- PE 150

- Posts

- Private Equity at an Inflection Point: Discipline, Selectivity, and the Path to 2026

Private Equity at an Inflection Point: Discipline, Selectivity, and the Path to 2026

As 2025 draws to a close, global private equity stands at a critical inflection point—emerging from a prolonged period of recalibration with renewed, but measured, confidence.

After navigating macroeconomic volatility, rising interest rates, and constrained exit markets, sponsors have shifted decisively away from volume-driven deployment toward a model anchored in discipline, durability, and execution certainty. The year did not mark a full return to prior-cycle exuberance, but rather a structural reset in how capital is raised, deployed, and monetized.

Throughout 2025, capital flows revealed a market increasingly defined by concentration and selectivity. Deal activity gravitated toward regions, sectors, and stages where risk could be more precisely underwritten and exits more clearly envisioned. Late-stage investments, profitability-focused IPOs, and lower deal cancellation rates collectively point to a market prioritizing quality over speed. At the same time, uneven geographic participation and subdued early-stage funding underscore that risk appetite, while improving, remains constrained by both LP expectations and macro uncertainty.

This report examines how private equity closed 2025 across dealmaking, sector allocation, funding dynamics, and exit execution—and what those signals imply for 2026. For investors and executives, the data offers a clear message: the next phase of the cycle will reward patience, operational rigor, and strategic clarity. Understanding where capital is flowing—and where it remains cautious—is essential to positioning portfolios for durable performance in the years ahead.

North America Reclaims Center Stage as Global Dealmaking Reawakens

As 2025 closed, global private equity and venture capital M&A activity told a story of uneven recovery—one defined less by broad-based momentum and more by regional concentration of conviction. After two years of valuation resets, tighter financing conditions, and elongated deal cycles, sponsors selectively re-engaged where scale, liquidity, and exit optionality were most defensible. The resulting pattern underscores a market still in normalization mode rather than a full return to pre-2022 exuberance.

Nowhere was this selectivity more evident than in North America. The U.S. and Canada absorbed the overwhelming majority of announced deal value, reflecting a convergence of factors that investors continue to prioritize: deeper capital markets, more predictable regulatory pathways, and a larger universe of scaled, sponsor-ready assets. As global uncertainty persisted through much of the year, capital gravitated toward regions where underwriting risk could be most confidently priced and where exit pathways—strategic or public—remain credible.

Outside North America, activity remained more measured. Europe and APAC showed signs of life, but with deal flow constrained by macro fragmentation, regulatory scrutiny, and uneven economic signals. Emerging markets, meanwhile, saw minimal aggregate value, reinforcing the reality that in a higher-for-longer rate environment, global PE capital is still favoring resilience and scale over geographic diversification. Heading into 2026, this concentration raises important questions about opportunity saturation in core markets—and latent upside in regions still on the sidelines.

Key takeaways from the data:

The U.S. and Canada accounted for approximately $346.5B in announced PE/VC M&A value in 2025, dwarfing all other regions and reaffirming North America’s role as the primary deployment engine.

Europe ($69.9B) and APAC ($46.3B) demonstrated renewed but cautious activity, suggesting improving sentiment without a full recovery in risk appetite.

Emerging regions—including Latin America, Africa, and the Middle East—registered negligible deal value, highlighting continued capital discipline and macro sensitivity.

The geographic imbalance reflects not just opportunity availability, but LP-driven pressure for capital certainty, visibility on exits, and downside protection.

For 2026, the data implies a bifurcated opportunity set: intensifying competition and pricing pressure in North America versus selective, potentially mispriced opportunities abroad for sponsors with local expertise and longer-duration capital.

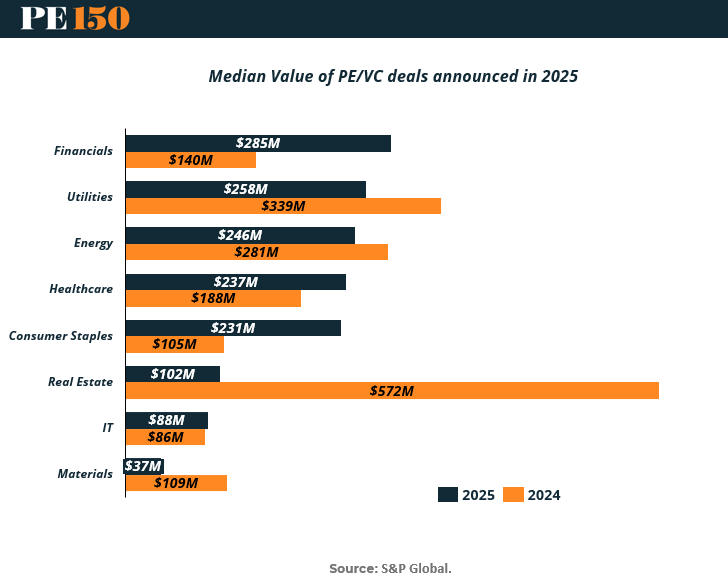

Deal Size Discipline Defines the 2025 Reset Across Sectors

The median deal values recorded in 2025 reflect a market that has decisively shifted from volume-driven deployment to precision underwriting. After the excesses of the prior cycle, sponsors entered 2025 with a clear mandate: preserve capital, focus on conviction assets, and structure transactions that can withstand prolonged holding periods. The result is a sector-by-sector recalibration of what “investable scale” looks like in a more constrained capital environment.

What stands out is not simply the level of median deal sizes, but their dispersion across industries. Sectors tied to financial infrastructure, utilities, and energy maintained relatively elevated medians, signaling sponsor willingness to underwrite larger checks where cash flows are predictable and downside risk is mitigated. Conversely, consumer-facing and cyclical sectors saw materially smaller median deals, reflecting both valuation sensitivity and a preference for platform build-ups over transformational acquisitions.

Looking toward 2026, these patterns suggest a private equity market that is still rebuilding confidence rather than accelerating aggressively. Median deal sizes are becoming a proxy for risk tolerance, capital structure flexibility, and exit visibility. Sponsors are clearly prioritizing sectors where scale can be achieved without relying on multiple expansion—and where operational value creation, rather than macro tailwinds, will drive returns.

Key takeaways from the data:

Financials led 2025 median deal values at approximately $285M, underscoring sustained sponsor interest in asset-light, cash-generative platforms.

Utilities and Energy remained resilient, with median deal sizes of roughly $258M and $246M, reflecting infrastructure-aligned investment strategies and inflation-linked cash flows.

Healthcare maintained a mid-range median (~$237M), highlighting steady demand tempered by regulatory and reimbursement uncertainty.

Consumer Staples and Real Estate saw significantly smaller median deal sizes relative to 2024, reinforcing a cautious stance toward interest-rate sensitivity and consumer demand risk.

Technology and Materials recorded the lowest median deal sizes, signaling continued valuation compression and a preference for smaller, staged investments.

Entering 2026, median deal sizes point to a market that is strategically selective rather than broadly expansionary, favoring downside protection over rapid capital deployment.

Late-Stage Capital Dominates as Investors Prioritize Visibility Over Velocity

The split between early- and late-stage funding in 2025 highlights a defining characteristic of the current private capital cycle: a pronounced preference for maturity, scale, and near-term monetization. While overall PE/VC funding rebounded from 2024 levels, the recovery was overwhelmingly concentrated in late-stage transactions, reflecting investor caution amid ongoing macroeconomic and geopolitical uncertainty. Capital returned to the market, but it did so selectively and with clear expectations around performance and timelines.

Late-stage funding benefited from a backlog of companies that had delayed raises during the downturn, coupled with sponsors seeking to deploy capital into assets with established revenue, clearer paths to profitability, and credible exit options. These rounds often served dual purposes—providing growth capital while also recapitalizing balance sheets stressed by higher interest rates. In contrast, early-stage funding remained constrained, signaling that risk appetite has not yet fully normalized despite improved sentiment.

As 2026 approaches, this divergence carries meaningful implications for the innovation pipeline and competitive dynamics across sectors. While late-stage dominance supports near-term value realization for investors, sustained underinvestment at the early stage could compress the future pool of scaled, sponsor-ready assets. For LPs and GPs alike, the challenge will be balancing the comfort of visibility today with the necessity of seeding tomorrow’s growth platforms.

Key takeaways from the data:

Late-stage funding increased materially year-over-year, rising from approximately $156.6B in 2024 to $231.1B in 2025, accounting for the vast majority of deployed capital.

Early-stage funding saw only modest growth, moving from roughly $20.8B to $23.9B, underscoring persistent caution around high-uncertainty investments.

The widening gap between late- and early-stage deployment reflects LP pressure for capital efficiency, shorter duration risk, and clearer exit pathways.

Late-stage rounds increasingly functioned as bridge financings, supporting companies navigating delayed IPO windows and slower M&A exits.

Heading into 2026, a continued imbalance could inflate competition and pricing for late-stage assets, while creating selective, high-conviction opportunities in early-stage investing for sponsors with longer horizons and higher risk tolerance.

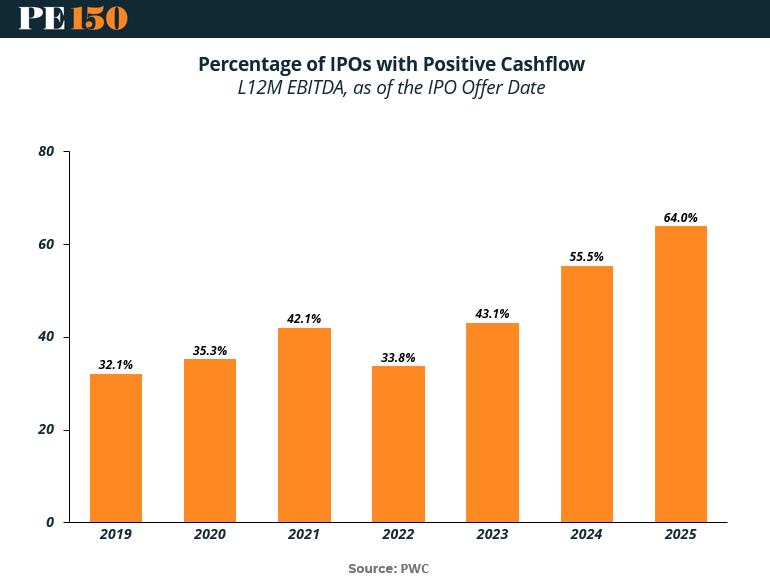

Profitability Becomes the Price of Admission for Public Market Exits

The evolution of IPO quality over the past several years has culminated in a decisive shift by 2025: profitability is no longer optional. As public markets reopened selectively following an extended shutdown, investors demonstrated a clear preference for issuers with demonstrable earnings power and disciplined cost structures. This recalibration reflects lessons learned from the prior cycle, where growth-at-all-costs models underperformed and eroded confidence in newly listed companies.

For private equity sponsors, this shift has materially altered exit planning. Portfolio companies are increasingly being prepared for public markets with a focus on EBITDA positivity, margin sustainability, and cash flow visibility well ahead of offering dates. The steady increase in profitable IPOs since 2022 signals not just improved company fundamentals, but also a structural tightening of public market gatekeeping that rewards operational maturity over aspirational growth narratives.

Looking ahead to 2026, this profitability threshold is likely to remain firmly in place. While this may limit the volume of IPOs in the near term, it enhances exit quality and post-listing performance—critical factors for both GP track records and LP confidence. For sponsors, the implication is clear: value creation timelines must incorporate operational transformation earlier in the hold period if public markets are to remain a viable exit channel.

Key takeaways from the data:

The percentage of IPOs with positive L12M EBITDA rose to approximately 64% in 2025, nearly doubling from 32% in 2019.

After a setback in 2022, profitability metrics improved consistently through 2023–2025, mirroring broader capital market discipline.

Public market investors are increasingly screening for cash flow durability, not just revenue growth or market share.

The data reinforces a shift toward fewer, higher-quality IPOs, rather than a broad reopening of the issuance window.

Entering 2026, sponsors that align portfolio companies with public-market profitability standards earlier in the investment cycle will enjoy greater exit optionality and valuation support.

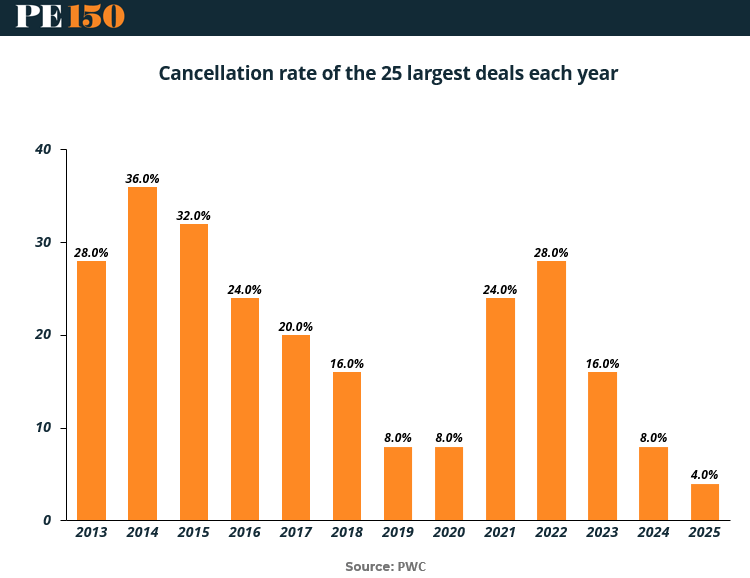

Execution Risk Recedes as Deal Certainty Returns to the Market

The cancellation rate of the largest private equity transactions offers a revealing lens into market confidence, financing availability, and regulatory friction. Over the past decade, elevated cancellation levels have typically coincided with periods of macro stress, valuation dislocation, or abrupt shifts in capital markets. Against that backdrop, the sharp decline in cancellations through 2024 and 2025 signals a meaningful normalization in deal execution conditions.

The contrast with earlier years is striking. Periods such as 2014–2016 and again in 2021–2022 were characterized by aggressive underwriting, rapid market shifts, and heightened regulatory scrutiny—factors that materially increased the probability of announced deals failing to close. By 2025, however, sponsors and strategic buyers appear to have internalized those lessons, approaching large transactions with more conservative assumptions, tighter diligence, and greater financing certainty from the outset.

As the market looks ahead to 2026, low cancellation rates suggest a healthier foundation for scaled transactions, even if overall deal volume remains selective. For investors and executives, this trend underscores a shift from speculative dealmaking toward disciplined execution. While risks remain—particularly around geopolitics and policy—the data indicates that when deals are announced in the current environment, they are far more likely to close.

Key takeaways from the data:

The cancellation rate among the 25 largest deals fell to approximately 4% in 2025, the lowest level in over a decade.

This marks a dramatic improvement from the 28%–36% range observed during periods of heightened market volatility earlier in the cycle.

The post-2022 decline reflects more conservative valuation assumptions, improved financing alignment, and stronger pre-signing diligence.

Lower cancellation rates enhance market credibility and LP confidence, particularly for large-cap and megafund strategies.

Entering 2026, reduced execution risk may support a gradual return of larger transactions, even as sponsors maintain disciplined deployment and heightened selectivity.

Conclusion

The private equity market entering 2026 is fundamentally different from the one that preceded the downturn. Capital has returned, but it is more discriminating. Deal sizes reflect tighter underwriting standards, late-stage funding dominates early-stage risk-taking, and public markets now demand profitability as a prerequisite rather than a future aspiration. Perhaps most tellingly, the sharp decline in deal cancellations suggests a healthier alignment between buyers, sellers, and financiers—an essential foundation for sustainable market recovery.

For sponsors, this environment elevates the importance of operational value creation, balance sheet resilience, and exit preparedness. Competitive advantage will accrue to firms that can source differentiated opportunities, execute with precision, and align investment timelines with a more demanding LP base. For investors, the opportunity set remains compelling—but requires a sharper focus on manager selection, strategy fit, and capital pacing.

Looking ahead, 2026 is poised to be a year of gradual expansion rather than rapid acceleration. While macro risks persist, the structural improvements in deal quality, execution discipline, and exit readiness suggest a market better positioned for durable growth. In this next phase, success in private equity will be defined not by how quickly capital is deployed, but by how thoughtfully it is invested—and how reliably it is returned.

Sources & References

PWC. Private Equity Dealmaking. https://www.pwc.com/us/en/services/consulting/deals/outlook.html

S&P Global. Global PE Deal Value up 43% in 2025. https://www.spglobal.com/market-intelligence/en/news-insights/articles/2026/1/global-private-equity-deal-value-up-43-in-2025-96746998

Morgan Stanley. PE 2026 Outlook. https://www.morganstanley.com/im/en-lu/institutional-investor/insights/outlooks/private-equity-2026-outlook.html

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|