- PE 150

- Pages

- Macro View Archive

Macro View Section

1/15/2025

📊 Macro View

Anatomy of Economic Growth: The Role of Investment Rates

An analysis of the period from 2013 to 2023 reveals a clear correlation between investment rates—both private and public—and GDP per capita growth. Countries that experienced higher investment rates have demonstrated stronger economic performance, fostering wealth creation and improving the standard of living for their populations. Notable examples include Ireland, China, India, Vietnam, and Ethiopia. These nations share a common trait: proactive efforts to enhance their policy environments, streamline business regulations, and attract significant levels of Foreign Direct Investment (FDI).

Conversely, countries that have made limited progress in creating a conducive business environment during this period have encountered persistently low investment rates, resulting in stagnation or even contraction in economic growth. Examples of such underperformance include Ukraine, Argentina, and Brazil, where structural challenges and policy inertia have hindered economic advancement.

1/8/2025

📊 Macro View

Donald Trump White House second half: Trade Wars 2.0?

Donald Trump’s return to the White House could bring back his signature trade policies, with the potential to escalate into another global trade war. The Allianz Research report paints a stark picture: under a contained trade war, China could lose $34.2 billion in trade, but a full-blown conflict might spike this to $125.3 billion. US allies like Mexico and Canada could also face heavy losses, at $52.1 billion and $39.2 billion, respectively.

Trump’s "America First" agenda is likely to revive tariffs as a strategic tool, disrupting global supply chains and economic partnerships. This spells volatility for multinationals and private equity firms with international exposure. For dealmakers, the playbook must shift—think diversification and supply chain resilience. The bottom line? Trade friction may be Trump’s leverage, but the fallout will be a global challenge.

12/20/2024

📊 Macro View

ECB to Markets: “We’re Cutting, Not Running”

The ECB just trimmed interest rates by a quarter-point to 3% and dropped its hawkish vibes. Eurozone growth forecasts look softer than overcooked pasta: 1.1% in 2025 (down from 1.3%) and 1.3% by 2027. Inflation? They’re seeing a neat 2% target — mostly. Markets aren’t buying a one-and-done; traders expect five more cuts by next September, dropping rates to 1.75%. The Fed might be less aggressive, but with Trump’s tariff threats hanging like a summer storm cloud, Europe’s export economy is looking increasingly vulnerable. “Gradual easing” is the new mantra — unless, of course, things get worse.

12/11/2024

📊 Macro View

The macroeconomic effects of liquidity supply during financial crises

New research by Porcellacchia and Sheedy spotlights the pivotal role of liquidity supply during financial crises. Their findings show that banks’ demand for liquid assets spikes during economic shocks, driven by self-fulfilling waves of pessimism that amplify funding costs and suppress investment. The study integrates this phenomenon into a business cycle model, revealing how countercyclical liquidity policies—such as increasing bank reserves—can stabilize the economy. By reducing liquidity premiums, these measures lower banks’ borrowing costs, fueling investment and boosting GDP.

The takeaway: accommodating banks’ liquidity needs during downturns is not just a backstop for financial institutions; it’s a cornerstone for broader economic resilience.

12/5/2024

📊 Macroeconomics Corner

Digital Business Productivity Index: M&A’s Compass

Ireland, the U.S., Singapore, and France aren’t just geographical points; they’re targets in the crosshairs of tech-savvy private equity. The Digital Business Productivity Index, blending tech investment vitality with worker output, ranks these countries as the epitome of digital efficiency. For PE sponsors, this means fertile ground for high-return investments: robust infrastructure that nurtures innovation and rising productivity—two ingredients critical for value creation and lucrative exits.

The message? Tech ecosystems with both brains (talent) and brawn (investment) are where tomorrow’s unicorns thrive—and where today’s sponsors should park their capital.

11/28/2024

📊 Macroeconomics Corner

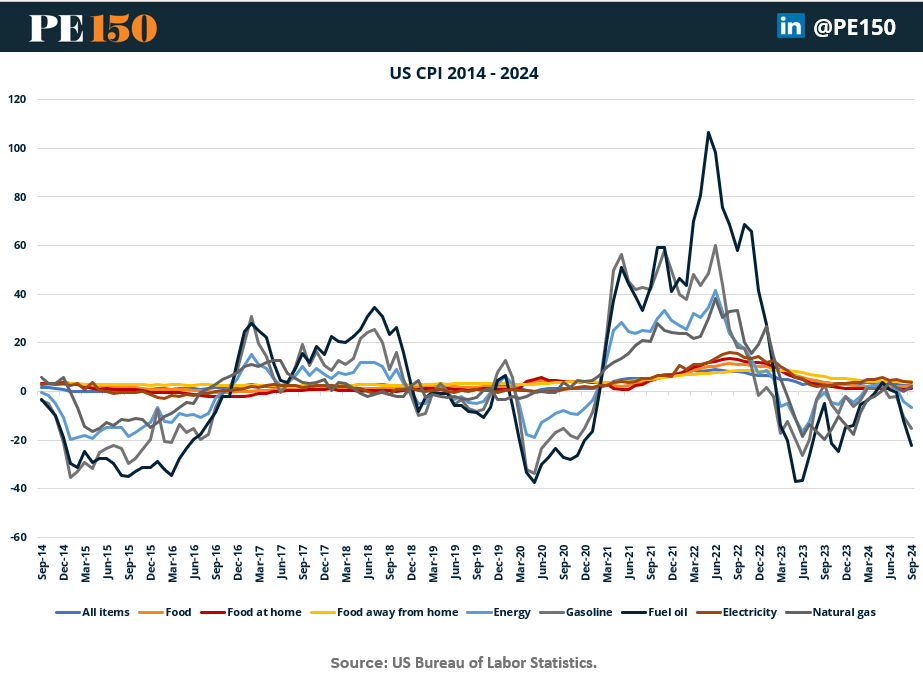

Americans Want Trump to Focus on Inflation in his First 100 Days

Inflation is back in the spotlight as President-elect Trump prepares to take office, with 35% of Americans identifying it as his top priority. The irony? Inflation, driven by pandemic-era disruptions, helped propel Trump’s victory after it plagued the Biden administration. Now, his pro-tariff agenda could stoke the very flames he’s expected to extinguish. Economists warn that tariffs on Chinese imports might hike prices further as businesses pass costs to consumers—rekindling the inflationary pressures voters just rejected.

11/20/2024

📊 Macroeconomics Corner

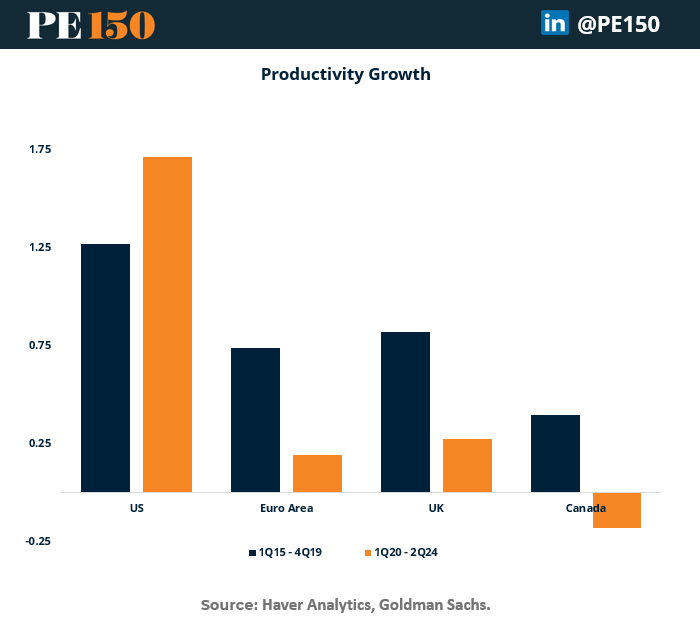

Productivity—the Unsung Hero of a Bullish U.S. Economy

Forget the political noise; productivity is the metric driving bullish economic projections for the United States. Since late 2019, U.S. labor productivity has grown at an annualized rate of 1.7%, a notable acceleration compared to its pre-pandemic pace of 1.3% and leagues ahead of the Euro area’s paltry 0.2%

This momentum underpins projections like Ed Yardeni’s “Roaring 2020s” scenario, which ties deregulation, tax cuts, and AI-driven efficiency gains to sustained GDP growth. Goldman Sachs echoes optimism, forecasting a 0.4 percentage-point productivity boost from AI by the late 2020s. If realized, this could bring productivity growth closer to its historical 2% average—a game-changer for revenue, earnings, and debt sustainability.

The catch? Policymakers can’t rest on this potential alone. A recalibration of tax and spending policies is essential to foster innovation. AI may provide the spark, but smart policy is the kindling that ensures the fire spreads.

11/14/2024

📊 Macroeconomics Corner

Financial Stability's Split Screen: Short-term Relief, Long-term Risks

While the global economy edges toward a soft landing, near-term financial stability looks promising, fueled by rate cuts and buoyant asset prices. But here’s the twist: long-term vulnerabilities are building up. Easy money is driving up asset valuations, debt levels, and leverage, making the financial system more fragile—think 2008 déjà vu. Meanwhile, low market volatility masks growing geopolitical risks, setting the stage for sudden sell-offs. With a potential disconnect looming between uncertainty and asset prices, central banks must balance rate cuts with vigilance, and policymakers need to focus on robust regulatory measures to prevent deeper systemic risks.