- PE 150

- Pages

- Deal of the Week Archive

Deal of the Week Section

1/15/2025

🤝 Deal of the Week

T-Mobile's $600M Bet on Vistar Media

T-Mobile is dialing up its advertising game with a $600 million acquisition of Vistar Media, a leader in digital out-of-home (DOOH) technology. This strategic move aims to enhance T-Mobile's Advertising Solutions by integrating Vistar's platform, which manages over 1.1 million digital screens worldwide. With DOOH ad spending projected to comprise more than a third of the nearly $10 billion U.S. out-of-home advertising market in 2025, T-Mobile is positioning itself to offer more targeted and measurable advertising solutions. The deal is expected to close in the first quarter of 2025, marking a significant step in T-Mobile's evolution from telecom giant to advertising powerhouse. Advisors from Allen & Co and Cleary advised T-Mobile, while Canaccord Genuity and Lowenstein advised Vistar Media.

1/8/2025

🤝 Deal of the Week

Insignia's $1.8B Power Play

Australia’s Insignia Financial has become the belle of the private equity ball. After rejecting Bain Capital’s A$2.67B offer, Insignia received a superior A$2.87B ($1.8B) bid from CC Capital, marking the New York firm’s first major foray into the Land Down Under.

The prize? Access to Australia’s $A4.1 trillion superannuation system—one of the largest private pension markets globally. Insignia’s shares jumped 11% on the news, hitting their highest level since 2022 but still trailing CC Capital’s A$4.30 per share bid. The offer carries a 21.5% premium over Friday’s closing price, but insiders hint that Insignia's board might push for more.

With Australian M&A surging 15% last year and inbound deals up 23%, this showdown could set the tone for 2025. The ball is now in CC Capital’s court, but satisfying regulators and shareholders could still be a steep climb. Stay tuned.

12/20/2024

🤝 Deal of the Week

PE Goes Deep: Ares, Arctos Score NFL Stakes

Private equity just breached the NFL’s fortress: Ares Management took a 10% minority stake in the Miami Dolphins at an eye-popping $8.1B valuation, while Arctos led a group acquiring equity in the Buffalo Bills. Long excluded from NFL team ownership, PE firms now have a clear path after rule changes in August—though the league capped investments at 10%. For Ares, the Dolphins deal includes slices of Hard Rock Stadium and F1’s Miami Grand Prix, sweetening the pot. As NFL team values soar—averaging $5.9B—these minority stakes provide a playbook for Wall Street: stable, lucrative returns in a recession-resistant league. Translation: PE just found its favorite new trophy asset.

12/11/2024

🤝 Deal of the Week

Mubadala Capital’s Big Play in US Private Credit

Abu Dhabi’s Mubadala Capital is flexing its muscles beyond passive wealth management with a bold move into US private credit. The firm is acquiring a 42% stake in Silver Rock Financial, a $10 billion Los Angeles-based credit fund co-founded by Michael Milken’s family office. The twist? Milken’s team will now hold minority equity in Mubadala Capital—marking their first foray into outside investments. This isn’t just about ownership; Mubadala plans to steer Silver Rock into structured products and high-yield investments, expanding its global private credit ambitions.

Why it matters: Abu Dhabi’s shift from check-writer to asset manager is reshaping Gulf investment dynamics, with Mubadala Capital managing $27 billion, nearly two-thirds for third-party investors. What’s next? Expect more strategic expansions—and maybe a few raised eyebrows in US boardrooms.

12/5/2024

🤝 Deal of the Week

BlackRock's $12B Move into Private Credit with HPS Acquisition

BlackRock continues to make bold strides in private markets with its latest acquisition of HPS Investment Partners for $12 billion in an all-stock deal. This marks the asset management giant's third major acquisition in 2024, reinforcing its aggressive push into private credit, an asset class that's expected to skyrocket from $1.5 trillion in 2023 to $2.6 trillion by 2029, according to Preqin. HPS, a private credit powerhouse managing $148 billion in assets, will integrate seamlessly with BlackRock’s existing $85 billion private credit platform, creating a formidable $220 billion franchise.

With this acquisition, BlackRock positions itself to rival giants like Apollo and Ares in the competitive private credit market, while boosting its private market fee-paying assets by 40%. This move follows a year of aggressive deal-making, including the $12.5 billion acquisition of Global Infrastructure Partners and the upcoming $3.2 billion purchase of Preqin. As private assets demand higher fees than BlackRock's traditional ETF business, this expansion not only strengthens its portfolio but also underscores CEO Larry Fink’s vision of private credit as a primary growth driver. The deal also sparks speculation about Fink’s eventual successor, as BlackRock cements its dominance across public and private markets.

11/28/2024

🤝 Deal of the Week

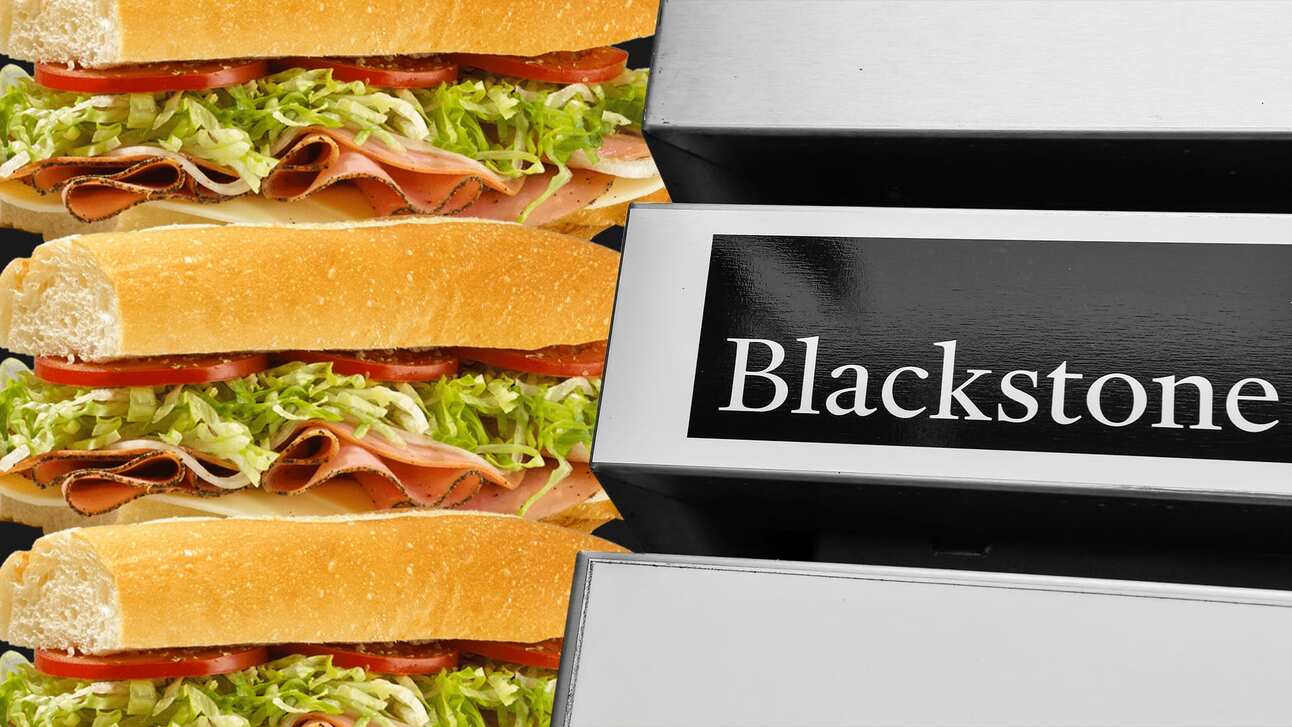

Blackstone’s $8B Bet on Jersey Mike’s

Blackstone is sinking its teeth into the fast-casual boom with an $8 billion (including debt) acquisition of Jersey Mike’s Subs. The sandwich chain, founded in 1956 and franchising since 1987, has grown to 3,000+ locations and is poised for more. The deal, set to close in early 2025, includes an earn-out tied to Jersey Mike’s hitting its 4,000th store—an increasingly common structure in today’s cautious M&A landscape.

This marks another notch in Blackstone’s food franchise belt after recent investments in 7 Brew Coffee and Tropical Smoothie Cafe. The world’s largest alternative asset manager sees franchise operations as a high-growth theme, leveraging its expertise in scaling global brands like Hilton Hotels. Founder Peter Cancro will retain an equity stake and continue leading the chain, positioning Jersey Mike’s for both domestic and international expansion. The takeaway: Blackstone isn’t just investing in sandwiches—it’s betting on a resilient, scalable franchise model.

11/20/2024

🤝 Deal of the Week

$1B for Qlik: Adia’s Latest Power Play in Private Equity

Adia, with nearly $1 trillion in assets, is acquiring a $1 billion stake in data powerhouse Qlik, boosting the software firm’s valuation to $10 billion. Qlik’s analytics subscriptions are flying high (30% YoY growth), and 2024 revenue projections hit $1.5 billion.

This transaction underscores the Gulf’s growing dominance in private equity, as Adia and Mubadala become prime backers amid PE’s slowdown. Thoma Bravo, which bought Qlik in 2016 for $3 billion, joins a growing list of firms leveraging Gulf capital to lock in gains. It’s a clear signal: sovereign funds call the shots in today's buyout landscape.

11/14/2024

🤝 Deal of the Week

Blackstone Buys ROIC for $4B – Another West Coast Real Estate Power Play

Blackstone is doubling down on grocery-anchored real estate, acquiring Retail Opportunity Investments Corp. (ROIC) in a $4 billion cash deal. With a portfolio of 93 properties in markets like LA and Seattle, ROIC’s grocery-anchored assets are viewed by Blackstone as well-positioned for steady demand. The $17.50 per share acquisition price reflects a 34% premium, underscoring confidence in grocery-based retail’s resilience amid minimal new developments. Blackstone’s Jacob Werner pointed to the sector’s strong fundamentals driven by necessity-based retail. Expected to close in early 2025, the deal has received ROIC board approval and awaits final shareholder sign-off.

11/6/2024

🤝 Deal Of The Week

KKR and Energy Capital Partners forge $50B infrastructure partnership

KKR and Energy Capital Partners (ECP) are going big, announcing a $50 billion investment deal to beef up infrastructure supporting the AI and cloud-computing wave. Leveraging KKR’s infrastructure and real estate muscle alongside ECP’s strategy pipeline, the two aim to provide scalable data and power solutions globally, positioning themselves as the providers of choice for tech giants seeking serious model training and storage capacity. No wonder KKR is bullish—its infrastructure division raked in a robust 18% return LTM, marking it as their crown jewel. Meanwhile, Blue Owl is ramping up, acquiring IPI Partners and adding 82 data centers to go toe-to-toe with KKR.

11/1/2025

🤝 Deal of The Week

Blackstone’s $22B Push Into Private Credit

Blackstone scored big this week, locking down $22B for its Senior Direct Lending Fund—more than double its original $10B goal. With direct lending funds outperforming most private markets at 11.1% returns, it’s no wonder they’re dominating private debt fundraising this year. Blackstone now manages over $123B in direct lending assets, solidifying its spot as a major player. As banks retreat amid shifting rates, PE players like Blackstone and Ares are happy to fill the gap, providing a lifeline for leveraged deals.

10/28/2024

🤝 Deal of the Week

EQT Leads $14.5B Nord Anglia Deal, Guided by Top Law Firms

Nord Anglia Education is set for a $14.5 billion acquisition, led by EQT, Neuberger Berman, and CPP Investments. Legal powerhouses Latham & Watkins, Cravath, and Ropes & Gray are steering the transaction, with EQT and CPP retaining shares in the education giant. Financial giants like Goldman Sachs and JP Morgan are backing the buyout, marking a significant milestone in private equity's push into global education. This deal underscores the strategic importance of international schools, particularly as demand spikes in emerging markets.