- PE 150

- Posts

- Permira’s £2.7bn Exit, 97% Direct Lending, and China’s $10B Health Play

Permira’s £2.7bn Exit, 97% Direct Lending, and China’s $10B Health Play

NatWest acquires Evelyn Partners as private credit usage hits 97% and platform buyers turn defensive.

Good morning, ! This week we're covering how direct lending is dominating in private credit, China and Hong Kong Private Equity investments, and the evolution of PE’s approach to platform investments

Want to advertise in PE 150? Check out our ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

REGIONAL FOCUS

Outbound Capital, Inbound Targets

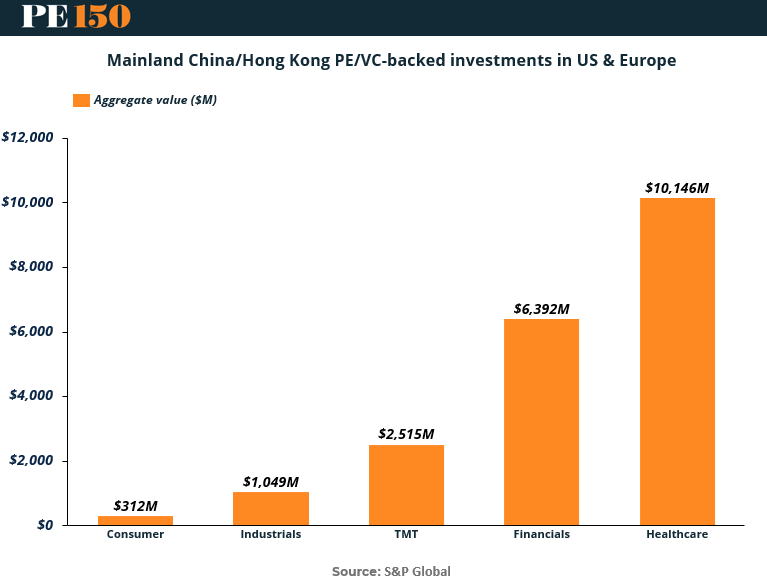

Mainland China and Hong Kong PE and VC backed investment into the US and Europe is not evenly distributed. Healthcare leads by a wide margin at $10,146M, followed by Financials at $6,392M. TMT trails at $2,515M, while Industrials at $1,049M and Consumer at just $312M barely register.

This is not spray and pray capital. It is concentrated, sector specific, and defensively positioned. Healthcare and Financials offer regulatory complexity, recurring revenue, and IP driven durability. Consumer does not.

For US and European sponsors, the implication is clear. Competitive tension will remain highest in healthcare platforms and specialty financial assets where cross border buyers see structural growth and capital preservation. In lower conviction sectors, pricing power may remain domestic.

Capital flows reveal conviction. Follow them. (More)

PRESENTED BY WHEREBY

Switching video infrastructure can feel painful, but sticking with a “good enough” solution has a cost too.

When security and privacy aren’t communicated clearly, when calls fail or glitch, or when UX adds friction, the impact becomes measurable: lower patient engagement, higher no-shows and drop-offs, increased support and operating costs, and greater churn risk.

Whereby breaks down how these costs show up in practice and why early evaluation lowers risk by creating options before you’re forced into a rushed decision.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

DEAL OF THE WEEK

From Roll-Up to Royal Flush

Permira and Warburg Pincus are cashing out of Evelyn Partners, selling the UK wealth manager to NatWest for £2.7B in a deal set to close summer 2026, pending regulatory approval.

The backstory matters. Permira bought Bestinvest in 2014 and stitched together Tilney, Towry, and Smith & Williamson, scaling AUMA from roughly £5bn to £69bn. Warburg joined in 2020. Classic buy-and-build, executed with patience.

Now comes the industrial logic. Combine Evelyn’s £69bn AUMA with NatWest’s £59bn private banking and wealth arm (including Coutts) and you get north of £127bn AUMA and £188bn in customer assets and liabilities. Scale wins in wealth.

The bottom line: a textbook PE consolidation story exits to a strategic buyer hungry for fee-based growth. (More)

PRIVATE CREDIT

Back to Basics, With a Twist

Private credit in 2025 looks familiar at first glance. Direct lending remains nearly universal, with 97% of firms active, up slightly from 2024. Tight spreads and crowding haven’t changed the core appeal: speed, predictability, and sponsor-friendly economics still win.

But the real story is what’s happening underneath. Special situations and credit opportunities jumped to 49% from 37%, as managers prepare for refinancing stress and maturity walls. Complexity is no longer a risk to avoid — it’s a feature to monetize.

Even more telling: fund finance and lender finance surged from 16% to 28%, signaling that private credit is increasingly financing its own ecosystem through NAV loans, GP facilities, and structured liquidity.

Meanwhile, mezzanine and asset-based lending lost ground, squeezed out by either senior-secured simplicity or bespoke structuring.

Bottom line: Private credit isn’t retreating. It’s polarizing — and rewarding flexibility over comfort. (More)

MICROSURVEY

Platform Discipline Replaces Platform Aggression

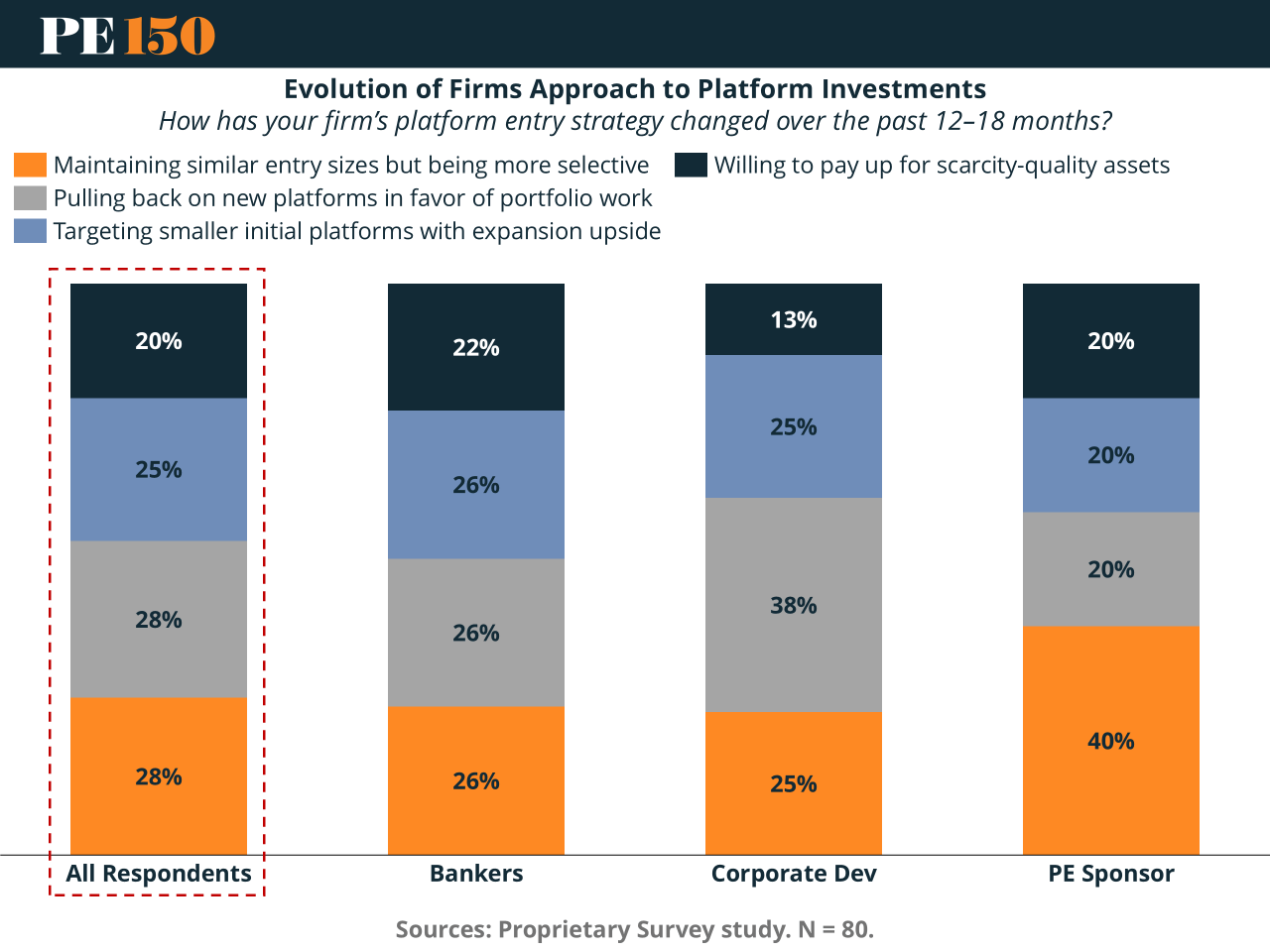

Our last survey shows platform investing has not disappeared. It has grown up. Across respondents, strategies are evenly split, but the common thread is restraint. 28% are keeping entry sizes steady while raising the bar. Another 28% are prioritizing portfolio work over new platforms. Only 20% are willing to pay up for scarcity quality assets.

PE sponsors remain active, but selective. Corporate development teams are stepping back, focused on extracting value rather than expanding footprints. The takeaway is subtle but important. Platform deals are still happening, just fewer, slower, and with far less tolerance for underwriting risk. Selectivity is now the strategy. (More)

PUBLISHER PODCAST

No Off Button: He Built North America's Largest AI Conference (& Had A Winning Exit)

Champions don’t quit when the plan breaks—they adapt. No Off Button is Aram’s publisher-led podcast honoring founders, executives, and creators who don’t have an off switch. Each episode spotlights operators who keep building through pivots, pressure, and imperfect conditions.

This week’s guest is Michael Weiss, co-founder of Ai4, the largest AI conference in North America. Michael walks through the pivot that changed everything—from an ambitious attempt to revive the 1893 Chicago World’s Fair to identifying AI as the defining opportunity of the decade before the boom. The conversation unpacks the realities of the event business, the discipline behind timing a market, and why surviving the compounding phase matters more than chasing early wins.

Why it matters: this episode is a blueprint for founders and investors alike—niche selection, execution, and resilience are what turn failed ideas into category-defining outcomes.

INTERESTING ARTICLES

TWEET OF THE WEEK

"You'll never do a whole lot unless you're brave enough to try."

Dolly Parton