- PE 150

- Posts

- $2.1T Moves Out Of Banks | Hear From Mathew Carvajal, Bobby Sharma, Julia Wittlin, Ben Fund & More

$2.1T Moves Out Of Banks | Hear From Mathew Carvajal, Bobby Sharma, Julia Wittlin, Ben Fund & More

Banks on defense under Basel IV and post-SVB caution; sponsors bypass loan desks for speed and certainty—$2.1T has migrated to private credit, with $490B ready to fund C&I and buyout deals.

Good morning, ! This week we’re covering bank retrenchment enabling a private credit surge, maturity breakdown of performing loans, semiliquid funds main managers, and crypto VC deal activity.

We’re also co-hosting a sports investing event in NYC on September 3rd! Learn more about it, here.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone who would love this? Pass it along—they’ll thank you later! Here’s the link.

DATA DIVE

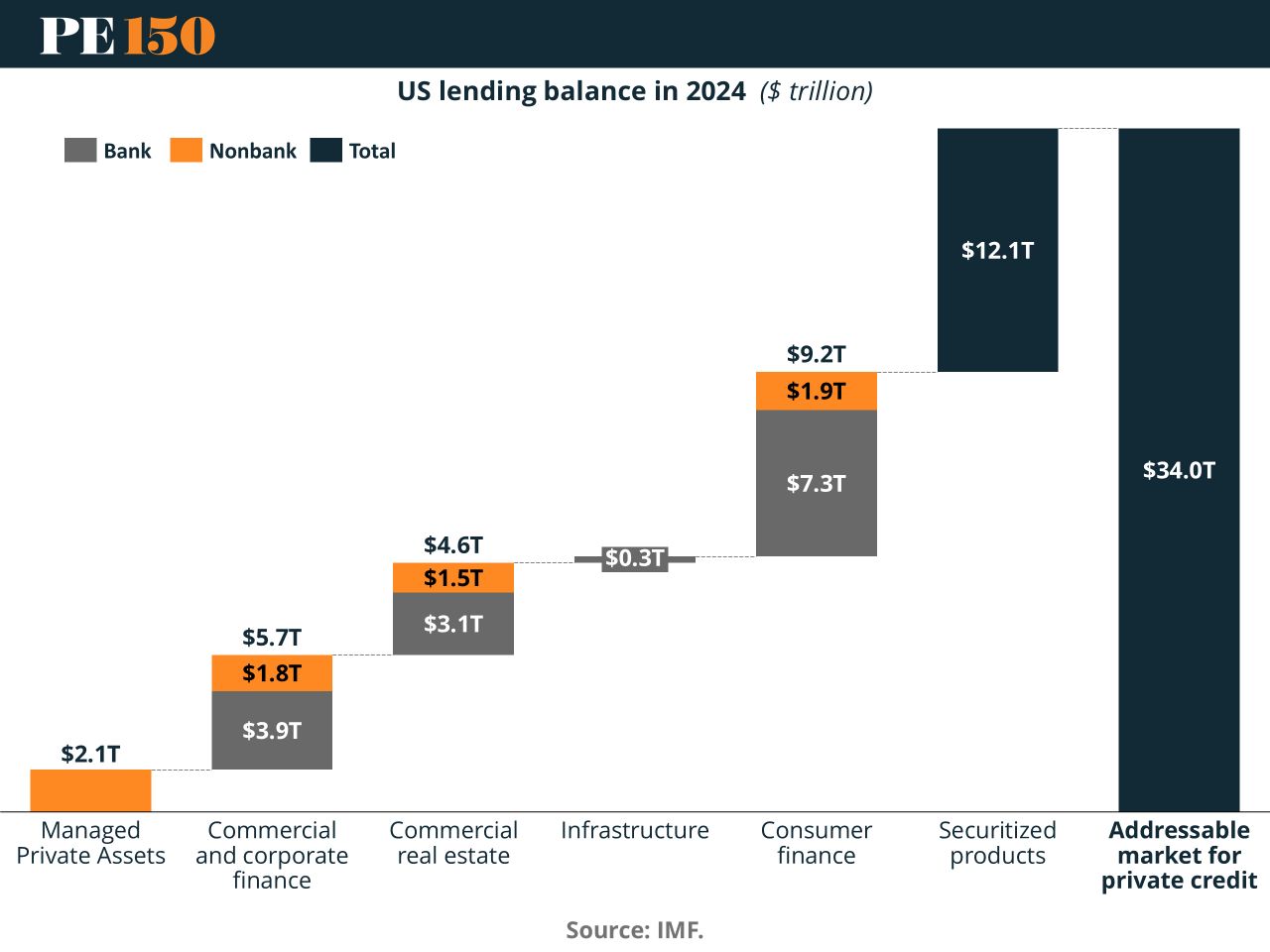

The Great Credit Migration

Over the last decade, $2.1T has quietly walked out of bank vaults and into private credit funds, signaling a permanent power shift in commercial lending. As banks play defense—hamstrung by Basel IV rules, weak liquidity, and post-SVB trauma—private credit has gone full offense. It’s not just about stepping in; it’s about displacement. From C&I loans to acquisition financing, sponsors are skipping banks entirely. Why? Speed, customization, and certainty. As of 2023, dry powder hit $490B, providing ample fuel to meet rising borrower demand. Public markets now feel like rotary phones in a world of iPhones: still there, just mostly ignored.

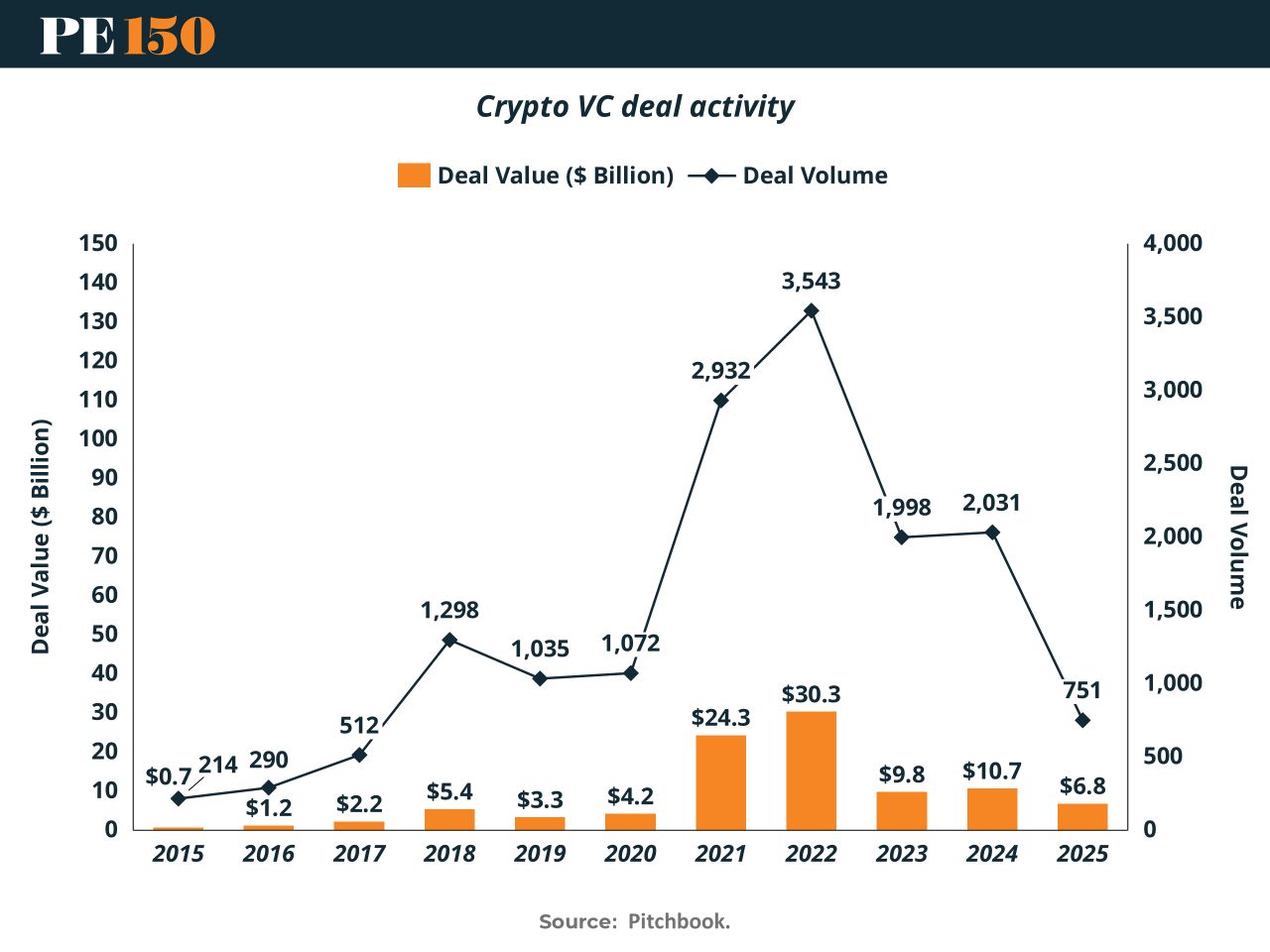

TREND OF THE WEEK

Crypto VC: Winter Outside, Heat Inside

Despite a bullish Q2 for public crypto markets, with Circle’s IPO soaring 168% on day one and stablecoin circulation hitting records, VC funding cratered 55% QoQ to $1.5B—its weakest showing since 2020. The catch? Investors are writing fewer checks, but at far higher valuations. Median early-stage deals jumped 159%, showing that capital is concentrating on proven teams and infrastructure plays. Plasma’s $50M raise at a $500M valuation, oversubscribed 7x, reinforces the new order: fewer lottery tickets, bigger bets. With the CLARITY Act vote looming, this bifurcation of “fund less, pay more” looks here to stay. (More)

PRESENTED BY PACASO

Big Investors Are Buying This “Unlisted” Stock

When some of the firms who backed companies like Uber and eBay before they IPO’d invest in a new company, people take note.

That’s the case with Pacaso.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions and service fees across 2,000+ owners. That’s good for more than $110M in gross profits to date, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long, this deal closes soon.

Invest in Pacaso before the opportunity ends September 18.

LIQUIDITY CORNER

Semiliquid Funds: The $200B Middle Ground

Semiliquid funds are quietly becoming a core strategy for asset managers navigating investor demand for flexibility. The top 10 managers now oversee $189B in semiliquid assets, led by Blackstone ($66B, 19% market share), Cliffwater ($31B), and Blue Owl ($21B).

Unlike traditional private equity vehicles, semiliquid funds offer more frequent liquidity windows—monthly or quarterly—without the full redemption rights of mutual funds. It’s a structure increasingly favored by wealth platforms and retail-adjacent allocators looking for private market exposure without decade-long lockups.

But scale isn’t uniform. While Pimco runs 7 funds totaling just $5B, Blackstone and Cliffwater have matched that AUM with just 3 funds each, suggesting deeper investor penetration per product.

Why it matters: As traditional exit markets remain challenged, semiliquid structures offer a new path to AUM growth—and potentially, LP liquidity. For GPs, the playbook is shifting from locked-up capital to managing flows without sparking redemption spirals. (More)

Learn from the Architects of Modern Brand Power

📍 September 3, 2025 | Jay Conference, Bryant Park, NYC | 9:00–11:00 AM

Join senior investors, agents, and operators at the intersection of capital and culture—where M&A meets media, and where sports, lifestyle, and brand equity are the new growth engines.

This isn’t just a panel breakfast. It’s a strategic look at how value is being built, monetized, and multiplied in the fast-evolving sports economy:

→ From Icons to IP: How elite agents structure wealth through equity, licensing, and brand control.

→ PE’s Sports Playbook: What leading firms are buying, how they’re navigating league rules, and where the real ROI lies.

Featuring speakers from Carlyle, RedBird, Bluestone Equity, and WME Sports, this event offers a rare lens into how sports deals really get done.

Seats are limited. Register here before it sells out.

DEAL OF THE WEEK

Thoma Bravo’s $11.2B HR Play

Thoma Bravo is back at it—this time with a deal to acquire Dayforce for $11.18bn ($12.3bn including debt). The $70 per share bid represents a 32.4% premium to pre-rumor trading levels. Why it matters: Sponsors remain laser-focused on recurring revenue software with AI and automation upside. The human capital management (HCM) sector is consolidating fast, with Paychex-Paycor ($4.1bn) and ADP-WorkForce ($1.2bn) already on the books this year. Dayforce stock has lagged peers—down 9% YTD—making it ripe for a sponsor-driven turnaround. For Thoma Bravo, this is less about cost-cutting and more about betting big on workforce tech as competition heats up. (More)

PRIVATE CREDIT

Higher for Longer” Just Means “Richer for Lenders

Private Credit isn't past its prime—it’s aging like a fine floating-rate wine. Despite a few Fed cuts, the SOFR forward curve tells us rates are sticking above 4% for years. That’s a gift for lenders who remember the pre-2022 1% LIBOR floor with contempt. Meanwhile, leveraged loan yields jumped 73% since 2022, and credit spreads could widen another 200 bps by mid-2025. Add a $2T funding gap (thanks, buyout dry powder), and you’ve got supply-demand tailwinds galore. Yes, defaults ticked up, but still trail long-term averages. If private credit’s golden age is over, it didn’t get the memo. (More)

MICROSURVEY

With deal flow shifting and competition rising, we want to know:

Which part of deal sourcing has become the most challenging recently? |

TOGETHER WITH SYNTHFLOW

Secure Voice AI for Multi-Location Businesses

Choosing the right Voice AI strategy starts here:

Meet HIPAA, GDPR, and SOC 2 standards

Launch across 100+ sites in under a month

Replace manual routing with secure, no-code workflows

MACROVIEW

Powell’s Signal: A Soft Landing... Off a Cliff?

The Fed is signalling a September rate cut, trying to make the market buy the soft-landing narrative. Powell’s dovish pivot—framed as caution—arrives despite re-accelerating inflation, record M2, and a $1.8T fiscal deficit. Add Trump’s pressure for a 1% rate and rising tariffs, and the policy mix resembles a Red Bull cocktail for inflation. Meanwhile, only 27.3% of PE sponsors believe in a soft landing, with nearly half expecting we’re already in mid-recession. If this is signaling, it’s Morse code during a thunderstorm. Credibility is now the Fed’s most endangered asset. (More)

THIS WEEK IN HISTORY

August 21, 1959: Hawaii Becomes the 50th State

On this week in 1959, President Eisenhower signed Proclamation No. 3309, officially admitting Hawaii as the 50th U.S. state. The path to statehood was a multi-decade political journey, met with resistance in Congress and concerns over geographic and demographic distance from the mainland.

Eisenhower supported the cause early in his presidency, but it wasn’t until March 1959 that the Hawaii Admission Act cleared Congress. In June, Hawaiians voted overwhelmingly in favor of statehood. By August, the U.S. had a new flag, and the Pacific had its first state.

Why it matters: Hawaii’s admission was a milestone in American expansionism—less about manifest destiny and more about geopolitics and economic integration. For PE and M&A professionals, it’s a reminder that markets (and regulations) evolve with political inclusion. Statehood unlocked federal funding, defense infrastructure, and regulatory clarity—catalyzing tourism, real estate, and logistics sectors that are now deeply capitalized. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

JUST IN: 🇺🇸 Fed Chair Jerome Powell suggests current conditions 'may warrant' interest rate cuts.

— Watcher.Guru (@WatcherGuru)

2:07 PM • Aug 22, 2025

"Don't be distracted by criticism. Remember, the only taste of success some people have is when they take a bite out of you."

Zig Ziglar