- PE 150

- Pages

- Trend of the Week

Trend of the Week Section

1/15/2025

📈 Trend Of The Week

PE’s New Balancing Act

Private equity is ditching its lean-and-mean playbook to chase new asset classes—from private credit to infrastructure funds—but the pivot isn’t without pain. Expanding into these areas means more compliance headaches, greater regulatory scrutiny, and pressure to upscale operations. Legacy back-office processes, largely manual, are ill-suited for today’s complexity. Regulators, meanwhile, are poised to start asking tougher questions, especially as firms lean into products that touch public markets. The cost-benefit analysis is clear: adapt or risk losing LP interest. This shift may lead to PE firms operating more like asset managers than the swashbuckling buyout shops of old.

1/8/2025

📈 Trend of the week

Urban Logistic: the capital needs for better cities

By 2030, cities could see a 61% surge in delivery vehicles, a necessary consequence of e-commerce growth. But this convenience comes at a cost: skyrocketing congestion, carbon emissions, and public safety risks. The World Economic Forum's latest report underscores the urgency for change, emphasizing zero-emission fleets, shared microhubs, and robust urban planning.

Here’s the play for Private Equity: Infrastructure for urban mobility—like EV charging networks and decentralized warehouses—isn't just a solution; it's a goldmine. With cities like Bengaluru projecting a 76% hike in transport emissions, demand for eco-friendly logistics is surging. For sponsors, it’s the perfect entry point to back scalable, sustainable models while riding the wave of regulatory and consumer-driven pressure for greener cities. The potential to reshape how goods—and investments—move has never been greater.

12/20/2024

📈 Trend of the week

AI Is Eating Capacity—And PE Is Footing the Bill

Data center construction is surging globally, with spending projected to hit $49B by 2030. What’s driving it? Artificial intelligence's insatiable need for computational power has outstripped current infrastructure. Hyperscalers and co-location companies are pouring billions into building data centers—but capital-intensive projects require hefty upfront investments and mid-to-long-term ROI. Enter private equity sponsors. PE firms are uniquely positioned to provide growth capital for data center developers, drawn to the sector’s stable, high-demand fundamentals and a CAGR flirting with 6%. As AI accelerates, those data centers—and the PE players behind them—are becoming indispensable.

12/11/2024

📈 Trend of the week

Family Offices — The Quiet Giants Keep Growing

The Family Office market is becoming an unstoppable force in global wealth management. Deloitte forecasts the number of Family Offices will surpass 8,000 in 2024, managing $5.5 trillion — a 31% jump from 2019. But it’s not just quantity; these wealth managers are swimming in deeper pools of capital, growing their total AUM by nearly 67% in just five years. Looking forward? By 2030, we’re talking about 10,000+ offices overseeing $9.5 trillion. In short: Family Offices are no longer the quiet little engines of wealth; they’re evolving into full-scale locomotives that will influence markets for decades.

12/5/2024

📈 Trend of the week

Financial Sector Goes All-In on AI

Private equity might be looking at its next gold rush: AI in the financial sector. Spending is projected to jump from $35B in 2023 to $97B by 2027—a sizzling 29% CAGR. The banking industry is leading the charge, already investing $20.6B this year, while retail isn’t far behind at $19.7B.

The kicker? Private capital is powering much of this momentum, suggesting the runway for value creation (and eventual exits) is substantial. Yet, competition is steep, and the winners will likely be those who crack the code on scalable applications in risk management, fraud detection, and personalized customer experiences.

The question for PE sponsors: Which portfolio companies are ready to capture this transformation—or risk being left behind?

11/28/2024

📈 Trend of the week

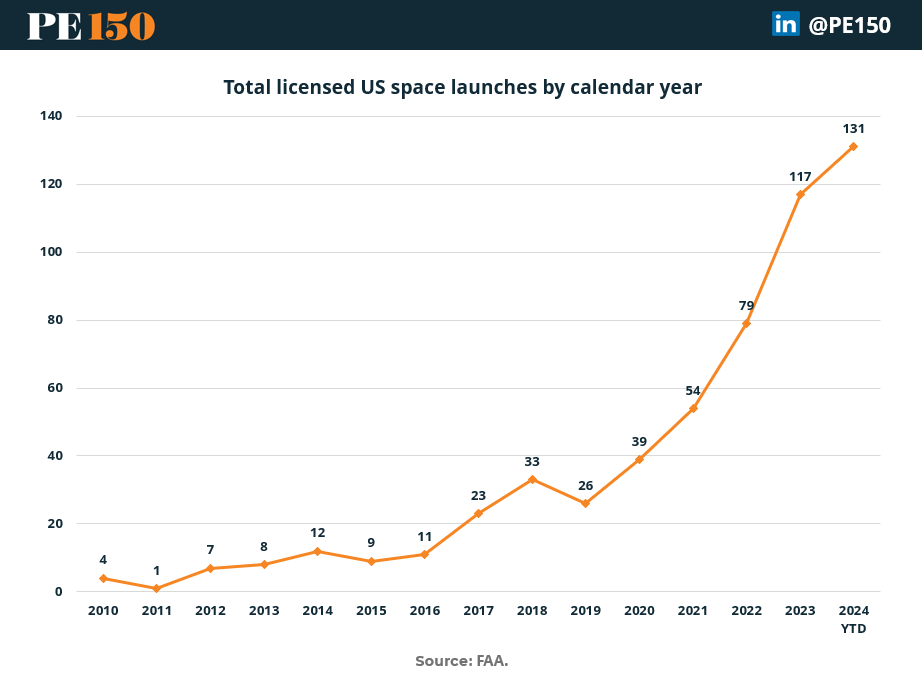

US vs Russia or China? No More: The Space Race Hits Private Equity

The space industry isn’t just about billionaires and governments launching rockets; it’s a magnet for private equity dollars. With the cost to reach orbit down 8x since 2008, startups are seizing on cheaper launches to innovate everything from satellite tech to propulsion systems. Total U.S.-licensed launches skyrocketed from single digits in 2010 to over 130 this year. Why does this matter? Satellite proliferation is rewriting how companies monitor assets, manage risk, and enhance operations in industries like defense and environmental mapping.

The big picture: Space infrastructure is now a PE frontier, with surging investment in applications ranging from industrial mapping to climate monitoring. Think of it as the ultimate emerging market—one that’s 62 miles above your head.

11/20/2024

📈 Trend of the week

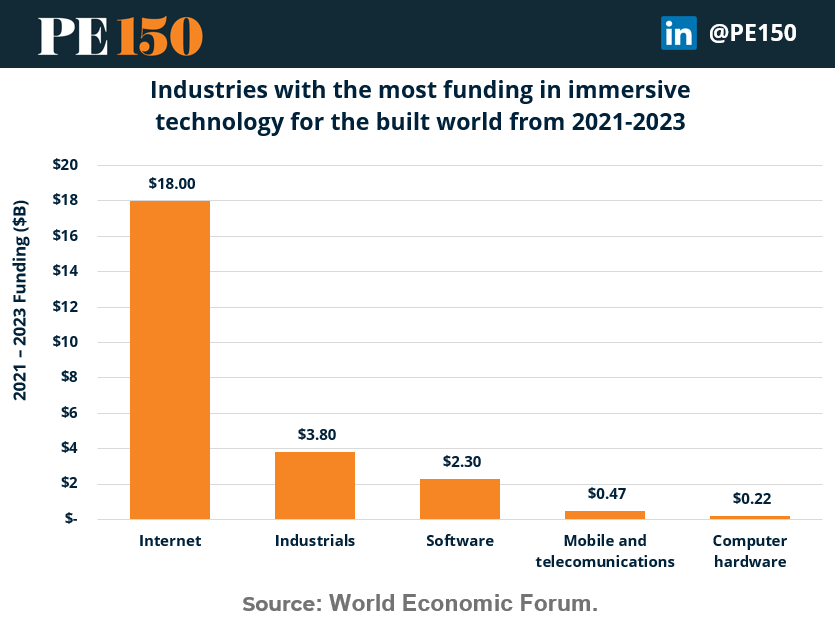

Immersive Technology: Building the Future of Construction

The construction industry is undergoing a digital transformation, with immersive technologies like virtual reality (VR) and augmented reality (AR) leading the charge. These tools enable architects and engineers to create detailed digital twins of structures, allowing for virtual prototyping and experimentation. This approach enhances accuracy, reduces errors, and optimizes project delivery. Moreover, immersive technologies facilitate remote collaboration, bringing together professionals from around the globe in a shared virtual space. This not only streamlines the design and construction process but also contributes to sustainability by minimizing the need for physical resources and reducing waste. As these technologies continue to evolve, they are set to revolutionize the built environment, making construction more efficient, cost-effective, and environmentally friendly.

Regions of innovation.

Countries with the most business and academic grant funding in immersive technology for the built world from 2021-2023:

United States: $21.2B

China: $2B

Canada: $838M

United Kingdom: $604M

Kenya: $506M

11/14/2024

📈 Trend Of The Week

Diligence as a Competitive Weapon

PE firms are shelling out serious cash—about 1% of deal value—on due diligence, with projected spending hitting $80 billion in the next five years. But as deal landscapes get tougher, this check-the-box approach isn’t cutting it anymore. The goal now? Make diligence a true competitive edge. It’s not enough to simply “do diligence”—firms that turn it into a source of differentiation will see stronger outcomes and a bigger return on these sizable investments. In an increasingly complex M&A world, the diligence game is evolving, and the winners will be those who play smarter, not just harder.

11/6/2024

📈 Trend of the week

Cost Crunch: Fintechs' Next Moves

Fintechs have a double headache: rising interest rates and skyrocketing customer acquisition costs (CAC). With overheads piling up, some are playing matchmaker. Take June’s eBay-Venmo deal, which lets eBay buyers use their Venmo balances—instant customer access. Meanwhile, big fish like SoFi are chasing bank charters to boost margins, and Robinhood is banking less on transaction fees. The writing's on the wall: fintechs can’t afford to be one-trick ponies anymore.

10/28/2024

📈 Trend Of The Week

Continuation Funds: PE’s Not-So-Secret Weapon

GPs’ favorite trick lately? Continuation funds. These vehicles let them hold onto high-performing assets while keeping exit doors open—an irresistible combo in volatile times. By 2024, exit values are set to hit $9.0B, a massive leap from $0.2B in 2014. Meanwhile, LPs remain wary. Why? Conflicts of interest abound when GPs sit on both sides of the table, prompting 56% of failed deals to cite valuation disputes. The lesson? Continuation funds may be thriving, but for LPs, it’s still a cautious embrace.