- PE 150

- Posts

- Private Credit's Great Divergence: One asset class. Three different bets.

Private Credit's Great Divergence: One asset class. Three different bets.

Private credit is surging, but the capital behind it is far from aligned.

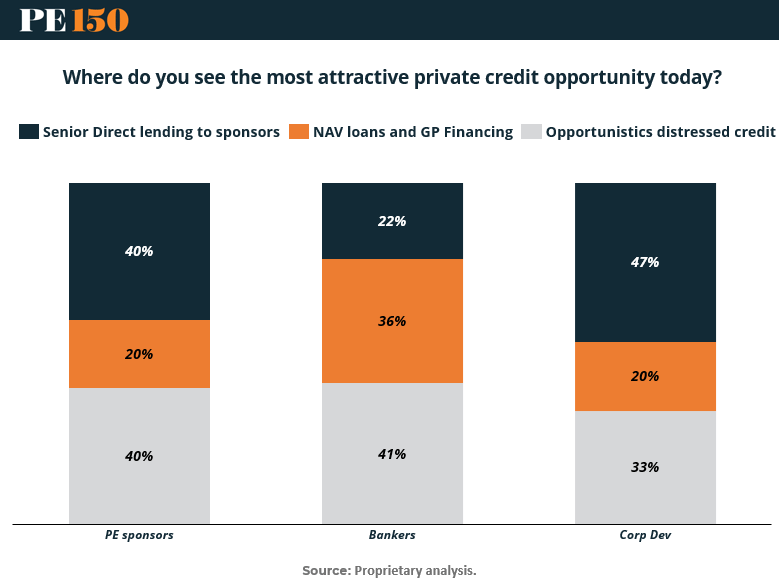

In our latest proprietary survey of 134 market participants, we asked a simple question: Where do you see the most attractive opportunities in private credit right now?

The responses reveal a sharp divergence—not just in strategies, but in perspectives shaped by job function.

PE sponsors split their vote: 40% favor senior direct lending, while another 40% see opportunity in opportunistic distressed credit. Just 20% picked NAV and GP financing, the so-called “structural plays.”

Bankers, in contrast, flipped the script: 36% cited NAV loans and GP financing as most attractive—the top choice for the group.

Corporate development teams leaned heavily toward traditional yield: 47% chose senior direct lending, more than any other cohort.

What explains the split? Each group is solving for a different problem. PE sponsors are straddling both ends of the risk spectrum—hunting yield in safe senior paper while also positioning for upside in distressed names. Corporate development teams are focused on reliable execution and deal certainty, making senior direct lending a natural fit.

But it’s the bankers’ tilt toward NAV and GP solutions that’s most telling. These structures—NAV loans, GP-led secondaries, preferred equity—are increasingly used as interim liquidity tools in a frozen exit environment. For intermediaries, they’re also fee-generating and transaction-rich, aligning with deal flow incentives.

This fragmentation signals a deeper shift: private credit is no longer a monolith. The “credit” label now spans a wide spectrum—from risk-off senior lending to risk-on distressed bets and structural creativity in the middle. And the capital behind each strategy isn’t necessarily chasing the same economic thesis.

Why it matters

In today’s liquidity-starved environment, private credit strategies are as much about time horizon and liquidity preference as they are about credit quality. For operators like Corp Dev teams, senior loans offer speed and certainty. For PE sponsors managing legacy portfolios, distressed and NAV-linked capital are ways to buy time or double down. For bankers, structure is the product.

As these perspectives diverge, so does dealmaking risk. What one party sees as high-yield opportunity, another views as contingent liability. The rise of bespoke structures—NAV loans, PIK toggles, continuation fund capital stacks—further complicates alignment.

The bottom line

Know your counterparty. In private credit’s bifurcated landscape, the same term sheet can mean very different things depending on who’s reading it. PE sponsors, bankers, and operators may all be in the same room—but they’re playing different games.