- PE 150

- Posts

- 7X Demand Growth: Will 0.98M B/D Cut It?

7X Demand Growth: Will 0.98M B/D Cut It?

Years of capital flight and ESG pressure have left supply starved just as demand accelerates—creating scarcity premiums and cash-rich upside for contrarian investors.

Good morning, ! This week we’re diving into how family offices are shifting from venture and real assets toward private credit, why AI infrastructure is fueling some of the largest private financings in history, how secondaries and NAV-based lending are becoming critical retention tools, and what Apollo’s $6.3B gaming platform deal signals about the future of PE rollups.

Join 50+ blue-chipadvertisers who reach our 400,000 executives every week: Start Here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

The Supply-Side Crunch: Oil & Gas’s Hidden Upside

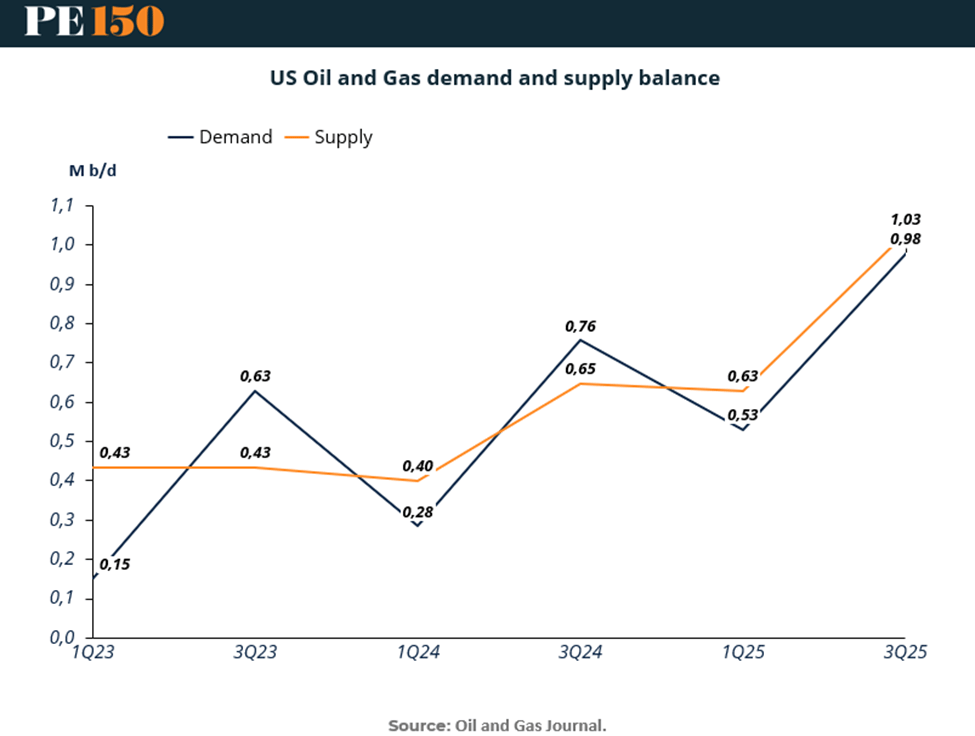

The energy transition has dominated headlines—but not the demand curve. From Q1 2023 to Q3 2025, US oil and gas demand is projected to surge 7X, rising from 0.15M b/d to 1.03M b/d. Supply, by contrast, lags significantly—climbing from 0.43M b/d to just 0.98M b/d over the same period. This growing gap isn’t cyclical—it’s structural.

Years of underinvestment, political pressure, and ESG constraints have crippled new upstream development. Meanwhile, private equity capital in upstream oil & gas has collapsed, falling from $17.2B in 2020 to just $6.9B YTD 2024, and deal count has halved. Notably, the largest PE-backed transactions are no longer in drilling, but in infrastructure and utilities—signaling a flight to low-risk assets.

The result? A broken supply engine, even as demand holds. Brent crude prices, though off 2022 highs, are stabilizing at a projected $73.75 by 2025, well above pre-pandemic levels. This environment supports robust margins for cash-flowing wells, with upside for investors positioned in a capital-starved segment.

Bottom line: The oil & gas supply story isn’t just mispriced—it’s misunderstood. For investors willing to zag while others zig, the setup points to durable yield, scarcity premiums, and outsized alpha.

TREND THE WEEK

Family Offices Are Rewriting the Private Markets Playbook

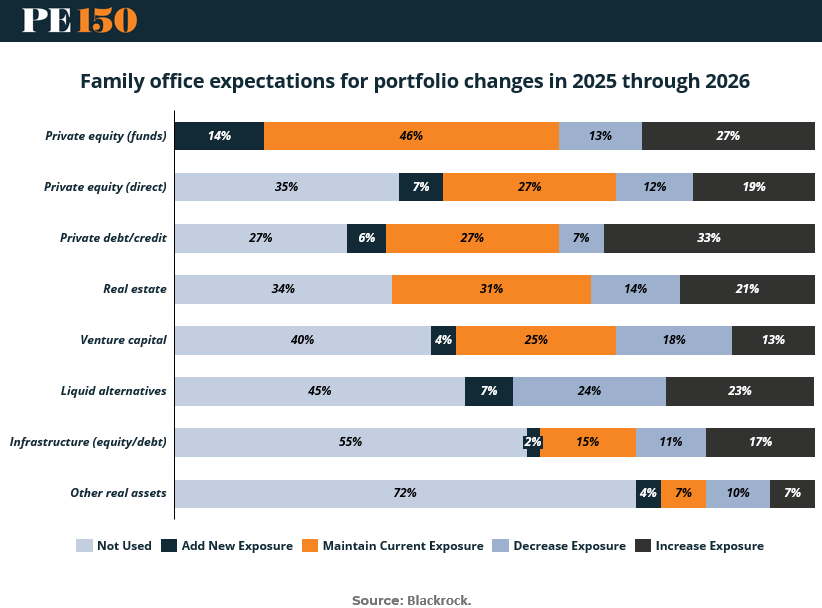

Family offices are signaling a major shift in how they allocate to private markets—and the winners aren’t who you might expect. The latest data shows a clear cooling in enthusiasm for traditional real assets and venture capital, while appetite is rising for yield-focused strategies.

Private debt is the standout. Roughly 33% of family offices plan to increase exposure to the asset class, outpacing both private equity funds (27%) and direct PE (19%). Real estate and venture capital lag with just 21% and 13% planning to allocate more, while liquid alternatives (23%) and infrastructure (17%) are emerging as secondary gainers.

What’s being cut? Real assets are getting shelved. A full 72% of respondents report no exposure to categories like timber, mining, or farmland, and only 7% expect to add any. Infrastructure also shows limited traction despite thematic tailwinds.

Bottom line: Family offices are gravitating toward cash flow, credit, and control. The shift away from venture and real assets toward private credit and liquid alternatives suggests a defensive posture—one that favors predictability over potential. (More)

IN PARTNERSHIP WITH PACASO

From a $120M Acquisition to a $1.3T Market

The wealthiest companies target the biggest markets. For example, NVIDIA skyrocketed ~200% higher last year with the $214B AI market’s tailwind. That’s why investors like Maveron backed Pacaso.

Created by a founder who sold his last venture for $120M, Pacaso’s digital marketplace offers easy purchase, ownership, and enjoyment of luxury vacation homes. And their target market is worth a whopping $1.3T.

No wonder Pacaso has earned $110M+ in gross profits to date, including 41% YoY growth last year alone. Now, with new homes planned in Milan, Rome, and Florence, they’re really hitting their stride. They even reserved the Nasdaq ticker PCSO.

And you can join well-known firms like Greycroft today. Lock in your Pacaso investment now for $2.90/share.

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public.Listing on the Nasdaq is subject to approvals.

LIQUIDITY CORNER

The Illiquidity Discount Nobody Talks About

Equity gets the glory, but liquidity does the heavy lifting. According to Morgan Stanley, 99% of equity comp decision-makers say liquidity options are critical for retention. Yet, many private firms still treat equity like a trust fall exercise—with no one catching you. As IPOs stall and M&A slows, PE sponsors are stepping in with structured secondaries, NAV-based lending, and partial buybacks to fill the void. The message is clear: paper wealth doesn’t keep talent. Access does. (More)

DEAL OF THE WEEK

Apollo's IGT-Everi Combo is PE’s Latest Platform Puzzle

Private equity’s favorite pastime—platform building—gets a new avatar with Apollo’s $6.3B merger of IGT’s Gaming & Digital and Everi. The new entity—branded IGT—bundles Gaming, Digital, and FinTech into one streamlined machine. Fernandez, the incoming CEO, will helm it from Q4 2025. Meanwhile, Everi investors got $14.25/share, and IGT left with $4B+ to play with—plus a clean slate for its freshly minted Brightstar Lottery. It’s another big move for Apollo, which seems to be reshuffling its gaming deck yet again. (More)

TOGETHER WITH LONG ANGLE

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for high-net-worth entrepreneurs, executives, and professionals across multiple industries. No membership fees.

Connect with primarily self-made, 30-55-year-olds ($5M-$100M net worth) in confidential discussions, peer advisory groups, and live meetups.

Access curated alternative investments like private equity and private credit. With $100M+ invested annually, leverage collective expertise and scale to capture unique opportunities.

PRIVATE CREDIT

$29B Bet: Meta’s AI Buildout Becomes a Private Credit Showcase

Meta is turning to private credit to bankroll its biggest infrastructure push yet—a $29B capital stack aimed at supercharging its AI data center expansion across the US. The deal, still in advanced structuring stages, includes $26B in debt and would rank among the largest private financings in history.

Top lenders in the mix include Apollo, KKR, Brookfield, Carlyle, and Pimco. Meta is working with Morgan Stanley to explore options to improve debt tradeability—critical for a deal of this magnitude.

The financing aligns with CEO Mark Zuckerberg’s high-stakes AI strategy. After a rocky Llama 4 rollout, Meta has ramped investment—committing $72B in capex and buying into ScaleAI and nuclear-powered compute infrastructure.

Private credit is proving to be the financing engine behind AI's physical footprint. Blue Owl recently backed a $15B JV with OpenAI, while Oracle and SoftBank are part of a $500B+ AI infra consortium. The trend is clear: as banks pull back and AI’s appetite for capital surges, private credit is stepping in—with scale, speed, and strategic positioning.

Why it matters: For private credit sponsors, AI infrastructure is no longer a fringe bet—it’s becoming core exposure. (More)

MICROSURVEY

AI’s operational Impact: Front Office Wins (For Now)

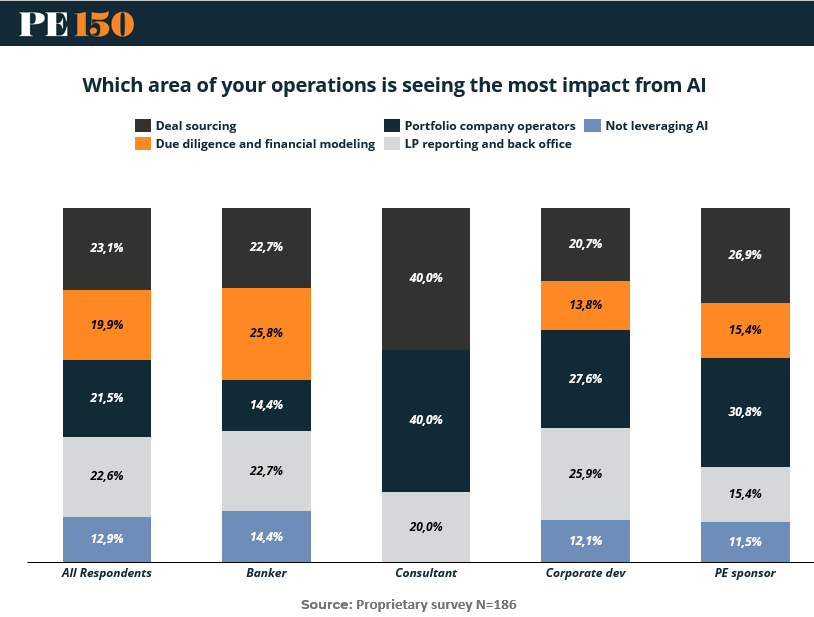

We asked 186 professionals where AI is having the biggest operational impact—and the front office is leading the charge.

Deal sourcing and portfolio operations dominate among consultants (40% each), reflecting AI’s growing role in client-facing workflows.

Bankers skew toward due diligence and modeling (25.8%), where automation can compress timelines without disrupting process.

For PE sponsors, the biggest lift comes in portfolio ops (30.8%) and deal sourcing (26.9%).

Just 12.9% of respondents say they’re not leveraging AI at all.

Why it matters: AI isn’t disrupting PE—it’s slotting into familiar pain points. While hype focuses on moonshot use cases, firms are prioritizing what’s measurable: faster sourcing, cleaner models, and tighter ops. Back office innovation? Still lagging. (More)

MACROVIEW

Is the signal out of service?

Rates are high, inflation is sticky, and no one feels good about it. The Fed’s old playbook — use rates to guide behavior — is showing its age. Consumer sentiment is worse than 2008, and inflation expectations are drifting north. That’s a problem when your entire model assumes trust in central banks. PE sponsors should recalibrate: expect duration risk to spike, LP skepticism to grow, and macroeconomic intuition to matter less than psychological noise. Welcome to a market where your next behavioral economist might be more useful than your bond trader. (More)

THIS WEEK IN HISTORY

Headline Versailles and the Long Shadow of Macro Risk

June 28, 1919: the Treaty of Versailles was signed, ending World War I—and kicking off a masterclass in economic overreach. Crushing reparations, sovereign debt spirals, and hyperinflation in Germany didn’t just destabilize a nation; they paved the road to global disorder. Today, the resonance is clear. Between debt overhangs, currency volatility, and geopolitical fragmentation, Versailles serves as a case study in how financial pressure turns systemic. For private equity, it’s a reminder: macro is strategy, not scenery. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

The long-awaited resurgence of deal activity in private markets was delayed again in Q2, confirming sluggish lending reported by private credit providers.

PitchBook’s Global PE First Look showed that the count of private equity exits declined by 25% QoQ in Q2. [h/t @lcdnews]

— PitchBook (@PitchBook)

4:45 PM • Jul 8, 2025

"Success is not the key to happiness. Happiness is the key to success. If you love what you are doing, you will be successful."

Albert Schweitzer