- PE 150

- Posts

- RIP 60/40: Why Private Markets are Taking Over Portfolios

RIP 60/40: Why Private Markets are Taking Over Portfolios

Alternatives assets are rising and challenging the 60/40 portfolio strategy, while continuation funds see a peak in 2024 and Private Credit rates are lowering.

Good morning, ! This week we’re covering the rise of Alternatives in todays investment strategies, how default rates are shaping sponsor behavior in private credit, what’s really slowing down AI adoption across deal teams, the growing PE appetite in WealthTech, and the strategic logic behind KKR’s latest biopharma royalty play. Plus, a look at how alternatives are reshaping the modern portfolio.

Join 50+ advertisers who reach our 500,000 executives: Start Here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

From 60/40 to Modern Portfolio Allocation: The Case for Private Market Alternatives

In 2022, the traditional 60/40 portfolio saw both stocks (-18.0%) and bonds (-13.0%) decline simultaneously, challenging long-standing diversification models. Cash returned 0.0%, offering little relief.

Private market assets are increasingly central to portfolio strategies. AUM in private markets is projected to grow from $14T in 2020 to $22T by 2024, with flexible formats like permanent capital vehicles and LP-driven structures now making up 33% of private capital AUM.

Portfolios with 30–40% allocated to alternatives have historically shown ~9.0% annual returns and higher risk-adjusted performance. Institutional investors are shifting accordingly: sovereign wealth funds now allocate more to real estate, private equity, and infrastructure than to hedge funds or commodities. Private credit has also grown 4x over the past decade, reaching $2.1T AUM.

Alternatives are becoming a structural component of modern portfolios.

TREND OF THE WEEK

WealthTech: Fewer, Richer, Bigger

European WealthTech funding rebounded 67% quarter-over-quarter in Q2 2025, hitting $700M—but the story is all about deal concentration. The total number of deals rose modestly from 24 to 35, still far from the 45 recorded a year ago. What drove the recovery? A 3.7x jump in $100M+ rounds, with FNZ’s $500M mega-deal leading the way.

Despite the headline growth, smaller rounds (<$100M) totaled just $200M, down nearly 50% year-over-year. The average deal size hit $20M, reinforcing a clear trend: investors are targeting scale, not scattering bets. Infrastructure-heavy, late-stage players are attracting the lion’s share of capital, while early-stage WealthTech struggles to regain momentum.

The bottom line: capital is consolidating around winners. Risk-off sentiment continues, and quality is beating quantity. (More)

PRESENTED BY SYNTHFLOW

Voice AI Security That Impacts Your Bottom Line

Learn how enterprise IT and ops leaders are using compliance to unlock Voice AI scale—deploying faster, reducing risk, and accelerating procurement.

This guide shows why HIPAA, GDPR, and SOC 2 are now deal-makers, not blockers. From securing PHI to routing across 100+ sites, see how security-first platforms reduce friction and enable real-world rollout across healthcare, insurance, and more.

LIQUIDITY CORNER

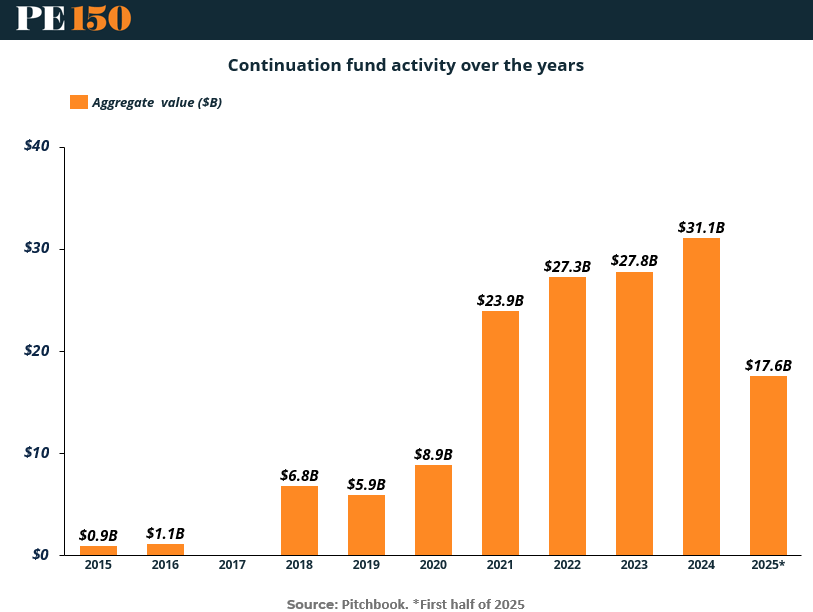

Continuation Funds Hit $31.1B Peak, But 2025 Pullback May Signal a Reset

Continuation fund activity has exploded over the last five years, jumping from $8.9B in 2020 to a record $31.1B in 2024, as GPs used these vehicles to hold onto prized assets and manufacture liquidity amid a frozen exit market. But early 2025 data shows a deceleration—just $17.6B in the first half—hinting that the boom may be cooling or normalizing.

Why it matters: Continuation funds have become the not-so-secret weapon for PE liquidity management, especially when IPO and M&A windows are shut. They offer GPs runway, LPs optionality, and portfolios breathing room. But concerns remain around pricing conflicts and process integrity—56% of failed continuation deals cite valuation disputes.

The takeaway: Expect continuation funds to remain a core part of the liquidity toolkit, but scrutiny will increase. LPs are watching deal terms more closely, and regulators are circling. In a market still starved for exits, the quality—not just the quantity—of continuation activity will define the next phase. (More)

DEAL OF THE WEEK

Deal of the Week: KKR Doubles Down on Biopharma Royalties

KKR just added a new tool to its healthcare arsenal. The global investment firm has acquired a majority stake in HealthCare Royalty Partners (HCRx), a $3B asset manager specializing in royalty-based financing for commercial-stage biopharma assets.

HCRx isn’t new to the game. The Stamford-based firm has deployed $7B+ across 55 products in over 10 therapeutic areas, positioning itself as a leader in a niche corner of healthcare finance: royalty monetization. With the acquisition, KKR gains an experienced team and a foothold in a capital-efficient segment of the market that allows companies to raise non-dilutive funding.

This move complements KKR’s broader healthcare strategy—having deployed $20B+ in equity capital since 2004 across names like BridgeBio, Dawn Bio, and Treeline. But HCRx gives KKR a specialized edge in structured credit and royalty-linked products, a market still underpenetrated (<5% of biopharma capital needs).

Why it matters: As R&D-heavy biopharma firms look for alternatives to equity or traditional debt, royalty transactions are becoming a strategic financing lever. KKR is betting that demand for flexible, IP-backed capital solutions will grow—and that it can deliver them at scale. (More)

TOGETHER WITH PACASO

Former Zillow exec targets $1.3T market

The wealthiest companies tend to target the biggest markets. For example, NVIDIA skyrocketed nearly 200% higher in the last year with the $214B AI market’s tailwind.

That’s why investors are so excited about Pacaso.

Created by a former Zillow exec, Pacaso brings co-ownership to a $1.3 trillion real estate market. And by handing keys to 2,000+ happy homeowners, they’ve made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO.

No wonder the same VCs behind Uber, Venmo, and eBay also invested in Pacaso. And for just $2.90/share, you can join them as an early-stage Pacaso investor today.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

PRIVATE CREDIT

Default Dips: Big Loans, Bigger Discipline

As reported by PitchBook Data, Inc., private credit default rates dropped to 1.76% in Q2, marking a 27% decline in QoQ and the second straight quarter of improvement. According to Proskauer’s Index, large borrowers (EBITDA ≥ $50M) led the charge—defaulting at just 0.5%, down from 1.7%. Mid-market names also tightened up, while the sub-$25M cohort actually slipped in the opposite direction.

The headline? Larger borrowers are proving bulletproof, smaller ones are leaking oil, and private credit as an asset class looks steady amid rate volatility. Sponsors continue leaning on amend-and-extend tactics and tighter documentation, showing that not all risk management is just wishful thinking in a rising-rate world. (More)

MICROSURVEY

The AI Adoption Bottleneck

Turns out AI isn’t being ghosted—it’s stuck in proof-of-concept purgatory. Our latest micro-survey shows “Unclear ROI” (26%) and “Data availability” (24%) as the top two barriers. PE sponsors are especially cautious, with nearly 1 in 3 citing ROI fuzziness as the biggest holdup. Meanwhile, consultants? They’re in a full-blown culture war: 50% blame “resistance to change.” The takeaway: the issue isn’t desire—it’s infrastructure, clarity, and trust. AI might be sexy, but until it can model IRR like a Bain partner, it’s staying in the sandbox. (More)

MACROVIEW

Transatlantic Tariffs, American Optics

What happens when two trading giants “agree” to disagree? A 15% flat tariff now hits nearly all EU goods bound for the US, up from an average of 5% — a compromise from Trump's threatened 30%, but hardly a win-win. The $236B U.S. trade deficit with the EU provided political cover; Germany's €34B auto exports and Ireland’s pharma are now collateral damage. Steel and aluminum remain at 50% tariffs, and pharma + semiconductors sit in legal purgatory. US optics? Dominant. EU outlook? Resigned. No lawsuits filed, but Berlin’s already on the line with Brussels. (More)

THIS WEEK IN HISTORY

From Ground Zero to GDP Boom

August 6th, 1945 marked the atomic bombing of Hiroshima, a moment of unprecedented destruction that ended World War II and launched the nuclear era. The impact on Japan’s economy was catastrophic: infrastructure obliterated, industrial output halted, and workforce decimated. But out of the ashes came one of the greatest national economic rebounds in modern history. U.S. aid, Korean War demand, and industrial reinvention helped Japan transform from a shattered empire to a global manufacturing powerhouse by the 1950s. The trauma seeded Japan’s post-war pacifism, but also catalyzed a capitalist reinvention that would reshape international trade for decades. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

Try walking into a bank and asking to sell 12% of an office building.

They’ll laugh.

Because traditionally, real-world assets like property, art, or private equity aren’t made to move.

They’re locked up, valuable, but stuck.

That’s where tokenization changes the game.

And

— 𝚁𝚊𝚢𝚗𝚎𝚛 (@raynerheanyi)

3:27 PM • Aug 5, 2025

"You build great companies by solving real problems."

Marcos Galperin