- PE 150

- Posts

- Real Estate’s 2026 Case; Slower Asia Capital; PE Under Scrutiny

Real Estate’s 2026 Case; Slower Asia Capital; PE Under Scrutiny

Wage growth outpaces home prices and mortgage rates stabilize at 6.3%, while Asia fundraising hits a structural slowdown.

Good morning, ! This week we're covering Real Estate 2026 Outlook and why it just might work, Asia private capital fundraising continuing to slow, the median holding periods for buyout exits, and PE’s new phase of regulatory scrutiny

Sponsor spotlight: In Affinity’s survey of nearly 300 private capital professionals, deal sourcing is still priority #1 for 2026—but bandwidth is the constraint. The 2026 Predictions report shows how firms are tightening data ecosystems and automating sourcing workflows to surface better opportunities faster. Read the Report →

DATA DIVE

Why Real Estate in 2026 Might Actually Work

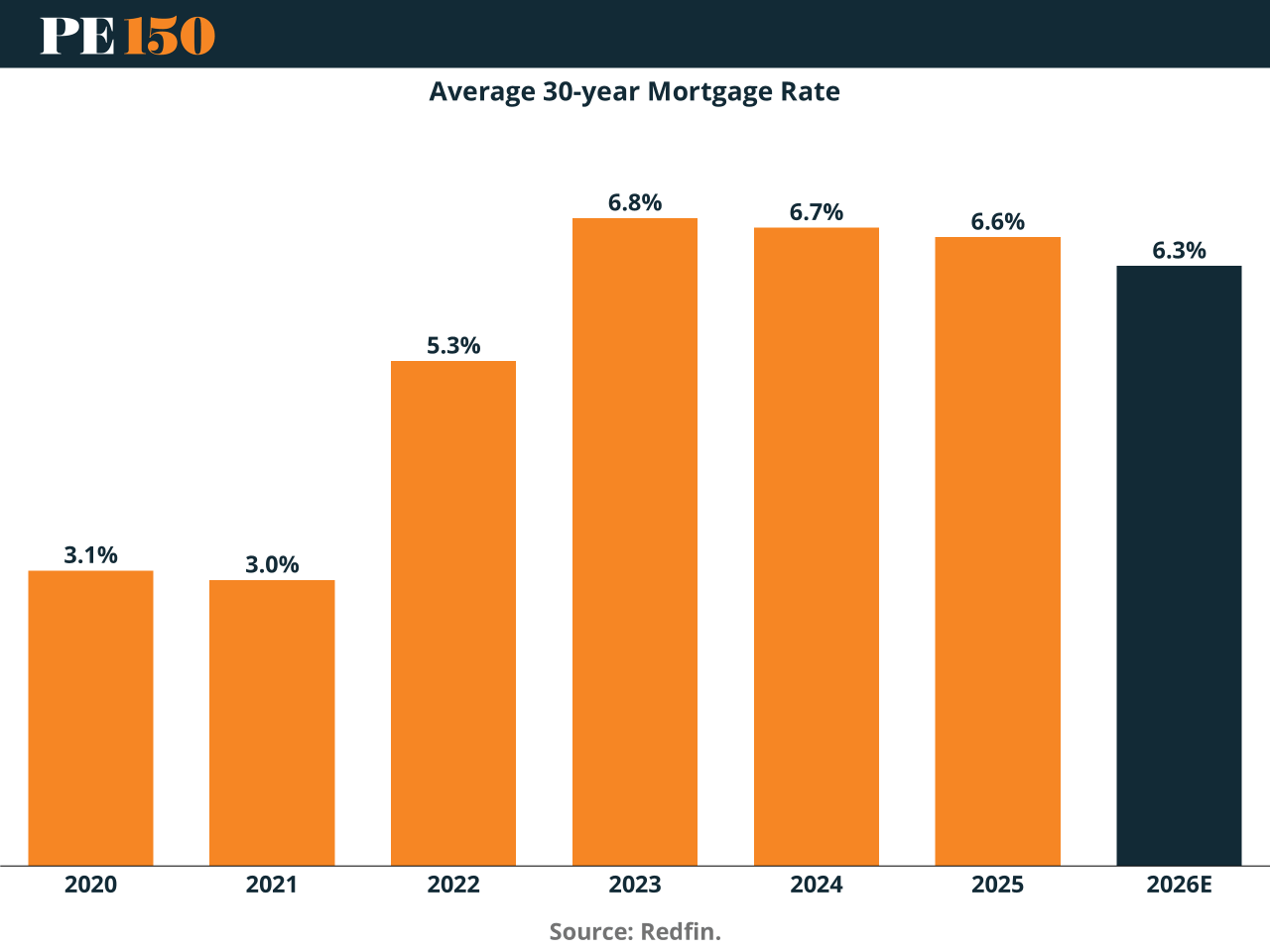

After years of volatility, 2026 is shaping up as a return to real estate sanity. The data points to a constructive, not speculative, backdrop: mortgage rates are easing, affordability is improving, and supply-demand dynamics are rebalancing.

At the core is a subtle but powerful shift: wage growth is finally outpacing home price appreciation, narrowing a distortion that’s plagued housing since the pandemic. Combine that with projected 30-year mortgage rates around 6.3%, and the result is a less volatile market where both buyers and sellers can act with more confidence.

This matters for private equity investors still circling real estate. The environment now favors underwriting discipline over leverage-fueled velocity. Volatility is falling, liquidity is returning, and pricing is starting to reflect long-term fundamentals—not stimulus distortions.

For long-duration capital, that’s not boring. That’s a better entry point.

Bottom Line: If the forecast holds, 2026 could reward patient capital across residential and select commercial segments—especially for GPs underwriting off normalized, not peak, assumptions.

TREND OF THE WEEK

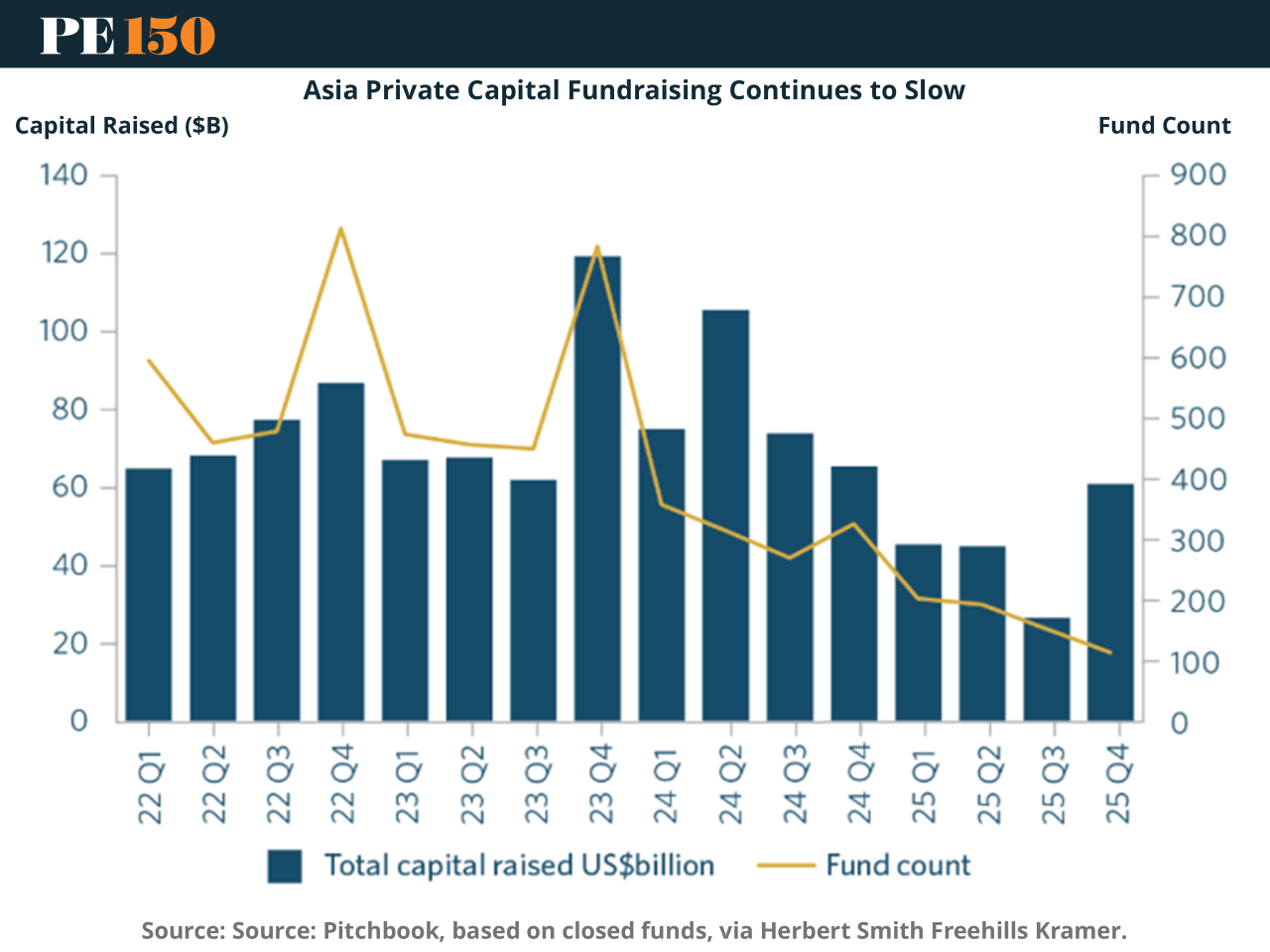

Asia Fundraising Hits a Structural Slowdown

Asia private capital fundraising is no longer just cooling. It is resetting lower. The chart shows a clear break from the pre 2022 pattern. Capital raised peaked in late 2023 and early 2024, then slid steadily through 2024 and into 2025. Fund counts fell even faster. By 2025, fewer managers are in market and those that are raising meaningfully smaller pools. This is not a cyclical pause driven only by rates. It reflects three structural frictions hitting Asia at once. First, China exposure remains politically and institutionally constrained for global LPs. Second, exit visibility across the region is weak, keeping DPI front of mind. Third, LP capital is being reallocated toward home markets where governance, liquidity tools, and underwriting feel more predictable.

The strategic implication is uncomfortable but clear. Asia is shifting from a capital abundance story to a capital rationing one. Large brand name GPs will still clear. Everyone else faces longer fundraising timelines, smaller targets, or forced strategy pivots.

For PE firms, Asia is no longer about growth at scale. It is about selectivity, local advantage, and proving liquidity in advance. Fundraising has become the first diligence gate, not the last. (More)

PRESENTED BY AFFINITY

One-third of dealmakers are now spending 21–40 hours every week just researching companies. That's half a full-time job before a single conversation happens.

In Affinity's survey of nearly 300 private capital professionals, deal sourcing remains their top priority for 2026. But the real bottleneck is having the bandwidth to evaluate opportunities before competitors do.

The firms pulling ahead are automating the manual research work, surfacing higher-quality targets faster, and protecting their teams from drowning in data.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

LIQUIDITY CORNER

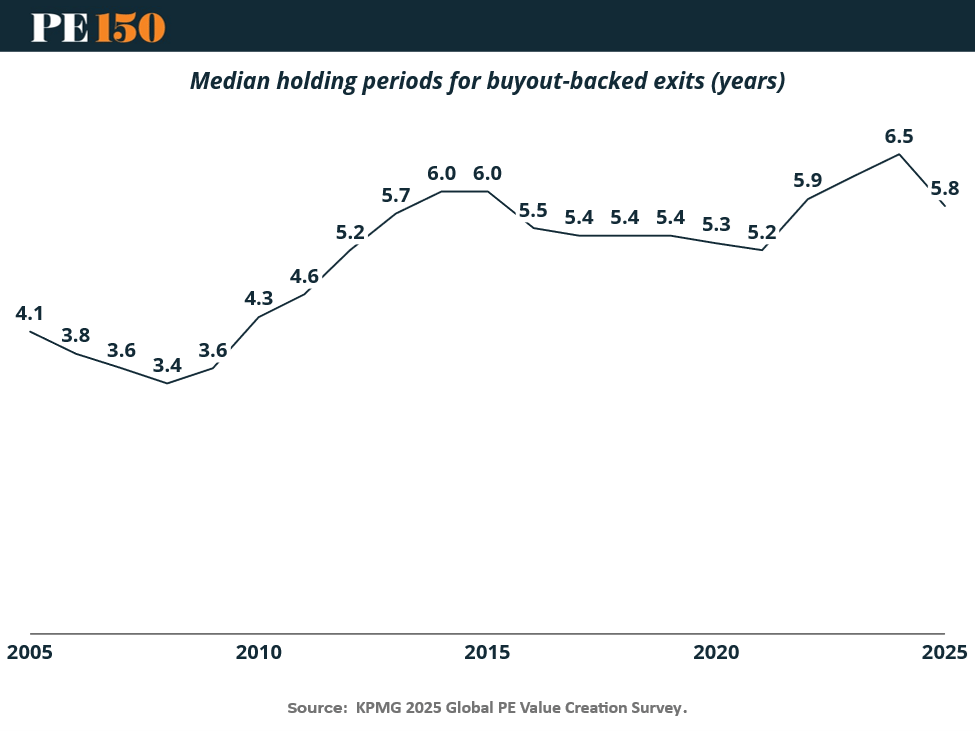

The Exit Clock Is Broken

Liquidity in private equity is slowing—and not because sponsors forgot how to sell. Median holding periods have stretched from 3–4 years to nearly 6, reflecting a deeper truth: the old playbook no longer clears today’s exit bar.

Traditional value creation levers—SG&A cuts, footprint expansion, quick EBITDA fixes—aren’t enough in a high-cost, low-growth environment. With multiple expansion off the table, exits now have to be earned operationally.

That’s why sponsors are doubling down on data quality, AI-enabled analytics, and management depth. Roughly 70% of firms plan to boost operational AI investment by at least 25%, and a growing share now balances growth and efficiency equally.

The result: longer holds, but stronger exits. Buyers are paying up for resilience and scalability, not financial engineering in a trench coat. (More)

MACROVIEW

The Macroeconomics of Artificial Intelligence in 2026

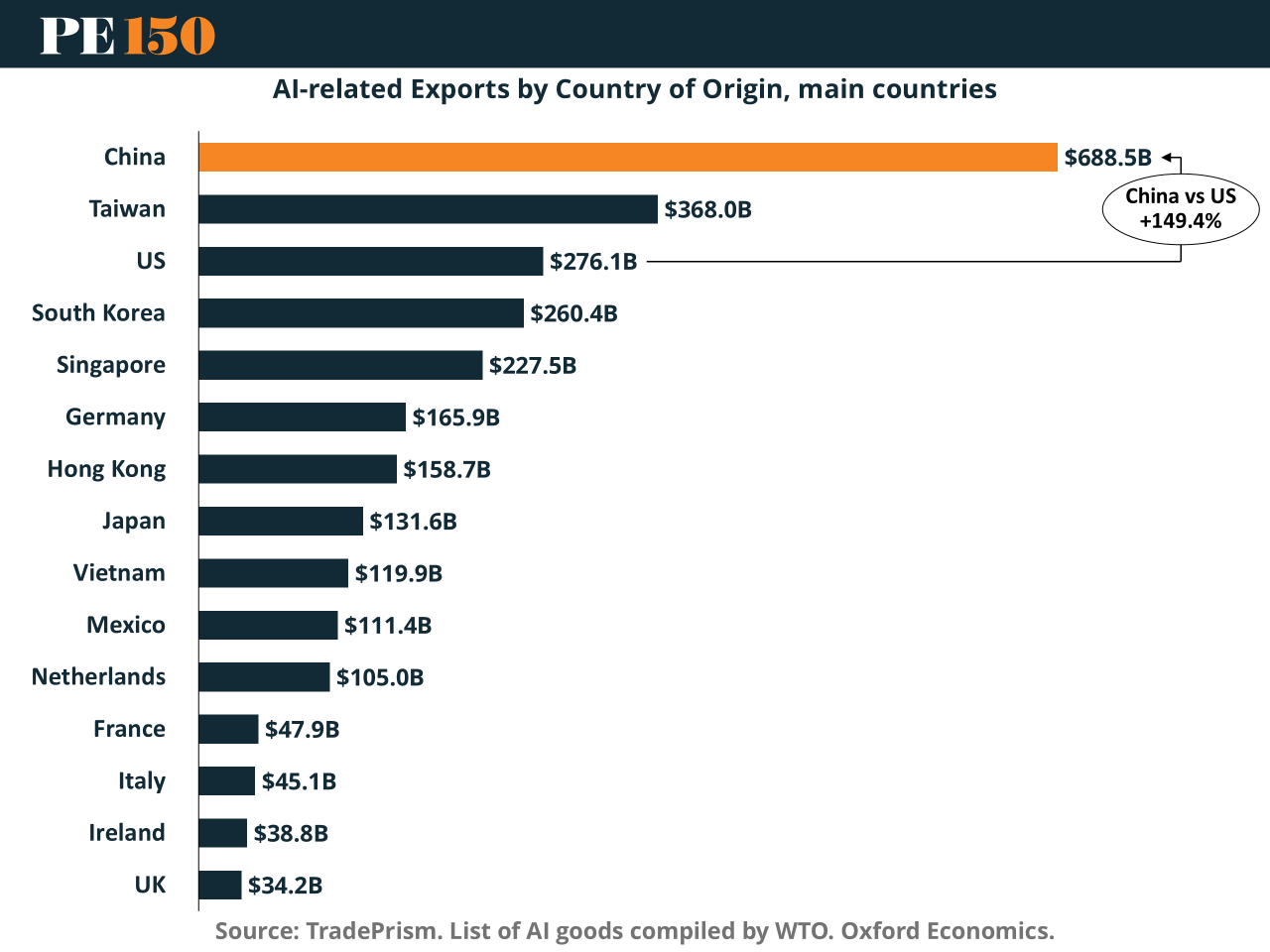

AI trade has quietly become a macro shock absorber. AI related goods now account for roughly 11% of global exports, and the geography matters more than the headline growth. China exports nearly $690B of AI related hardware, more than 2.5x the United States at $276B, with Taiwan and South Korea filling out the semiconductor spine of global trade.

This is not a consumer tech story. It is an infrastructure cycle. Semiconductors, processors, memory, and networking gear dominate flows, pulling capital toward fabs, data centers, power grids, and logistics. While tariffs and protectionism continue to suppress non AI goods, AI linked trade is growing roughly twice as fast, offsetting a meaningful share of global trade drag.

The strategic wrinkle is concentration risk. Asia captures the export dividend, while Western economies import the capex. As a result, growth increasingly shows up in industrial production and fixed investment, not wages or consumption.

Why it matters for PE: macro growth driven by AI is capex heavy, debt financed, and regionally uneven. Returns will favor sponsors positioned in infrastructure, power, supply chain relocation, and second order industrial beneficiaries, not just software narratives. (More)

COMPLIANCE CORNER

Transparency Gets Teeth

Private equity is entering a new phase of regulatory scrutiny, and this one is less about rules and more about disclosure credibility. The SEC’s 2026 exam priorities sharpen the focus on valuation methodologies, fee and expense allocations, conflicts of interest, and liquidity terms—areas that already drove enforcement in 2024–2025.

The August 2025 ADI update raises the bar for registered vehicles holding private assets, pressing firms to clearly explain illiquidity risk, governance frameworks, and side-letter economics. Plain-English, layered disclosure is no longer just for retail funds—it’s becoming the default expectation.

For PE firms, this means tightening valuation committee processes, documenting independent appraisal overrides, and maintaining defensible records around allocation policies and related-party transactions. The shift is clear: compliance is becoming a differentiator, not just a shield. (More)

PUBLISHERS PODCAST

No Off Button: Real leadership shows up after the frameworks fail.

In this episode, Aram sits down with Konstantinos Papakonstantinou to unpack the uncomfortable gap between formal education and real-world execution. They get into why degrees, playbooks, and neat frameworks tend to break down when capital is at risk—and how judgment is actually forged through ownership and consequence.

The conversation zeroes in on decision-making under pressure, accountability, and the kind of lessons teams only learn when outcomes are real and reversible mistakes are gone.

Why PE should care: returns aren’t driven by credentials—they’re driven by operators who can make clear calls with imperfect information, carry responsibility, and execute when it counts.

Watch the full conversation and see what holds up when theory meets reality.

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"If you don't like something, change it. If you can't change it, change your attitude."

Maya Angelou