- PE 150

- Posts

- Liquidity Isn’t A Gift—It’s a Trap

Liquidity Isn’t A Gift—It’s a Trap

Liquidity feels like freedom but often erodes wealth when volatility hits. True compounding survives through patience, not constant access.

Good morning, ! This week we’re exploring the math of compounding returns over time; revisiting 2008, when TARP birthed modern bailout capitalism; and examining how macro volatility erodes performance—and why the illiquidity premium in private markets remains the best defense.

Want to advertise in PE 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

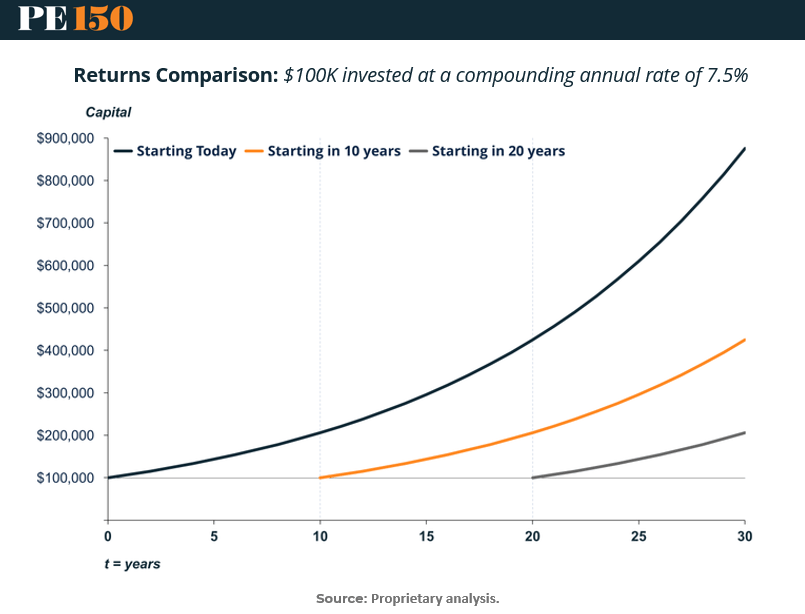

Time: The One Asset You Can’t Replace

Forget picking the perfect asset class—$100K invested today at 7.5% annual return turns into ~$890K in 30 years. Wait just 10 years to start, and you're left with only ~$340K. That’s not just lost return—it’s a lost doubling.

The math is brutal. Using the Rule of 72, every decade delay means forfeiting a full wealth doubling. This holds true whether you’re betting on stocks, real estate, or private equity. Compounding rewards those who begin early and stay invested, not those who obsess over the best market timing or flashiest vehicles.

And small differences in return have exponential effects. At 6%, your money grows 10x in 40 years. At 12%, it grows 100x. That’s the exponential curve the wealthy ride—not by luck, but by staying in the game long enough to let it kick in.

Strategic takeaway: Time horizon is the true alpha. Asset selection matters, but if your investment can’t survive for decades, it won’t matter. The biggest risk isn’t picking wrong—it’s waiting too long.

TREND OF THE WEEK

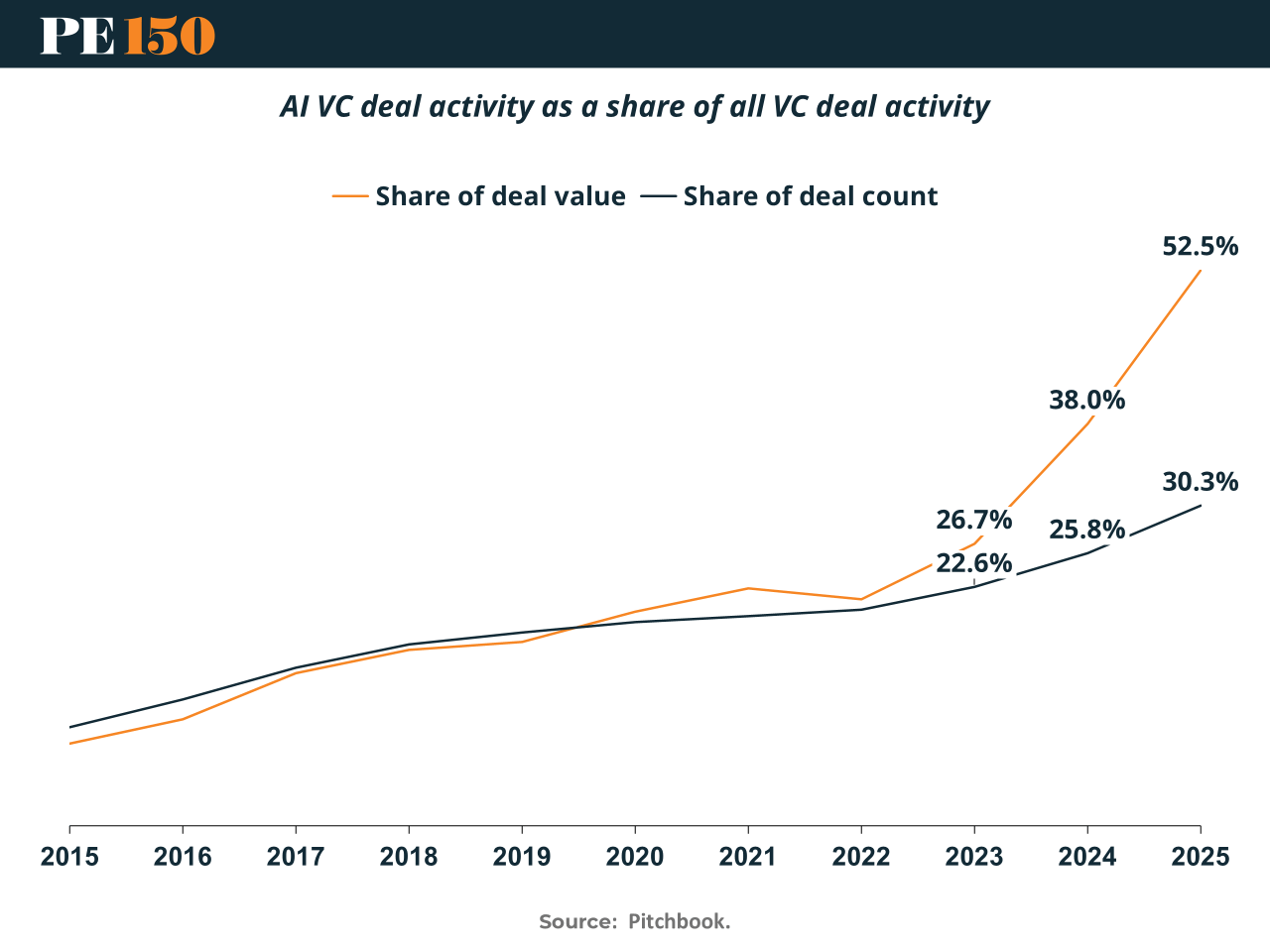

AI Eats VC

AI is no longer just a hot vertical—it’s the majority of venture capital. In 2025, 52.5% of VC deal value went into AI, up from 22.6% in 2022, per PitchBook. Deal count also climbed to 30.3%, but the gap between value and volume says it all: money is clustering in fewer, larger AI bets. Think mega-rounds in foundation models, enterprise AI, and vertical applications (healthcare, finance, cybersecurity). For PE and growth funds, two takeaways: AI now drives valuations across industries, and later-stage investors are crowding earlier in the cycle, squeezing traditional buyout entry points. The bigger question: as AI dominates deal flow, how fast will exits, carve-outs, and secondary trades reshape PE pipelines? (More)

Evolver: Reasoning Systems That Scale Institutional Investment Intelligence

Private equity success depends on applying decades of institutional knowledge consistently across complex, interconnected value creation challenges. Traditional tools automate tasks. Evolver builds reasoning systems that think.

Our platform doesn't just process data—it synthesizes your firm's collective investment intelligence, maintains contextual memory of portfolio evolution, and reasons through multi-layered operational interdependencies the way your most experienced professionals do.

Navigator learns from every deal outcome, building persistent institutional memory that gets smarter with each investment cycle. It reasons through complex scenarios: How does a pricing strategy in one business unit affect supply chain optimization in another? What patterns from your best exits should inform current transformation initiatives?

This isn't AI automation—it's augmented institutional intelligence. Our reasoning systems apply your firm's investment philosophy and decision-making frameworks consistently across every portfolio company, learning and adapting based on real outcomes.

Stop competing on experience alone. Scale your institutional reasoning across every investment decision, operational challenge, and value creation opportunity.

Experience strategic intelligence that thinks like your best investment professionals—with perfect memory and pattern recognition across your entire portfolio history.

LIQUIDITY CORNER

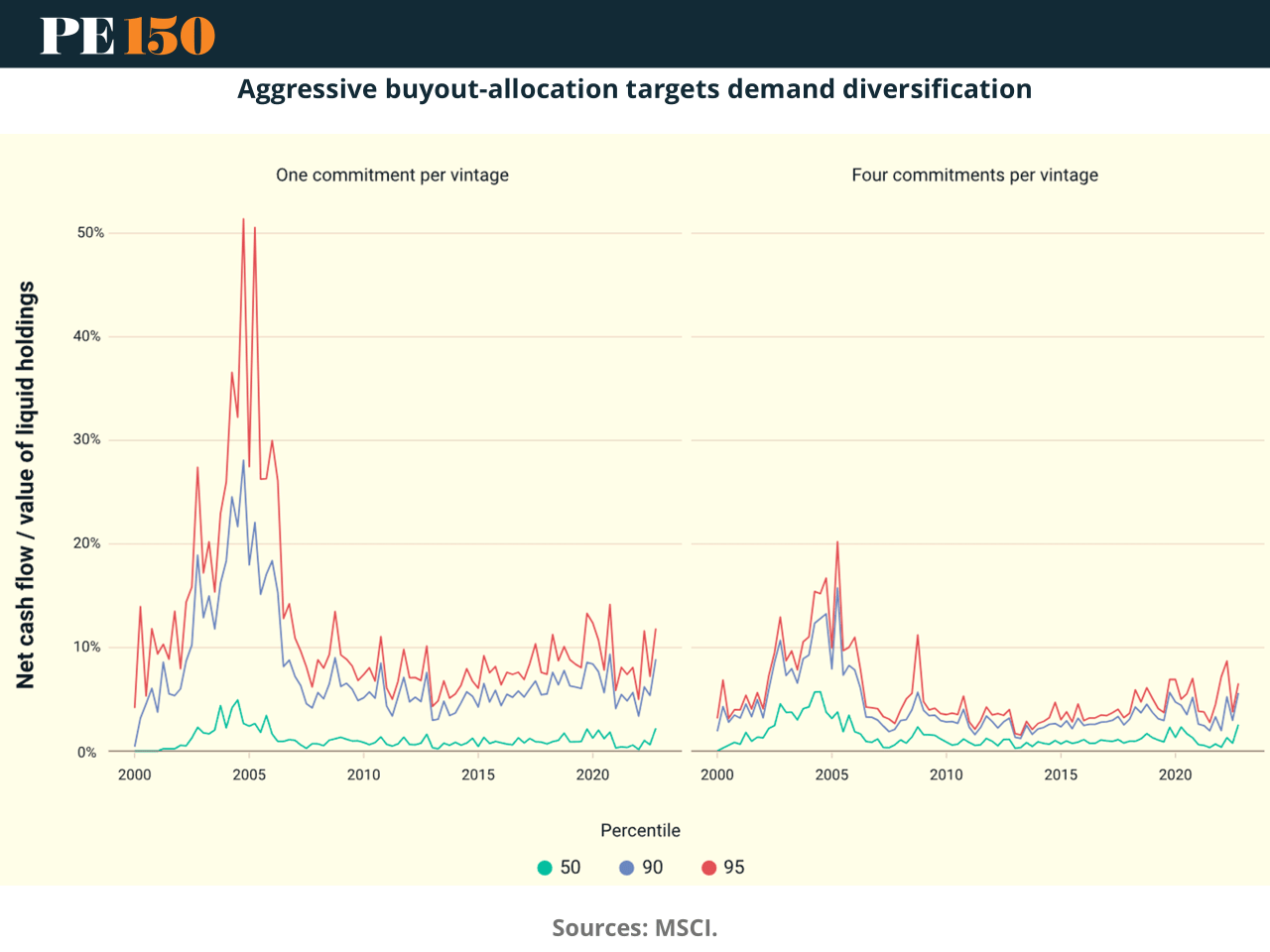

Liquidity Risk? Not So Fast.

Despite the folklore, buyout funds aren’t the ticking liquidity time bombs many fear. The latest modeling shows that a diversified LP targeting 15% of NAV in buyout needed to sell off less than 3% of liquid assets—even at the 95th percentile of stress. That’s not risk. That’s noise. When portfolios did wobble, the culprit wasn’t capital calls—it was collapsing public equity valuations. And for those running more aggressive allocations (hello, 60%), the fix isn’t prayer—it’s diversification. Four commitments per vintage cut peak drawdowns by more than half. TLDR: Smart LPs aren’t sweating liquidity. They're sweating FOMO. (More)

DEAL OF THE WEEK

Silver Lake Doubles Down on AI in Healthcare

Silver Lake’s AI empire just added a new organ. Its portfolio company Qualtrics will acquire Press Ganey — the healthcare feedback platform — for $6.75B (including debt), marking Qualtrics’ largest deal ever. The move pairs Qualtrics’ AI-driven customer experience tools with Press Ganey’s reach across 41,000 healthcare providers, creating a data-rich vertical for AI-powered patient engagement. Ares Management and Leonard Green & Partners, the current owners, will exit via a cash-and-stock deal, backed by 11 lenders.

The playbook is classic Silver Lake: use a flagship tech asset as a platform for consolidation. For a PE market still struggling with exits, this is the kind of AI-meets-healthcare story that keeps limited partners interested — and deal bankers busy. (More)

TOGETHER WITH COW SWAP

UN-Limited Limit Orders

Why pay gas for limit orders that never execute? With CoW Swap, you can set an unlimited number of limit orders – more than your wallet balance – then cancel them all at no cost to you. Try Limit Orders.

PRIVATE CREDIT

Loan Market Priorities: It's Not Just About M&A Anymore

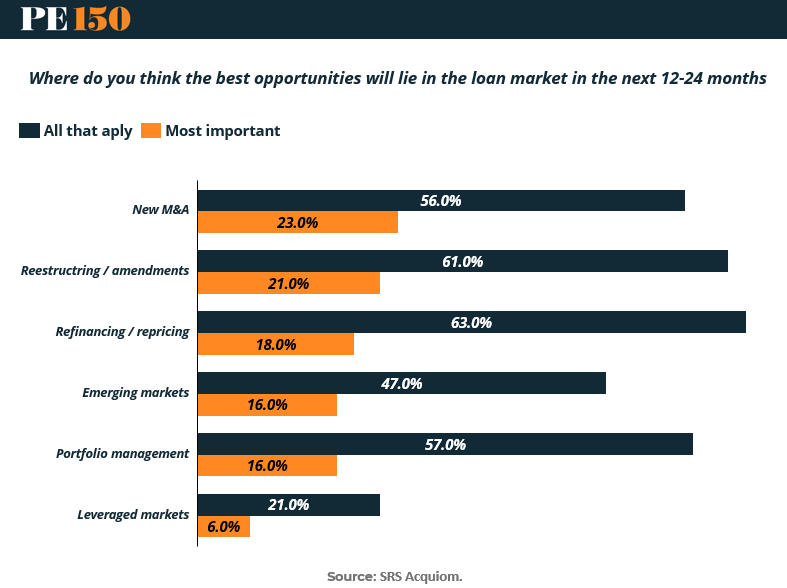

A new survey suggests private credit investors are recalibrating their playbook. While 56% still see new M&A as a major opportunity, it’s refinancing and repricing that top the list overall—63% flagged it as a key area, though just 18% called it the single most important.

Restructuring and amendments are also drawing sharp focus (61% all-in, 21% “most important”), reflecting a market still digesting high-rate legacy debt. In a world where traditional exits are delayed and capital structures are under pressure, sponsors and lenders are leaning into amendments, extensions, and liquidity patches.

Meanwhile, emerging markets and portfolio management tie at 16% for “most important,” suggesting a split between growth hunting and downside control. Notably, leveraged markets barely registered—only 6% called it a top priority, a clear sign that appetite for riskier credits remains muted.

Why it matters: This is a lender’s market—but not a blind one. Credit investors are prioritizing repair over risk and cashflow over complexity. Expect more recap-driven activity and a greater emphasis on structuring flexibility than pure yield.

MICROSURVEY

“What’s the biggest factor influencing your firm’s decision to delay or accelerate an exit?” |

MACROVIEW

Macro Volatility: The Silent Killer in Your IRR

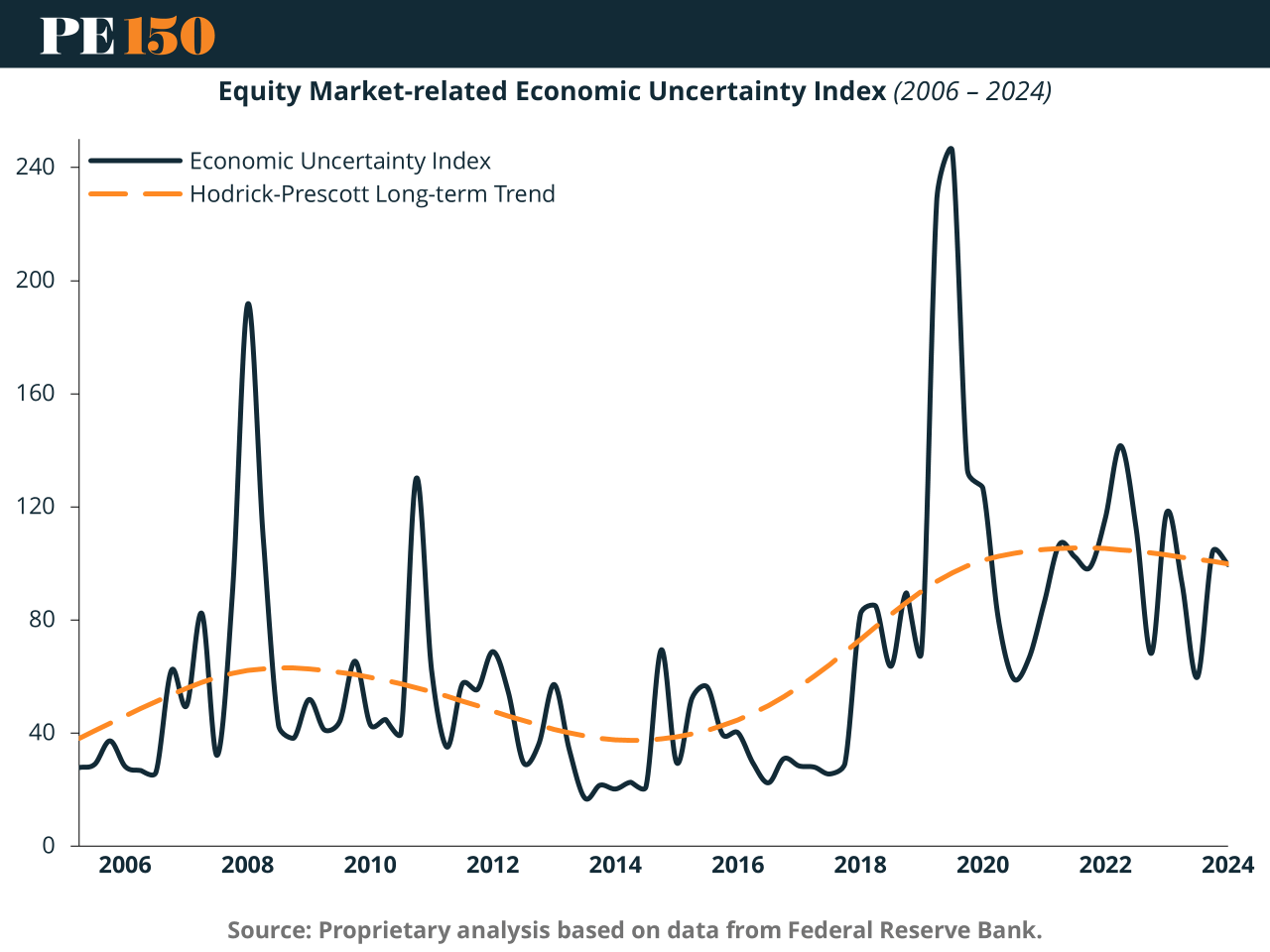

Volatility isn't just a market mood—it’s a wealth destroyer, quietly compounding losses across portfolios. The latest data show that public markets, with their liquidity and transparency, react violently to shifts in the 10Y yield—with the NASDAQ 100 clocking a sensitivity of −0.5706. In contrast, middle-market private equity is only half as reactive, with a coefficient of −0.2307. That’s not just insulation—it’s armor. Structural illiquidity, long holding periods, and negotiated valuations allow PE to ride out macro chaos without panic selling. As uncertainty grows, so does the case for capital staying private. The message? In this market, patience beats panic—and structure beats sentiment. (More)

THIS WEEK IN HISTORY

$700B and a Pen Stroke

This week in 2008, the U.S. government didn’t just backstop banks—it bought them. TARP authorized $700B, meant for toxic assets, but quickly pivoted into equity injections across financials, autos, and insurers. Critics saw a bailout; markets saw survival. Asset prices stabilized, and the move set expectations for how Uncle Sam would behave in future meltdowns. For private equity, the impact was immediate: dealmaking pipelines unclogged, distressed funds sprouted, and government capital indirectly fueled private capital deployment. The irony? A program designed to save Wall Street also helped create the conditions for one of the longest bull markets in history—and reinforced that when liquidity disappears, policy risk is the only LP that matters. (More)

COMPLIANCE CORNER

Compliance Fatigue? Not This Year.

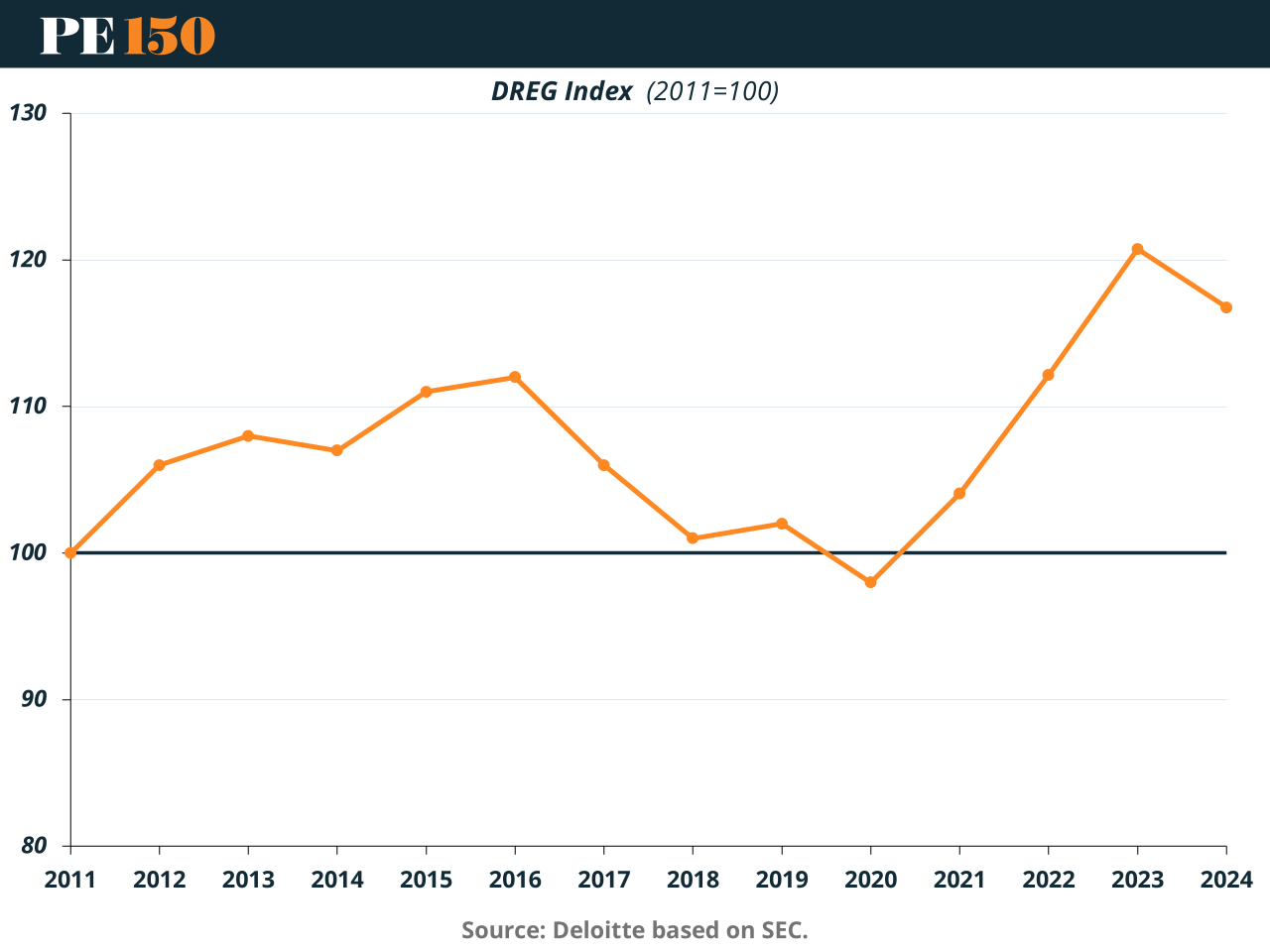

With regulatory intensity falling off a cliff (the DREG Index dropped to 117 vs. a projected 125), the SEC seems less inclined to flood inboxes with rule updates. Instead, it’s wielding guidance to quietly expand access: think retail-friendly closed-end funds, looser digital asset restrictions, and a green light for private equity in 401(k)s.

The catch? Guidance is fragile—it can disappear faster than it arrives. For now, compliance teams should embrace this pause to retool platforms, refresh risk frameworks, and prep for a likely rebound. Remember: a deregulatory lull is not a regulatory void. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

Why Did Jared Kushner and Saudi Investors Take Over EA Games?

Saudi Arabia just pulled off the largest leveraged buyout in history.

Its $925B sovereign wealth fund - with Jared Kushner’s Affinity Partners as a partner - is taking Electronic Arts private in a $55B deal, paying a

— David Kenah (@david_kenah)

5:33 PM • Oct 1, 2025

"The secret of business is to know something that nobody else knows."

Aristotle Onassis