- PE 150

- Pages

- Data Dive Archive

Data Dive Section

1/15/2025

📚 Data Dive

Private Equity and Real estate

The private equity and venture capital-backed real estate market has seen a notable shift since the record-breaking activity in 2021.

Both the number of deals and aggregate transaction values have declined, signaling a new phase shaped by changing economic dynamics and investor caution.

The data highlights this trend clearly: in Q4 2021, aggregate transaction values peaked at $34.77 billion across 203 deals, marking a high point in the market.

By Q1 2023 however, transaction values dropped to just $3.14 billion with 77 deals, a stark contrast to the previous highs. This downward trajectory has continued into 2024, with Q2 figures showing $3.10 billion across 39 deals.

This decline reflects broader market challenges coming from the usual suspects of rising interest rates, persistent inflation, and tightening credit conditions that has increased the cost of capital, making real estate investments less attractive.

Additionally, uncertainties surrounding global economic growth, geopolitical tensions, and sector-specific disruptions have led investors to rethink their strategies.

Despite these challenges, real estate remains a key area of focus for private equity, particularly in niche segments like residential housing, logistics, and hospitality. However, recent data suggests that investors are proceeding more cautiously, focusing on long-term value creation while navigating short-term headwinds.

Want to learn more?

1/8/2025

📚 Data Dive

Private Equity's Robotic Goldmine

Private Equity’s new automation playground is the Robotic Process Automation (RPA) market, which is set to explode from $7B in 2023 to $69B by 2032, with a sizzling 29.86% CAGR. North America leads the charge, holding a 38.3% market share, thanks to early adoption, a dynamic entrepreneurial ecosystem, and robust competition driving efficiency.

Our Digital Investment Vitality Index (DIVI) pinpoints where the next big wins are: India and APAC are surging ahead, saving 4.9 weekly hours per worker through automation. Meanwhile, LATAM’s untapped potential and public services' low adoption rates present hidden gems for investors.

The lesson? Smart capital allocation in high-growth regions and fragmented industries could transform RPA investments into standout performers

Want to learn more?

12/20/2024

📚 Data Dive

Monthly Edition: PE’s New “Patient Capital” Powerhouse

The family office market keeps growing—and so is its appetite for Private Equity. With $5.5 trillion in wealth and set to reach $9.5 trillion by 2030, family offices have quietly become the ultimate long-term investors. Roughly 19% of their portfolios are now in PE, drawn to its mix of control, growth, and strategic returns. Why? They can afford to think in decades, not quarters, while funds scramble to show annual exits. Unlike traditional LPs, family offices bring flexibility and a willingness to take on illiquidity for outsized rewards. The trend is global, with North America leading, but Europe and Asia are quickly catching up. For PE sponsors, this means more than capital—it’s aligned, stable, and deeply patient. If you’re not talking to a family office yet, someone else is. And they’re likely sealing the deal.

Want to learn more?

12/11/2024

📚 Data Dive

Private Equities in Pension Funds: Underallocated?

As traditional asset classes like stocks and bonds struggle to deliver the stability and returns they once promised, pension funds are increasingly turning to alternative investments. Among these, private equity stands out as a clear leader, offering the potential for higher, uncorrelated returns and portfolio diversification. This report explores how pension funds are shifting their strategies in response to rising life expectancies, aging populations, and diminishing yields in traditional markets. While private equity has gained traction, significant underallocation persists, leaving pension funds with untapped opportunities to bolster their returns and better meet long-term liabilities.

Despite challenges such as illiquidity and macroeconomic uncertainties, the data paints a compelling picture of private equity’s superiority over public equities. Over the past two decades, private equity has delivered an average annual return of 11%, significantly outpacing public equities at 6.2%. Allocations to private equity increased from 14.5% in 2022 to 17.0% in 2023, reflecting growing confidence in its performance. Yet gaps remain—high-profile funds like CalPERS, for instance, are billions below their allocation targets. By addressing these gaps and increasing exposure to private equity, pension funds can harness its unparalleled long-term growth potential, securing financial stability in an evolving investment landscape.

Want to learn more?

12/5/2024

📚 Data Dive

The RegTech Boom: a $100B Deal

The RegTech market is on fire, projected to skyrocket from $12.6 billion in 2023 to $104.17 billion by 2034—an impressive 21.3% CAGR. Why? Skyrocketing compliance costs and regulatory complexity are forcing companies to adopt tech-driven solutions. In sectors like finance, ESG, and cybersecurity, navigating ever-changing rules such as GDPR (Europe) and CCPA (California) is no longer optional. RegTech delivers real-time tracking, automated reporting, and AI-powered tools that boost accuracy while cutting costs.

Private equity should especially focus on high-potential geographic targets like Europe, the birthplace of many regulations and RegTech pioneers. The UK leads in dealmaking, with 23% of Europe’s activity in H1 2024. Beyond that, Singapore and the UAE shine as prime regions for adoption, thanks to their combination of stringent regulatory environments and robust digital infrastructure. With the industry's youth and fragmentation, the opportunity for consolidation and creating niche leaders is massive—a recipe for both operational impact and alpha returns.

Want to learn more?

11/28/2024

📚 Data Dive

Private Credit: Opportunity or overstretch?

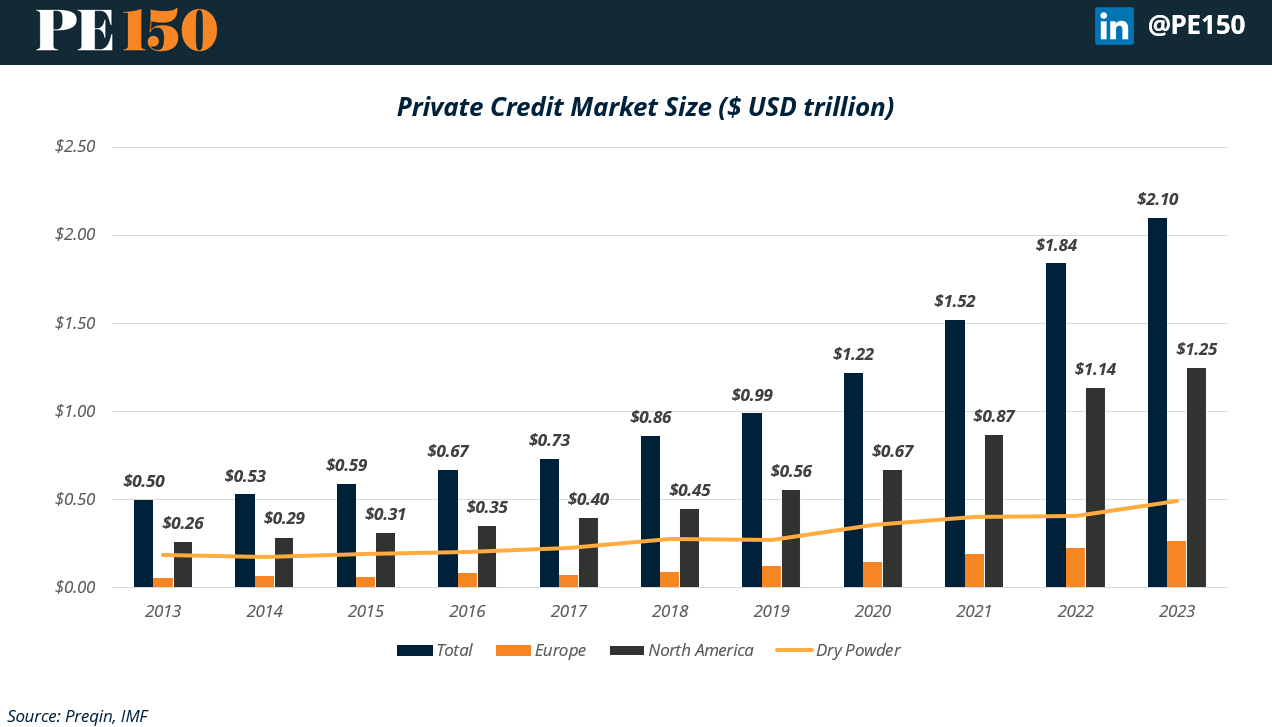

The private credit market has experienced exponential growth, soaring to $2.1 trillion in 2023 from $1.84 trillion in 2022, with a remarkable 15% compound annual growth rate (CAGR) over the past decade. This rapid expansion underscores the rising demand for alternative financing solutions that offer flexibility and high yields. North America continues to dominate, accounting for $1.25 trillion—60% of the global market—while Europe follows with a $0.27 trillion market size, reflecting a 17% CAGR. Investors’ confidence in the sector is further evidenced by the rise in "dry powder" reserves, reaching $0.49 trillion, signaling readiness to seize opportunities amid tightening credit conditions and elevated interest rates.

This impressive growth reflects a global shift toward private credit as a critical source of capital for mid-market and corporate borrowers. The sector’s balance of low annual credit losses (0.9%) and customizable loan structures has solidified its appeal among institutional investors like pension funds, insurance companies, and sovereign wealth funds. The report delves into the driving forces behind this growth, the regional dynamics, and the growing reserves of undeployed capital, highlighting both the immense opportunities and the potential risks in navigating the next phase of private credit’s evolution.

Want to learn more?

11/20/2024

📚 Data Dive

Private Equity’s $243 Billion Question in the Travel Insurance Space

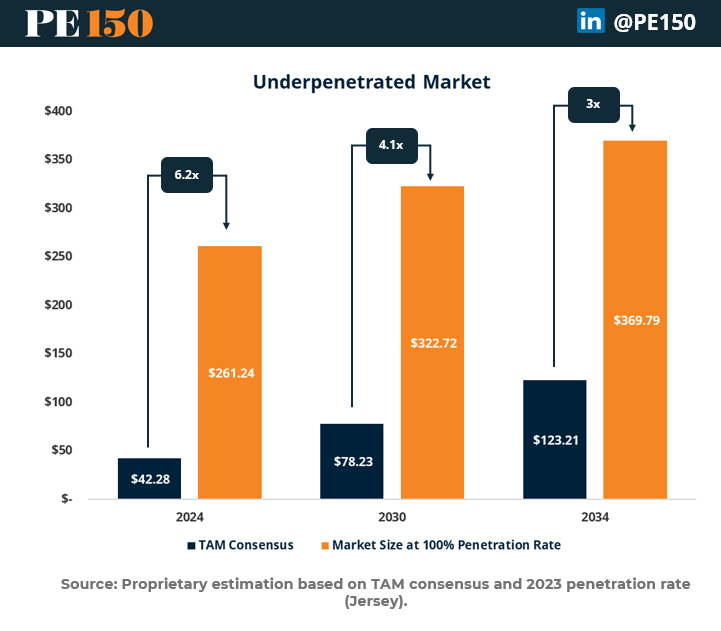

The travel insurance market, projected to grow from $42 billion in 2024 to $123 billion by 2034, offers a lucrative playground for private equity sponsors. The catalyst? A penetration rate currently at 30%, with a modest annual growth of just 1%. If adoption rates accelerate, the market could balloon to a staggering $243 billion in untapped potential by 2034.

Key drivers include a rebound in global travel (expected to reach 1.49 billion travelers by 2035), rising disposable incomes, and increasing consumer awareness around travel risks. Growth capital and innovative strategies to improve penetration are critical for unlocking this opportunity. For PE sponsors, it’s not just about funding; it’s about building scalable infrastructure and dynamic go-to-market plans. Those who hesitate risk ceding the space to faster-moving competitors—both insurers and Insurtech disruptors.

Want to learn more?

11/14/2024

📚 Data Dive

M&A's Resilience: Why Deals Still Drive Business Growth

Even in turbulent economic conditions, M&A remains central to business strategy. It provides a faster route to growth than organic expansion, allowing companies to enter new markets, acquire advanced technologies, and increase efficiencies.

The B2B sector leads in both volume and value of M&A deals globally, driven by needs for consolidation and scale. Despite headwinds from high interest rates and geopolitical challenges, M&A continues to offer a path to market resilience, competitive positioning, and long-term growth potential.

Key Data Points:

B2B Dominance: 36.5% of M&A deals are in the B2B sector from 2013–2024.

Top Value Deals: 28% of total M&A value comes from transactions over $5 billion.

Economic Resilience: M&A offers companies a way to withstand inflation and other economic pressures through scale and synergies.

Want to learn more?

11/6/2024

📚 Data Dive

Capital Unbound: Exploring New Liquidity Solutions in Private Markets

As private equity (PE) firms and private companies face growing demand for liquidity, traditional pathways like IPOs and trade transactions are being supplemented by alternative solutions. Stakeholder expectations are pushing companies to address liquidity not just for capital gains but to enhance employee retention and align business goals. New strategies—like secondary transactions, continuation funds, and direct transactions—are expanding to meet these needs, allowing firms to maintain flexibility amid volatile markets.

In this report, we explore the critical rise of the secondaries market, which has grown from $25B in 2012 to $112B by 2023, and the increasing use of continuation funds to extend asset holds without full exits. With $171 billion in dry powder, yet only a fraction of private equity’s $5.3 trillion AUM, liquidity solutions are essential as firms respond to prolonged hold periods and shifting exit strategies. Key insights reveal how PE is leveraging these evolving tools to create resilience, optimize liquidity, and manage risk across an unpredictable economic landscape.

11/1/2024

📚 Data Dive

Private Equity Opportunities in Mobile Phone Insurance

The mobile phone insurance market is booming, projected to grow from $31.56 billion in 2023 to $73.2 billion by 2030, at a CAGR of 12.77%. This growth is driven by rising smartphone prices, higher device vulnerability, and increasing consumer demand for digital protection solutions. For private equity investors, this presents a compelling opportunity to back InsurTech platforms that offer digital insurance products. With app-based purchasing, simplified claims, and subscription models, these platforms cater to a tech-savvy user base while creating scalable and high-margin business models. Moreover, bundling insurance with smartphone sales or telecom services unlocks valuable cross-selling potential, maximizing returns for PE-backed ventures.

10/28/2024

📚 Data Dive

The Infinite Game of Private Equity

Private Equity (PE) isn’t about winning a single deal—it's about staying in the game. The real winners? Those who know how to play the long game. Like Simon Sinek's "Infinite Game," PE isn’t about closing the biggest deal; it’s about staying in the game. Think strategic partnerships, adaptability, and always learning. For PE firms, it’s less about “winning” today’s bid and more about positioning themselves for tomorrow's opportunities. They focus on relationships, not just transactions, ensuring they’re around for the next big move.

Want to learn more?