- PE 150

- Posts

- $22B Funds Win While Everyone Else Struggles — Here’s Why

$22B Funds Win While Everyone Else Struggles — Here’s Why

KKR hits its $22B hard cap and private credit volumes stabilize at $17B/quarter, while dealmakers face a sourcing bottleneck.

Good morning, ! This week we're unpacking how local vs. foreign LP capital is reshaping Asian PE, why private credit has found a higher, more permanent gear, what sponsors say matters most when underwriting new platforms, and how scale continues to win in fundraising as KKR pushes past $20B.

Sponsor spotlight: In Affinity’s survey of nearly 300 private capital professionals, deal sourcing is still priority #1 for 2026—but bandwidth is the constraint. The 2026 Predictions report shows how firms are tightening data ecosystems and automating sourcing workflows to surface better opportunities faster. Read the Report →

PRIVATE CREDIT

The 5x Private Credit Surge Nobody's Talking About

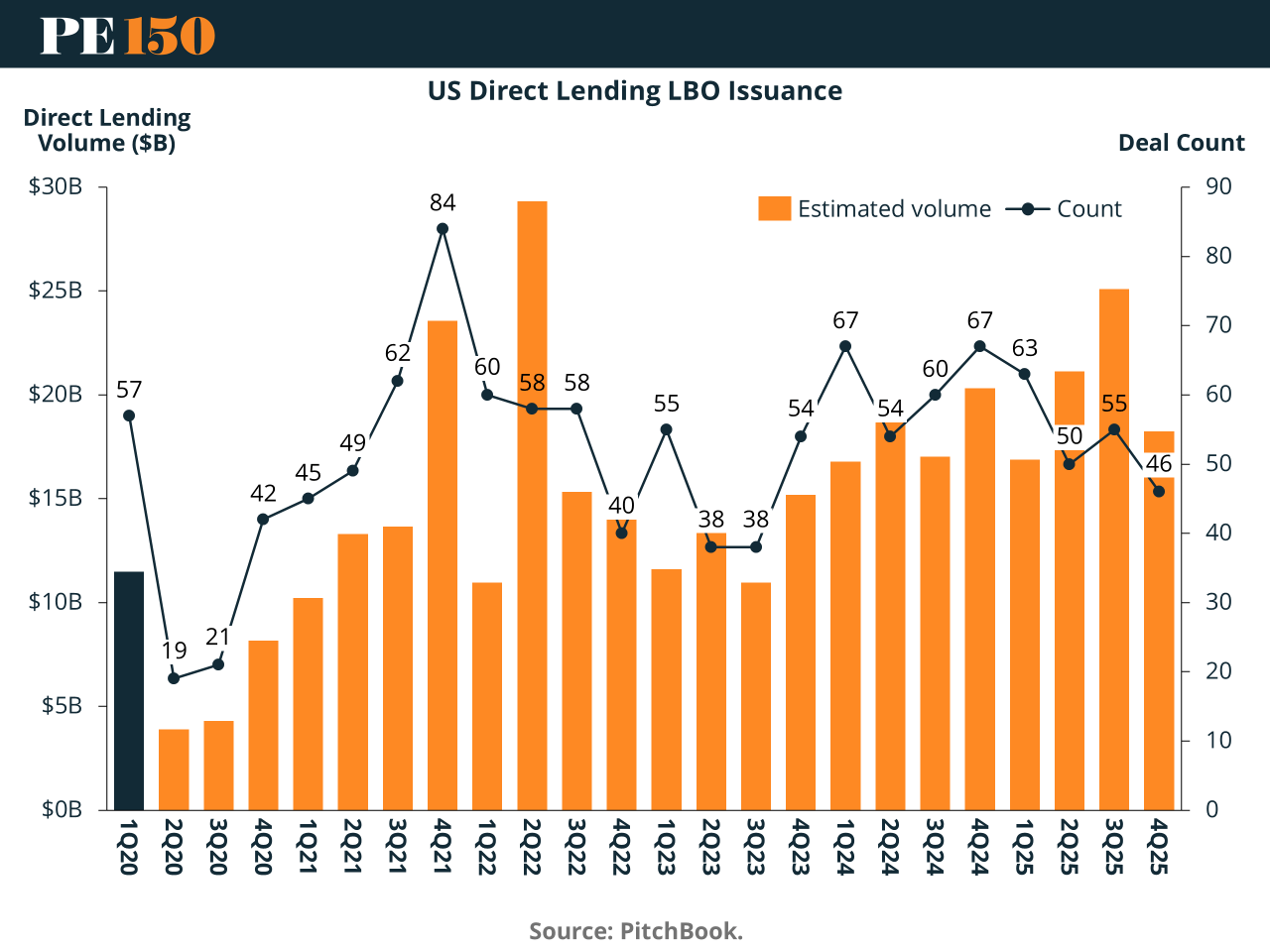

After the post-COVID whiplash, private credit deal activity appears to be settling into a higher gear. In 2020, deal count collapsed to just 19 transactions in Q2, with estimated volume falling to $3.89B. But by Q4 2025, quarterly volumes had climbed back to $18.24B across 46 deals—a level that now seems to represent the new floor, not the ceiling.

What’s striking isn’t just the recovery—it’s the consistency. Since early 2023, private credit has averaged 54 deals and ~$17B per quarter, suggesting the asset class is entering a more stable, institutionalized phase. That’s a sharp contrast to its historically cyclical behavior tied to broader credit markets.

The takeaway? Private credit isn’t just a tactical tool during bank pullbacks—it’s becoming a permanent fixture in the capital stack. With banks still retrenching and sponsors favoring speed and certainty, expect direct lending to keep playing offense in 2025.

REGIONAL FOCUS

Domestic Capital Draws the Lines in Northeast Asia

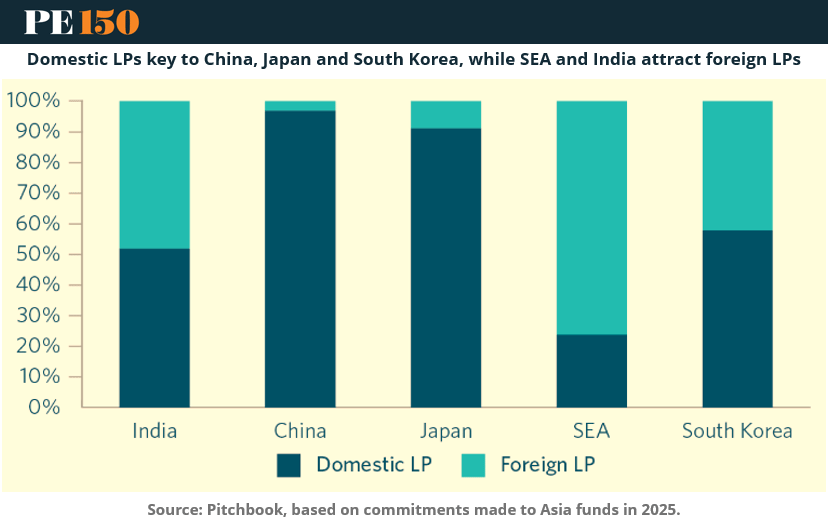

The LP mix across Asia is quietly dictating where private equity can actually scale. China and Japan remain overwhelmingly domestically funded markets, with roughly 90% plus of capital coming from local LPs. South Korea follows the same pattern, though less extreme, with domestic institutions still supplying a clear majority at around 60%. The implication is straightforward. Access is governed less by global fundraising prowess and more by local relationships, regulatory comfort, and long term institutional trust.

India sits in the middle. Capital is almost evenly split between domestic and foreign LPs, making it one of the few large Asian markets where global sponsors can still compete on relatively level footing without deep sovereign or pension backing.

Southeast Asia flips the script entirely. Roughly 75% of capital is foreign sourced, turning the region into the most externally driven PE market in Asia. That dynamic favors global funds, regional platforms, and cross border strategies over purely domestic players.

Why this matters. Asia is not one capital market. China, Japan, and Korea reward localization. India rewards balance. Southeast Asia rewards global connectivity. Fund strategy, team composition, and return expectations should follow that reality, not regional headlines. (More)

PRESENTED BY AFFINITY

One-third of dealmakers are now spending 21–40 hours every week just researching companies. That's half a full-time job before a single conversation happens.

In Affinity's survey of nearly 300 private capital professionals, deal sourcing remains their top priority for 2026. But the real bottleneck is having the bandwidth to evaluate opportunities before competitors do.

The firms pulling ahead are automating the manual research work, surfacing higher-quality targets faster, and protecting their teams from drowning in data.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

DEAL OF THE WEEK

KKR’s Fundraising Flex

KKR is about to do what most private equity firms can’t right now: beat its own fundraising target. The firm is on track to raise up to $22B for North America Fund XIV, blowing past its original $20B goal and hitting the fund’s hard cap, per Bloomberg. Final close is expected in Q1 2026, after roughly 18 months on the road.

Context matters. Fundraising has been brutal across private markets, with several publicly listed peers coming up short. Yet KKR’s private equity platform—led by Pete Stavros and Nate Taylor—keeps attracting capital, helped by a 10% trailing 12-month return and a 50% jump in realised carried interest year-over-year.

Zoom out: improving US exit activity—$728B in 2025, per PitchBook—is restoring LP confidence. For now, scale still sells. (More)

MICROSURVEY

What is the most critical attribute you look for in a new platform investment today?We would like to know what matters most when underwriting a new platform today. |

INTERESTING ARTICLES

TWEET OF THE WEEK

PUBLISHERS PODCAST

No Off Button: Real leadership shows up after the frameworks fail.

In this episode, Aram sits down with Konstantinos Papakonstantinou to unpack the uncomfortable gap between formal education and real-world execution. They get into why degrees, playbooks, and neat frameworks tend to break down when capital is at risk—and how judgment is actually forged through ownership and consequence.

The conversation zeroes in on decision-making under pressure, accountability, and the kind of lessons teams only learn when outcomes are real and reversible mistakes are gone.

Why PE should care: returns aren’t driven by credentials—they’re driven by operators who can make clear calls with imperfect information, carry responsibility, and execute when it counts.

Watch the full conversation and see what holds up when theory meets reality.

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"If you don't like something, change it. If you can't change it, change your attitude."

Maya Angelou