- PE 150

- Posts

- India heats up, Europe tightens, and capital gets selective

India heats up, Europe tightens, and capital gets selective

India PE deal value hits $26.3B and European credit outperforms the U.S., while 31% of allocators prioritize opportunistic deployment.

Good morning, ! This week we did a survey on incremental capital allocation, India PE deal activity, and European credit metrics in comparison with US metrics.

Sponsor spotlight: Affinity’s report breaks down 7 best practices top PE firms use to turn relationship intelligence into better sourcing—finding warm paths early, tightening banker coverage, and building firm-wide visibility. Download Report →

DEAL OF THE WEEK

Bigger Is Back

Clayton, Dubilier & Rice (CD&R) is going big—again. The firm is targeting $26B for its next flagship private equity fund, with total commitments potentially pushing $28B once GP capital is included. That would put it in rare air, just below CVC’s $29.B and above Thoma Bravo’s $24.3B.

Context matters: global PE fundraising slid to $407.5B in 2025, down sharply from 2024. CD&R’s timing looks contrarian, but not reckless. Its prior Fund XII closed at $26B in 2023 and is already posting a 37.19% IRR for CalSTRS—early days, but a strong signal.

The strategy stays pure-play: control buyouts, no credit detours, focused on healthcare, industrials, tech, and business services. Recent proof points include Sealed Air ($10.B) and the Foundation Building Materials exit to Lowe’s.

Bottom line: LPs may be cash-constrained, but brand-name managers with receipts still get meetings. (More)

PRESENTED BY AFFINITY

Private equity firms face rising competition as auctions drive valuations higher and differentiation lower. The firms that consistently outperform are not simply deploying more capital. They are managing networks more strategically, uncovering warm paths into targets before processes begin, maintaining disciplined banker coverage, and creating visibility across every relationship.

This best practices guide highlights seven proven strategies used by leading firms to source proprietary deals, streamline execution, and position portfolio companies for stronger exits. Built around real-world examples, it shows how relationship intelligence is reshaping private equity deal making from origination through exit.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

PUBLISHERS PODCAST

Introducing No Off Button: Conversations with founders/investors

Relentless builders don’t wait for permission, and they don’t hit pause. No Off Button goes inside the minds of operators who keep compounding when others tap out.

This week, Aram sits down with Walker Deibel, WSJ bestselling author of Buy Then Build and founder of Acquisition Lab. Walker makes a PE-relevant case that hits close to home: building from zero is often the worst risk-adjusted bet, while buying profitable, owner-operated businesses offers immediate cash flow, control, and asymmetric upside.

The conversation dives into acquisition entrepreneurship, the Silver Tsunami of baby boomer exits, and why “boring” industries deliver better downside protection than most venture-backed plays.

Why PE should care: this is roll-up logic, applied at the individual-operator level, capital discipline, cash yield, and buying earnings instead of narratives.

PRIVATE CREDIT

Europe Holds the Line as U.S. Leverage Climbs

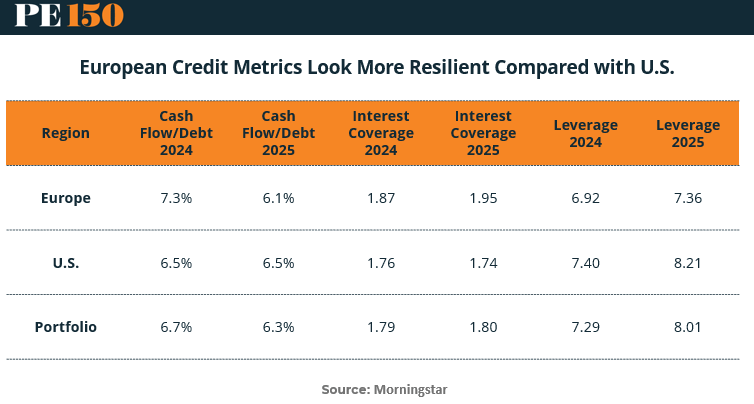

New credit metrics show that European private equity debt remains more resilient than in the U.S., a rare sign of credit discipline amid rising rate fatigue.

Across surveillance-rated companies, European cash flow-to-debt is forecast to fall to 6.1% in 2025, but still outperforms the U.S. at 6.5%, where the ratio remains flat. More telling: U.S. leverage is projected to climb to 8.21x in 2025—up from 7.40x in 2024—while European leverage rises more modestly from 6.92x to 7.36x.

Europe also shows improving interest coverage (from 1.87x to 1.95x), compared to a slight deterioration in the U.S. (from 1.76x to 1.74x).

Why it matters: Rising U.S. leverage and stagnant cash flow generation suggest tighter spreads and more refinancing risk ahead—especially for sponsor-backed borrowers. For Europe-focused GPs, the relative conservatism could become a selling point as LPs grow more sensitive to debt sustainability.

In a market where duration and default risks are top-of-mind, these cross-Atlantic divergences may shape how allocators view credit quality in PE portfolios going into H2 2025. (More)

MICROSURVEY

Incremental Capital Has No Single Home

We asked where firms are allocating incremental capital right now. The answer was not platforms versus add ons. It was optionality.

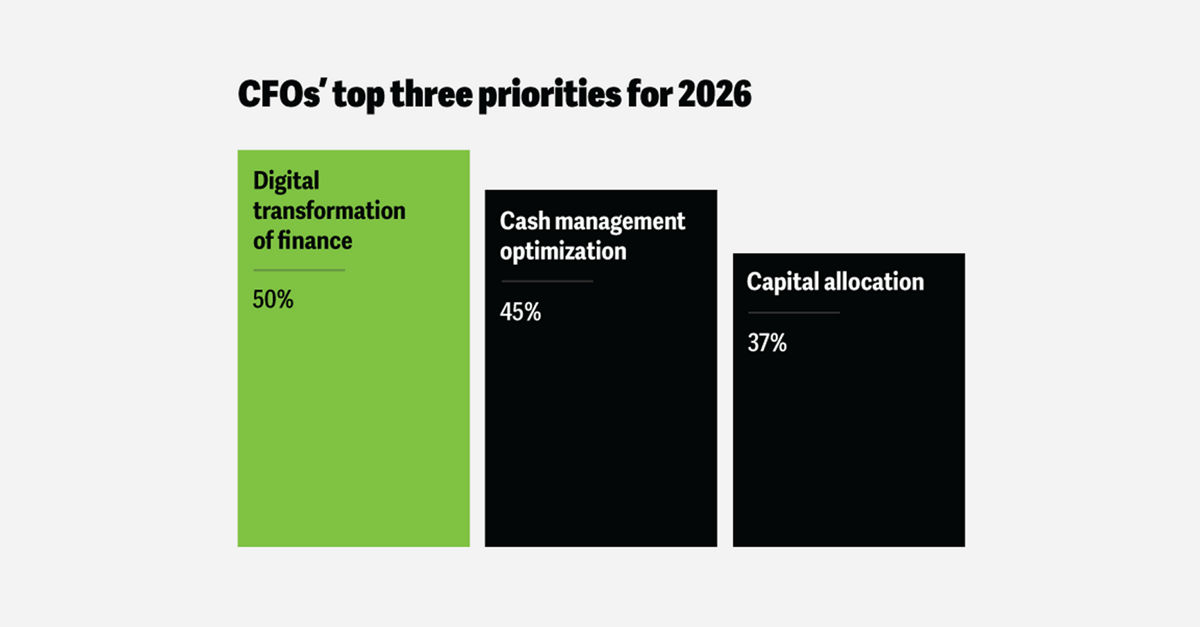

Across all respondents, preferences split almost evenly between new platform investments at 31% and opportunistic, deal by deal deployment at 31%. Balanced strategies accounted for 20%, while add ons for existing portfolio companies came in at 19%. No strategy dominates. Capital is flowing to conviction, not mandates.

The role level splits sharpen the picture. Consultants tilt heavily toward new platforms at 44%, reflecting belief in long runway build stories despite slower volumes. Corporate development teams favor opportunism at 42%, paired with 26% focused on add ons, consistent with bolt on driven strategy. PE sponsors stand out as the most flexible cohort, with 40% prioritizing opportunistic deployment and virtually none allocating incremental capital primarily to add ons.

The takeaway is simple. This market rewards flexibility over formula. Incremental capital is being treated as an option to be deployed selectively, not a box to be filled. (More)

REGIONAL FOCUS

India’s PE Market Grows Up

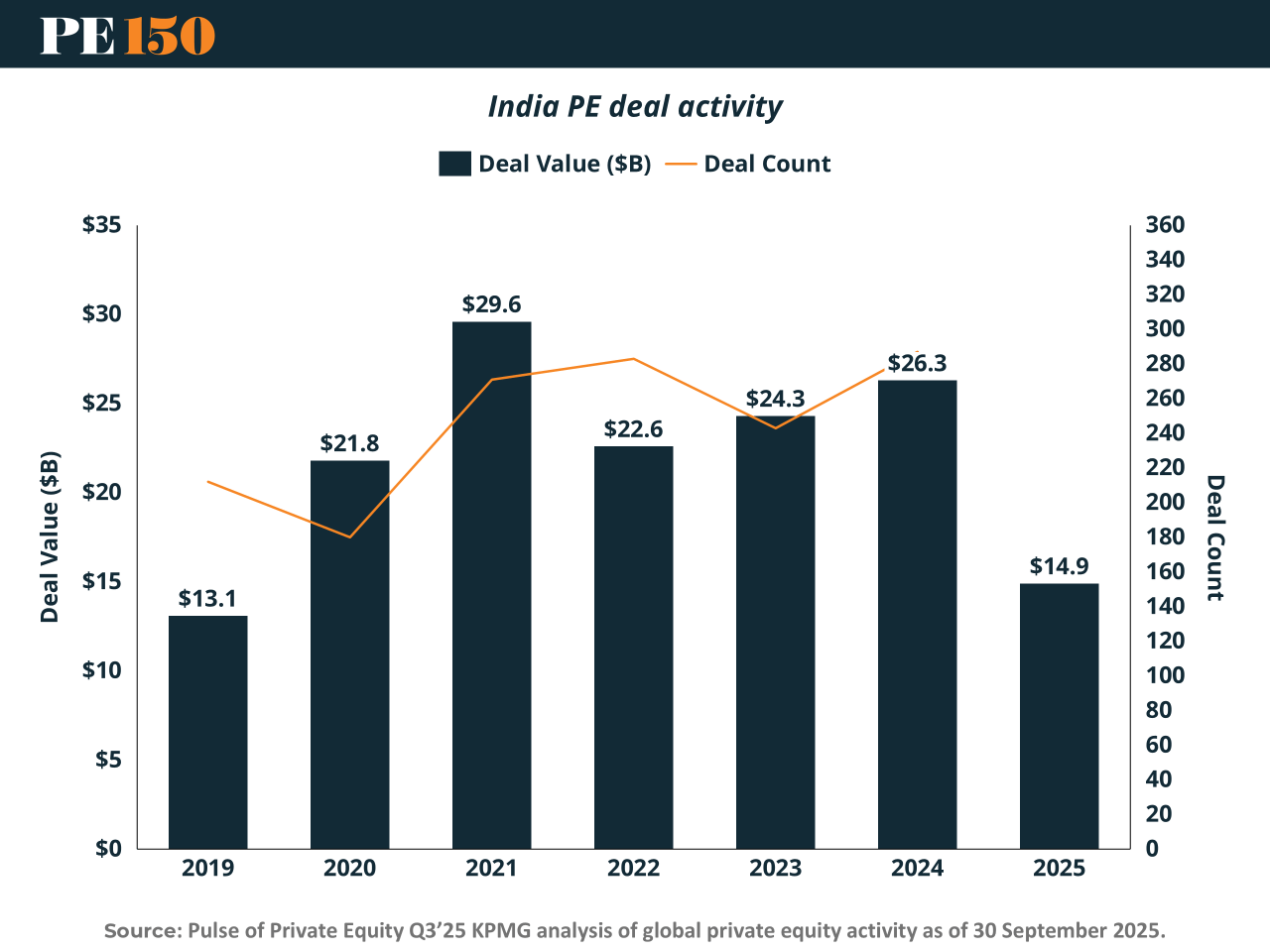

India remains one of global private equity’s most resilient markets, but the story has shifted from velocity to discipline. Deal value surged from $13.1bn in 2019 to a pandemic-era peak of $29.6bn in 2021, fueled by liquidity, tech adoption, and fintech enthusiasm. Since then, activity hasn’t collapsed—it’s normalized.

Deal value settled at $22.6bn in 2022 and $24.3bn in 2023, before rebounding to $26.3bn in 2024, alongside the highest deal count (~290) in the period. Translation: fewer mega-checks, more conviction.

2025 YTD shows $14.9bn across roughly 215 deals, reflecting partial-year data and a tilt toward mid-market, control transactions, and profitable growth.

Bottom line: India PE is no longer liquidity-led. It’s now driven by operational value creation and selective capital. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"Our greatest weakness lies in giving up. The most certain way to succeed is always to try just one more time."

Thomas Edison