- PE 150

- Posts

- Private Equity’s New Reality: 80% Liquidity Pressure, $475B in Add-Ons, 400+ bps Alpha

Private Equity’s New Reality: 80% Liquidity Pressure, $475B in Add-Ons, 400+ bps Alpha

Private markets deliver 400–850 bps in alpha and add-ons reach $475B, while 80% of firms report rising liquidity pressure.

Good morning, ! This week we’re unpacking PE’s evolving antitrust playbook, how AI is already moving pricing and diligence outcomes, why 80% of private companies now feel liquidity pressure, what a ~25% rise in consumer prices since 2019 means for underwriting, why $475B+ in add-on deals remains a core strategy, and how private markets continue to outperform publics by 400–850 bps over time.

Want to advertise in PE 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

The Long Game: How Private Markets Weaponize Time

Compounding isn’t just a financial concept—it’s a competitive edge. Over every major time horizon (5, 10, 15, and 20 years), private equity has consistently outperformed public equities by 400–850 bps annually, turning the pacing of capital deployment into an alpha engine. While public investors react in real-time to market shocks, private investors build exposure methodically—across vintages, insulated from panic.

Take the 20-year window: private equity returned 15.2%, while public equity managed just 9.7%. That 5.5% spread, compounded over decades, translates into vastly divergent wealth outcomes. And it’s not just about returns—volatility tells the other half of the story. Even during macro shocks like 2008, COVID, and 2022’s inflation spiral, private equity volatility remained muted, protecting investors from behavioral errors and liquidity-driven selloffs.

The punchline? Public markets are snapshots—pricing sentiment in real time. Private markets are slow-motion films—capturing operational value over time. For allocators, that means diversification isn’t just about asset classes. It’s about emotional tempo. And nothing compounds quite like patience.

Bottom line: Treating a portfolio as a process, not a pie chart, turns volatility into an asset and time into the most powerful investment lever.

TREND OF THE WEEK

Add-On Deals: A Plateau with a Pulse

After peaking at $777.6B in 2021, global PE add-on activity is settling into a lower but persistent rhythm. The latest KPMG data shows $475.2B in aggregate add-on value through Q3 2025, on track to finish below 2024’s $604.4B, and far off the 2021 highs.

The story? After the 2021 M&A supercycle, GPs leaned into bolt-ons as a safer path to value creation amid macro headwinds. Even as headline buyout volumes dropped, add-ons provided scale, synergy, and defensible growth in a tougher fundraising and exit climate.

But the post-COVID sugar high is over. Rising debt costs and tighter capital discipline are slowing the pace. Still, 2025 is on track to outpace pre-pandemic years like 2019 ($444.6B) and 2020 ($402.0B), signaling that add-ons remain a structural feature of modern PE.

Bottom line: Bolt-ons aren’t booming—but they’re still building. For platform-heavy strategies, this is the new normal. (More)

PRESENTED BY MONEY.COM

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to get the coverage you actually need.

LIQUIDITY CORNER

Liquidity Pressure Goes Mainstream

Private companies are discovering that liquidity has shifted from a luxury to a line item on the strategic agenda. The data is blunt: four out of five companies now feel pressure to provide some form of shareholder liquidity, and 27% say it’s a lot of pressure. Early-stage firms absorb it lightly, but the squeeze intensifies with maturity. Only 14% of Series A–B companies report heavy pressure, versus 30% at Series C+ and a chart-topping 37% among companies 10+ years old. Employees want value realization, investors want rotation, and both groups are done waiting. The shift reframes liquidity as a strategic asset—fuel for retention, cap table management, and cleaner fundraising. For leadership teams, proactive programs beat reactive fire drills. (More)

MACROVIEW

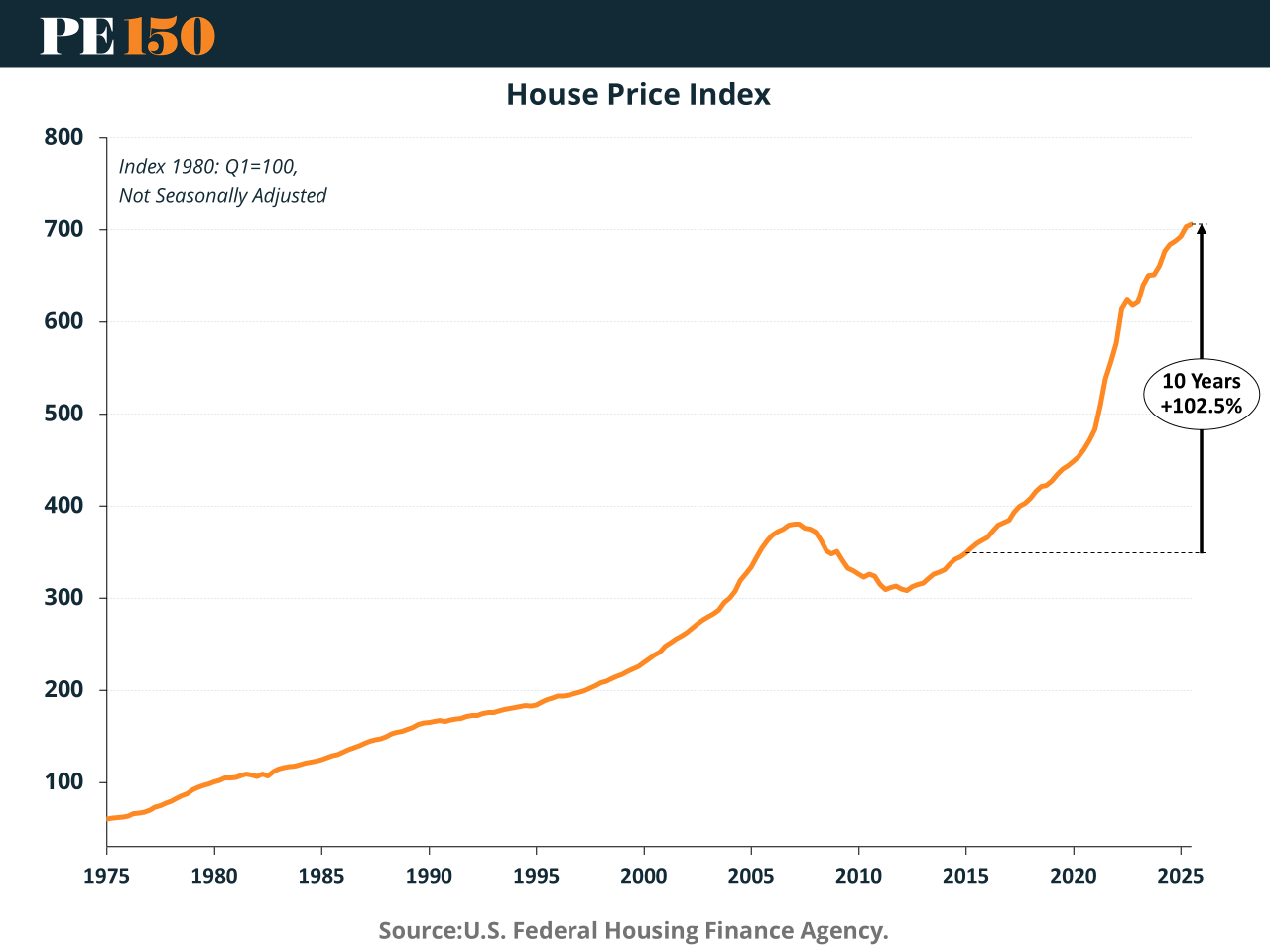

The Economy’s New Normal Is Still Expensive

The Fed may be easing, but households still feel broke. That’s the paradox of today’s economy: disinflation has brought CPI back to ~3%, but consumer price levels are ~25% higher than five years ago. For most households, that means pain is sticky—especially when shelter, childcare, and insurance keep climbing. Meanwhile, rate cuts help wealthier borrowers and asset holders, not renters or those locked into high mortgages. The Fed’s shift toward neutrality won’t fix structural issues like housing shortages and supply constraints. Bottom line: macro stability has returned, but micro-level pain persists. Private equity investors betting on the consumer need to read between the economic lines—GDP isn’t the same as discretionary income. (More)

COMPLIANCE CORNER

Antitrust Enforcement Gets More Predictable—but Not Easier

Private equity is no longer the punching bag of antitrust regulators—but it’s not out of the spotlight either.

The latest updates from Morgan Lewis suggest a shift from headline-grabbing hostility to a more structured, rules-based regime. PE sponsors are now treated more like strategic buyers, thanks to stabilizing leadership at the FTC and DOJ. Still, scrutiny remains high, and the playbook is evolving.

Key shifts:

Early termination is back under the HSR Act, offering a faster close—but it comes with public disclosure risks.

New HSR rules demand disclosure of supply-chain overlaps and require significantly more preparation.

State-level filings are expanding rapidly, especially in healthcare and tech. Expect longer timelines and added friction.

Settlements dominate enforcement outcomes. Agencies are prioritizing negotiated remedies over court battles—but post-closing risk is rising under the Tunney Act.

Bottom line: The environment is less adversarial—but far more layered. PE firms pursuing roll-ups or high-profile carveouts need to anticipate deal timing challenges and involve antitrust counsel early. Predictability doesn’t mean simplicity. (More)

"Nothing is impossible. The word itself says 'I'm possible!'"

Audrey Hepburn