- PE 150

- Posts

- Private Equity Exit Slowdown Triggers Fundraising Fatigue

Private Equity Exit Slowdown Triggers Fundraising Fatigue

Global PE exits fell to $80.8B in Q1 2025—stalling capital returns and prolonging fundraising cycles. Here’s what it means for GPs and LPs.

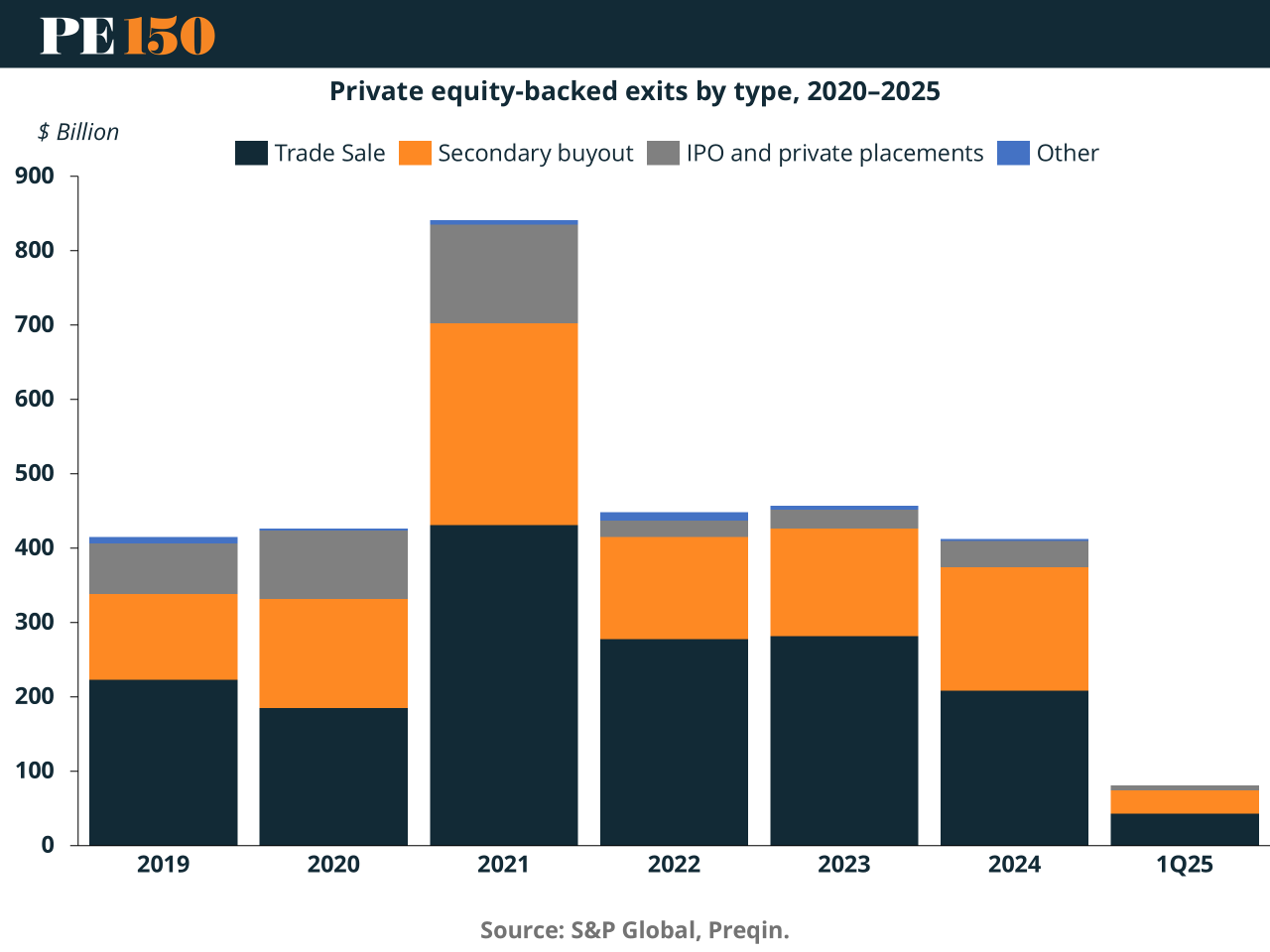

Through Q1 2025, global PE exits sank to their lowest level in two years, with just 473 completed transactions totaling $80.81B, according to S&P Global and Preqin. While deal pipelines remain full, actual closings are lagging as buyer and seller expectations diverge. Strategic acquirers are holding back, financial sponsors are waiting for cleaner comps, and the IPO window is barely ajar—with just 18 PE-backed listings globally, the lowest quarterly total in five years.

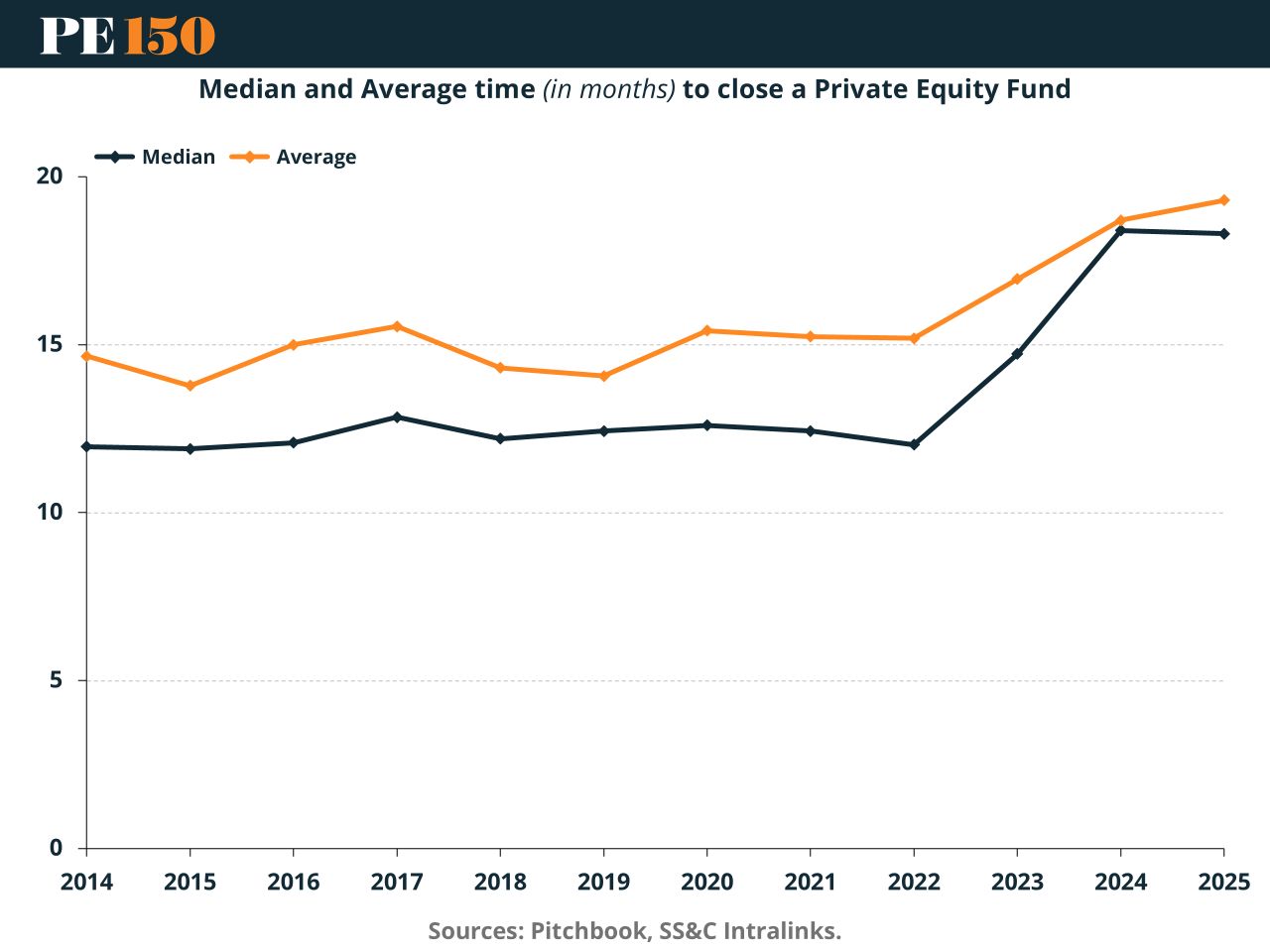

This exit freeze is reverberating across the fundraising cycle. PE funds typically rely on returning capital to LPs via exits before launching new vehicles. But with distributions drying up, LPs are underallocated and overexposed—holding commitments with little liquidity to redeploy. As a result, the median time to close a PE fund has ballooned from 11.2 months in 2022 to 18.1 months in H1 2024, and is hovering at 18.3 months in early 2025.

Even industry leaders aren’t immune. Blackstone’s flagship buyout fund, targeting $20B, remains open more than two years after launch. Platinum Equity’s sixth fund, live since October 2021, is still raising. Despite healthy aggregate figures—$155B raised by US PE funds in H1 2024 across 129 vehicles—fundraising has bifurcated: capital is consolidating with the largest GPs, while emerging managers struggle to get traction.

The broader market data underscores the problem. Cash-on-hand, measured by dry powder divided by annual contributions, hit 5.5 years by mid-2024—a 16-year high. And 57.1% of global dry powder is now older than three years, up from 49.2% in 2023. The system isn’t just clogged—it’s aging.

Why this matters for PE professionals: prolonged fundraising compresses the deployment window, pressures IRRs, and leads to rushed underwriting. It also raises existential questions for firms unable to return capital on schedule. LPs are watching closely—and their willingness to re-up depends increasingly on whether managers can convert paper value into real cash.

With IPOs constrained and M&A tepid, GPs are leaning harder on alternative liquidity paths. Continuation funds—which allow GPs to roll high-performing assets into new vehicles—are on track to hit $9B in exit volume in 2024, up from just $0.2B a decade ago. But LP skepticism remains, especially when conflicts of interest emerge in GP-led secondary deals.

Bottom line: the slowdown in exits is no longer just a market phase—it’s a structural challenge. Until PE firms can reopen the liquidity spigot, fundraising momentum will remain sluggish, timelines extended, and capital deployment uneven. For GPs, the priority now isn’t pitching new funds—it’s proving they can close the last act.