- PE 150

- Posts

- Buyouts Split, Credit Scales, KKR Eyes $10B Prize

Buyouts Split, Credit Scales, KKR Eyes $10B Prize

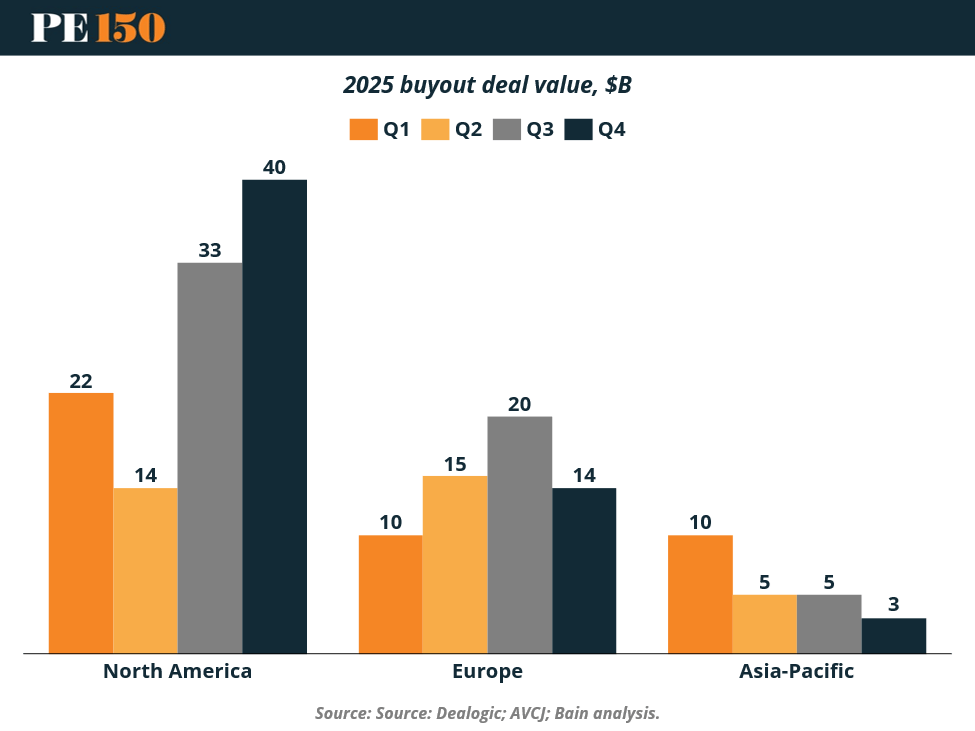

North America outruns the world, private credit becomes "infrastructure," and the $1.5T AI capex boom.

Good morning, ! Today we're taking a look at how North America outran Europe and Asia-Pacific combined in Buyouts deal value in 2025. Private credit becomes core infrastructure amid refinancing during the AI demand boom. KKR-led group targets $10B-plus STT GDC.

Want to advertise in PE 150? Check out our ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

REGIONAL FOCUS

Same Recovery, Different Playbooks

Healthcare PE bounced back in 2025—but not uniformly. Europe led on scale, with deal value doubling to $59bn, powered by biopharma mega-deals. Just five transactions made up roughly 65% of total value, signaling a clear return of large-cap sponsor conviction. Exit markets followed, driven largely by sponsor-to-sponsor sales.

North America took a choppier route. Midyear volatility slowed activity, but a surge in $1bn+ deals—26 through November—rescued the year. More than 70% were secondary buyouts, pushing exit value up to $90bn and reopening liquidity.

Asia-Pacific stood out for breadth. Growth spanned biopharma, providers, medtech, and healthcare IT, with provider deal value more than doubling year-over-year.

Different paths, same lesson: scale and sponsor depth win cycles. (More)

PRESENTED BY WHEREBY

Virtual care is becoming the backbone of modern healthcare. But access and delivery are only the beginning. The real challenge is building virtual care systems people can trust, and that work reliably at scale.

In Whereby’s State of Virtual Care survey, telehealth leaders highlight the same pressure points that slow adoption: keeping patients engaged, building trust, and delivering a smooth experience without technical issues.

Whereby, a video call solution for telehealth platforms, pulled the key findings into a practical set of benchmarks you can use to check priorities for 2026.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

DEAL OF THE WEEK

Sovereigns Plug Into the Grid

KKR is circling a familiar asset — and this time, it may be bringing heavyweight friends. GIC and Mubadala are reportedly in talks to join KKR and Singtel in a potential acquisition of STT GDC, a global data centre operator that could be valued north of $10bn including debt.

The structure is classic late-stage infrastructure PE: sovereign wealth funds as minority co-investors, bank financing potentially topping SGD5bn, and a platform already operating at scale — more than 100 data centres across 20 markets. KKR and Singtel know the asset well, having bought in at $1.3bn last year.

The pitch is obvious: AI-driven data demand, contracted revenues, and digital infrastructure as the new defensive growth trade. The risk? Capital intensity — and a market starting to wonder if everyone piled in at once. (More)

PRIVATE CREDIT

Systematical changes in Private Credit

Private credit enters 2026 less as a niche and more as infrastructure.

Preqin expects private credit AUM to more than double to $4.5T by 2030, with fundraising rebounding after the 2025 pause. The headline is not growth. It is breadth. Capital is spreading beyond vanilla direct lending into distressed, special situations, asset backed finance, and evergreen vehicles that pull in both institutional and wealth capital.

Two forces matter most for deal flow. First, refinancing. More than $620B of high yield bonds and leveraged loans mature in 2026 to 2027, much of it issued in the zero rate era. Speed and certainty now matter more than headline pricing. Private credit is structurally advantaged, but default risk rises with every basis point.

Second, real asset demand. Data center construction tied to AI spending is driving asset backed lending as hyperscalers commit over $1.5T in capex over five years. This is long dated financing that banks struggle to hold.

The risk is not demand. It is discipline. As semi liquid and retail flows expand, underwriting standards will be tested just as regulators increase scrutiny.

Strategic takeaway: Private credit is moving from opportunistic capital to systemically important capital. Managers who price risk for refinancing cycles and operational complexity will compound. Those who chase volume will not. (More)

MICROSURVEY

We would like to understand how your firm’s approach to platform investments has evolved.How has your firm’s platform entry strategy changed over the past 12–18 months? |

INTERESTING ARTICLES

TWEET OF THE WEEK

PUBLISHER PODCAST

No Off Button: The "Karmic Banker" theory of business

Champions don’t step away—they keep building. No Off Button is where Aram sits down with founders, operators, and creators who never needed an off switch to create real value. No startup mythology. Just the people who compound through discipline, relationships, and execution.

This week’s guest is Greg Topalian, Chairman of Clarion Events North America and founder of LeftField Media. Greg built New York Comic Con—the largest pop culture event in North America—without ever quitting his job. An intrapreneur by design, he scaled passion-driven communities inside large institutions, managed a $100M+ events portfolio, and learned the business fundamentals the hard way—selling food off a Sysco truck.

The conversation dives into intrapreneurship, enthusiast markets, and Greg’s “Karmic Banker” philosophy: the best operators give first, build relationships early, and let value compound over time.

Why it matters: this is a reminder that long-term wins come from operational grit, leverage, and human connection—not flashy exits.

"It is not the strength of the body that counts, but the strength of the spirit."

J.R.R. Tolkien