond fund outflow scenario. In that world, tail risk pricing matters again. (More)

COMPLIANCE CORNER

Fundraising Goes Public—With Conditions

The SEC’s March 2025 guidance opens the door for PE firms to publicly market under Rule 506(c)—with less friction. Firms can now verify accredited investors using minimum investment thresholds ($200K for individuals, $1M for entities) plus self-attestations, easing a major compliance hurdle.

This unlocks digital fundraising—social media, webinars, ads—especially for emerging managers. But the SEC isn’t backing off enforcement. Expect scrutiny on marketing accuracy, investor verification, and fee disclosures.

Bottom line: New flexibility brings new risk. Firms must document verification steps, review materials under the Marketing Rule, and reinforce KYC and disclosure protocols. Public fundraising is now viable—if compliance is airtight. (More)

PUBLISHER PODCAST

No Off Button: The "Karmic Banker" theory of business

Champions don’t step away—they keep building. No Off Button is where Aram sits down with founders, operators, and creators who never needed an off switch to create real value. No startup mythology. Just the people who compound through discipline, relationships, and execution.

This week’s guest is Greg Topalian, Chairman of Clarion Events North America and founder of LeftField Media. Greg built New York Comic Con—the largest pop culture event in North America—without ever quitting his job. An intrapreneur by design, he scaled passion-driven communities inside large institutions, managed a $100M+ events portfolio, and learned the business fundamentals the hard way—selling food off a Sysco truck.

The conversation dives into intrapreneurship, enthusiast markets, and Greg’s “Karmic Banker” philosophy: the best operators give first, build relationships early, and let value compound over time.

Why it matters: this is a reminder that long-term wins come from operational grit, leverage, and human connection—not flashy exits.

"It is not the strength of the body that counts, but the strength of the spirit."

J.R.R. Tolkien