- PE 150

- Posts

- Why Earnings Growth Is the New Alpha in Private Equity

Why Earnings Growth Is the New Alpha in Private Equity

Private equity activity in the U.S. remains under pressure in 2025, as higher-for-longer interest rates and extended holding periods reshape the calculus for returns.

Despite dry powder levels remaining elevated, dealmakers are facing a stark reality: the bar for earnings growth has risen sharply — and with it, the urgency to extract value from every portfolio company.

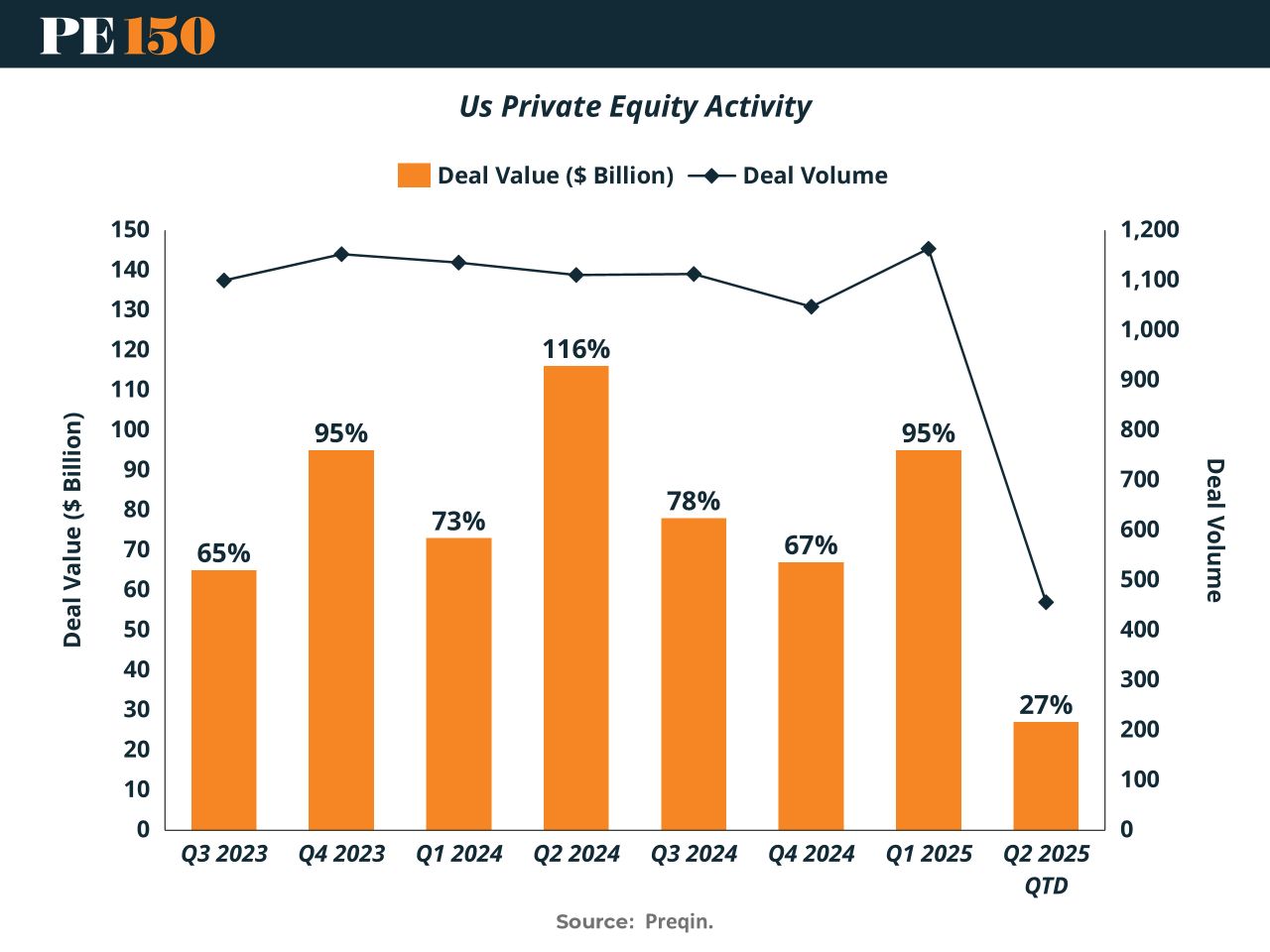

According to data from Preqin, U.S. private equity deal volume has slowed meaningfully in Q2 2025, while deal value has dropped to just 27% of the quarterly average from previous periods. This deceleration underscores a growing conservatism among sponsors who now face steeper hurdles to hit return targets. Consider this: achieving a 20% IRR over a seven-year horizon now requires 4.2% annual earnings growth at a 7% interest rate — more than double the requirement under a 3% rate.

How the Game Has Changed

In this new environment, value creation strategies are shifting:

Operational levers are in the spotlight, with sponsors prioritizing pricing power, AI-driven efficiency, and product-channel mix optimization.

Holding periods are lengthening, prompting a rise in continuation vehicles, secondaries, and fund restructurings.

Credit stress is rising, with liability management exercises (LMEs) nearly doubling in volume compared to last year — a sign of sponsors racing to amend terms and preserve liquidity without forced exits.

Themes to Watch

AI adoption is becoming table stakes, not just in cost control but as a strategic asset.

Retailization of funds is accelerating, providing GPs with new capital sources amid institutional caution.

Complexity and carve-outs are growing in popularity, with buyers targeting deals that offer embedded transformation opportunities.

Looking Ahead: Winners Will Rethink the Playbook

The traditional PE playbook of leverage and cost cuts is no longer enough. The firms that win in the second half of 2025 will be those that combine strategic foresight with execution muscle — embedding analytics, driving topline growth, and staying disciplined with capital. As exit paths narrow and capital costs stay elevated, value creation must be proactive, not opportunistic.

In short, it’s no longer just about buying right. It’s about growing right — and growing fast enough to beat the math.