- PE 150

- Pages

- Liquidity Corner Archive

1/15/2025

💰Liquidity Corner

Co-investing deals alternative for liquidity crunch

Co-investing deals have emerged as a powerful tool for addressing liquidity challenges in the private equity sector, particularly in a landscape marked by slower exit activity and tightening capital markets. By allowing LPs to invest directly in specific portfolio companies, midlife co-investments provide a dual advantage: they offer a pathway for PE firms to raise fresh capital while simultaneously enabling existing investors to access liquidity outside the traditional fund cycle. Sovereign wealth funds (SWFs), for instance, have dominated these transactions in value, participating in nearly half of global co-investing deals in early 2024, typically favoring larger, high-value investments. On the other hand, corporates, which accounted for 66% of co-investing deals by volume, leaned toward smaller, more frequent transactions. This flexibility underscores the appeal of co-investments in creating bespoke solutions for diverse investor needs, strengthening relationships between GPs and LPs while maintaining the focus on long-term portfolio value creation.

In the broader liquidity framework, co-investments serve as an innovative response to investor demands in a constrained market. The global co-investing market, which peaked at $260 billion in 2021, remains a significant avenue for both capital growth and liquidity generation, even as deal volumes have slowed. As private equity firms navigate an environment of rising interest rates and competition for capital, offering co-investing opportunities enhances their ability to retain and attract investors while providing quicker access to returns compared to traditional fund structures. Furthermore, the ability to tailor these deals—such as including delayed-draw options or bespoke repayment terms—ensures alignment with both the financial goals of LPs and the operational strategies of portfolio companies. In a landscape where GPs must innovate to maintain momentum, co-investments represent a versatile and impactful solution to the sector's liquidity challenges.

1/8/2025

💰Liquidity Corner

Liquidity lifeline: Private Equity and ETFs

The rise of private asset ETFs is set to transform the private equity landscape, offering investors unprecedented access to traditionally exclusive markets like private equity, private credit, and venture capital. These ETFs promise to democratize private markets by packaging them into a familiar, liquid, and cost-effective structure, making them accessible to both retail and institutional investors. By investing in a diversified portfolio of private assets, private asset ETFs could provide exposure to high-growth opportunities while reducing risks associated with individual issuers. Moreover, their structure is designed to improve price transparency and offer secondary liquidity, two features historically absent in private markets. Early filings, including ETFs focused on private credit with up to 15% exposure to illiquid assets, highlight the industry's commitment to innovation despite regulatory challenges.

However, this democratization comes with hurdles. The inherent liquidity mismatch, combining illiquid private assets with the daily tradability of ETFs, poses significant pricing and market-making challenges. In times of market stress, ETFs may trade at discounts or premiums to their net asset value (NAV), reflecting underlying illiquidity. Despite these concerns, industry giants like BlackRock and Invesco are leading the charge, investing heavily in infrastructure to address these issues and unlock retail access to private markets. As private markets grow, projected to surpass $18 trillion in assets under management by 2027, the introduction of private asset ETFs could open the door to a new era of investment, making private equity a more prominent part of portfolios across investor classes.

12/20/2024

💰 Liquidity Corner

2025 - A year of pressure for Private Equities

The growing maturity wall of $298 billion in leveraged buyout (LBO) loans by the end of 2025 underscores an urgent liquidity challenge for private equity (PE) firms, particularly as traditional refinancing options become constrained. With high interest rates and stagnant exit channels, GPs face the dual pressure of improving portfolio company EBITDA to offset rising debt costs while devising creative solutions to bridge liquidity gaps. Unlike during the Global Financial Crisis (GFC), where GPs could buy back debt at deep discounts, today’s economic conditions—marked by elevated borrowing costs and fewer distressed opportunities—demand alternative approaches to ensure portfolio stability and avoid value erosion.

To address this liquidity squeeze, proactive GPs are turning to innovative strategies such as NAV loans, equity infusions, and continuation vehicles. NAV loans, which borrow against the portfolio rather than individual companies, offer immediate relief but risk creating a drag on fund performance. For firms with untapped equity, injecting capital to make debt manageable can buy time but requires balancing dilution concerns. Additionally, continuation vehicles allow GPs to refinance single assets and reset cap tables while giving LPs the flexibility to roll their investments. In an environment where exit stress is mounting, these liquidity solutions are no longer optional—they are imperative for preserving portfolio value, maintaining investor confidence, and positioning assets for future recovery.

12/11/2024

💰Liquidity Corner

Tokenization of Private Equity Assets

Tokenization, the process of creating digital representations of assets on blockchain networks, has emerged as a transformative solution to address the historical illiquidity of private equity. Traditionally, private equity has been characterized by long lock-up periods, making it inaccessible for investors seeking liquidity. Tokenization changes this dynamic by enabling fractional ownership of private equity assets, allowing for easier buying and selling on secondary markets. As the accompanying chart highlights, the private equity and venture capital market, estimated at $7 trillion by 2030, is projected to see $0.7 trillion in tokenized assets.

The chart also underscores the broader potential of tokenization across asset classes, from real estate funds to trade finance, illustrating how blockchain technology is poised to transform global financial markets. In private equity, tokenization not only enhances liquidity but also leverages smart contracts to streamline operations, automate distributions, and ensure compliance, all of which contribute to reduced costs and increased efficiency. With $1.5 trillion in tokenized real estate funds and $1.9 trillion in tokenized corporate debt expected by 2030, private equity’s adoption of tokenization is part of a larger trend reshaping financial markets.

12/5/2024

💰Liquidity Corner

GP Stakes Deals: Fueling Growth and Cash Flow for PE Firms

GP stakes investing, once a niche strategy in the alternative asset space, has grown into a sophisticated and dynamic tool for generating returns in private equity (PE). This strategy involves purchasing minority equity stakes in PE firms in exchange for a share of their revenue streams, offering investors a blend of steady cash flows and exposure to long-term growth. Notably, GP stakes investments provide PE firms with much-needed liquidity, allowing them to diversify their balance sheets, fund operations, or expand their investment strategies without diluting their control.

From the early days of sovereign wealth funds and public pensions making direct investments to the rise of specialized vehicles like Goldman Sachs’ Petershill funds and Dyal Capital Partners, the GP stakes market has undergone significant milestones. As illustrated in the accompanying chart, deal value in 2023 rebounded modestly to $2.08 billion after a sharp drop from the 2021 peak of $7.36 billion, reflecting the market’s resilience and potential for resurgence. By providing PE firms with liquidity and strategic capital, GP stakes investing enables firms to weather market challenges and seize growth opportunities while offering investors access to stable revenue streams from management fees and carried interest.

11/28/2024

💰Liquidity Corner

Flexible Alternatives: Unlocking Private Equity Liquidity with Tender Offer Funds

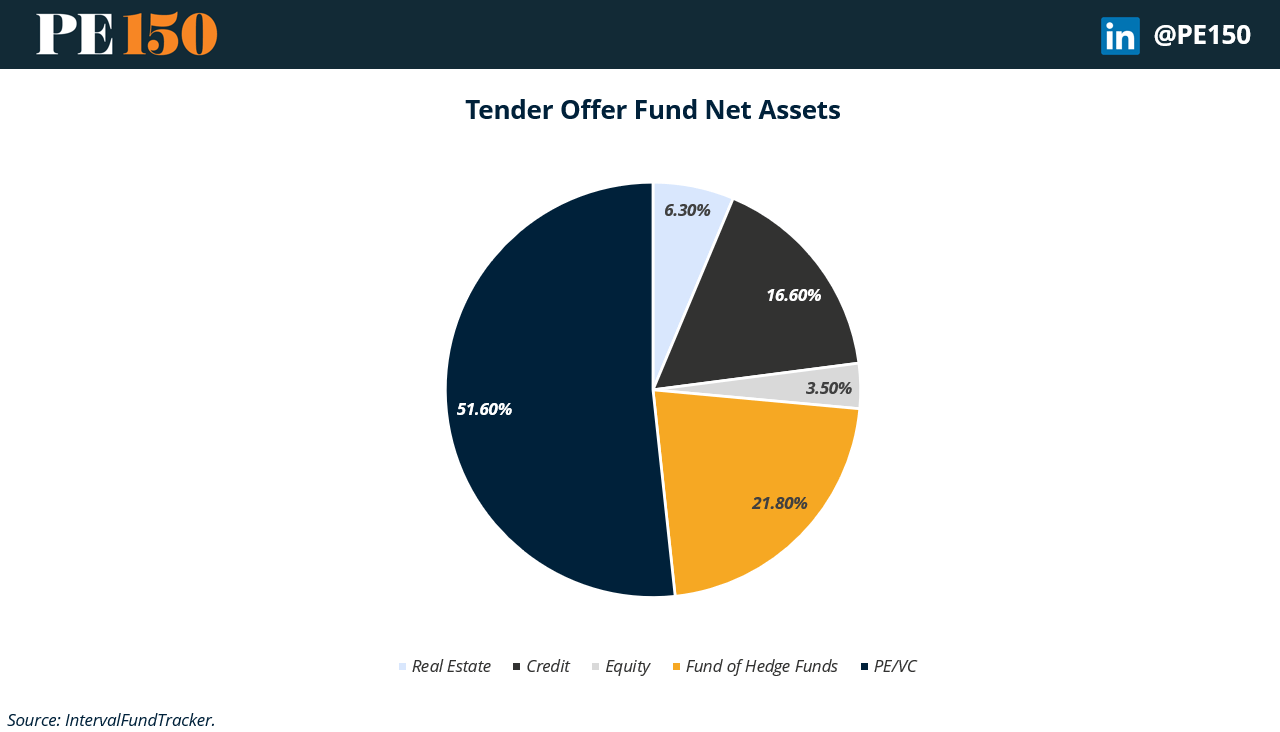

Tender offer funds provide private equity (PE) firms a way to balance long-term investment goals with investor liquidity needs. These funds allow periodic buybacks of investor shares, offering flexibility compared to traditional closed-end PE structures. The allocation of assets, as shown in the chart, emphasizes PE/VC investments (51.6%), while credit (16.6%) and real estate (6.3%) offer diversification and stable cash flow to support redemptions. This structure helps PE managers maintain adequate capital for growth while addressing liquidity demands.

The periodic redemption process is key to these funds’ appeal, as it aligns liquidity provisions with cash flow cycles. The inclusion of income-generating assets, like credit and real estate, and liquid strategies, like fund-of-hedge-funds (21.8%), provides flexibility for managing investor redemptions. This diversified approach, highlighted in the chart, makes tender offer funds an attractive option for investors seeking exposure to private equity with improved liquidity access.

11/20/2024

💰Liquidity Corner

Interval Funds – Unexploited Liquidity alternative?

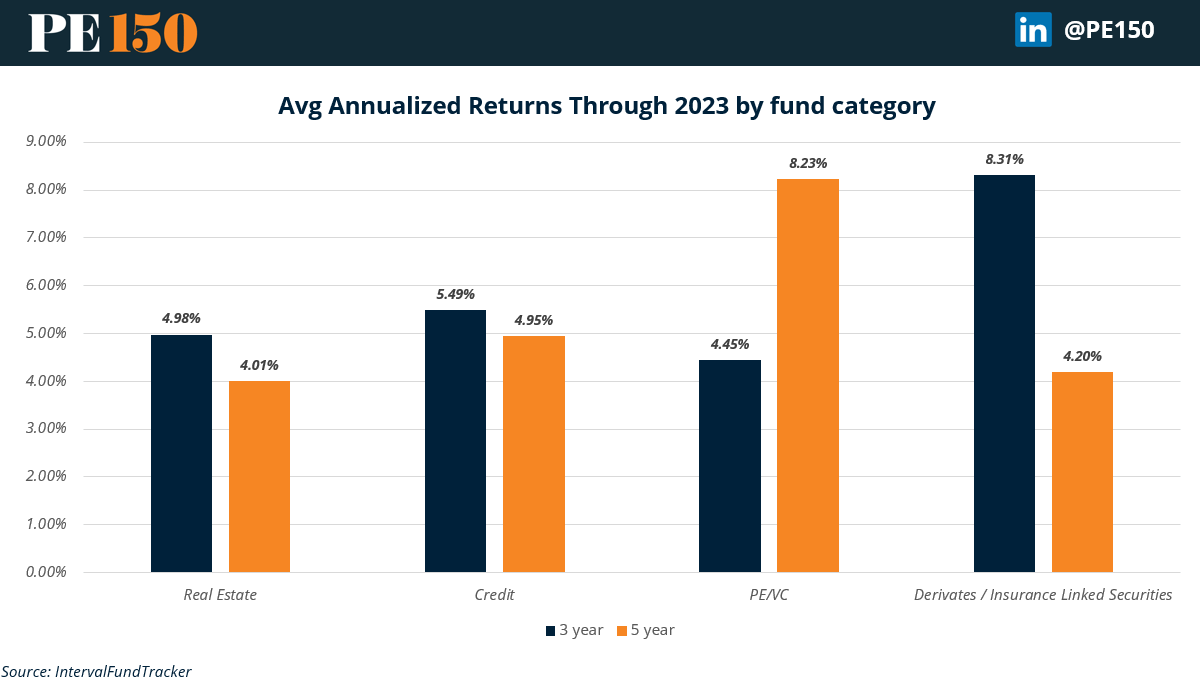

The latest data on interval funds reveals that Credit dominates the market, accounting for a substantial 62.9% of total net assets. This concentration highlights the current appetite for credit instruments, likely due to their steady yield and resilience in an uncertain economic climate. Real Estate follows with 19.9%, attracting investors seeking inflation hedges and income-generating assets. Equity sits at 9.7%, indicating cautious interest in growth-focused assets within these funds, which still prioritize periodic liquidity.

In terms of returns, the Private Equity/Venture Capital (PE/VC) category, while making up just 3% of net assets, continues to stand out with robust annualized returns (8.23% 5-year avg annualized returns) compared to other categories. This higher performance aligns with the typically high return potential of private equity and venture investments, which appeal to investors willing to accept less liquidity.

However, the trade-off for higher returns is reflected in the limited allocation within interval funds, as these investments carry inherent liquidity constraints that challenge periodic redemption requirements. For investors, the PE/VC category offers a compelling option within interval funds but requires a careful balance between maximizing returns and managing liquidity needs.

11/14/2024

💰Liquidity Corner

The NAV Financing Boom: A New Liquidity Lifeline

NAV Financing is evolving from a niche banking tool into a mainstream liquidity solution for PE funds, particularly those in the later stages of the investment lifecycle. By using the fund’s NAV as collateral, PE sponsors can raise cash without issuing capital calls or selling assets at a discount—offering greater flexibility to manage timing gaps and meet short-term liquidity needs. This flexibility is becoming more valuable as PE hold periods lengthen, driven by economic uncertainty and slowed exit markets. With banks expanding their offerings around this model, NAV Financing is poised to continue its growth.

The numbers back this trend: NAV Financing, valued at around $100 billion in 2022, is forecasted to hit $700 billion by 2030. As an alternative to traditional secondary market exits, this financing offers a distinct advantage for funds looking to retain upside without the typical 20-30% discount seen in secondary sales. As a result, NAV Financing is drawing a broader range of users, not only PE funds but GPs and even LPs looking to optimize cash flow while holding on to their equity stakes.

11/6/2024