- PE 150

- Posts

- Private Credit Returns vs. Fixed Income and Equities: An Emerging Advantage

Private Credit Returns vs. Fixed Income and Equities: An Emerging Advantage

Private credit has rapidly evolved from a niche investment to a major force in global capital markets.

Today, with an estimated market size exceeding $3 trillion (Alternative Credit Council, 2024), private credit is attracting attention from institutional investors, retail capital, and even traditional banks seeking new partnerships. But how does private credit stack up against traditional fixed income and public equities—particularly in terms of returns and volatility?

Superior Yields in a Low-Yield Environment

One of the most striking advantages of private credit is its yield profile. As of March 31, 2025, direct lending—a key segment of private credit—offered a yield to maturity of 11%, according to KKR, Cliffwater, and Bloomberg data.

By comparison:

US Treasuries yielded 4.1%

US Aggregate Bond Index (US Agg) yielded 4.6%

US Investment Grade Corporate Bonds yielded 5.2%

Commercial Mortgage-Backed Securities (CMBS) yielded 4.4%

Clearly, direct lending delivers a substantial yield premium. Why is this possible? Private credit loans often involve bespoke structures, negotiated terms, and funding for companies that might otherwise be underserved by traditional banks due to regulatory constraints. Borrowers are willing to pay higher yields in exchange for speed, flexibility, and certainty of capital.

Furthermore, private credit lenders can accept more complex collateral, and private credit funds do not suffer from the asset/liability mismatch that plagues bank balance sheets. This enables funds to hold loans through volatile periods without forced selling, contributing to their appeal during economic uncertainty.

Historical Returns and Volatility

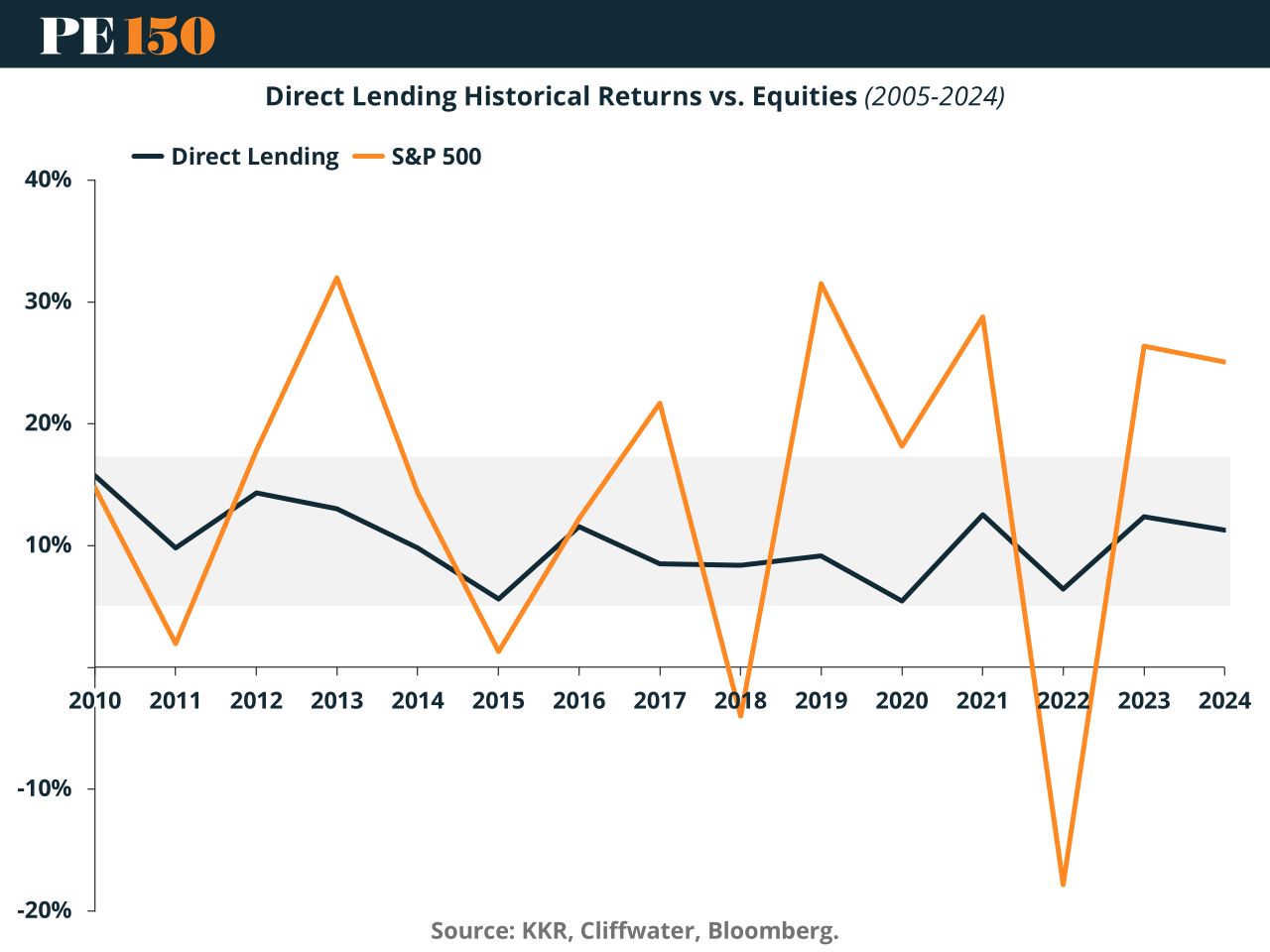

Yield alone doesn’t tell the full story. Volatility and consistency of returns are equally important. When compared to public equities, private credit exhibits far more stable return patterns—while still providing strong returns.

As shown in the chart, the S&P 500 has delivered highly variable returns since 2010, ranging from gains above 30% to losses nearing -20%. In contrast, direct lending returns have remained remarkably consistent, typically in the 8-12% range annually. Even during periods of severe public market stress—such as the Global Financial Crisis and the COVID-19 pandemic—private credit demonstrated resilience.

This stability arises from several structural advantages:

Locked-up capital: Investors in private credit funds commit for long durations, preventing liquidity shocks.

Customized deal structures: Private credit funds can negotiate protective covenants and collateralization, reducing downside risk.

Limited mark-to-market volatility: Since private loans are not publicly traded, their valuations are less sensitive to daily market sentiment swings.

A Growing Market with Diversification Benefits

Private credit’s compelling risk/return profile is fueling its growth. From 2022 to 2023 alone, annual capital deployment increased from $203 billion to $333 billion (ACC & EY, 2024). Institutional investors—particularly pensions and insurers—value the asset class for its ability to generate steady income and hedge against public market volatility.

Moreover, private credit is diversifying beyond corporate lending. Today, about 40% of AUM is dedicated to asset-backed, real estate, and infrastructure debt—further broadening its investment applications.

Conclusion

For investors seeking higher returns than public fixed income and lower volatility than equities, private credit represents an increasingly attractive solution. Its historical resilience, yield premium, and structural alignment with long-term capital needs make it well suited for modern portfolios.

As the ecosystem matures—bolstered by innovations in secondary markets and collaboration with traditional banks—private credit’s role in the global financial system is set to expand further. While risks remain (such as regulatory uncertainty and bespoke structuring complexity), the industry’s adaptability and growing transparency provide confidence that private credit’s growth is not a passing trend but a structural evolution in capital markets.